{“@context”: “https://schema.org”, “@graph”: [{“@type”: “Article”, “headline”: “Mobile Home Values 2023 | Manufactured Housing Consultants”, “description”: “Discover what determines mobile home values today. From new to used homes, get insights on prices, depreciation, and factors affecting value.”, “author”: {“@type”: “Person”, “name”: “”}, “publisher”: {“@type”: “Organization”, “name”: “Manufactured Housing Consultants”, “logo”: {“@type”: “ImageObject”, “url”: “https://mobilehomeslaredo.com/wp-content/smush-webp/2023/06/download.png.webp”}}, “datePublished”: “2025-05-06T02:45:41.325337”, “dateModified”: “2025-05-06T02:45:41.325337”, “mainEntityOfPage”: {“@type”: “WebPage”, “@id”: “https://mobilehomeslaredo.com/determine-mobile-home-values/”}}, {“@type”: “FAQPage”, “mainEntity”: [{“@type”: “Question”, “name”: “What is the national average price for new mobile homes in 2023?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “The national average price for new mobile homes in 2023 is $124,300.”}}, {“@type”: “Question”, “name”: “How much do used mobile homes typically cost?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Used mobile homes typically cost $69,781, with a price range of $20,000 to $100,000+.”}}, {“@type”: “Question”, “name”: “What factors influence the value of a mobile home?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Factors influencing mobile home value include age and HUD code compliance, location and community, land ownership status, home size and features, and overall condition and upgrades.”}}, {“@type”: “Question”, “name”: “Why is it important to know your mobile home’s worth?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Knowing your mobile home’s worth is important for setting the right selling price, refinancing, ensuring adequate insurance coverage, estate planning, and accurately assessing property taxes.”}}, {“@type”: “Question”, “name”: “Do mobile homes appreciate or depreciate over time?”, “acceptedAnswer”: {“@type”: “Answer”, “text”: “Unlike traditional site-built homes that typically appreciate over time, manufactured homes often follow different valuation patterns, typically depreciating at a rate of 3-5% annually.”}}]}]}

What Determines Mobile Home Values in Today’s Market

Mobile home values vary significantly across the U.S., influenced by multiple factors that every owner and buyer should understand. If you’re looking for a quick answer about what mobile homes are worth today:

| Type | National Average Price (2023) | Price Range | Annual Depreciation |

|---|---|---|---|

| New Mobile Homes | $124,300 | $100,000-$164,100 | 3-5% typically |

| Used Mobile Homes | $69,781 | $20,000-$100,000+ | Varies by condition |

| Single-Wide | ~$50,000 (new) | $10,000-$50,000 | 3-3.5% |

| Double-Wide | ~$75,000 (new) | $50,000-$100,000 | 3-3.5% |

Note: These values exclude land prices and vary significantly by location and condition.

Determining what your mobile home is worth isn’t as straightforward as searching online or checking a standard real estate database. Unlike traditional site-built homes that typically appreciate over time, manufactured homes often follow different valuation patterns.

The good news? Mobile homes remain significantly more affordable than traditional homes, with new models costing about $285,572 less than the average new single-family home ($409,872) in 2023.

Whether you’re buying, selling, insuring, or refinancing, understanding the true value of a manufactured home requires considering:

- Age and HUD code compliance (homes built after 1976 meet higher standards)

- Location and community (values in Washington average $164,100 vs. $103,000 in Indiana)

- Land ownership status (owned land can dramatically increase total property value)

- Home size and features (double-wides command 20-50% higher resale values than single-wides)

- Overall condition and upgrades (which can impact value by up to 50%)

This guide will help you steer these factors to accurately determine what your mobile home is worth in today’s market.

Why Knowing Your Mobile Home’s Worth Matters

Understanding your mobile home’s value isn’t just about curiosity—it’s a practical necessity in several common scenarios:

- Selling your home: Setting the right price means the difference between a quick sale and months of waiting, or worse, leaving money on the table.

- Refinancing: Lenders require accurate valuations to determine loan amounts and interest rates.

- Insurance coverage: Without knowing your home’s true replacement value, you risk being underinsured.

- Estate planning: Proper asset valuation ensures fair distribution among heirs.

- Property taxes: Challenging incorrect tax assessments requires evidence of your home’s actual market value.

As one of our Laredo customers recently shared: “I almost listed my double-wide for $15,000 under market value because I didn’t realize how much my energy-efficient upgrades had increased its worth. Getting a proper valuation saved me thousands.”

Understanding Mobile Home Values Today

The manufactured housing market has changed dramatically in recent years. Between 2018 and 2023, mobile home values increased by an impressive 58.34% nationwide, outpacing the 37.66% growth seen in single-family home prices during the same period.

This rapid appreciation challenges the old assumption that all manufactured homes automatically lose value over time. While depreciation remains a reality for many units (especially those on rented land), the full picture is more nuanced.

Current Market Averages

The national average price for a new manufactured home reached $124,300 in 2023, but your location makes a huge difference in what you’ll pay. If you’re in Washington state, you’re looking at around $164,100 for a new home, while folks in Indiana might pay just $103,000 for something similar.

Here in Texas, our average sits at $121,400 – up a whopping 61.44% since 2018! Some states have seen even more dramatic growth, with Kansas leading the pack at nearly 85% price increases over five years.

When you compare these figures to the average site-built home price of $409,872, it’s easy to see why manufactured housing remains such an attractive option for budget-conscious homebuyers.

Can Mobile Home Values Appreciate?

The old saying that manufactured homes only go down in value simply isn’t always true anymore. While many units do lose value over time (especially those in parks), appreciation is possible under the right circumstances.

Land ownership is the biggest factor – when you own both the home and land, the property as a whole can ride the wave of the local real estate market. Homes permanently affixed to foundations with utilities connected are more likely to hold or gain value, especially newer models built to HUD standards.

Quality maintenance makes a huge difference, too. Well-maintained homes with regular updates can preserve or even increase in value, particularly in desirable locations with strong housing demand.

The Federal Housing Finance Agency (FHFA) has conducted research showing that manufactured homes can appreciate at rates similar to site-built homes under favorable conditions, particularly when the land is owned. This scientific validation helps dispel outdated myths about manufactured housing as a poor investment.

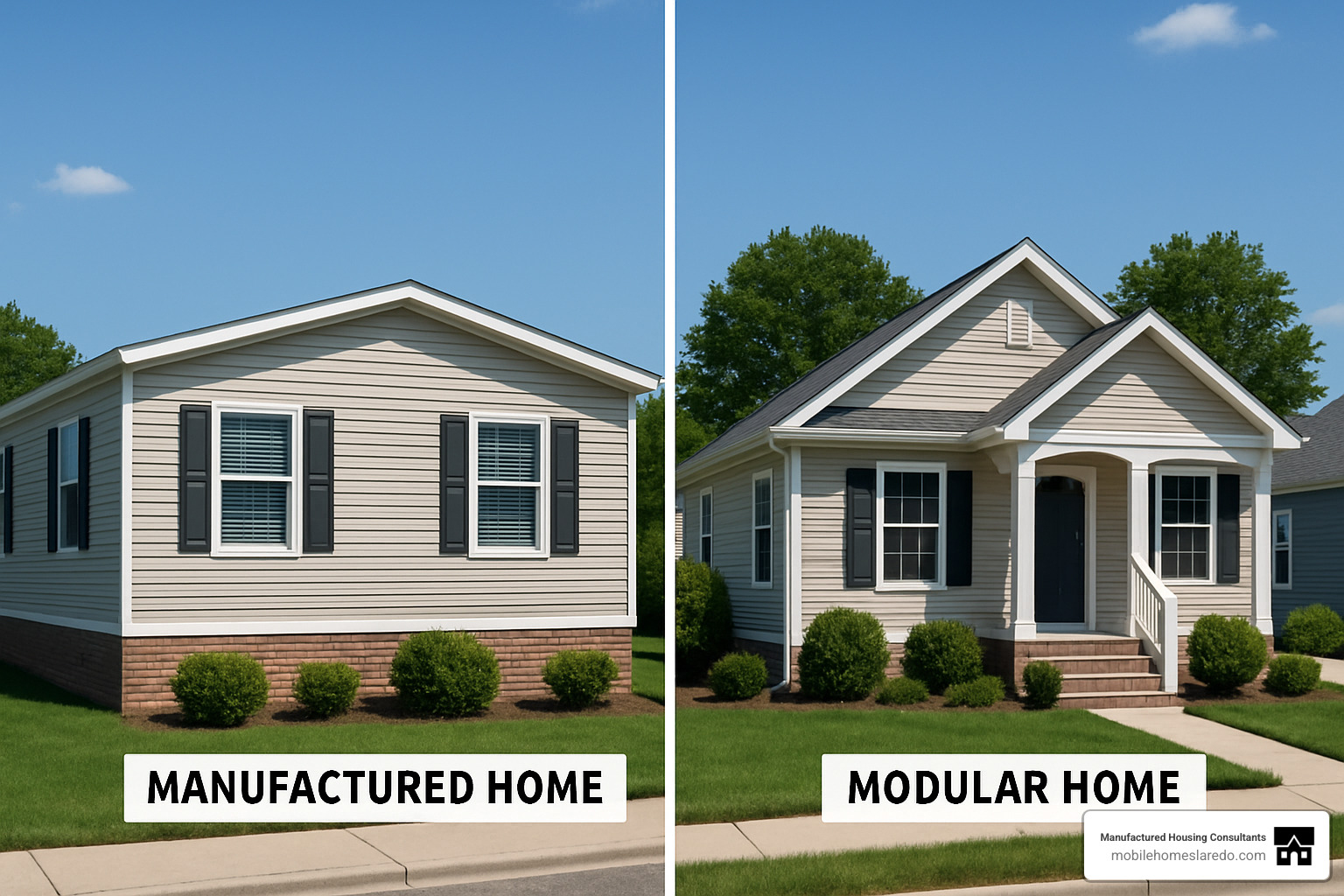

Mobile, Manufactured & Modular: Does the Label Change Value?

The terminology used to describe factory-built housing isn’t just semantics—it can significantly impact mobile home values and your financing options.

“Mobile home” technically refers only to units built before the 1976 HUD code. These older homes typically have the lowest values and face the most financing challenges.

“Manufactured homes” are built after June 15, 1976, to HUD code standards. They must be at least 8 feet wide and 40 feet long and are built on a permanent chassis. While still factory-built, these homes meet federal safety standards that their older counterparts don’t.

“Modular homes” represent another category entirely. These factory-built homes are constructed to state, local, or regional building codes rather than the HUD code. They’re typically placed on permanent foundations and legally classified as real property from day one.

These distinctions matter for your wallet. Modular homes typically qualify for conventional mortgages more easily than manufactured homes. They’re appraised using different methods and generally follow appreciation patterns more similar to site-built homes. Even insurance costs vary between these housing types.

Want to learn more about the different housing options available? Check out our guide to Types of Mobile Homes and Factors That Influence Mobile Home Values.

How to Determine and Improve Mobile Home Values

Finding out what your manufactured home is truly worth isn’t as simple as checking a website or calling a realtor. Unlike traditional homes, manufactured housing follows different valuation rules – but don’t worry, I’m here to walk you through the process in plain English.

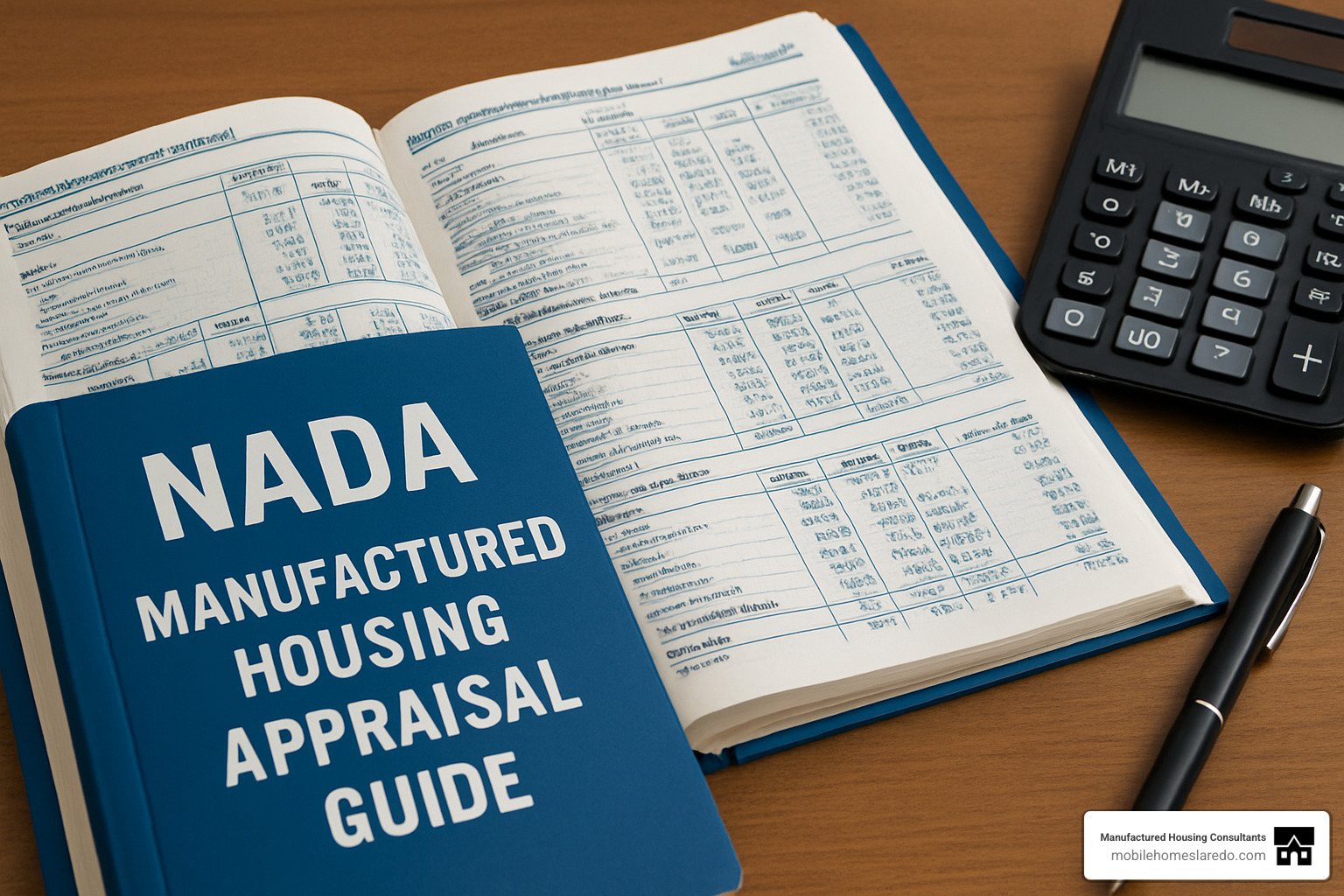

The NADA Guide Method

Think of the NADA Manufactured Housing Appraisal Guide as the “blue book” for mobile home values. Just like you might check the Kelley Blue Book before buying a car, the NADA guide gives you baseline values based on your home’s manufacturer, age, size, features, and region.

While incredibly useful, the NADA guide does have its limitations. It doesn’t factor in your specific location (which can make a huge difference), doesn’t include land value, might not reflect the latest market trends, and doesn’t fully account for your home’s condition or any upgrades you’ve made.

That said, the NADA guide is perfect for getting a quick baseline value, estimating insurance replacement costs, or figuring out what your home might be worth if you plan to move it to a new location.

Professional Appraisal Method

When accuracy really matters – especially for financing, selling, or legal purposes – nothing beats a professional appraisal. A qualified appraiser will physically inspect your home, consider your specific location, look at recent comparable sales, account for land value separately, and provide legally recognized documentation.

These professionals typically charge between $250-$400 and use Form 1004C for manufactured homes classified as real property. While this might seem expensive, it’s money well spent when thousands of dollars are on the line in a sale or refinance.

As Maria from Laredo told us, “I thought my double-wide was worth maybe $45,000 based on online estimates. The professional appraiser valued it at $68,500 because of my lot location and the upgrades I’d made over the years. That $300 appraisal fee earned me an extra $23,500!”

Comparative Market Analysis (CMA)

A comparative market analysis looks at recent sales of similar manufactured homes in your area to determine what buyers are actually willing to pay right now. This approach reflects current market conditions, accounts for location value, and provides real-world pricing guidance.

Many knowledgeable real estate agents can perform a CMA for you, often at no cost if they hope to list your property. When searching for comparable sales, use these radius guidelines:

- Urban areas: Look within a half-mile

- Suburban areas: Look within one mile

- Rural areas: Expand your search to a five-mile radius

Step-by-Step: Using the NADA Guide

The NADA guide remains the most accessible starting point for determining baseline mobile home values. Here’s how to use it effectively:

First, gather all your home information. Locate your data plate (typically inside a kitchen cabinet, electrical panel, or master bedroom closet) and note the manufacturer, model, year, and VIN/serial number. Measure your home’s dimensions and document any factory options or add-ons.

Next, visit the NADA website or purchase a physical copy. Basic online reports cost about $35, while advanced reports with more detail run around $55.

Enter your information accurately, including your home’s make, model, year, dimensions, features, region, and overall condition. The report will show you the average retail value – just remember this excludes land, delivery, and setup costs.

Consider this a starting point rather than the final word on your home’s value. You’ll need to adjust for factors not included in the report, like your specific location quality (which can add or subtract up to 20%), actual condition (up to 50% difference), special features or upgrades, and local market conditions.

When to Hire a Professional Appraiser for Mobile Home Values

While DIY methods work for basic estimates, certain situations demand professional expertise for accurate mobile home values:

Financing requirements typically top the list – most lenders simply won’t approve loans without a professional appraisal. Estate settlements and legal proceedings often require certified valuations, while insurance disputes and tax appeals need expert documentation to succeed.

Homes with significant upgrades, land ownership, or unusual features benefit tremendously from expert assessment. And frankly, the more money involved in your transaction, the more important accuracy becomes.

Finding and Adjusting Comparable Sales

Nothing beats real-world evidence of what similar homes have sold for in your market. To find truly comparable homes, look for properties with similar age (within 5-10 years), similar size and configuration, similar location quality, similar amenities, and recent sales (preferably within the last 6 months).

When making adjustments for differences, you’ll typically adjust about $20-30 per square foot for size differences, 3-5% per year for age differences, up to 50% for condition variations, and the actual cost of upgrades (discounted for age) for feature differences.

Good sources for comparable sales data include online marketplaces specializing in manufactured homes, county property records, local mobile home dealers, and real estate agents familiar with manufactured housing.

Remember to separate land value from home value. For homes on owned land, research vacant land values in your area and subtract that to determine your home’s contribution to the total property value.

Generally speaking, single-wide homes typically sell for $10,000-$25,000 used, while double-wides range from $20,000-$60,000+, depending on condition, age, and location. Triple-wide or multi-section homes can easily command $100,000+ even without land.

Upgrades & Maintenance That Protect Mobile Home Values

The right improvements can significantly boost your mobile home’s value and slow depreciation. Strategic investments in your property can pay dividends when it’s time to sell.

For exterior improvements, focus on roof maintenance (resealing after storms and considering metal roofing upgrades), skirting (replacing damaged vinyl and upgrading to brick or stone-look options), siding (repairing damaged sections and considering vinyl or fiber-cement upgrades), landscaping (maintaining your lawn and adding defined walkways), and structural integrity (annual leveling and proper tie-downs).

Inside your home, kitchen renovations deliver the biggest bang for your buck. Modern countertops, updated cabinets, and energy-efficient appliances can transform your space. Bathroom improvements like updated fixtures and modern vanities make a big impression, too. Consider replacing worn carpet with luxury vinyl plank (LVP) or laminate flooring for a fresh, modern look.

Energy efficiency upgrades aren’t just good for the planet – they’re great for your wallet and your home’s value. Improved insulation, energy-efficient windows and doors, smart thermostats, and Energy Star appliances all contribute to higher valuations.

At Manufactured Housing Consultants, we’ve helped hundreds of Texas homeowners understand and maximize their home values. Our expertise in the local market can help you make smart decisions about which improvements will deliver the best return on investment for your specific property.

Conclusion & Next Steps

Understanding mobile home values isn’t just about numbers—it’s about recognizing the true worth of your investment. Whether you’re buying your first manufactured home, considering selling, or looking to maximize your current home’s value, knowledge is power.

Throughout this guide, we’ve explored how manufactured homes offer remarkable affordability in today’s housing market. At $124,300 for the average new manufactured home in 2023, compared to $409,872 for site-built homes, the value proposition is clear. But as we’ve seen, the story goes deeper than just the price tag.

Your manufactured home’s worth depends on a rich mix of factors. Location remains king—a well-maintained home in a desirable area of Texas will command a significantly higher price than an identical model elsewhere. Condition speaks volumes to potential buyers and appraisers alike, while age and land ownership status create the foundation for your home’s long-term value prospects.

Perhaps most encouragingly, we’ve debunked the myth that all manufactured homes automatically depreciate. When permanently installed on owned land in growing communities, many homes actually appreciate over time—particularly those built to modern HUD standards with quality upgrades and proper maintenance.

At Manufactured Housing Consultants, we’re passionate about helping Texas families find affordable, high-quality housing solutions. Our team in Laredo understands the unique Texas manufactured housing landscape and can help you steer it with confidence.

We’re here to help you make informed decisions about your manufactured home. The mobile home values we’ve discussed reflect not just structures, but the lifestyle, community, and financial freedom that manufactured housing provides to so many Texas families.

Related content about mobile home values: