Why Foreclosed Mobile Homes Are Your Fast Track to Affordable Homeownership

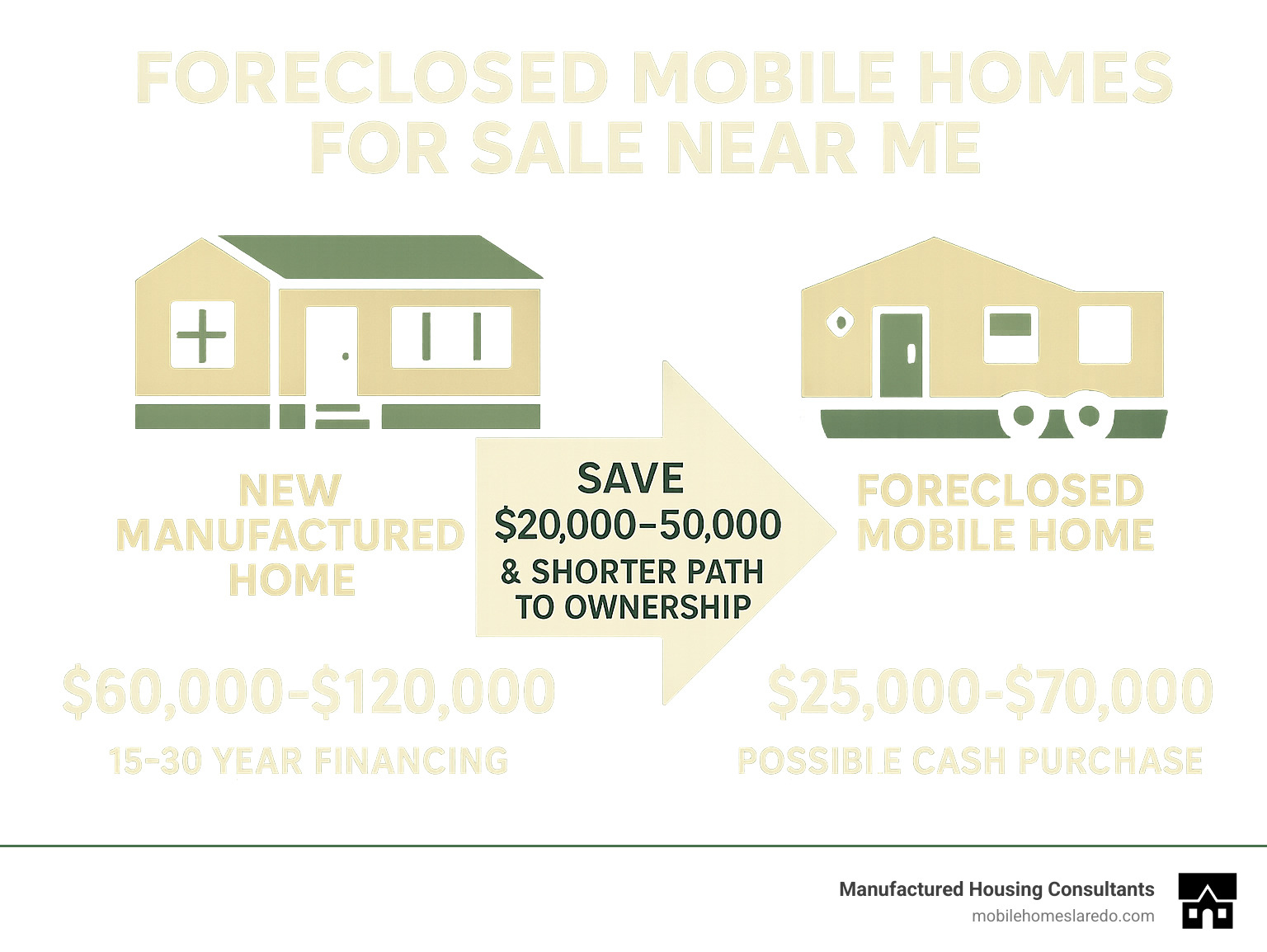

Searching for foreclosed mobile homes for sale near me is one of the smartest paths to homeownership for budget-conscious buyers. These repo properties can cost thousands less than new homes—sometimes as little as a down payment on a traditional house.

Quick Answer: Where to Find Foreclosed Mobile Homes

- Local banks and credit unions in their REO (Real Estate Owned) departments

- Government auctions like GSA Auctions and local surplus sales

- Specialized dealers like Manufactured Housing Consultants with repo inventory

- Online listing platforms and bank websites

- Directly from manufactured home lenders

When a homeowner can’t make payments, the lender repossesses the home. The bank’s goal is to sell it quickly, which means you can save big. These homes often sell for significantly less than market value because lenders prioritize a fast sale over maximum profit.

However, these homes are sold “as-is, where-is” with no warranties. You might find minor cosmetic issues or major structural problems. That’s why smart buyers always get professional inspections and work with experienced dealers who understand the repo market.

The good news? With proper guidance, you can find quality foreclosed homes that just need minor touch-ups, allowing you to avoid long-term loans entirely.

Foreclosed mobile homes for sale near me terms to know:

How to Find and Buy Foreclosed Mobile Homes for Sale Near Me

Finding your dream home at a fraction of the cost is an exciting treasure hunt. When you know where to look, buying foreclosed mobile homes for sale near me becomes a straightforward process with a rewarding ending.

What Are Foreclosed Mobile Homes? (Pros & Cons)

Foreclosed mobile homes for sale near me are properties that lenders have repossessed after the previous owners defaulted on their mortgage. The bank now owns the home and wants it off their books quickly, creating your opportunity.

Unlike a regular used home where the seller knows its history, a foreclosed home’s past is often a mystery to the bank. They just want to sell it fast.

Pros: You’ll typically pay thousands less than market value. This can lead to instant equity, as improving the home can quickly raise its value above what you paid. At Manufactured Housing Consultants, many of our repo models are habitability certified, ensuring they meet essential living standards.

Cons: These homes are sold “as-is, where-is” with no warranties. You are responsible for any issues, which can range from minor cosmetic fixes to serious problems like roof leaks, soft floors, or faulty HVAC systems. Budget for potential repairs beyond the purchase price.

Where to Find the Best Deals on Listings

Knowing where to look is the secret to finding these hidden gems. Be ready to act when the right opportunity appears.

- Local Banks and Credit Unions: Start with their REO (Real Estate Owned) departments. A quick call can reveal listings that haven’t hit the broader market.

- Manufactured Housing Consultants: We maintain a direct line to repossessed homes through our industry connections. Our repo inventory changes rapidly, so contact us directly for the latest deals. Learn more at More info about Bank Repos.

- Government Auctions: The GSA Auctions website lists surplus government assets, including manufactured housing. These listings often come with detailed condition notes.

- GovDeals: This online marketplace is where government entities sell surplus assets. Homes that don’t meet their reserve price may be relisted, creating better opportunities for patient buyers.

- Online Platforms: Many bank websites have dedicated sections for their foreclosed properties, providing detailed pricing and information.

The inventory of foreclosed mobile homes for sale near me moves fast. Partnering with experts like us gives you the best chance to spot the perfect deal.

The Smart Way to Finance Foreclosed Mobile Homes for Sale Near Me

Financing a foreclosed manufactured home is more accessible than you might think. We work with over a dozen lenders to help you secure the best rates.

- Chattel Loans: This is the most common option, financing the home itself as personal property. It’s ideal if you don’t own the land where the home will sit.

- FHA and VA Loans: These government-backed loans are excellent options if you own (or are buying) the land. They often have favorable terms and lower down payments.

- Conventional & In-House Loans: Traditional bank loans work well if the home is on a permanent foundation. We also offer flexible in-house financing and a FICO Score Improvement Program for all credit types.

- Cash Purchases: The affordability of repo homes makes cash purchases viable, eliminating interest and long-term loans.

Lenders often have no restrictions on the age of a used mobile home, and up to 100% financing may be possible. Beyond the purchase price, budget for appraisal fees, closing costs, transport, setup, and potential repairs. We can help you understand all financial aspects.

For more detailed information, visit:

- More info about Mobile Home Financing

- More info about Bad Credit Mobile Home Loans Guaranteed Approval

Your Step-by-Step Guide to a Successful Purchase

Follow this structured process to protect your investment when buying a foreclosed mobile home for sale near me.

- Get Pre-Approved: If you’re not paying cash, start with financing. Knowing your budget focuses your search and strengthens your offers.

- Find the Property: Use the resources listed above to find potential homes. Note the year, dimensions, and any listed damages.

- Get a Professional Inspection: This is non-negotiable. An expert can identify hidden defects and save you from costly surprises.

- Conduct a Title Search: Ensure the home has a clear title with no outstanding liens or legal issues.

- Make Your Offer: After completing your due diligence, make an offer that accounts for the home’s condition and anticipated repair costs.

- Secure Financing & Insurance: Finalize your loan and obtain full coverage homeowner’s insurance, which is required for any financed purchase.

- Close the Deal: Sign the paperwork, transfer funds, and get the title officially in your name. The timeline is typically 4-8 weeks, depending on the loan type.

Working with experienced professionals like us at Manufactured Housing Consultants simplifies each step, ensuring a smooth path to homeownership.

Final Steps to Secure Your Dream Home

You’ve researched foreclosed mobile homes for sale near me and are ready to move forward. These final steps are your safety net, helping you make a smart, informed decision.

What to Look For During an Inspection

A thorough inspection is your insurance against costly surprises when buying an “as-is” home. Here’s what to prioritize:

- Foundation and Leveling: A home’s stability depends on its foundation. Look for signs of settling, shifting, or damaged piers. An unlevel home leads to sticking doors, cracked walls, and other issues.

- Roof Leaks: Water damage is a mobile home’s worst enemy. Check every ceiling and wall for water stains, and inspect the roof surface for tears or excessive wear.

- Floor Soft Spots: Walk through every room, paying attention to how the floor feels. Spongy or soft areas usually indicate water damage or structural problems with the subflooring.

- Plumbing Problems: Test every faucet, toilet, and shower. Look for leaks under sinks and around the water heater. Check for poor water pressure or slow drainage.

- Electrical Systems: Test all outlets and light switches. Look for frayed wires, scorch marks, or signs of amateur work. Ensure the electrical panel is in good condition.

- HVAC Condition: Test both heating and cooling systems. Listen for unusual noises and check for proper airflow. A failing HVAC system is an expensive replacement.

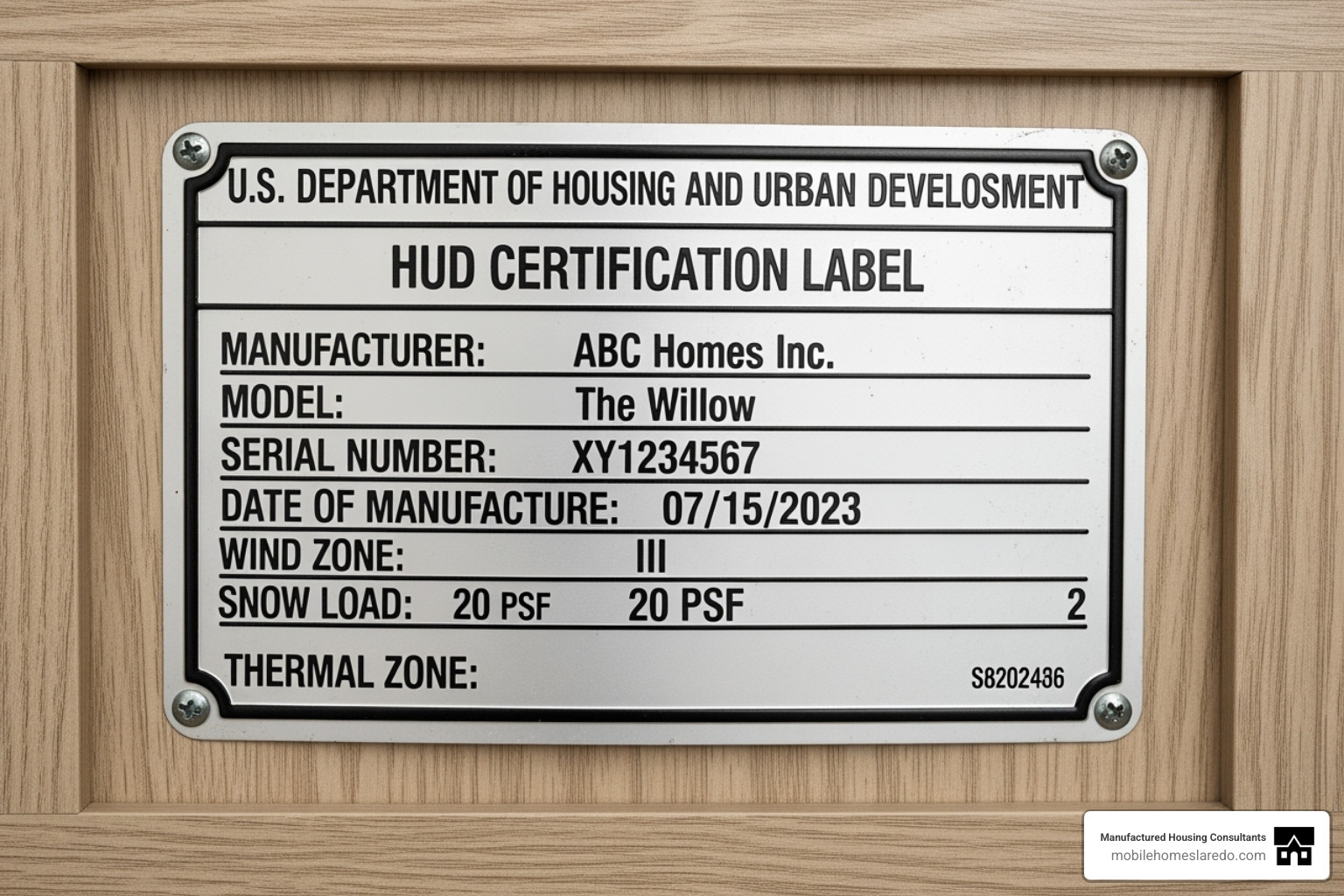

- HUD Data Plate: This is critical. Homes built after June 15, 1976, must have a HUD Data Plate inside and a red Certification Label outside. These prove the home meets federal safety standards and are essential for financing and insurance.

If you can’t inspect the property in person, rely on detailed photos and reports. But an in-person visit is always best.

Partner with an Expert to Find Foreclosed Mobile Homes for Sale Near Me

This guide shows the incredible opportunities among foreclosed mobile homes for sale near me. The “as-is” nature of these properties means you need careful research and a solid understanding of the process. This is where partnering with experts like us at Manufactured Housing Consultants makes all the difference.

We specialize in affordable manufactured homes throughout Texas and know the repo market inside and out. Here’s how we help:

- Steer Complex Paperwork: The repo buying process involves confusing documentation. Our team handles it for you, preventing costly errors.

- Find Certified Homes: We ensure our used and repo models are habitability certified, giving you peace of mind that the home meets essential living standards.

- Ensure Clear Title: We conduct thorough title searches to confirm there are no hidden liens or legal problems, so you receive a clear title.

- Access Specialized Financing: We work with over a dozen lenders to find the best rates for all credit types, supported by our FICO Score Improvement Program.

- Guarantee Lowest Prices: Our large selection from 11 top manufacturers increases your chances of finding the perfect home at a price that fits your budget.

- Handle Seamless Logistics: From free site inspections to coordinating delivery and setup, we manage the details so you can focus on the excitement of homeownership.

At Manufactured Housing Consultants, we believe in transparent pricing and legendary Texas-friendly customer service. Don’t let the idea of buying a foreclosed home intimidate you. With the right partner, it can be your smartest path to homeownership.

Ready to find your perfect foreclosed mobile home for sale near me? More info about our Bank Repos.