How to buy a house with bad credit can be a daunting question for many, but it doesn’t have to stop you from realizing your homeownership dreams. Whether you’re looking to put down roots in Laredo, Texas, or anywhere across the Lone Star State, navigating the home buying process with less-than-perfect credit is possible with the right knowledge and strategies.

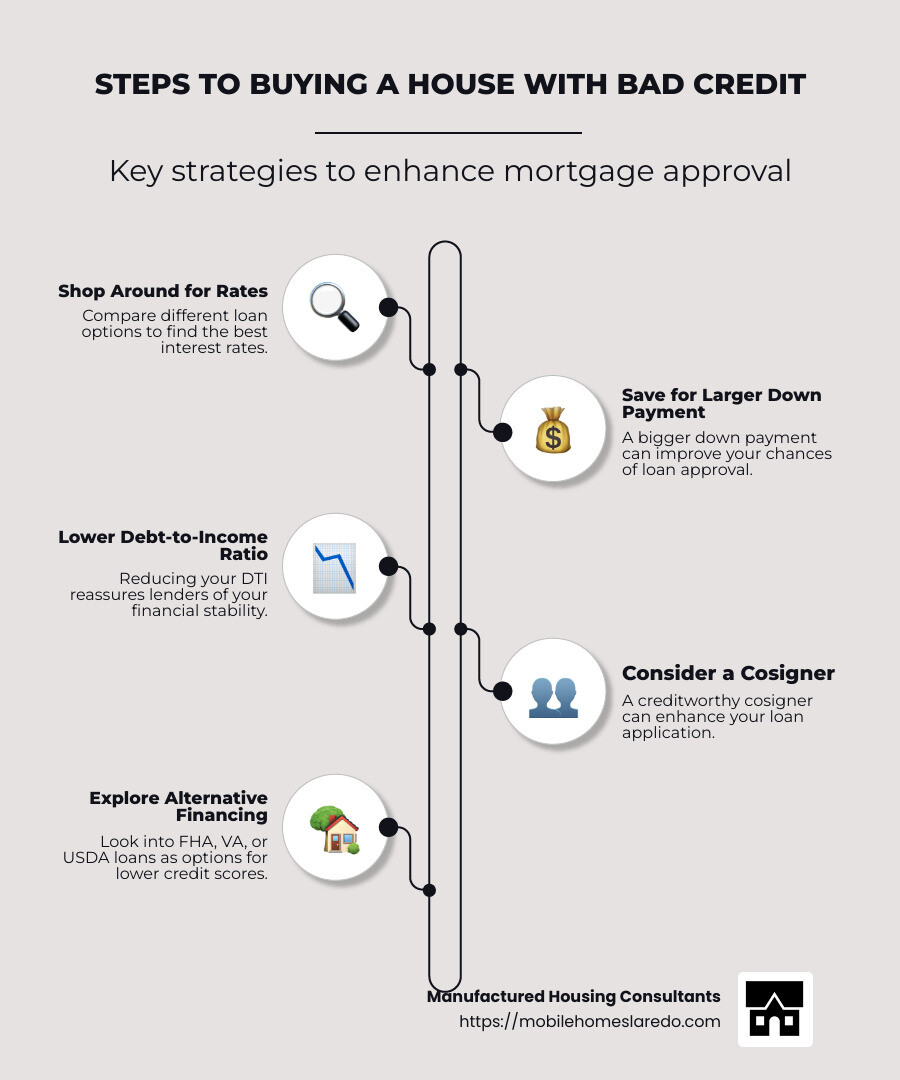

Here’s a quick guide:

-

- Shop Around for Interest Rates: Compare different loan options.

- Save for a Larger Down Payment: It can improve approval chances.

- Lower Debt-to-Income Ratio: This reassures lenders of your financial stability.

- Consider a Cosigner: A creditworthy cosigner can improve your application.

- Explore Alternative Financing: Options like FHA, VA, or USDA loans can be beneficial.

- Boost Your Savings: Demonstrating financial reserves can improve your prospects.

Buying a home is a significant milestone, and while credit challenges can seem overwhelming, there’s always a path forward. At Manufactured Housing Consultants in Laredo, Texas, we understand the intricacies of mobile home financing and are here to help people like Maria, who aspire to stylish and affordable housing solutions, steer the process.

Maria’s journey towards owning a modern, stylish mobile home begins with understanding her credit and preparing to meet potential financial problems head-on. With expert guidance and a commitment to finding the right solutions, she can turn credit woes into a home sweet home.

Understanding Bad Credit

When you’re considering how to buy a house with bad credit, it’s crucial to understand what “bad credit” means. Credit scores, especially FICO scores, are a key part of this journey. They range from 300 to 850 and help lenders determine your creditworthiness.

Credit Score Ranges: The Basics

Here’s a quick breakdown of FICO score ranges:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Exceptional

Most lenders use the FICO score to assess risk. If your score falls in the “Poor” range, it may be harder to get a loan, but it’s not impossible.

Why Credit History Matters

Your credit history is like a financial report card. It shows lenders how you’ve managed debt in the past. If you’ve had late payments, bankruptcy, or high credit utilization, it can impact your score. But remember, everyone’s credit history is unique. Two people with the same score might have very different stories.

Key Points to Improve:

- On-Time Payments: Consistency is key. Paying bills on time can boost your score.

- Credit Utilization: Keep this ratio low by paying down credit card balances.

- Avoid New Credit Applications: Too many hard inquiries can lower your score.

Real-Life Example: Maria’s Path to Homeownership

Maria, a potential homeowner in Laredo, Texas, faced credit challenges. Her FICO score was in the low 600s due to a few missed payments and high credit card balances. By focusing on making on-time payments and reducing her credit utilization, she improved her score significantly. This opened doors to more financing options, like FHA loans, which are more forgiving for lower credit scores.

At Manufactured Housing Consultants, we know that understanding your credit is just the first step. Whether you’re aiming for a mobile home or a more traditional house, knowing where you stand with your credit can help you make informed decisions.

Next, we’ll explore specific financing options for those with bad credit, so you can find the right path to homeownership.

How to Buy a House with Bad Credit

Buying a house with bad credit might seem challenging, but it’s not impossible. Let’s explore some strategies and loan options that can make homeownership a reality, even if your credit score isn’t perfect.

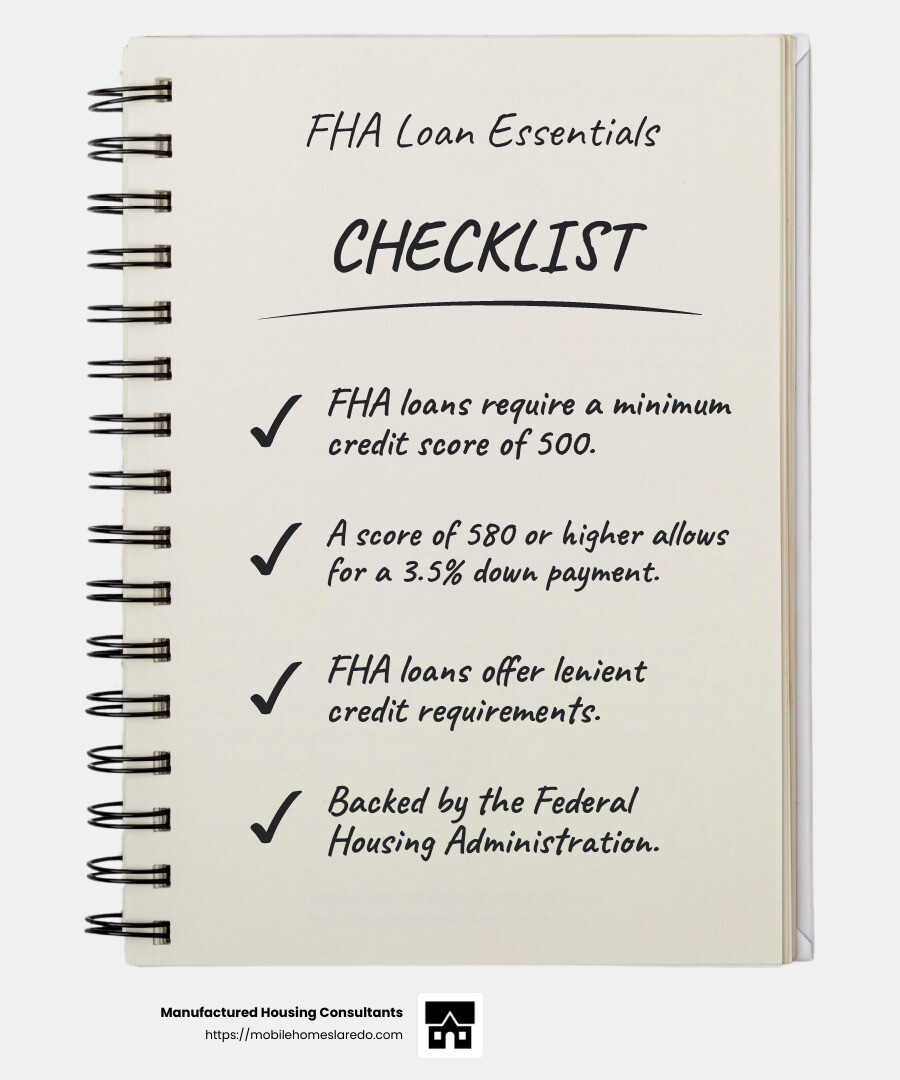

FHA Loans: A Popular Option

FHA loans are a great starting point for those with less-than-perfect credit. These loans are backed by the Federal Housing Administration and are known for their lenient credit requirements. With a minimum credit score of 500, you can qualify for an FHA loan, though a higher score of 580 will allow you to make a smaller down payment of just 3.5%.

Example: Maria from Laredo, Texas, improved her credit score by making on-time payments, allowing her to qualify for an FHA loan with a lower down payment.

VA Loans: For Veterans and Military Members

If you’re a veteran or active-duty service member, a VA loan could be your ticket to homeownership. VA loans, backed by the Department of Veterans Affairs, don’t require a down payment, and they have no specific minimum credit score. However, most lenders look for a score of at least 620.

Key Benefit: No down payment required, making it easier to purchase a home without a large upfront cost.

USDA Loans: For Rural Homebuyers

For those looking to buy a home in rural areas, USDA loans offer another viable option. These loans, supported by the U.S. Department of Agriculture, also require no down payment. However, they are only available for properties in eligible rural areas, and most lenders prefer a credit score of 640 or higher.

Tip: Check if your desired property in Laredo qualifies as a rural area to take advantage of USDA loans.

Understanding Down Payments

A larger down payment can significantly improve your chances of getting approved for a mortgage, even with bad credit. It reduces the lender’s risk and might lead to better loan terms. While FHA loans require as little as 3.5% down with a credit score of 580, having more cash on hand can make your offer more attractive.

Pro Tip: Start saving early and consider cutting unnecessary expenses to increase your down payment fund.

Managing Your Debt-to-Income Ratio

Lenders also consider your debt-to-income (DTI) ratio when approving a mortgage. This ratio compares your monthly debt payments to your income. A lower DTI demonstrates that you manage your debts well, which can be crucial if your credit score is low. Aim for a DTI of 43% or less to improve your mortgage prospects.

Actionable Step: Pay down existing debts and avoid taking on new ones before applying for a mortgage.

By understanding these options and focusing on improving your financial situation, you can steer the path to homeownership, even with bad credit. Whether you’re considering an FHA, VA, or USDA loan, each has its unique benefits that can help you secure a home loan.

Next, we’ll explore how you can improve your credit score to increase your chances of securing a better mortgage deal.

Improving Your Credit Score

Improving your credit score is a crucial step in how to buy a house with bad credit. Here are some strategies to help you boost your score and increase your chances of getting a mortgage.

On-Time Payments

Your payment history accounts for a significant portion of your credit score. Consistently making on-time payments can help improve your score over time. Even if you can only afford the minimum payment on your credit cards or loans, it’s better than missing a payment.

Tip: Set up automatic payments or reminders on your phone to ensure you never miss a due date.

Credit Utilization

Credit utilization refers to the amount of credit you’re using compared to your credit limit. Keeping your credit utilization below 30% can positively affect your score.

Example: If you have a credit card with a $10,000 limit, try to keep your balance below $3,000. Paying down your balances can help lower your credit utilization ratio.

Pro Tip: Don’t close unused credit cards, as this can increase your credit utilization ratio by reducing your available credit.

Dispute Errors

Errors on your credit report can drag down your score. It’s essential to check your credit reports regularly for inaccuracies. You can get a free copy of your credit report from each of the three major credit bureaus once a year at AnnualCreditReport.com.

Actionable Step: If you find errors, dispute them promptly. Correcting errors can lead to a quick boost in your credit score.

Case Study: A Texas resident found a mistake on their credit report that showed a late payment they never made. After disputing it, their credit score improved by 40 points, making it easier to qualify for a home loan.

By focusing on these key areas, you can improve your credit score and improve your mortgage options. Improving your credit takes time, but the effort can pay off with better loan terms and lower interest rates.

Next, we’ll dig into financing options for bad credit, exploring different loan types and how they can help you buy a home even with a less-than-perfect credit score.

Financing Options for Bad Credit

When you’re exploring how to buy a house with bad credit, it’s crucial to understand your financing options. Here are some paths you can take:

Government-Backed Loans

FHA Loans: These are insured by the Federal Housing Administration and are popular for those with lower credit scores. You can qualify with a score as low as 500, but you’ll need a 10% down payment. If your score is 580 or higher, a 3.5% down payment is enough. FHA loans are a solid choice for first-time homebuyers.

VA Loans: If you’re a veteran or active military member, a VA loan might be your best bet. Backed by the Department of Veterans Affairs, these loans offer benefits like no down payment and no minimum credit score requirement. However, lenders typically look for a score of at least 580.

USDA Loans: These loans are for rural homebuyers and are backed by the U.S. Department of Agriculture. You can secure a loan with no down payment, but a score of 640 is usually needed.

Alternative Lenders

If traditional loans aren’t an option, consider alternative lenders. These lenders might be more flexible with credit requirements, but be prepared for higher interest rates. It’s essential to shop around and compare terms to find the best deal.

Cosigner

Adding a cosigner to your mortgage can help you qualify for a loan. A cosigner with good credit can improve your application by lowering the perceived risk to lenders. The cosigner is equally responsible for the loan, so ensure they understand the commitment.

Case Study: Maria in Laredo, Texas, was struggling to get a loan due to her credit score. By adding her father as a cosigner, she secured a better interest rate and bought her dream home.

By exploring these financing options, you can find a path to homeownership even with bad credit. Next, we’ll answer some frequently asked questions about buying a house with bad credit, including what credit score you need and how to proceed without a down payment.

Frequently Asked Questions about Buying with Bad Credit

Can you get a house with a credit score of 500?

Yes, it’s possible to buy a house with a credit score of 500, but your options might be limited. The most viable route is through an FHA loan. With a score of 500, you’ll need to make a 10% down payment. This is higher than the 3.5% down payment required for those with a score of 580 or above. FHA loans are popular because they are more forgiving of lower credit scores, making them a suitable option for many first-time homebuyers.

What is the lowest credit score to buy a house?

The lowest credit score typically required to buy a house is 500, specifically for an FHA loan. However, the down payment requirement is higher for scores below 580. For VA loans, there’s technically no minimum credit score, but most lenders prefer a score of at least 580. USDA loans, which are designed for rural homebuyers, generally require a credit score of 640. Each loan type has its own set of requirements and benefits, so explore which option best fits your situation.

How to buy a house with bad credit and no down payment?

If you’re looking to buy a house with bad credit and no down payment, VA loans and USDA loans are your best options.

- VA Loans: These are available to veterans and active-duty military members. They offer the advantage of no down payment and are backed by the Department of Veterans Affairs. While there’s no official credit score minimum, lenders usually look for a score of 580 or higher.

- USDA Loans: These are aimed at rural homebuyers and require no down payment. However, you need to meet specific income requirements, and a credit score of at least 640 is typically needed. This makes USDA loans a great option if you qualify geographically and financially.

By understanding these options, you can steer the home-buying process even with bad credit. Next, we’ll explore how to improve your credit score to improve your chances of securing a better loan.

Conclusion

Buying a home is a significant step, and it can feel even more daunting when you have bad credit. But remember, your journey to homeownership doesn’t have to be a solo endeavor. At Manufactured Housing Consultants, we are committed to helping you steer this path with confidence and clarity.

Improving Your Credit

Improving your credit is a crucial part of the home-buying process. A better credit score can open doors to more favorable loan terms and lower interest rates. Even small steps like making on-time payments and reducing your debt can make a big difference. Our FICO Score Improvement Program is designed to help you improve your credit profile with expert guidance and personalized strategies.

Your Homeownership Journey

Whether you’re eyeing a cozy tiny home or a spacious manufactured house, we offer a wide range of affordable options to fit your needs. Our financing solutions cater to all credit types, ensuring that your credit score doesn’t stand in the way of your dream home. We partner with multiple lenders to provide you with the best rates and terms possible.

Partner with Us

At Manufactured Housing Consultants, we believe that everyone deserves a chance to own a home, regardless of their credit history. Our team in Laredo, Texas, is here to support you every step of the way—from exploring financing options to closing the deal. With our expertise and commitment to your financial future, we aim to make your dream of homeownership a reality.

Explore our mobile home financing options today and take the first step toward owning your home sweet home. Let us help you turn credit challenges into opportunities for a brighter tomorrow.