Why FHA Mortgages Make Manufactured Home Ownership Possible

Factory-built housing has come a long way. Modern manufactured homes include energy-efficient appliances, granite countertops and smart-home tech, often at half the price of comparable site-built properties. The catch is financing: many banks still view manufactured homes as higher-risk.

That’s where an FHA mortgage for manufactured home buyers shines. Backed by the Federal Housing Administration, these loans lower the bar on credit, down payment and debt-to-income (DTI) ratios so more Texas families can purchase a safe, comfortable home.

Quick Answer: FHA Manufactured Home Loan Basics

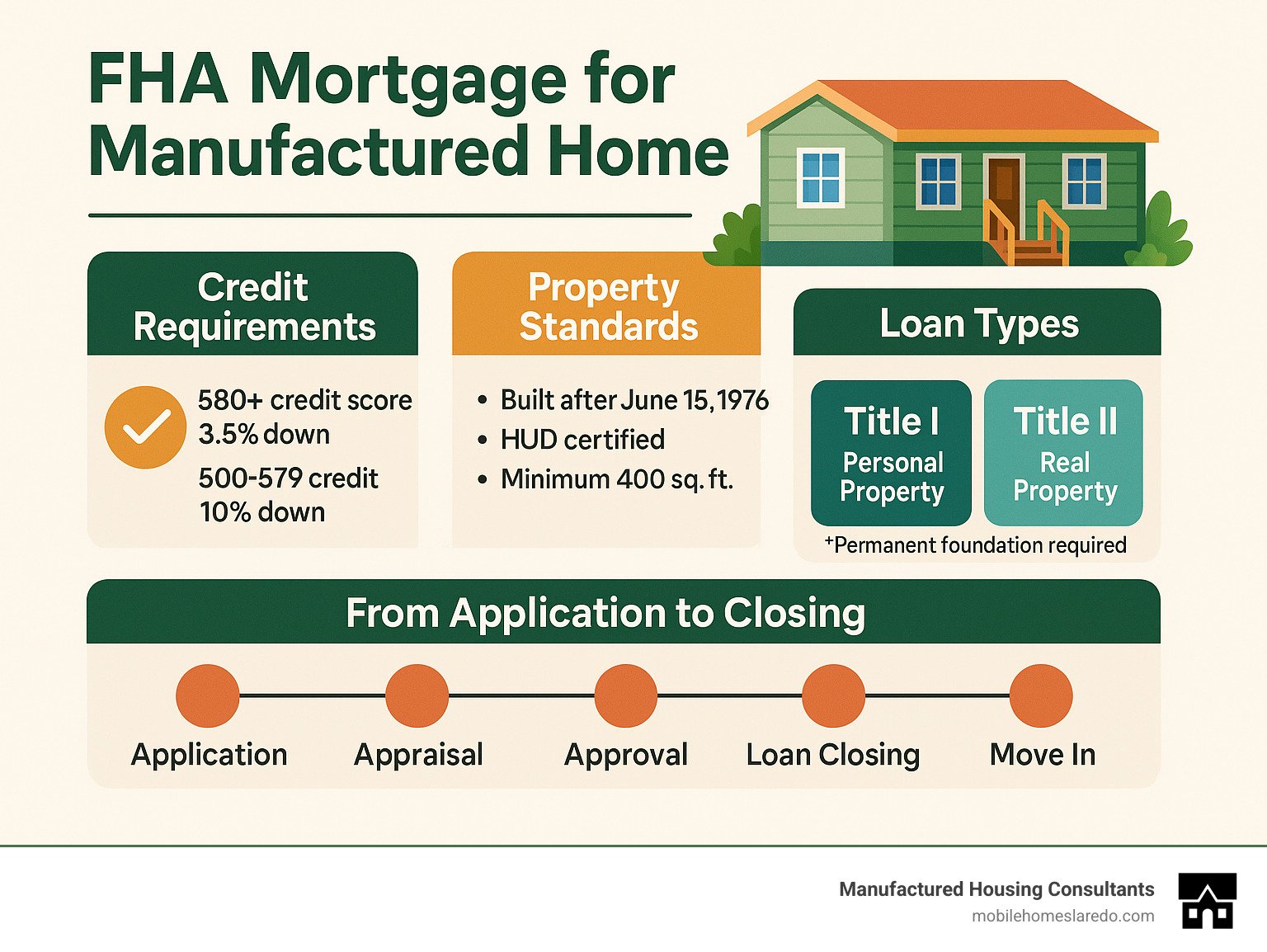

- Minimum Down Payment: 3.5% (credit 580+) or 10% (credit 500-579)

- Loan Types: Title I (personal property) or Title II (real property)

- Home Requirements: HUD-code, built after June 15 1976, ≥ 400 sq ft

- Foundation: Permanent attachment required for Title II loans

- Loan Limits (2024): Up to $92,904 (Title I home+lot) or $498,257 (Title II)

- Terms: 15-30 years, depending on loan type and property

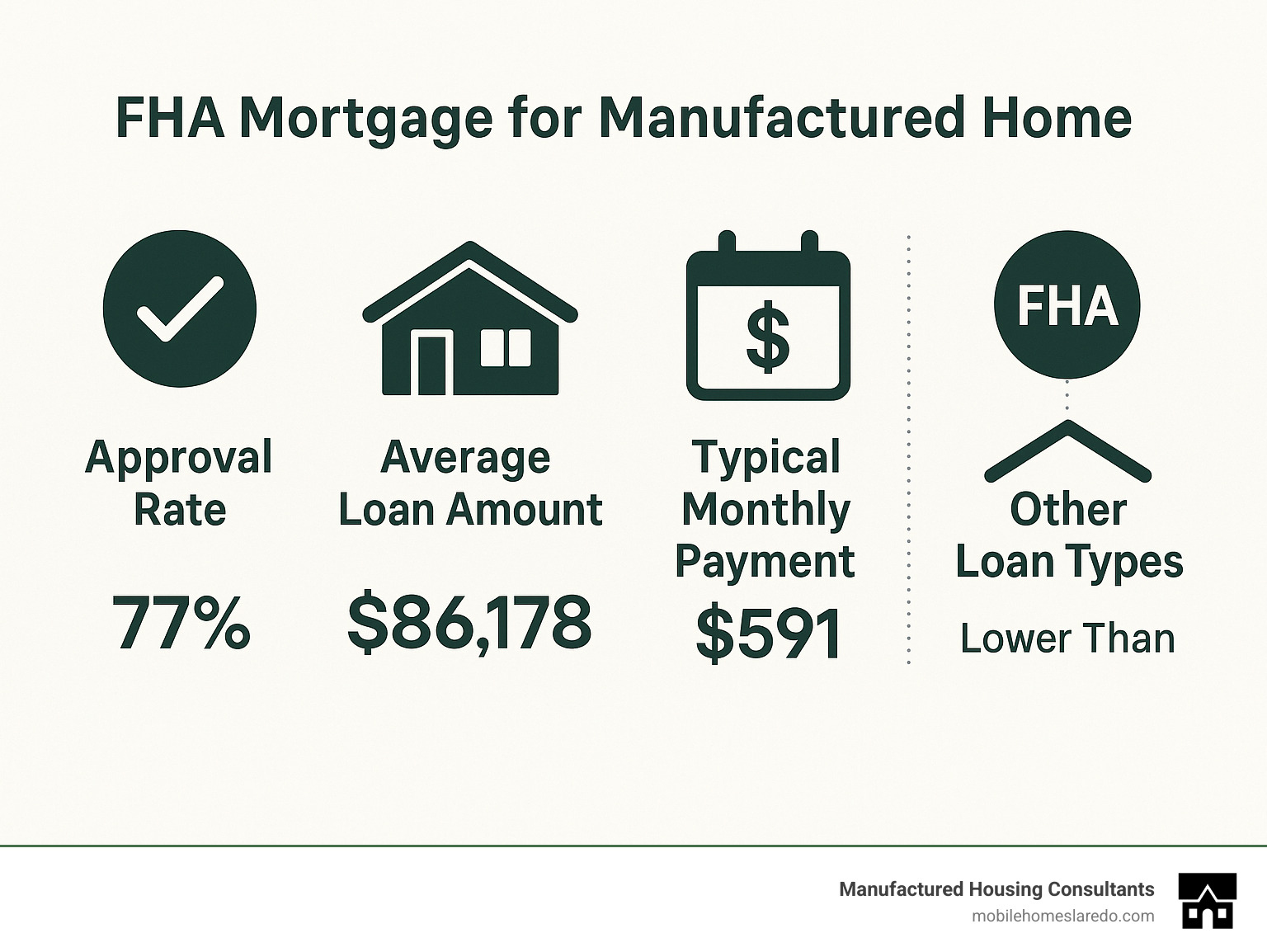

In Texas, manufactured homes already account for roughly 8 % of all housing units, providing an affordable path to ownership for first-time buyers, retirees and growing families. With today’s FHA programs, Manufactured Housing Consultants can match you to a home that meets HUD standards and your budget—without the 20 % down payment a conventional lender might demand.

FHA Mortgage for Manufactured Home: Eligibility & Application Steps

Title I vs. Title II Loan Programs

| Feature | Title I | Title II |

|---|---|---|

| Max Loan Amount | $92,904 (home+lot) | $498,257 (most TX counties) |

| Terms | 15-25 yrs | Up to 30 yrs |

| Foundation | Basic install | Permanent foundation |

| Land | Lease OK (≥3 yrs) | Must own or finance |

| Down Payment | Varies by lender | 3.5 % min |

| Interest Rates | Usually higher | Usually lower |

• Title I treats the home as personal property—ideal if you’re placing the unit on leased land or inside a park.

• Title II treats the home + land as real estate, offering longer terms and larger loan limits.

Manufactured vs. Mobile vs. Modular

– Manufactured (FHA-eligible): HUD-code, built after 6/15/1976, permanent chassis, ≥ 400 sq ft.

– Mobile (not eligible): Pre-1976 units that lack HUD certification.

– Modular (eligible under standard FHA rules): Built to local codes, assembled on-site like a site-built home.

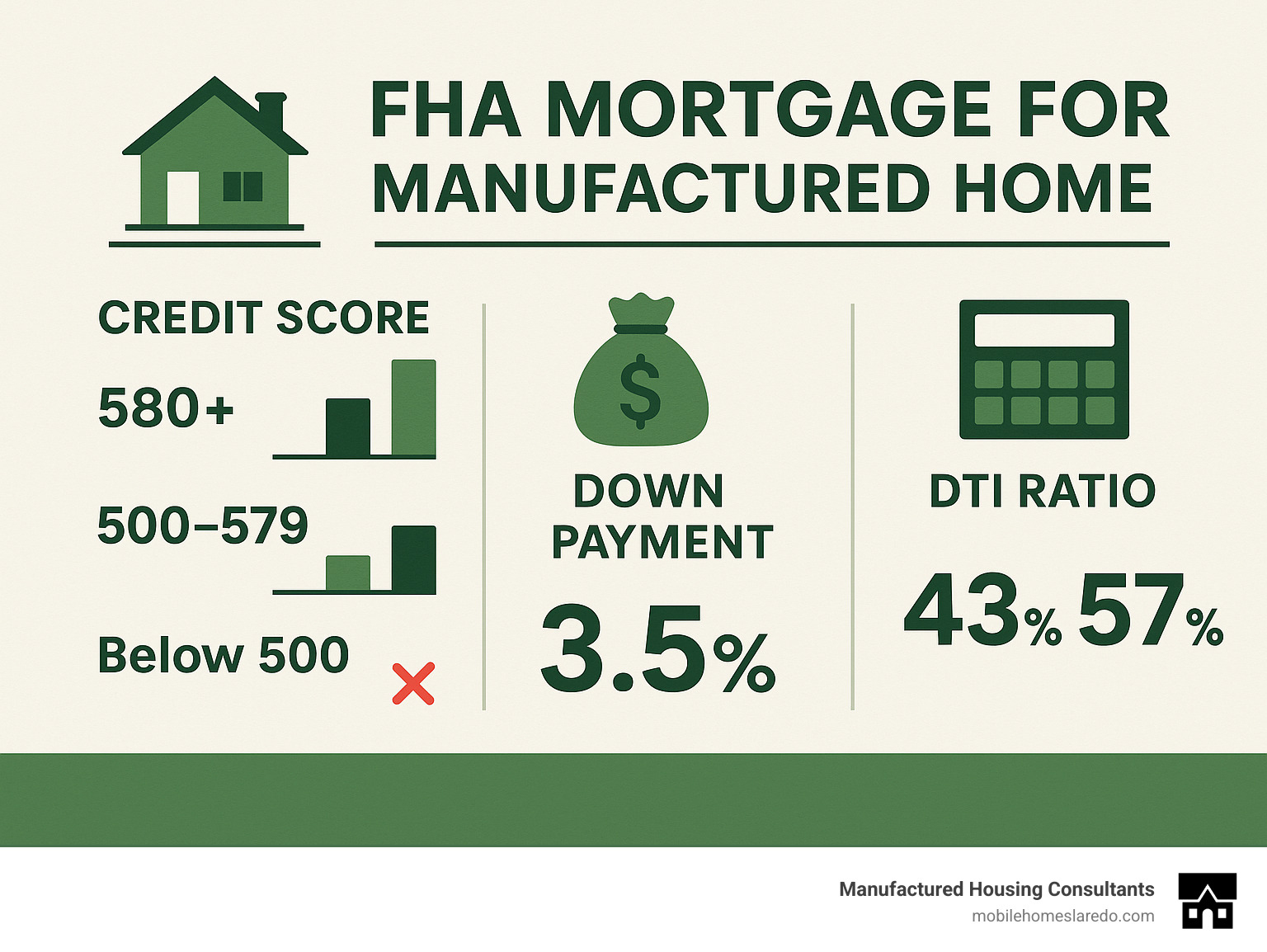

Credit & Income Rules

• 580+ score = 3.5 % down.

• 500-579 score = 10 % down.

• Typical max DTI 43 %, but up to 57 % with strong compensating factors.

• 2-year employment history and clean CAIVRS (no federal debt defaults) required.

Get your free score on LendingTree Spring today to see where you stand.

Step-by-Step Application

- Pre-approval – Supply tax returns, pay stubs and bank statements to an FHA-approved lender.

- Shop HUD-certified homes – Verify the red HUD tag and build date.

- Foundation & site check – For Title II, the home must be placed on a foundation that meets the FHA Permanent Foundations Guide.

- Appraisal – An FHA appraiser confirms value and safety.

- Underwriting & close – Sign final documents, fund the loan and record the title.

Use the HUD lender list to find specialists, or start with Manufactured Housing Consultants—we work with multiple lenders that know Texas manufactured housing inside and out.

Pros, Cons & Next Steps for FHA Mortgage for Manufactured Home

Refinance & Mortgage Insurance Costs

– Up-front MIP: 1.75 % (can be rolled into the loan).

– Annual MIP: 0.15–0.75 % (often ~0.85 %).

– Streamline refinance: No appraisal or income docs needed if you later want to lower your rate.

– Equity-build exit: Once you hit 20 % equity, refinance to a conventional loan to drop MIP.

Current rates: Mobile Home Mortgage Interest Rates

Benefits vs. Drawbacks

Pros:

• 3.5 % down payment option

• Credit scores accepted from 500 (with 10 % down)

• Assumable loan—may help resale if rates rise

• Standardized guidelines across lenders

Cons:

• MIP lasts the life of the loan with <10 % down

• Strict HUD property standards

• Primary residence only

• Loan limits may cap luxury purchases

Alternatives: Conventional (20 % down, no MIP), VA (0 % down for veterans), USDA (0 % down in rural areas) or chattel loans for homes on leased land. Financing Your Manufactured Home compares each option.

Final Checklist

✅ HUD label & post-1976 build

✅ ≥ 400 sq ft and proper chassis

✅ Permanent foundation (Title II)

✅ Credit, income and reserves ready

✅ Pre-approval letter in hand

Manufactured Housing Consultants pairs you with FHA-ready homes from 11 top builders and lenders that welcome every credit tier. Our FICO Score Improvement Program has already helped thousands of Texans open up lower rates and smaller down payments.

Need a guide? Explore Mobile Home Financing 2: What You Need to Know or visit our Laredo showroom to start your journey today.