Understanding Your Bad Credit Mobile Home Loan Options

Bad credit mobile home loans guaranteed approval is something many prospective homebuyers search for when facing credit challenges. While true “guaranteed” approval doesn’t exist, several viable financing options are available:

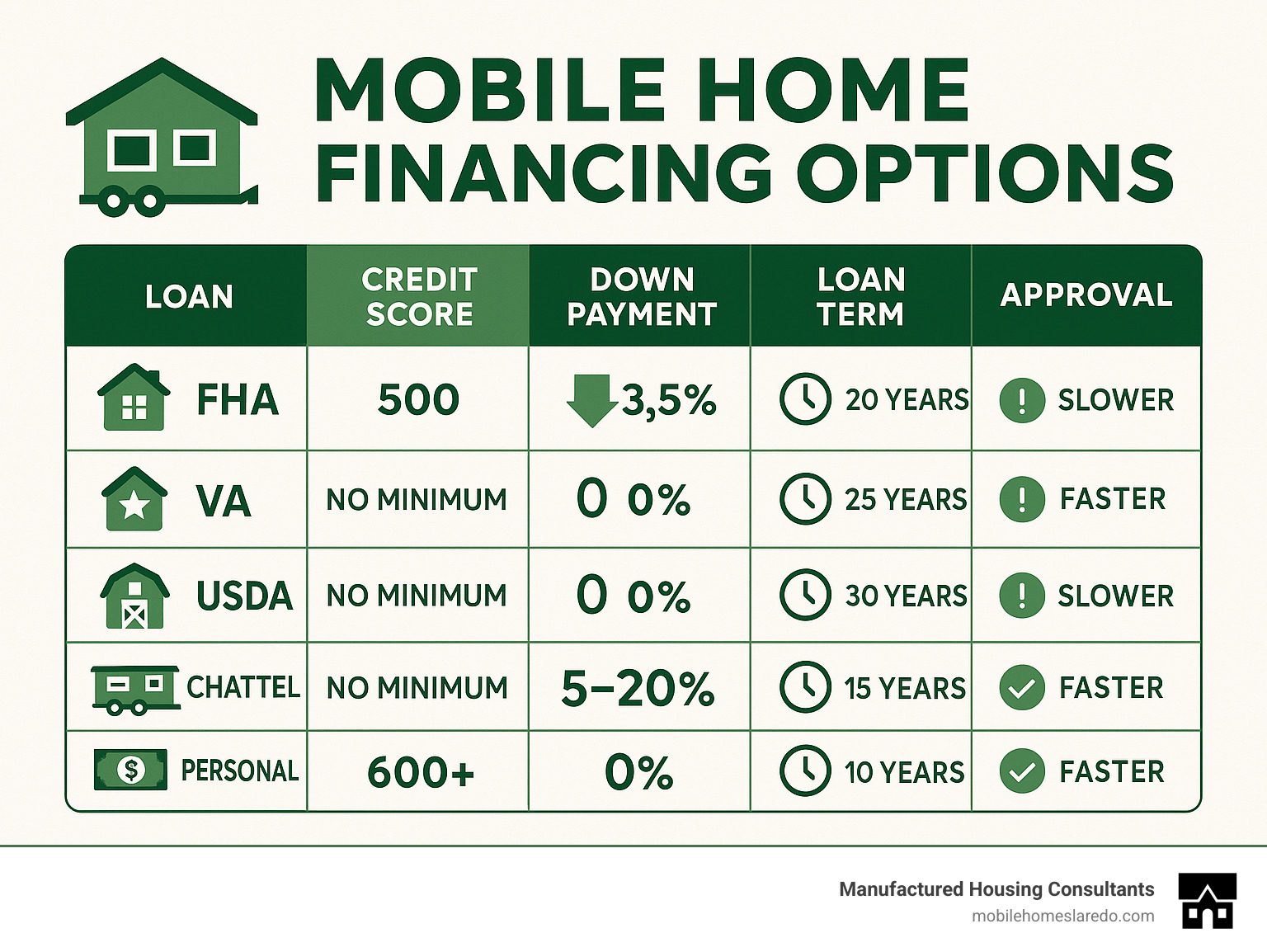

| Loan Type | Minimum Credit Score | Down Payment | Best For |

|---|---|---|---|

| FHA Title I | 500+ | 10% (3.5% with 580+) | First-time buyers with credit issues |

| Chattel Loans | No minimum (higher down payment) | 5-35% | Park/leased land homes, quick closing |

| USDA Rural | No set minimum | 0% | Rural properties, low-to-moderate income |

| VA Loans | No set minimum | 0% | Veterans and service members |

| Personal Loans | Varies (600+ ideal) | Typically 0% | Faster funding, no foundation requirements |

Manufactured homes offer an affordable path to homeownership, with average costs around $88,200 compared to $244,000 for site-built homes. When traditional mortgages seem out of reach due to credit challenges, specialized mobile home financing becomes essential.

Many families like Maria’s find themselves in this situation – wanting the stability of homeownership but facing roadblocks due to past credit mistakes. The good news? Lenders have developed programs specifically for manufactured housing that accommodate credit challenges.

“This might be the first time you ever thought of buying a mobile home—you want quality for your family without getting ripped off,” as one Texas dealer puts it. That’s why understanding your financing options is crucial.

While lenders advertising “guaranteed approval” are using marketing language rather than making promises, many legitimate options exist for scores as low as 500 or even no credit score at all (with sufficient down payment).

The key is knowing which programs match your situation and how to improve your application’s strength.

Are Bad Credit Mobile Home Loans Guaranteed Approval—or Too Good to Be True?

When you see advertisements promising “bad credit mobile home loans guaranteed approval,” it’s natural to feel a spark of hope—especially if you’ve faced rejection from traditional lenders. But let’s have an honest conversation about what these claims really mean in the manufactured housing world.

Here’s the reality: no legitimate lender can truly guarantee loan approval without looking at your financial situation. Think of these marketing phrases more as a signal that the lender specializes in working with credit-challenged borrowers rather than a promise of automatic approval.

What these lenders are usually offering is a more flexible approach. They typically have less rigid qualification standards than big banks, provide multiple program options for different situations, and yes—they may approve loans with higher interest rates to balance out the risk they’re taking on you.

As Charles Arnell, who has helped over 2,000 families secure manufactured home financing, puts it: “We don’t have minimum credit score requirements for most loans, but folks with scores under 575 or zero credit history usually need larger down payments—typically around 35%.”

What “Bad Credit Mobile Home Loans Guaranteed Approval” Really Means

When you see “guaranteed approval” in an advertisement, what the lender is really saying is “we have programs designed for people like you” rather than promising everyone gets approved no matter what.

In the real world, these programs usually involve some trade-offs. You might need a higher down payment—while good-credit borrowers might qualify with just 3.5-5% down, you might need 20-35% if your credit needs work. You’ll likely face higher interest rates too, perhaps between 7-14% compared to the 5-7% offered to prime borrowers.

Many of these lenders look beyond just your credit score. They might evaluate your steady income history, length of employment, whether you’ve paid rent consistently, if your utility payments are on time, and how much you can put down upfront.

One of our Texas dealers often tells customers: “We believe in fair and transparent prices for everybody. Nothing is hidden in our pricing—no matter your income.” This approach helps you understand exactly what you’re getting into when financing with less-than-perfect credit.

Most reputable manufactured home lenders will pre-qualify you first to check eligibility before moving forward with a full application. This saves you time and prevents unnecessary credit inquiries that could further damage your score.

Minimum Credit Scores & Typical Requirements

While every lender has their own standards, here’s what you can generally expect when shopping for a manufactured home loan:

For FHA Title I Loans:

If your credit score is around 500, you’ll need about 10% down. Score a 580 or higher, and that drops to just 3.5% down. Most lenders want to see your debt-to-income ratio (all your monthly debts divided by your monthly income) staying below 43%, though exceptions exist. They’ll also look for steady employment—typically 2+ years—and no major negative credit events in the past 12-24 months.

For Conventional Loans:

You’ll generally need at least a 620 credit score, 5% or more down, and a debt-to-income ratio between 36-43%.

For Chattel Loans (Home-Only):

These flexible loans don’t have strict minimum scores, but lower scores mean higher down payments—ranging from 5% with excellent credit to 35% with poor or no credit. Interest rates typically run from 7.75% to 14%.

For USDA Rural Housing Loans:

There’s no official minimum credit score (though individual lenders might have their own requirements). The amazing part? You might qualify for 0% down if you meet income limits and the home is in an eligible rural area.

For VA-Backed Loans:

If you’ve served in the military, these loans have no official minimum score (though lenders typically want to see at least 580). The big benefit is potentially 0% down payment.

Greg Downey, a loan officer with over 30 years in mortgage lending, shares this wisdom: “We look at the whole picture, not just the credit score. Sometimes a buyer with a 550 score but stable employment and a good down payment is a better risk than someone with a 620 score who’s changed jobs three times in the last year.”

Best Loan Programs and Strategies for Bad-Credit Borrowers

When traditional financing seems out of reach, knowing which specialized programs to pursue can make all the difference in securing your manufactured home. Let’s explore the most viable options for credit-challenged buyers who are searching for that seemingly elusive bad credit mobile home loans guaranteed approval.

Government-Backed Paths: FHA, USDA, VA

Government-backed loans often provide the most accessible paths to manufactured home ownership for those with credit challenges.

FHA Title I Loans are specifically designed for manufactured homes and offer some of the most flexible credit terms available. With credit scores as low as 500 accepted (though you’ll need 10% down), and scores of 580+ qualifying for just 3.5% down, these loans are a lifeline for many families.

You can borrow up to $69,678 for the home alone or $92,904 for the home and lot, with terms extending up to 20 years for a manufactured home or lot, and 25 years for both. The beauty of FHA loans is their flexibility – you can finance just the home, just the lot, or both together.

I recently worked with a client who shared, “After my divorce tanked my credit, I thought homeownership was years away. The FHA program let me buy a beautiful double-wide with just 10% down, even with my 540 score.” That’s the kind of life-changing opportunity these programs provide.

USDA Rural Development Loans are perfect for folks looking to place a manufactured home in a rural area. These loans offer remarkable benefits including no established minimum credit score (though most lenders prefer 640+) and the possibility of 0% down payment with 100% financing options.

To qualify, your home must be in a USDA-eligible rural area, your income cannot exceed 115% of the area median, the home must be on a permanent foundation, and the property must be your primary residence.

One of our USDA loan specialists recently told me, “We’ve seen families with credit scores in the 580-620 range successfully secure financing with no money down, as long as they demonstrate willingness and ability to manage their obligations.” That’s what I call giving people a fair chance!

More info about USDA manufactured loans

VA-Backed Loans are a godsend for veterans, active-duty service members, and eligible surviving spouses. These loans have no official minimum credit score (though lenders may set their own), offer 0% down payment options, require no mortgage insurance, and feature competitive interest rates. The home must be on a permanent foundation, and you must meet military service requirements.

A veteran client of mine shared this touching story: “After 12 years of service and a foreclosure during deployment, my credit was in rough shape. The VA loan program allowed me to buy a three-bedroom manufactured home with no money down despite my 560 credit score.” It’s stories like these that remind us why we do what we do.

Chattel, Personal & Dealer Financing for Park or Leased-Land Homes

When your manufactured home will sit on leased land or in a mobile home park, traditional mortgage options typically vanish. That’s when these financing options become your best friends:

Chattel Loans treat the manufactured home as personal property rather than real estate. While there’s no official minimum credit score, you’ll need higher down payments for lower scores (typically ranging from 5-35% based on credit).

Yes, the interest rates are higher (starting around 7.75%) and terms are shorter (typically 15-20 years), but the closing process is faster than mortgage loans. Plus, they work for homes in parks or on leased land – situations where other loans simply won’t.

Many lenders like 21st Mortgage (the nation’s largest manufactured home lender for 14 consecutive years) offer chattel loans with flexible credit requirements. Their approach is refreshingly straightforward: “We have no restrictions for the age of the home and take stringent measures to protect your personal information with industry-leading security technology.”

Personal Loans can be a good option for smaller loan amounts or when you need quick funding. They typically require credit scores of 600+ for reasonable rates and usually don’t require a down payment. Just be prepared for higher interest rates (6.99-26%) and shorter terms (typically 2-7 years). The upside? No foundation requirements and fast funding – often within 1-2 business days.

Dealer Financing is something we’re proud to offer at Manufactured Housing Consultants. Many manufactured home dealers like us offer in-house financing options or partnerships with specialized lenders. We’re often more flexible with credit requirements and may offer “second chance” programs for folks with recent bankruptcy or foreclosure. We can coordinate with land loans if needed and sometimes offer rent-to-own options.

We’ve developed relationships with multiple lenders who specialize in credit-challenged borrowers. This allows us to match customers with the most appropriate financing based on their specific situation – not just a one-size-fits-all approach.

Comparison of Loan Types for Credit-Challenged Borrowers

| Feature | Chattel Loan | FHA Title I | USDA Rural |

|---|---|---|---|

| Property Type | Personal property | Real or personal property | Real property only |

| Foundation Required | No | Depends on classification | Yes, permanent |

| Land Ownership | Not required | Optional | Required |

| Credit Score Minimum | None official (higher down with lower score) | 500 (10% down), 580 (3.5% down) | None official |

| Down Payment | 5-35% | 3.5-10% | 0% possible |

| Interest Rates | 7.75-14% | 5-7% | 3-5% |

| Loan Term | 15-20 years | Up to 25 years | 30 years |

| Closing Timeline | 2-3 weeks | 30-45 days | 30-60 days |

Bad Credit Mobile Home Loans Guaranteed Approval Alternatives & Work-Arounds

When traditional approval seems unlikely, consider these alternative approaches that have helped many of our clients:

The Co-Signer Strategy can work wonders. Adding a co-signer with stronger credit significantly improves approval odds because their income and credit strengthen your application. This can reduce down payment requirements and may qualify you for better interest rates. Just remember that your co-signer shares legal responsibility for the loan – so make those payments on time!

The Larger Down Payment Approach is one of the most effective ways to overcome credit challenges. A 20-35% down payment can offset credit concerns, reduces lender risk, demonstrates financial responsibility, and lowers your monthly payments. As one of our lender partners explains, “We’ve approved buyers with scores in the low 500s when they brought 25-30% to the table. The larger down payment significantly reduces our risk.”

Land Equity Leverage is perfect if you already own land. Your existing land equity can count toward your down payment, potentially qualifying you for land-home package loans with better terms. This can reduce or eliminate cash down payment needs and opens up more loan program options.

The Credit-Builder Loan Strategy works well for those with time before purchase. Take out small secured credit-builder loans to establish positive payment history. This can improve scores by 30-50 points in 6-12 months, potentially qualifying you for better loan programs after improvement.

Some lenders offer Buy-For Programs where a family member with better credit purchases the home on your behalf. This typically requires at least 20% down payment. You make payments to the lender and can refinance into your name after credit improvement.

Fast Ways to Boost Your Approval Odds

If you’re planning to apply for manufactured home financing in the next 3-6 months, these strategies can quickly improve your chances:

First, focus on Payment History Improvement by ensuring all current accounts are paid on time. Set up automatic payments to avoid missed due dates, address any current delinquencies immediately, and contact creditors about goodwill adjustments for isolated late payments.

Credit Utilization Reduction is another quick win. Pay down credit card balances to below 30% of limits, avoid closing unused credit cards (this maintains available credit), request credit limit increases on existing accounts, and pay down revolving balances before statement closing dates.

Don’t overlook Credit Report Error Disputes. Order free reports from annualcreditreport.com, dispute inaccuracies through credit bureaus’ online portals, follow up in writing if necessary, and request deletion of outdated negative items.

Implementing a Savings Plan shows lenders you’re serious. Build a dedicated down payment fund, document all deposits with clear source records, avoid large undocumented cash deposits, and demonstrate consistent saving ability.

At Manufactured Housing Consultants, we offer a specialized FICO Score Improvement Program designed to help potential homebuyers qualify for better loan terms. This program includes credit analysis and a personalized improvement plan, guidance on which accounts to pay down first, strategic approaches to credit utilization, and documentation assistance for loan applications.

One of our clients recently shared: “After following the FICO improvement plan for just four months, my score jumped from 545 to 612. This qualified me for an FHA loan with 3.5% down instead of the 15% I would have needed before.” Now that’s what I call results!

More info about FICO Score Improvement Program

For additional strategies on homebuying with credit challenges:

How to Buy a House with Bad Credit

The path to manufactured home ownership with credit challenges isn’t always straightforward, but with the right guidance and preparation, it’s absolutely achievable. We see families overcome these problems every day.

Conclusion & Next Steps

While bad credit mobile home loans guaranteed approval might sound like a marketing promise, the truth is that manufactured home ownership is absolutely within reach for credit-challenged buyers. It’s all about understanding your options and taking smart steps to strengthen your application.

Here at Manufactured Housing Consultants in Laredo, Texas, we’ve helped countless families turn their homeownership dreams into reality, even with credit obstacles. We don’t just sell homes – we provide solutions through:

- Personalized loan matching with our network of specialized lenders who understand manufactured housing

- Credit improvement strategies through our proven FICO Score Improvement Program

- Affordable home options from 11 top manufacturers, giving you plenty of choices

- Transparent pricing backed by our guaranteed lowest price commitment

Your Action Plan for Securing Financing

The path to financing your manufactured home starts with getting organized. First, assess your current credit situation by ordering free credit reports from all three bureaus. Take note of your FICO scores and identify specific areas where you can improve. If you have past credit issues, document explanations – lenders appreciate honesty about previous financial hardships.

Next, gather your documentation – this is something many buyers overlook until the last minute. Have your last two years’ tax returns, recent pay stubs, and bank statements ready to go. Don’t forget proof of other income sources, rental payment history, and your government-issued ID. Being prepared shows lenders you’re serious and organized.

Shop multiple lenders – this might be the most important step. Compare terms from at least 3-5 specialized manufactured home lenders. Look at both direct lenders and dealer financing options. Interest rates don’t tell the whole story – examine total loan costs, including fees. And always check lender reviews and reputation before proceeding.

Unfortunately, this industry does attract some predatory players. Be wary of scams by avoiding upfront fees before loan approval. Never wire money to secure “guaranteed” approval, and be suspicious of any lender who doesn’t verify your income. A quick check of a lender’s licensing with state authorities can save you headaches later.

Finally, plan for future refinancing. Many of our customers start with higher-rate loans when their credit is challenged, then refinance later as their situation improves. Set calendar reminders to check refinance options annually, continue your credit improvement efforts, and consider an FHA streamline refinance when you become eligible.

Manufactured homes offer exceptional value for your money – averaging just $88,200 compared to $244,000 for site-built homes. This makes them a perfect entry point to homeownership. With the right financing, these homes provide quality, affordable housing with modern amenities and energy efficiency that might surprise you.

I’ll never forget when Maria, one of our recent customers, told me: “I never thought I’d qualify with my 540 credit score and previous bankruptcy. Manufactured Housing Consultants found me a lender who worked with my situation, and now I’m paying less for my beautiful 3-bedroom home than I was for rent.”

Ready to explore your manufactured home financing options? We’re here to help at Manufactured Housing Consultants in Laredo, Texas. Our specialty is finding paths to homeownership for credit-challenged buyers. Our friendly team will walk you through available programs, help improve your credit profile, and match you with the perfect home from our extensive inventory.

More info about Mobile Home Financing

The journey to homeownership isn’t about having perfect credit—it’s about finding the right lender, the right program, and the right home for your unique situation. Let’s take that first step together today.