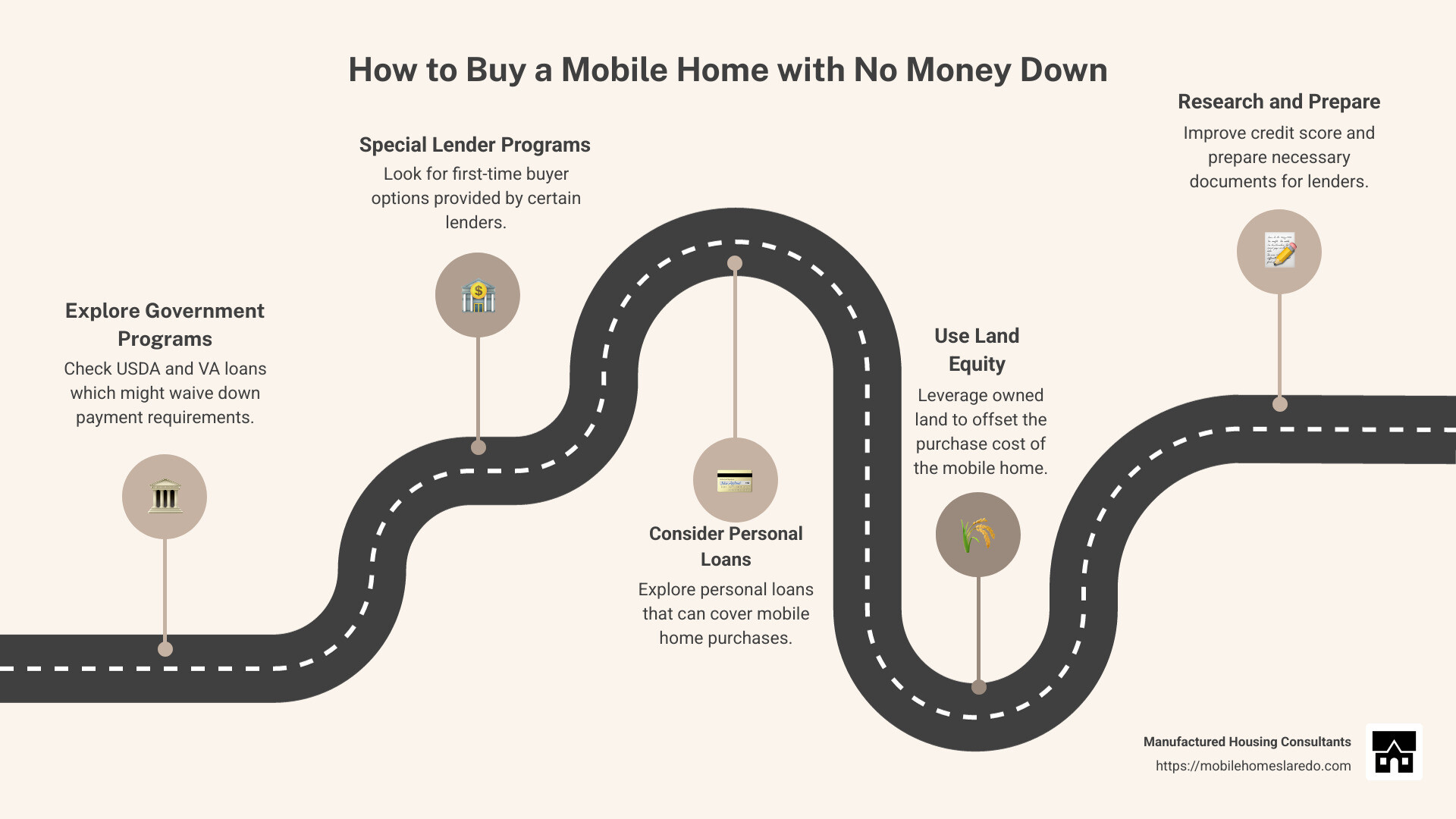

How to buy a mobile home with no money down might sound like a dream, but it’s more achievable than you think. Here’s a quick roadmap:

- Explore Government Programs: USDA and VA loans often waive down payment requirements.

- Check for Special Lender Programs: Look for first-time buyer options.

- Consider Personal Loans: Some lenders offer personal loans that cover mobile home purchases.

- Use Land Equity: If you own land, it might be used to offset the purchase cost.

Buying a home is a major milestone, and for many like Maria, a budget-conscious Texan, finding an affordable option that fits both financial goals and personal style can seem daunting. Manufactured and mobile homes offer a compelling alternative to traditional housing, providing comfortable and often more cost-effective living solutions. However, navigating the financing options can be tricky, especially for those with credit challenges.

Thankfully, several programs can make buying a mobile home with no money down possible. From government-backed loans to special lender initiatives, understanding these pathways lets you make a smart, stress-free decision.

Whether you’re just starting to explore your options or ready to take the plunge, we’ll walk you through everything you need to know to turn the dream of homeownership into a reality.

Understanding Mobile and Manufactured Homes

When diving into mobile and manufactured homes, it’s crucial to understand the key differences and standards that define them. This knowledge is vital when considering how to buy a mobile home with no money down.

Differences Between Mobile and Manufactured Homes

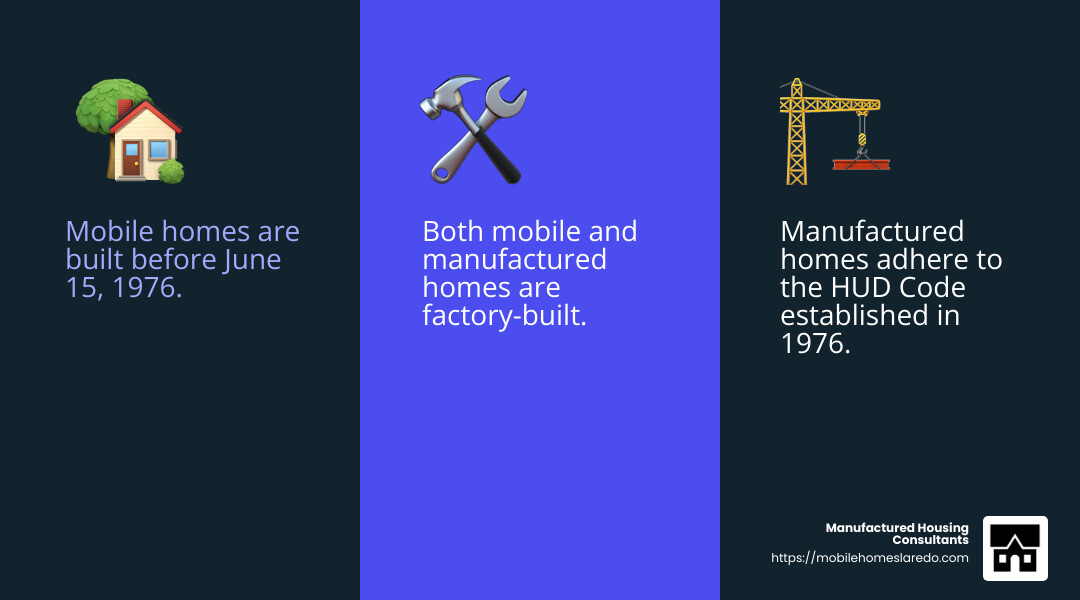

The terms “mobile home” and “manufactured home” are often used interchangeably, but they aren’t quite the same. The distinction lies in the HUD Code introduced in 1976. This code set construction and safety standards for homes built in factories. Homes built before June 15, 1976, are referred to as mobile homes, while those built after this date are known as manufactured homes.

Mobile Homes: These are factory-built homes constructed before the HUD Code. They often have a steel chassis and are known for their mobility. However, due to outdated safety standards, they are less common today.

Manufactured Homes: Post-1976, manufactured homes adhere to stringent HUD standards. They are built with more durable materials and are designed to remain in one location after installation, unlike their mobile predecessors.

Modular Homes vs. Manufactured Homes

While both modular and manufactured homes are factory-built, the similarities largely end there.

Manufactured Homes: As mentioned, these homes must comply with the HUD Code and are transported to the site on a permanent chassis.

Modular Homes: These homes are also factory-built, but they follow local building codes rather than federal standards. They are constructed in sections or modules and assembled on a permanent foundation at the site.

The main takeaway is that modular homes are often indistinguishable from traditional site-built homes once installed. They offer customization options and must adhere to local zoning laws and building codes.

Understanding these differences is essential when considering financing options for your home purchase. Whether you’re looking at a manufactured home or a modular home, knowing the standards and regulations can help you make an informed decision.

How to Buy a Mobile Home with No Money Down

Purchasing a mobile home with no money down might seem challenging, but there are several financing options and down payment assistance programs available to make this dream a reality. Let’s explore these options in detail.

Financing Options for Mobile Homes

-

FHA Loans: The Federal Housing Administration (FHA) offers loans specifically for mobile and manufactured homes. These loans typically require a down payment of at least 3.5% if your credit score is 580 or higher. However, if you have land or other assets, you might be able to negotiate terms that effectively reduce this requirement to zero upfront.

-

USDA Loans: If your mobile home is located in a rural area, you might qualify for a USDA loan. These loans are designed to support rural development and often require no down payment, making them a fantastic option for eligible buyers.

-

Chattel Loans: These loans are ideal for mobile homes not attached to land. They are typically easier to obtain than traditional mortgages but come with higher interest rates and shorter terms. Despite the higher costs, they offer a pathway to ownership with minimal initial cash outlay.

Down Payment Assistance Programs

-

Grants and Forgivable Loans: There are several programs offering grants or forgivable loans to help with the down payment. For example, some government and non-profit organizations provide financial assistance that doesn’t need to be repaid if you meet certain conditions, like living in the home for a specified number of years.

-

Tax Credits: Some states offer tax credits as a form of down payment assistance. While you still need to come up with the down payment initially, these credits can help you recoup some costs when you file your taxes.

These programs and loans can significantly lower the barriers to entry for first-time homebuyers or those with limited funds.

When exploring how to buy a mobile home with no money down, it’s crucial to research each option thoroughly and understand the eligibility criteria. Speaking with a knowledgeable lender can also help you steer these choices and find the best fit for your situation.

Steps to Purchase a Mobile Home with No Money Down

Finding the Right Lender

Start by doing your homework. Research different lenders to find one that suits your needs. Look for banks, credit unions, and specialized mobile home lenders.

Check Your Credit Score: Your credit score is crucial. A higher score can help you get better loan terms. You can get your free credit report from Experian, Equifax, or TransUnion through AnnualCreditReport.com.

Understand Lender Requirements: Different lenders have different criteria. Some might require a minimum credit score or specific income levels. Ensure you meet these requirements before applying.

Compare Loan Terms: Look at the interest rates, fees, and repayment terms. Speak with at least three lenders to find the best deal. Online lenders might offer competitive rates and a simpler application process.

Lender Acceptance: Some lenders might not finance certain types of mobile homes, like single-wides. Make sure your home type is accepted by the lender you choose.

Preparing for the Purchase

Once you’ve secured financing, it’s time to prepare for the purchase.

Site Preparation: If you’re placing your mobile home on land, ensure the site is ready. This includes checking zoning laws and securing necessary permits. Your retailer can help with this process.

Delivery and Installation: Coordinate with your retailer to deliver and install your home. This involves setting up utilities and ensuring the home meets local regulations.

Insurance: Before moving in, you’ll need to insure your mobile home. Most lenders require this to protect their investment. Shop around for the best rates and coverage.

By carefully navigating these steps, you can successfully purchase a mobile home with no money down. This process can make homeownership accessible, even if you’re new to it.

Conclusion

Purchasing a mobile home with no money down is a viable and exciting option for many aspiring homeowners. At Manufactured Housing Consultants, we are dedicated to helping you steer this journey with ease and confidence. Our mission is to provide affordable options and guidance custom to your financial situation, ensuring you find the perfect home that suits your needs and budget.

Our extensive range of manufactured, modular, and tiny homes offers something for everyone. With the guaranteed lowest prices and a large selection from 11 top manufacturers, you can rest assured that you’re getting the best deal possible. We also offer specialized financing options for all credit types, including a FICO Score Improvement Program to help boost your creditworthiness.

Starting on Your Homeownership Journey

Starting on the path to homeownership doesn’t have to be daunting. Our team of experts is here to guide you through every step of the process, from securing financing to preparing your home site. We understand the unique challenges of buying a mobile home, and we’re committed to making your experience as smooth and rewarding as possible.

Whether you’re a first-time buyer or looking to downsize, we invite you to explore our mobile homes for sale and find the possibilities that await. Let us be your partner in this exciting journey toward owning a mobile home, where affordability meets comfort and convenience.

By choosing Manufactured Housing Consultants, you’re not just buying a home; you’re investing in a future filled with stability and opportunity. Let’s make your dream of homeownership a reality, together.