Open uping Your Path to Homeownership

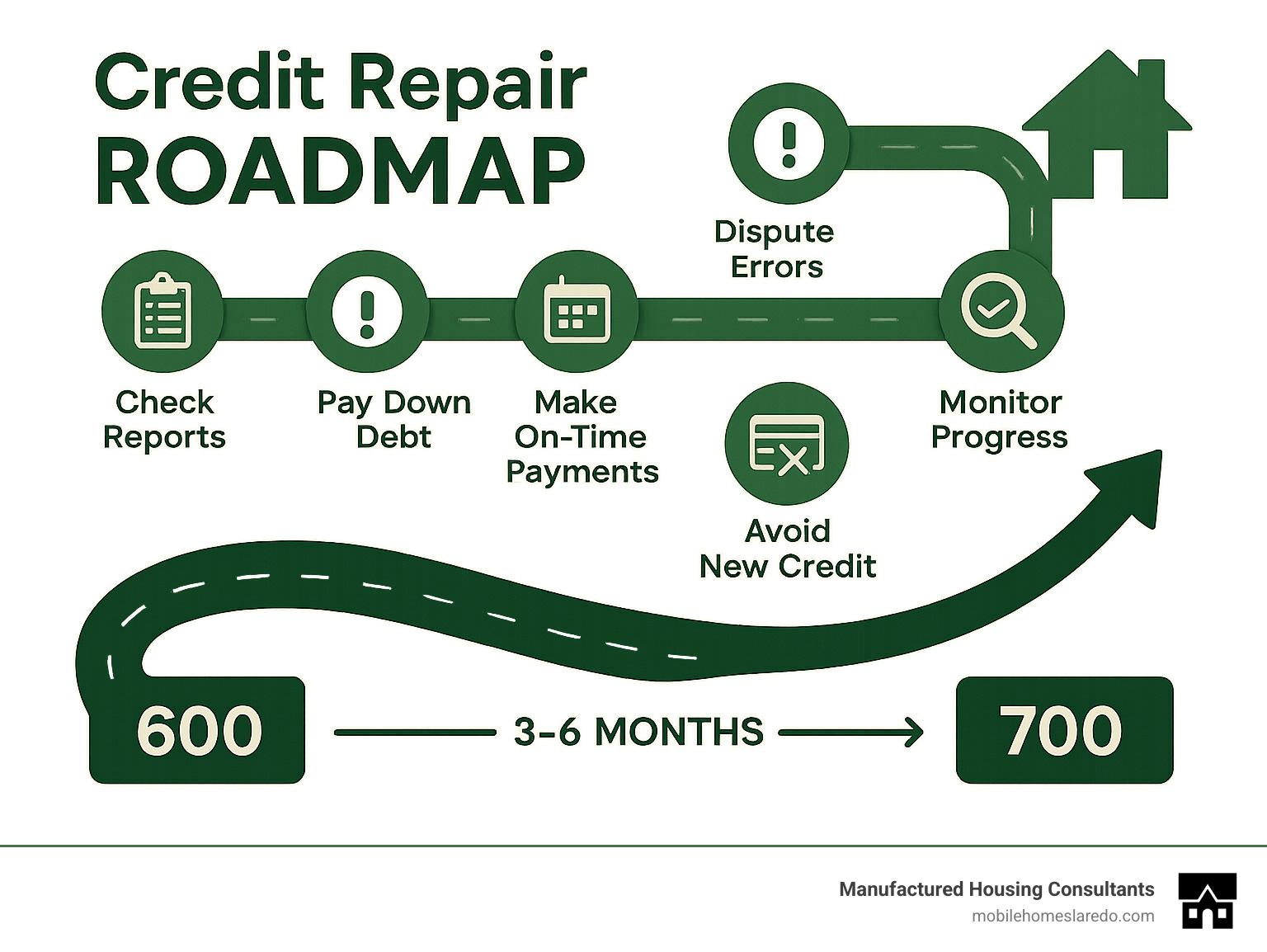

Credit repair for home loans is a critical process for anyone looking to buy a house but struggling with less-than-perfect credit. If you’re searching for quick ways to improve your credit for a mortgage, here’s what you need to know:

- Check your reports: Order free copies from all three bureaus through AnnualCreditReport.com

- Dispute errors: About 1 in 5 consumers has confirmed errors on their report

- Pay down balances: Keep credit utilization below 30% of available credit

- Make on-time payments: Payment history accounts for 35% of your FICO score

- Avoid new credit: Don’t open new accounts during the mortgage application process

Your credit score dramatically affects both your ability to get approved for a home loan and the interest rate you’ll pay. With the average FICO score in the U.S. at 717, lenders typically look for a minimum score of 620 for conventional loans, though government-backed options like FHA loans may accept scores as low as 500 with a larger down payment.

“What’s encouraging is that your credit score isn’t set in stone—you can improve it with the right strategies,” notes one mortgage expert. This is especially true when you consider that payment history (35%) and amounts owed (30%) make up the bulk of your FICO score calculation.

For Maria and many Texans like her, manufactured housing offers an affordable path to homeownership—but securing financing still requires credit preparation. The good news? Many credit improvements can boost your score in just one month, though a six-month effort is typically recommended for significant results.

Whether you’re aiming for a manufactured home or traditional housing, the steps to repair your credit remain the same: identify problems, create a plan, and execute consistently.

Key credit repair for home loans vocabulary:

Credit Repair for Home Loans: Build a Lender-Friendly Profile

When you’re dreaming of homeownership, your credit profile is like your financial resume to mortgage lenders. They don’t just glance at your score—they dive deep into your financial history to determine if you’re a good risk.

Here at Manufactured Housing Consultants, we’ve helped countless Texas families transform their credit profiles from “denied” to “approved.” Our experience shows that focusing on a few key areas can make all the difference.

Know Where You Stand: Reports, Scores & Red Flags

Your first step in credit repair for home loans should be getting acquainted with your credit reports from all three major bureaus: Equifax, Experian, and TransUnion.

Access your reports through AnnualCreditReport.com, the only government-authorized source for free credit reports. You’re entitled to one free report from each bureau every 12 months. Some consumers stagger these requests—pulling one bureau every four months—for year-round monitoring.

When mortgage lenders review your application, they typically pull a “tri-merge” report that combines information from all three bureaus.

Your FICO score will fall somewhere on this scale: Exceptional (800-850), Very Good (740-799), Good (670-739), Fair (580-669), or Poor (300-579). Most conventional loans require at least 620, though FHA loans may go as low as 500 with a larger down payment.

While reviewing your reports, watch for red flags like late payments, collections, charge-offs, judgments, high balances, or unfamiliar accounts. The Federal Trade Commission found that about one in five consumers has a confirmed material error on their credit report.

Fix What’s Broken: Disputes, Rapid Rescore & Old Collections

If you find errors, gather supporting documentation and submit a formal dispute to each bureau reporting the error. Include a clear explanation and copies of supporting documents. For maximum protection, send everything via certified mail with return receipt requested.

Credit bureaus must investigate disputes within 30 days and notify you of the results. If they confirm the information is incorrect, they must remove or correct it.

For old collections accounts, under newer FICO models, paid collections hurt less than unpaid ones. For smaller collections under $2,000, consider negotiating a “pay for delete” arrangement, sending a goodwill letter, or requesting debt validation.

For larger collections or judgments, consult a mortgage professional before taking action. Some well-intentioned moves can temporarily lower your score.

If you’re already in the mortgage application process, ask your lender about rapid rescoring. This service can update your credit report in days rather than weeks, potentially raising your score by 20-100 points.

Grow Your Points: Utilization Hacks & DTI Wins

Beyond fixing negatives, you can actively boost your score by optimizing credit utilization and debt-to-income ratio.

Your credit utilization accounts for 30% of your FICO score. People with the highest scores typically keep utilization below 10%, but staying under 30% is a good target. Keep balances below 30% of your limit on each card and overall. Pay down high-balance accounts first for maximum impact. Making multiple payments per month can keep reported balances low.

Consider requesting credit limit increases on existing accounts or becoming an authorized user on a family member’s long-standing, low-utilization card.

While your debt-to-income ratio (DTI) doesn’t directly affect your credit score, it’s crucial for mortgage approval. Most lenders prefer a DTI of 43% or lower.

To improve your DTI, consider the debt snowball method (paying off smallest balances first) or the debt avalanche approach (tackling highest-interest debt first). You might also look into consolidating high-interest debts into a single, lower-interest loan.

Our FICO Score Improvement Program is specifically designed to help prospective homebuyers optimize their credit profiles for manufactured home financing.

Credit Repair for Home Loans Timeline: How Fast Can Scores Rise?

Within 30 days, you can often see improvements from disputing errors, paying down credit card balances, becoming an authorized user, or using rapid rescoring.

By the three-month mark, you’ll likely see benefits from establishing a pattern of on-time payments, reducing your overall debt load, and improving your credit utilization.

At six months, you’ll have developed a longer positive payment history, and the impact of collections and negative items will start to diminish.

Some negative items have fixed expiration dates on your report:

- Late payments remain for 7 years from the delinquency date

- Collections stay for 7 years from the first missed payment

- Chapter 7 bankruptcy lingers for 10 years from filing

- Chapter 13 bankruptcy and foreclosures remain for 7 years

Free tools like Credit Karma and Experian’s free monitoring can help you track your progress. Many credit card issuers now provide free FICO score updates too.

Credit repair for home loans isn’t an overnight process, but with consistent effort, most people see significant improvements within 3-6 months.

Mortgage-Ready Moves & Conclusion

As your credit score climbs and you inch closer to that home loan application, there are specific steps that can make or break your approval chances. Think of this as the final stretch of your credit repair marathon.

When my client Maria was preparing to apply for her manufactured home loan, we created a pre-application checklist together. The “dos” were straightforward: maintain stable employment, save aggressively for down payment and closing costs, continue making on-time payments, gather documentation early, and get pre-approved before house hunting.

Just as important were the “don’ts”: avoid new credit applications, put off large purchases until after closing, stay in your current job if possible, keep old credit accounts open, and never co-sign loans during this critical period.

Here’s a little-known credit hack: When you’re ready to shop for mortgage rates, FICO gives you a 45-day window where multiple mortgage inquiries count as just one inquiry on your credit report.

For a more detailed walkthrough of the manufactured home loan process, check out our mobile home loan application step-by-step guide.

Loan Options & Required Scores

Different loan programs cater to different credit profiles, and understanding these options can help you target the right credit repair for home loans strategy.

| Loan Type | Minimum Credit Score | Down Payment | Best For |

|---|---|---|---|

| Conventional | 620+ | 3-20% | Borrowers with good credit |

| FHA | 580+ | 3.5% | First-time buyers, lower credit scores |

| FHA | 500-579 | 10% | Borrowers rebuilding credit |

| VA | No official minimum (typically 580+) | 0% | Eligible veterans and service members |

| USDA | No official minimum (typically 640+) | 0% | Rural homebuyers with moderate income |

| Chattel (for manufactured homes) | 575-620+ | 5-20% | Manufactured home buyers without land |

Lenders also look at “compensating factors” that can offset a lower credit score. These include making a larger down payment, having significant cash reserves, maintaining a low debt-to-income ratio, showing a stable employment history, or having documented on-time rent payments.

At Manufactured Housing Consultants, our Laredo team works with multiple specialized lenders who understand the unique aspects of manufactured home financing.

Credit Repair for Home Loans After Closing: Monitor & Protect

The journey doesn’t end at closing! Your new mortgage becomes a powerful credit-building tool.

After helping clients close on their manufactured homes, I always share these post-closing credit strategies: set up autopay for your mortgage, keep those old credit accounts open, regularly check your credit reports, consider identity theft protection, keep credit card balances low, and gradually diversify your credit mix as needed.

Your mortgage payment history quickly becomes the backbone of your credit profile. Those consistent, on-time payments create a strong foundation that can help you qualify for better rates on everything from auto loans to insurance.

Be vigilant about warning signs that could indicate identity theft or reporting errors: unexpected score drops, unfamiliar accounts, unauthorized inquiries, or addresses you’ve never lived at appearing on your reports.

At Manufactured Housing Consultants, we see homeownership as just the beginning of your financial journey. That’s why we offer ongoing credit coaching to our customers long after they’ve moved into their new manufactured home.

For more details about our specialized financing options, visit our mobile home financing page.

Final Thoughts on Credit Repair for Home Loans

The journey to improve your credit for a home loan isn’t always quick or easy, but the financial rewards make every effort worthwhile. When you boost your score by 100 points, you’re potentially saving $30,000 or more over your mortgage term through lower interest rates.

Here at Manufactured Housing Consultants, we’ve watched countless Texas families transform their homeownership dreams into reality through dedicated credit improvement. Our Laredo team specializes in matching folks with manufactured homes that fit both their lifestyle needs and financial situation.

The credit repair roadmap we’ve covered leads to real results:

First, get clear on your current credit picture by reviewing those reports. Next, dispute any errors and address negative items. Keep credit card balances low (remember that 30% utilization sweet spot!) and make every payment on time.

While in the mortgage application process, avoid opening new accounts or making major purchases. Choose the loan program that aligns with your credit profile. And remember, the credit journey continues long after you get those keys.

Whether you’re ready to shop for a manufactured home today or planning for a purchase down the road, implementing these credit repair for home loans strategies puts you on the path to better options and significant savings.

Our team at Manufactured Housing Consultants is ready when you are. We’re proud to offer an impressive selection from 11 top manufacturers, alongside specialized financing programs designed for folks at every point in their credit journey. From credit challenges to dream home selection, we’ve helped families just like yours steer the entire process with confidence.

Ready to explore what’s possible? Contact our team today and let’s turn those homeownership dreams into your family’s reality—no matter where you’re starting from on the credit spectrum.