Double wide cost is a topic that resonates with many prospective homeowners. With housing affordability being a significant concern for many, like Maria in Texas, understanding how much a double wide home will cost can be invaluable. Double wide homes offer a unique combination of affordability and flexibility, making them an attractive option for budget-conscious individuals seeking modern and stylish living spaces.

- Affordability: Typically, double wide homes are more cost-effective than traditional homes. Their construction in controlled environments reduces weather-related delays and material wastage, translating into lower costs.

- Flexibility: These homes come with customizable floor plans that allow buyers to design spaces according to their personal needs. This adaptability extends beyond design—with options to situate homes in parks or on purchased land.

- Manufactured Homes: Often termed as manufactured or modular homes, double wide homes are built in factories and assembled on-site. This method promotes sustainability by utilizing materials efficiently.

For those who seek a richer understanding of double wide homes, our article will dig into the comprehensive breakdown of their costs, influencing factors, and potential financing avenues.

Understanding Double Wide Costs

Factors Influencing Double Wide Cost

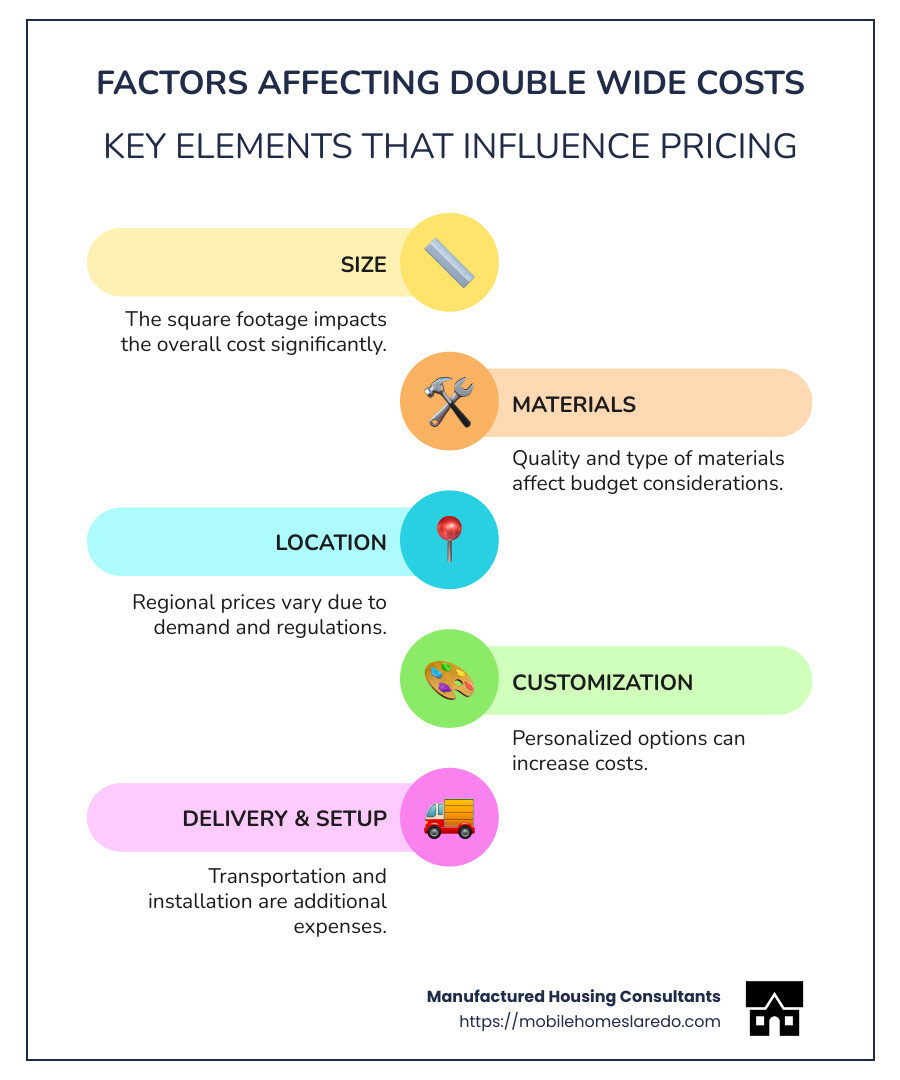

When it comes to double wide cost, several factors come into play. Each element can significantly impact the final price you pay.

1. Size: The size of a double wide home is one of the most significant cost determinants. These homes typically range from 1,200 to 2,500 square feet. Larger homes require more materials and labor, which naturally increases the cost.

2. Materials Used: The quality and type of materials used in construction also affect the cost. High-end materials for interiors and exteriors can raise prices, while more economical options can keep costs lower.

3. Location of Land: Where you plan to place your double wide home can have a big impact on the price. Land costs vary widely from one region to another. In some areas, land might be affordable, while in others, it can be quite expensive.

4. Customization: Customizing your double wide home with unique layouts or finishes can also add to the cost. The more elaborate the customization, the higher the price tag.

Double Wide Cost Per Square Foot

Understanding the cost per square foot can help you compare double wide homes with other housing options.

- Average Cost: On average, the cost of a double wide home ranges from $120,000 to $160,000. This cost typically includes delivery and assembly but excludes land, foundation, and utility hookups.

- Regional Differences: Costs can vary significantly depending on the region. For example, in Texas, where land might be more affordable, the overall cost could be lower compared to states with higher land prices.

- Price Range and Square Footage: Considering the price per square foot, double wide homes often offer a more affordable option compared to traditional site-built homes. This affordability makes them appealing to many buyers.

In summary, while double wide cost is influenced by several factors, understanding these can help prospective buyers make informed decisions. Whether it’s the size, materials, or location, each aspect plays a role in determining the final cost. Understanding these elements is key to finding the right home that fits both your budget and lifestyle needs.

Financing Options for Double Wide Homes

When you’re considering a double wide home, understanding the financing options available is crucial. These options can significantly affect your buying power and the overall cost of your home.

Specialized Financing Programs

1. Loan Programs and Credit Score Requirements

Financing a double wide home often requires meeting specific credit score requirements. Conventional loans typically require a credit score of at least 620. However, there are specialized programs with more lenient criteria:

- FHA Loans: Backed by the Federal Housing Administration, these loans are popular for their flexibility. They allow for a lower credit score of 580 and require a down payment as low as 3.5%.

- VA Loans: Available to veterans and active-duty military members, VA loans require no down payment if you have full entitlement. They also accept a credit score starting at 580, making them an excellent option for eligible buyers.

- USDA Loans: For those purchasing in rural areas, USDA loans offer a zero down payment option and require a minimum credit score of 640. These loans are designed to encourage home ownership in less populated areas.

2. Down Payments and Loan Types

The type of loan you choose will determine your down payment. Conventional loans generally require at least 5% down, while FHA, VA, and USDA loans offer lower or no down payment options. This flexibility can make a significant difference, especially if you’re working with a tight budget.

3. Impact of Credit Scores

Your credit score plays a pivotal role in the type of loan you can secure and the interest rate you’ll receive. A higher score can qualify you for better rates, potentially saving you thousands over the life of the loan. If your score is lower, focusing on improving it before applying can be beneficial.

In summary, exploring various financing options can help you find the best fit for your financial situation and home buying goals. Whether it’s an FHA, VA, or USDA loan, understanding the requirements and benefits of each can guide you toward making an informed decision.

Next, we’ll dive into the additional costs you might encounter beyond the purchase price of your double wide home.

Additional Costs to Consider

When purchasing a double wide home, the initial price is just one part of the equation. There are several additional costs you’ll need to budget for, including land, delivery, and more.

Land and Site Preparation

1. Land Purchase

Buying land for your double wide is a significant expense. The cost varies based on location and size. In areas like California, land can be pricey, while in Texas, it might be more affordable. Always research local land prices before making a decision.

2. Delivery

Transporting your double wide home to your site can be costly. Delivery fees generally range from $1,000 to $5,000 within a 100-mile radius. If your site is further away, expect to pay between $6.00 and $15.00 per mile.

3. Foundation

A proper foundation is crucial for stability. Costs for foundations can vary widely, often ranging from $7,000 to $47,000, depending on the type and complexity.

4. Zoning Restrictions

Before purchasing land, check for zoning restrictions. These rules can affect whether you can place a manufactured home on the property. It’s essential to ensure the land is zoned appropriately to avoid future issues.

5. Utility Hookups

Connecting utilities like water, electricity, and sewage can add to your expenses. Costs depend on the distance to existing utility lines and local regulations. Budget for several thousand dollars to cover these essential connections.

Insurance and Taxes

1. Homeowners Insurance

While not legally required, homeowners insurance is highly recommended. It covers your home and belongings against damage and theft. Insurance premiums depend on factors like location, home size, and coverage level. Expect to pay more if your home is in an area prone to natural disasters.

2. Property Tax

Property taxes for manufactured homes can vary. They’re influenced by the land’s value and local tax rates. Check with local tax authorities to understand your obligations and budget accordingly.

Understanding these additional costs ensures you’re fully prepared for the financial commitment of owning a double wide home. Next, we’ll address some common questions about the cost of double wide homes.

Frequently Asked Questions about Double Wide Cost

How much are most double wides?

The average cost of a double wide home typically ranges from $120,000 to $160,000. This price includes delivery and assembly. However, it’s important to note that this does not cover additional costs like land purchase or utility hookups.

When considering a new vs pre-owned double wide, new homes generally fall within the standard price range mentioned above. Pre-owned homes, on the other hand, can be more affordable but may vary significantly in price depending on their condition and location.

How much do double wides sell for?

Regional variations can significantly impact the selling price of double wides. For instance, in states like Texas, where land is more abundant, prices might be more competitive compared to states with higher land costs, like California.

Market trends also play a role. Double wide homes in high-demand areas or those with appreciating real estate markets might sell for higher prices. According to recent data, manufactured homes, including double wides, appreciate at a rate similar to traditional homes, making them a sound investment in many areas.

What are the financing options for double wides?

When it comes to financing, there are several loan types available for purchasing a double wide home. These include conventional loans, as well as government-backed options like FHA loans, VA loans, and USDA loans. Each of these has specific requirements and benefits.

Your credit score will significantly impact your financing options. For instance, FHA loans generally require a credit score of at least 580, while conventional loans typically need a score of 620 or higher. A higher credit score can also lead to better interest rates and loan terms.

Understanding these aspects of double wide costs and financing can help you make informed decisions when purchasing a manufactured home.

Conclusion

At Manufactured Housing Consultants, we believe that investing in a double wide home is not just about finding a place to live; it’s about securing a valuable asset for the future. Our homes are designed to offer both affordability and flexibility, making them a smart choice for those looking to invest in real estate.

Value Appreciation

One of the most compelling reasons to consider a double wide home is its potential for value appreciation. While traditionally, manufactured homes were seen as depreciating assets, recent trends show that well-maintained double wides can appreciate at rates similar to traditional homes. This is particularly true when the home is placed on owned land, as land value tends to increase over time. By choosing a double wide from Manufactured Housing Consultants, you’re not just buying a home—you’re investing in a property that can grow in value.

Investment Potential

Double wide homes offer a unique investment potential. With the rising costs of traditional homes, manufactured homes provide an affordable entry point into the housing market. They allow homeowners to build equity and accumulate wealth over time. This is especially advantageous in regions with appreciating real estate markets, where the demand for affordable housing continues to grow.

Choosing a double wide home from Manufactured Housing Consultants means you’re partnering with a company that offers guaranteed lowest prices and a wide selection from top manufacturers. Our specialized financing options cater to all credit types, ensuring that your path to homeownership is as smooth as possible.

If you’re ready to explore the possibilities of owning a double wide home, we invite you to learn more about the resale value of mobile homes. Let us help you find a home that not only fits your budget but also sets the stage for a brighter financial future.