Finding Foreclosed Mobile Homes With Land: Your Affordable Housing Solution

Foreclosed mobile homes with land are properties where manufactured homes and the land they sit on have been repossessed by lenders due to non-payment, and are now available for purchase, often at significant discounts.

For those seeking immediate information, here’s what you need to know:

| What to Know | Details |

|---|---|

| Average Price | $492,183 (median: $299,000) |

| Typical Savings | 20-40% below market value |

| Where to Find | County records, bank REO listings, specialized dealers, online foreclosure sites |

| Land Size Range | Small parcels to 100+ acres (avg. 31.1 acres) |

| Benefits | Lower cost, immediate availability, equity potential |

| Requirements | Often cash-only, “as-is” condition, buyer arranges possession |

Finding affordable housing doesn’t have to mean sacrificing quality or space. Foreclosed mobile homes with land offer a unique opportunity to purchase property at below-market prices while gaining both a home and the land it sits on.

These properties become available when previous owners default on their loans, leading banks or lenders to repossess and resell them to recover their investment. With over 6,300 such properties currently available nationwide, the market offers substantial options for budget-conscious buyers.

The savings can be significant—repossessed and foreclosed mobile homes typically sell for 20-40% below market value. Recent examples include properties with 4.8 acres in North Dakota selling for $84,900 and 6.65 acres in Missouri listed at $150,300.

While these properties represent excellent value, understanding the buying process, financing options, and potential pitfalls is essential before jumping in. The foreclosure process differs from standard home purchases, often requiring cash payment, accepting “as-is” condition, and navigating unique title transfer procedures.

Common foreclosed mobile homes with land near me vocab:

Why This Guide Matters

If you’ve ever searched for “foreclosed mobile homes with land near me,” you’ve likely encountered a frustrating gap in the market: plenty of listings for traditional foreclosed homes, and separate listings for mobile homes, but limited resources that combine both with land.

With 6,352 mobile-home-with-land properties currently available nationwide at an average price of $492,183, there’s clearly inventory out there—but finding and navigating these opportunities requires specialized knowledge.

This guide fills that gap by providing a step-by-step roadmap specifically for those seeking foreclosed manufactured homes that come with land. Whether you’re a first-time homebuyer, looking to downsize, or an investor seeking value properties, we’ll walk you through the entire process from search to closing.

Market Insights & Listings

Looking for foreclosed mobile homes with land but feeling lost in a sea of confusing listings? You’re not alone. This unique market segment offers incredible opportunities, but it often stays hidden from mainstream real estate channels.

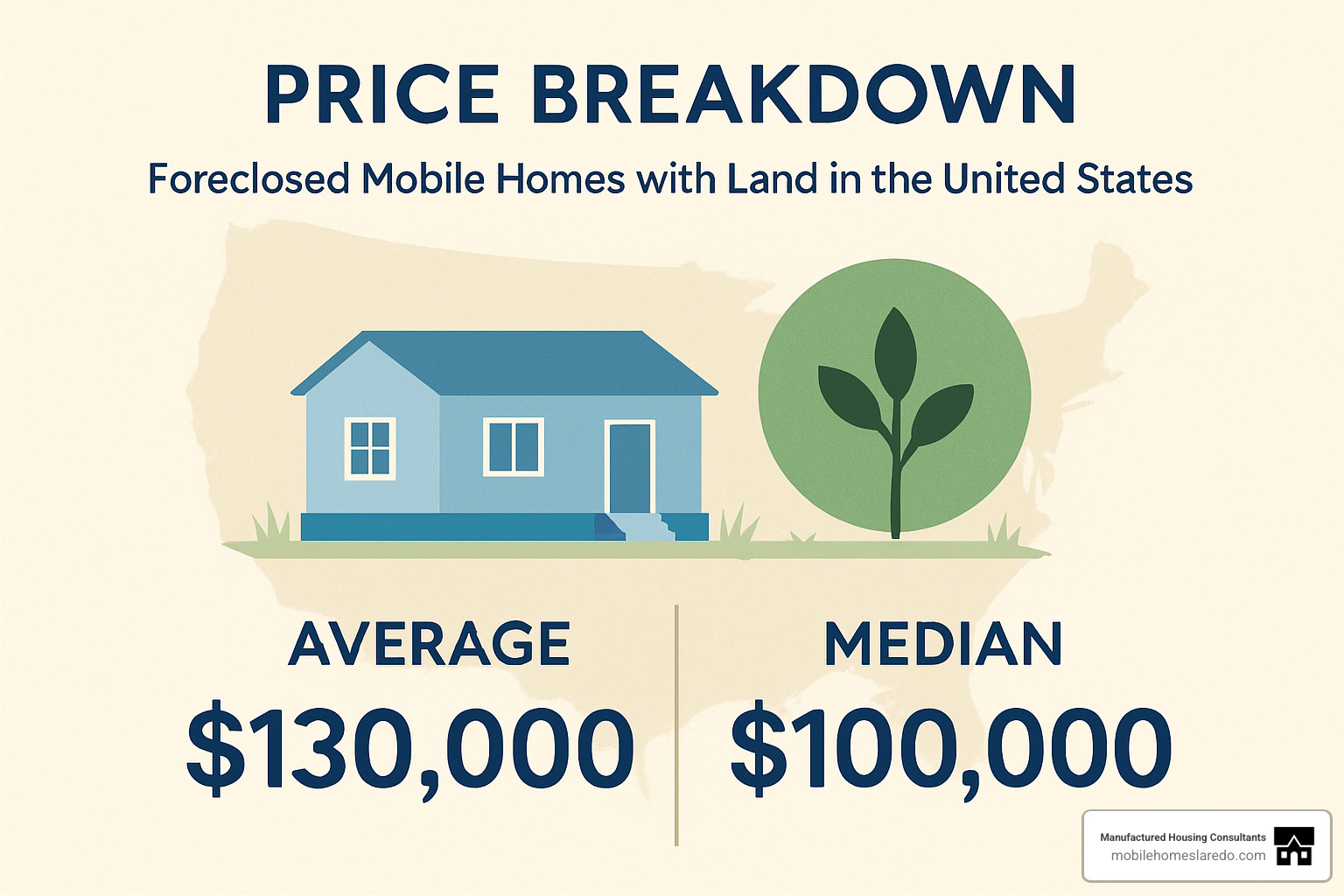

The current landscape is actually quite promising. Our research shows these properties average an impressive 31.1 acres per listing—though you’ll find everything from cozy single-acre homesteads to sprawling 100+ acre properties. With a median list price of $299,000, there’s something for nearly every budget, including some starter models on smaller lots at significantly lower price points.

“What makes these properties truly special is you can often move in right after closing,” explains our housing specialist at Manufactured Housing Consultants. “Unlike traditional construction where you might wait months or even years, many foreclosed mobile homes with land are ready for you to call home almost immediately.”

What Counts as a Foreclosed Mobile Home With Land?

When we talk about a foreclosed mobile home with land, we’re referring to a property where both the manufactured home and the land it sits on went through foreclosure together. This is fundamentally different from mobile homes in parks, where you might own just the home but pay rent for the land beneath it.

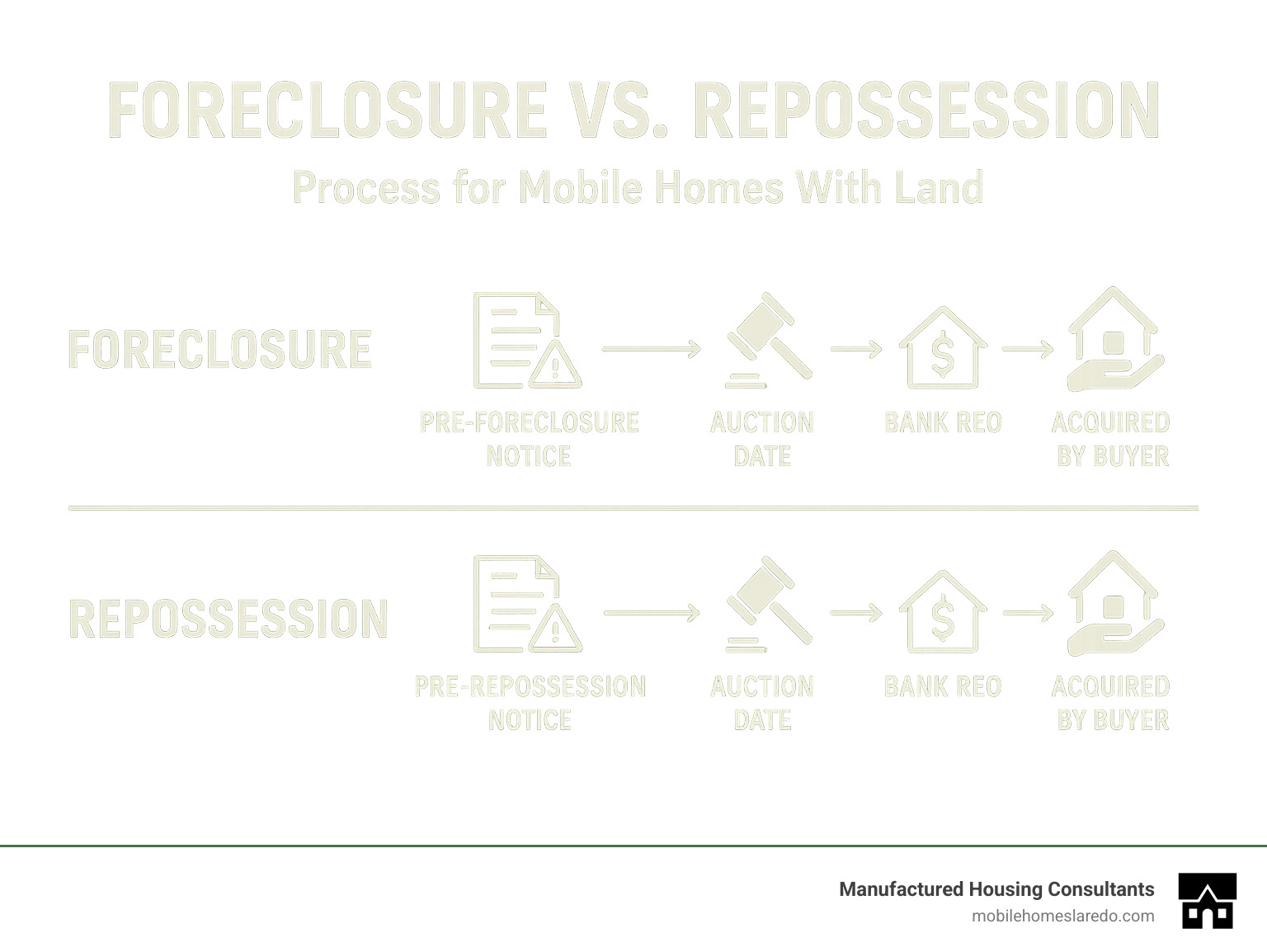

The journey to foreclosure typically begins when a homeowner falls behind on mortgage or land contract payments. After a series of notices and legally-required waiting periods (these vary depending on your state), the lender eventually takes possession and puts the property up for sale to recoup their investment.

You’ll encounter these properties in several forms. Some are Bank REOs (Real Estate Owned)—properties that have completed the foreclosure process and now belong to the lender. Others might be pre-foreclosures still in the early stages, potentially available through short sales. You’ll also find auction properties sold at county auctions or trustee sales, and occasionally government-seized properties repossessed by agencies like HUD, VA, or USDA.

What makes these listings special is that they include both the home and land under a single title—giving you true ownership of everything, with no monthly lot rent to worry about.

How to Search for Foreclosed Mobile Homes With Land

Finding foreclosed mobile homes with land near you requires looking beyond typical real estate listings. Here’s where to focus your search:

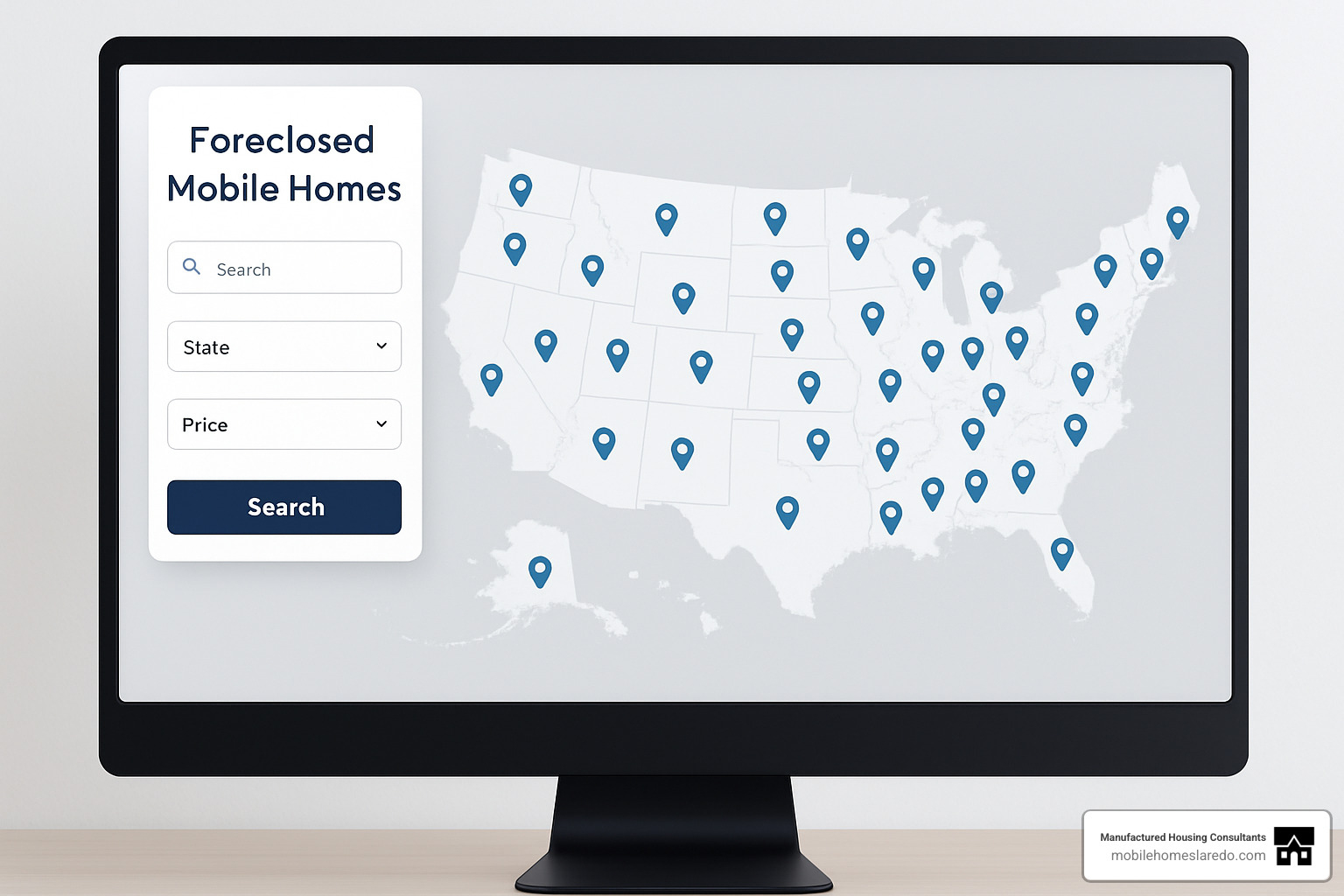

Specialized foreclosure websites like Foreclosure.com, RealtyTrac, and Auction.com often include manufactured homes with land. Meanwhile, working with a real estate agent who knows how to set up MLS searches specifically for bank-owned manufactured homes can open doors to listings you might otherwise miss.

Don’t overlook your local county’s upcoming foreclosure auctions, which frequently include mobile homes with land. Many banks also maintain dedicated “REO” departments with listings of foreclosed properties, including manufactured homes on land.

Here at Manufactured Housing Consultants in Laredo, Texas, we’ve built relationships with lenders specifically to help connect you with Foreclosure Mobile Homes for Sale and Repossessed Mobile Homes in your target area.

When searching online, be specific with keywords like “foreclosed mobile home with land,” “REO manufactured home with acreage,” or “bank-owned doublewide with property.” Most listing sites allow you to save these searches and receive alerts when matching properties become available.

“Persistence is your best friend in this market,” our housing specialist often tells clients. “Well-priced properties in decent condition rarely sit for long. Setting up alerts ensures you’re among the first to know when something promising hits the market.”

Prices, Savings, Pros & Cons of Foreclosed Mobile Homes

The financial upside of buying foreclosed mobile homes with land can be truly impressive. Our latest market analysis reveals:

The average listing price sits at $492,183, with a more accessible median price of $299,000. You’ll typically pay around $15,903 per acre, but here’s the real draw: these properties generally sell for 20-40% below comparable market properties. That’s instant equity the moment you sign the papers!

Like any investment, these properties come with both sunshine and shadows. On the bright side, you’re getting immediate equity potential thanks to that below-market purchase price. You’ll own both your home and land outright—no monthly lot rent eating away at your budget. Many properties are available for immediate move-in, and you’ll have plenty of opportunities to increase value through strategic renovations.

The variety of land sizes (averaging 31.1 acres) means you can find something that fits your lifestyle, whether you want just enough space for privacy or enough land to start a small farm. And unlike new construction with its endless delays, these homes are already built and waiting for you.

Of course, there are challenges too. Most foreclosed properties are sold “as-is” with limited disclosures about their condition. You might face significant repair costs, and many transactions require cash payment (though we can help with financing options). There could be title issues or liens to resolve, and your location choices are limited to what’s currently available. Despite thorough inspections, some problems might remain hidden until after purchase.

Let me share a real example: We recently helped a client purchase a 1972 mobile home on 4.8 acres in North Dakota for just $84,900. The property included valuable rural water access and a brand-new septic system. Despite the mobile home’s age, the land value and infrastructure made this an exceptional deal—similar properties in the area were selling for 30-40% more.

Buying Process, Financing, and Due Diligence

Purchasing a foreclosed mobile home with land involves a process that differs in several important ways from buying a traditional home. Understanding these differences can help you steer the purchase successfully and avoid common pitfalls.

Step-by-Step Buying Roadmap

-

Pre-Search Preparation

- Determine your budget and financing options

- Get pre-approved if using financing

- Identify target areas and property requirements

- Assemble your team (agent, lender, inspector)

-

Property Search

- Use multiple search channels (online listings, auctions, REO departments)

- Set up alerts for new listings

- Drive target neighborhoods to spot unlisted opportunities

-

Property Evaluation

- Review available property information and disclosures

- Research county records for liens, permits, and tax status

- Perform preliminary drive-by assessment

-

Making an Offer

- Determine appropriate offer price based on condition and comparables

- Prepare for possible multiple offer situations

- Include contingencies for inspection and title search

- Be prepared for “as-is” terms

-

Earnest Money Deposit

- Typically 1-5% of purchase price

- Held in escrow during transaction

- May be non-refundable in some foreclosure situations

-

Due Diligence Period

- Professional home inspection

- Land survey if boundaries are unclear

- Title search and insurance

- Appraisal (if financing)

- Environmental assessment if concerns exist

-

Addressing Issues

- Negotiate repairs or price adjustments if allowed

- Resolve any title issues

- Finalize financing

-

Final Preparations

- Arrange homeowner’s insurance

- Schedule utilities transfer

- Prepare for closing costs

-

Closing

- Final walkthrough

- Document signing

- Fund transfer

- Key handover

-

Post-Closing

- Record deed

- Address immediate repair needs

- Change locks

- Update address information

“The biggest difference with foreclosed properties is the compressed timeline and ‘as-is’ nature of the sale,” explains our housing specialist. “Banks are looking to move these properties quickly and typically won’t make repairs or offer the negotiation flexibility you might find with traditional sellers.”

Financing Options & Getting Pre-Approved

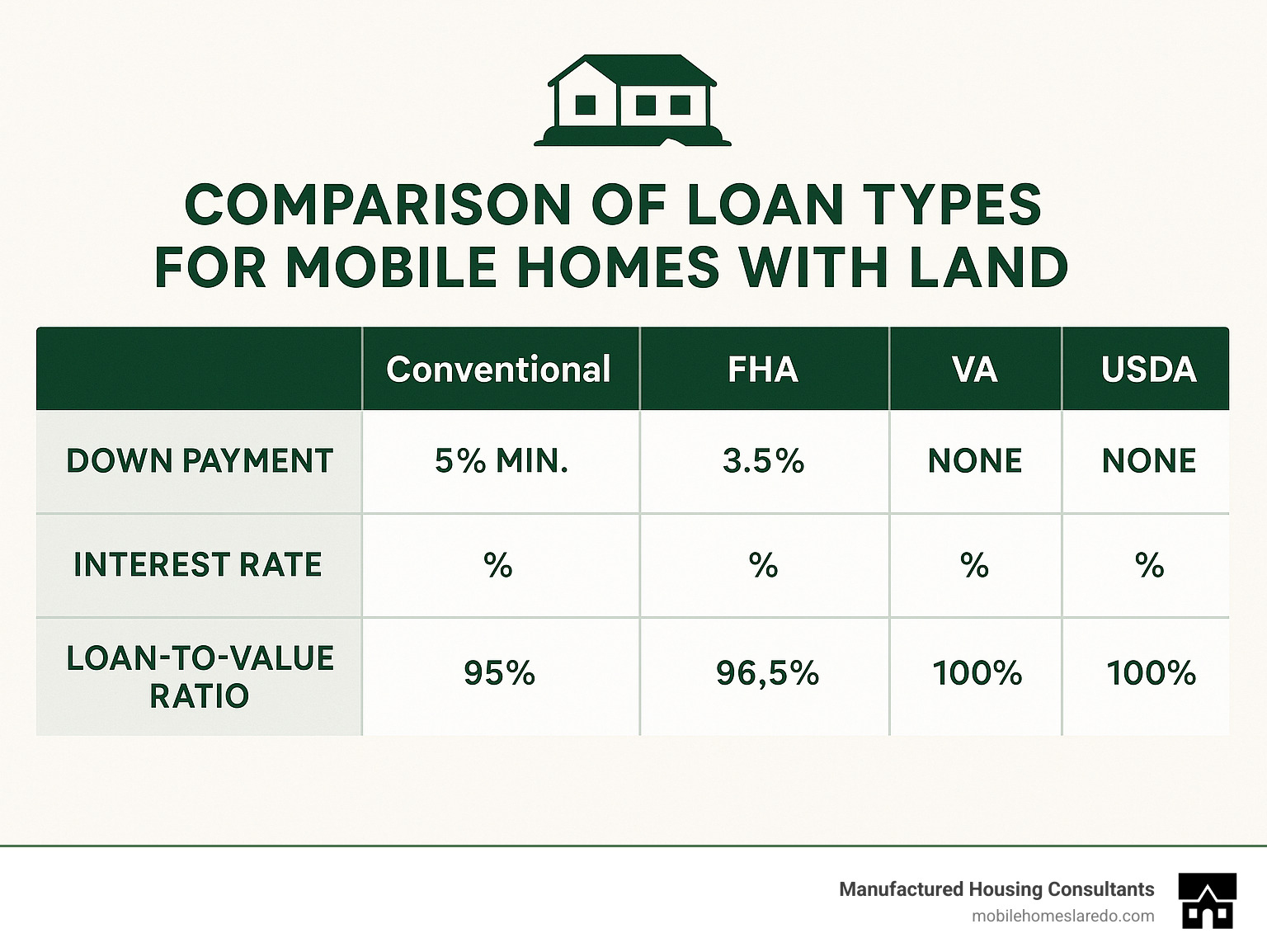

Despite the common misconception that foreclosed mobile homes with land require cash purchases, several financing options exist:

- Conventional Mortgages: For properties in good condition that meet lender requirements

- FHA Loans: Including the popular 203(k) program for properties needing repairs

- VA Loans: For qualifying veterans and service members

- USDA Loans: For properties in eligible rural areas

- Chattel Loans: For mobile homes that aren’t permanently affixed to foundations

- Land-Home Packages: Combined financing for both components

- Seller Financing: Sometimes available through banks for their REO properties

At Manufactured Housing Consultants, we specialize in helping buyers find appropriate Mortgage for Mobile Home and Land solutions and Mobile Home Mortgage Financing regardless of credit situation.

Getting pre-approved is crucial in the competitive foreclosure market. To begin the pre-approval process:

- Gather financial documents (tax returns, bank statements, pay stubs)

- Check your credit report and address any issues

- Calculate your debt-to-income ratio

- Contact our financing specialists to explore options

For buyers with credit challenges, our FICO Score Improvement Program can help improve your score to qualify for better rates and terms.

Inspection Checklist & Red Flags

The inspection phase is particularly critical when buying foreclosed mobile homes with land since these properties are typically sold “as-is” with limited disclosures. Here’s a comprehensive inspection checklist:

Mobile Home Structure:

- HUD data plate/certification label verification

- Foundation condition and type

- Frame integrity and rust assessment

- Floor structure and subflooring

- Wall and ceiling condition

- Roof condition, age, and leak signs

- Windows and doors operation

- Insulation adequacy

Systems and Utilities:

- Electrical system and panel condition

- Plumbing system, pipes, and fixtures

- HVAC system functionality and age

- Water heater condition and age

- Well and/or septic system (if applicable)

- Water quality testing

Land Components:

- Property boundaries verification

- Drainage patterns and potential issues

- Soil stability and erosion signs

- Access road condition

- Utility connections and easements

- Zoning compliance for manufactured housing

- Environmental hazards assessment

Red Flags to Watch For:

- Water damage or mold evidence

- Uneven floors or sagging ceilings

- Amateur electrical or plumbing work

- Foundation issues or improper setup

- Missing HUD certification label

- Unpermitted additions or modifications

- Title issues or missing documentation

- Evidence of pest infestation

“When purchasing a Bank Repo Manufactured Home, the inspection is your primary protection,” advises our housing specialist. “Unlike traditional sales where sellers must disclose known issues, foreclosures typically come with minimal disclosures. A thorough inspection is your best defense against unexpected problems.”

Consider hiring an inspector specifically experienced with manufactured homes, as they have unique construction elements that differ from site-built homes.

Title Transfer, Closing & Hidden Costs

The title transfer and closing process for foreclosed mobile homes with land involves several specialized steps and potential hidden costs:

Title Considerations:

- Manufactured homes may have separate titles from the land

- Older mobile homes might have title issues or missing documentation

- Title company will perform lien search and title examination

- Title insurance protects against unfinded claims

Closing Process:

- Title company or attorney prepares closing documents

- Buyer reviews closing disclosure and funds closing costs

- Documents are signed by all parties

- Funds are disbursed to appropriate parties

- Keys are transferred to new owner

- Titles are recorded with appropriate agencies

Hidden Costs to Anticipate:

- Title search and insurance: $500-1,500

- Escrow/attorney fees: $500-1,000

- Recording fees: $50-200

- Transfer taxes: Varies by location

- Delivery and setup costs (if home needs to be moved): $5,000-15,000

- Utility connection fees: $500-2,000

- Immediate repairs: Varies based on condition

- Property tax proration: Varies

- Survey costs (if required): $300-800

- Home insurance: Typically higher for manufactured homes

“One of the most overlooked aspects of buying a foreclosed mobile home with land is ensuring proper title work,” notes our closing specialist. “Unlike traditional homes, manufactured homes can have both a land deed and a mobile home title that need to be properly joined through a process called ‘title elimination’ or ‘title retirement’ to be considered real property.”

At Manufactured Housing Consultants, we guide buyers through this complex process to ensure clean title transfer and compliance with all legal requirements.

Programs, Incentives & Professional Help

Several programs and incentives can make purchasing foreclosed mobile homes with land more affordable:

First-Time Homebuyer Programs:

- Down payment assistance grants

- Closing cost assistance

- Reduced interest rates

- Tax credits in some areas

Rural Development Programs:

- USDA Direct and Guaranteed Loans

- Rural Housing Repair Loans and Grants

- Self-Help Housing Program

Industry Discounts:

- Oil Field Discounts for energy sector workers

- Military and veteran incentives

- First responder programs

Professional Assistance:

Working with experienced professionals is crucial when navigating foreclosed mobile home purchases:

- Specialized Agents: Real estate agents familiar with manufactured housing and foreclosures

- Manufactured Home Lenders: Financial institutions experienced with mobile home financing

- Mobile Home Inspectors: Professionals who understand the unique aspects of manufactured housing

- Title Companies: Those experienced with both land and mobile home title issues

- Escrow Officers: Specialists who can handle the unique aspects of these transactions

- Credit Counselors: To help improve credit scores for better financing terms

At Manufactured Housing Consultants, we maintain relationships with all these professionals and can connect you with the right experts for your specific situation.

“The right team makes all the difference,” emphasizes our housing consultant. “Foreclosed mobile homes with land involve specialized knowledge in several areas. Working with experts who understand this niche can save you thousands in mistakes and help you find the best opportunities.”

Conclusion

The journey to finding foreclosed mobile homes with land near me might seem daunting at first, but as we’ve explored throughout this guide, it represents one of today’s most promising paths to affordable homeownership. When you consider the average savings of 20-40% below market value and the security that comes with owning both your home and the land beneath it, these properties truly shine as hidden gems in today’s challenging housing market.

After helping hundreds of families find their perfect manufactured home, I’ve seen how these properties can transform lives. With median prices hovering around $299,000, many of our clients have secured their dream of homeownership when they thought it was out of reach.

What makes these opportunities so special is their incredible diversity. Some families fall in love with cozy single-wides on small lots perfect for first-time buyers, while others find sprawling properties with luxurious double-wides set on acreage averaging 31.1 acres – plenty of room for gardens, workshops, or just enjoying the peace of country living.

The search process doesn’t have to be overwhelming. Whether you’re combing through specialized websites, working with a real estate agent to set up MLS filters, checking county records, or partnering directly with us at Manufactured Housing Consultants, persistence is key. These properties move quickly, but new opportunities emerge every day.

Don’t let the “cash-only” reputation of foreclosures discourage you. We’ve helped buyers with all types of credit situations secure financing through conventional mortgages, FHA loans, VA options for veterans, and specialized manufactured home financing programs. Our FICO Score Improvement Program has opened doors for families who initially thought their credit would hold them back.

I do want to emphasize one crucial point: due diligence is absolutely critical when purchasing these properties. Because they’re typically sold “as-is,” thorough inspections, careful title searches, and professional guidance can make all the difference between a dream home and a costly mistake. This is where our expertise becomes particularly valuable.

Here at Manufactured Housing Consultants in Laredo, Texas, we’ve built our reputation on guiding buyers through every step of this complex process. Our team understands the unique challenges of manufactured housing and maintains strong relationships with lenders, inspectors, and title companies who specialize in this niche market.

Whether you’re a young family buying your first home, empty-nesters looking to downsize, or an investor seeking value properties, we’re here to help you steer the entire journey. With our guaranteed lowest prices, specialized financing options, and decades of experience, we’re committed to making affordable homeownership your reality.

Ready to explore current opportunities? For more details about bank-repo deals and foreclosure opportunities in your area, visit our bank-repos information page or give us a call today. Your perfect home-and-land package might be waiting just around the corner.