Understanding How to Sell a Mobile Home in Texas

How to sell a mobile home in texas follows a unique process. Unlike traditional homes, mobile homes are often classified as personal property, not real estate, which changes the ownership transfer process. Understanding whether you’re selling personal property (home only) or real property (home with land) is the first step to a successful sale.

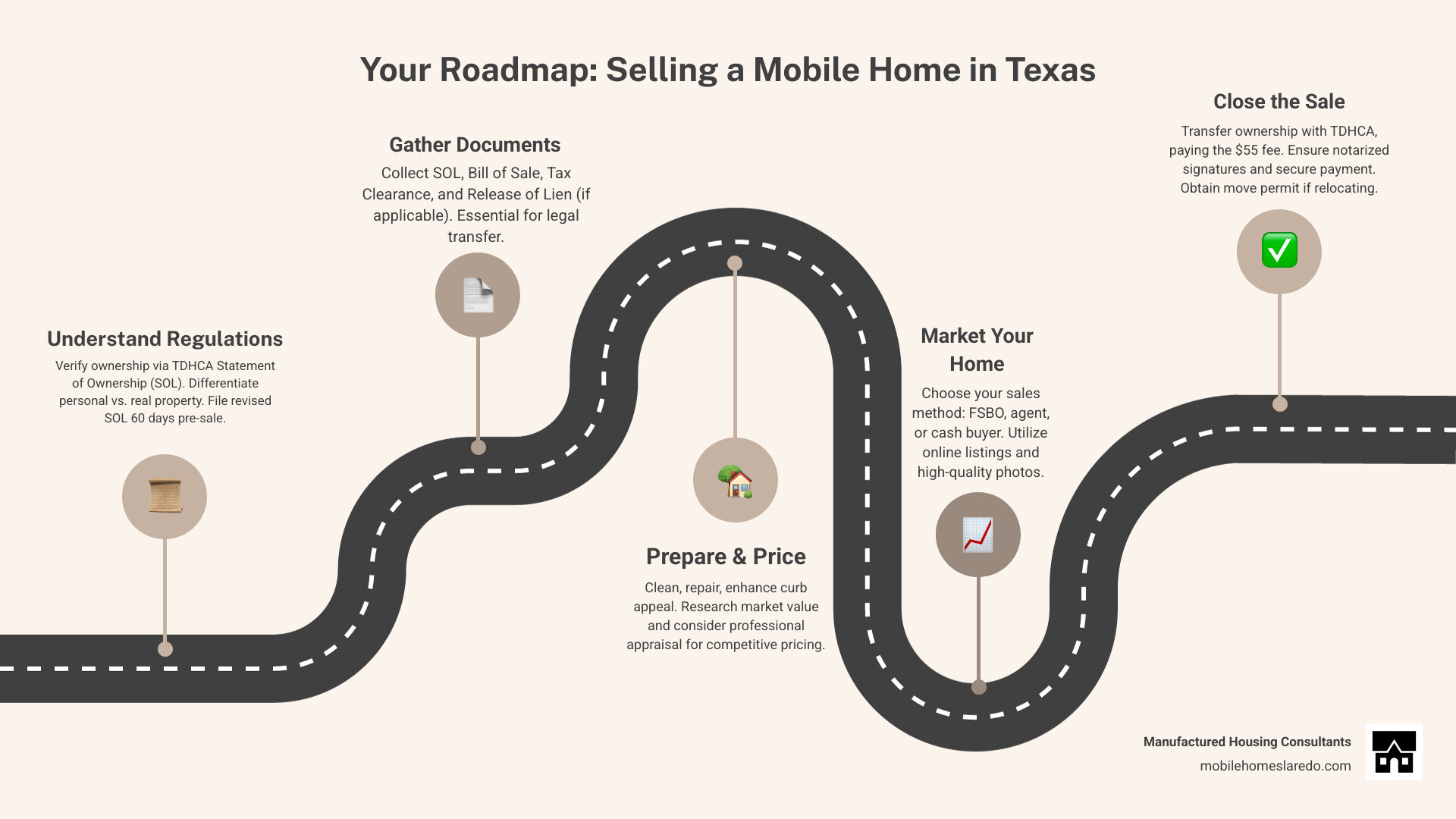

Quick Answer: Essential Steps to Sell Your Mobile Home in Texas

- Verify ownership with the Texas Department of Housing and Community Affairs (TDHCA).

- Gather documents: Statement of Ownership, Bill of Sale, Tax Clearance, and Release of Lien.

- Prepare your home: Clean, repair, and boost curb appeal.

- Choose a selling method: For Sale By Owner (FSBO), real estate agent, or a cash buyer.

- Complete the transfer by filing paperwork with TDHCA.

- Obtain a moving permit if the home is being relocated.

Texas has a high-demand housing market, but sellers often face legal issues by not following the correct process. Since 2003, Texas has used a Statement of Ownership instead of a traditional title. This document is filed with the TDHCA’s Manufactured Housing Division, and a revised Statement of Ownership and Location (SOL) must be submitted at least 60 days before your sale.

The Essential Guide on How to Sell a Mobile Home in Texas

Selling your mobile home in Texas can feel overwhelming, but breaking it down into five clear steps makes the process manageable. By understanding each stage, you can steer the sale with confidence and avoid common pitfalls.

Step 1: Understanding Regulations for How to Sell a Mobile Home in Texas

Before listing, understand the unique rules for mobile home sales in Texas. Unlike traditional real estate, these homes fall under a different system.

The Texas Department of Housing and Community Affairs (TDHCA) manages all manufactured home records. Your first step is to visit the Texas Department of Housing and Community Affairs website to verify your ownership and check for any outstanding liens.

Since 2003, Texas has used a Statement of Ownership instead of a traditional title. You must submit a revised Statement of Ownership and Location (SOL) to the TDHCA at least 60 days before your sale date, so plan accordingly.

The biggest distinction is whether your home is personal property or real property. If you’re selling the home without land, it’s considered personal property or chattel, like a vehicle. If you own the land and the home is on a permanent foundation, it may qualify as real property, which can attract more buyers and better financing. This requires retiring the original title and obtaining a warranty deed for the home and land.

As a private seller, you don’t need a special license. However, if you work with a professional, ensure they are licensed. Retailers and brokers selling two or more homes in 12 months must be licensed by the TDHCA, as must their salespersons. Finally, locate your home’s Data Plate, a metal plate usually found in a kitchen cabinet, which contains essential identifying information.

Step 2: Gathering Essential Documents

Organizing your paperwork upfront prevents delays. Missing documents are a common reason sales fall through.

Here’s what you’ll need:

- Statement of Ownership: This is your proof of ownership. If you’ve lost it, you can request a duplicate from the TDHCA, as records have been electronic since 2012.

- Application for Statement of Ownership: You and the buyer will complete this form to transfer ownership.

- Bill of Sale: While not always required by TDHCA, a Bill of Sale is a crucial receipt for the transaction, protecting both parties. It should detail the price and terms.

- Tax Clearance Statement: You must prove all personal property taxes are paid. Obtain this from your county tax office. Be aware of specific timing requirements for paying current and upcoming taxes depending on the month of sale.

- Title Transfer Fee: A $55 money order is needed for standard processing (about 15 days). Expedited processing is available for a higher fee, but plan for potential delays.

- Release of Lien: If you had a loan on the home, you must provide a Release of Lien from your lender showing the loan is paid off. You cannot legally transfer ownership without it.

Step 3: Preparing and Pricing Your Home

First impressions are critical for securing a better price. A little effort can dramatically increase buyer interest.

Home Preparation

- Clean and declutter: A spotless, tidy home appears larger and more inviting. Pack away personal items so buyers can envision themselves in the space.

- Minor repairs: Fix leaky faucets, sticky doors, and flickering lights. Small fixes prevent buyers from seeing larger problems.

- Curb appeal: Improve landscaping, repair or replace worn vinyl skirting, fix driveway cracks, and consider a fresh coat of paint. These upgrades add significant perceived value.

- Staging: Depersonalize the space but keep it warm. A light, airy aesthetic can be particularly appealing.

Pricing Your Home

Getting the price right is crucial. Start with a professional appraisal to get an expert valuation and identify any potential issues early. Also, research the market by looking at recent sales of similar homes in your area. The average price varies widely based on:

- Location: Homes in desirable communities command higher prices.

- Age and Condition: Newer homes in excellent condition sell for more.

- Features: Upgrades like modern appliances, drywall, and energy-efficient windows boost value.

- Land: Homes sold with land are considered real property and typically fetch higher prices.

Step 4: Marketing and Choosing a Sales Path

With your home prepared and priced, it’s time to find a buyer. An effective online presence is critical.

Marketing Your Home

- Invest in high-quality photos and videos. Your home must look its best online.

- Use online listings. Post on specialized sites like MHVillage and general platforms like Facebook Marketplace and Craigslist.

- Leverage social media. Share your listing on personal accounts and in local community groups.

- Write detailed, honest descriptions. Highlight your home’s best features and upgrades to build trust.

Choosing Your Sales Path

You have three main options for how to sell your mobile home in Texas:

- For Sale By Owner (FSBO): You handle everything and pay no commission, but it requires significant time and legal knowledge.

- Real Estate Agent: A professional handles marketing, negotiations, and paperwork for a commission (typically 5-6%). They offer expertise and a wider reach, but you have less direct control.

- Cash Buyer: This is the fastest and simplest option. At Manufactured Housing Consultants, we buy mobile homes as-is, with no repairs, commissions, or hidden fees. We handle all paperwork and can close quickly. The trade-off for speed and convenience may be a lower price than the full market value.

If your home is in a mobile home park, contact management early to understand their rules for sales and buyer approval.

Step 5: The Closing Process for How to Sell a Mobile Home in Texas

Closing the sale involves officially transferring ownership to the buyer.

The core of closing for how to sell a mobile home in Texas is filing the correct paperwork with the TDHCA. You and the buyer will complete the Application for Statement of Ownership and submit it along with the Bill of Sale, Tax Clearance Statement, Release of Lien (if applicable), and the $55 transfer fee. Standard processing takes about 15 days, but plan for potential delays.

If the home is being moved, the buyer is typically responsible for obtaining a permit for the move from the Texas Department of Motor Vehicles and hiring specialized movers. These costs can influence their offer.

Before finalizing, conduct a final walkthrough with the buyer to confirm the home’s condition. For payment, a cashier’s check is the safest method. To ensure legal compliance, always verify ownership and liens with the TDHCA, provide a Tax Clearance Statement, use a Bill of Sale, and offer a written disclosure about the home’s condition. For complex sales, consider consulting a real estate attorney for guidance.

Finalizing Your Sale and Ensuring a Smooth Transition

By following these steps, you are well-positioned for a successful sale. How to sell a mobile home in Texas is manageable when broken down into clear actions.

As the seller, your key responsibilities are honesty and thoroughness. Ensure all documents are accurate, taxes are paid, and any liens are released. Legal compliance with the TDHCA is crucial for a smooth transaction that protects both you and the buyer.

Understanding buyer financing can also help close the deal. For homes sold with land (real property), buyers may use FHA loans, VA loans, or even owner financing. For homes sold without land (personal property), buyers typically seek chattel mortgages from specialized lenders.

At Manufactured Housing Consultants, we understand the Texas manufactured housing market. Whether you’re selling your current home or looking to upgrade, we can help. We offer a wide selection of affordable manufactured, modular, and tiny homes with financing for all credit types, including our unique FICO Score Improvement Program.

The Texas mobile home market is strong, and by following the proper procedures, you can complete your sale with confidence. Ready for your next step? Learn about new mobile home financing options and see how we can make your transition smooth and affordable.