Why Understanding Interest Rates on New Mobile Homes Matters

Interest rates on new mobile homes typically range from 6% to 12%, depending on your credit score, down payment, and loan type. Here’s what you need to know:

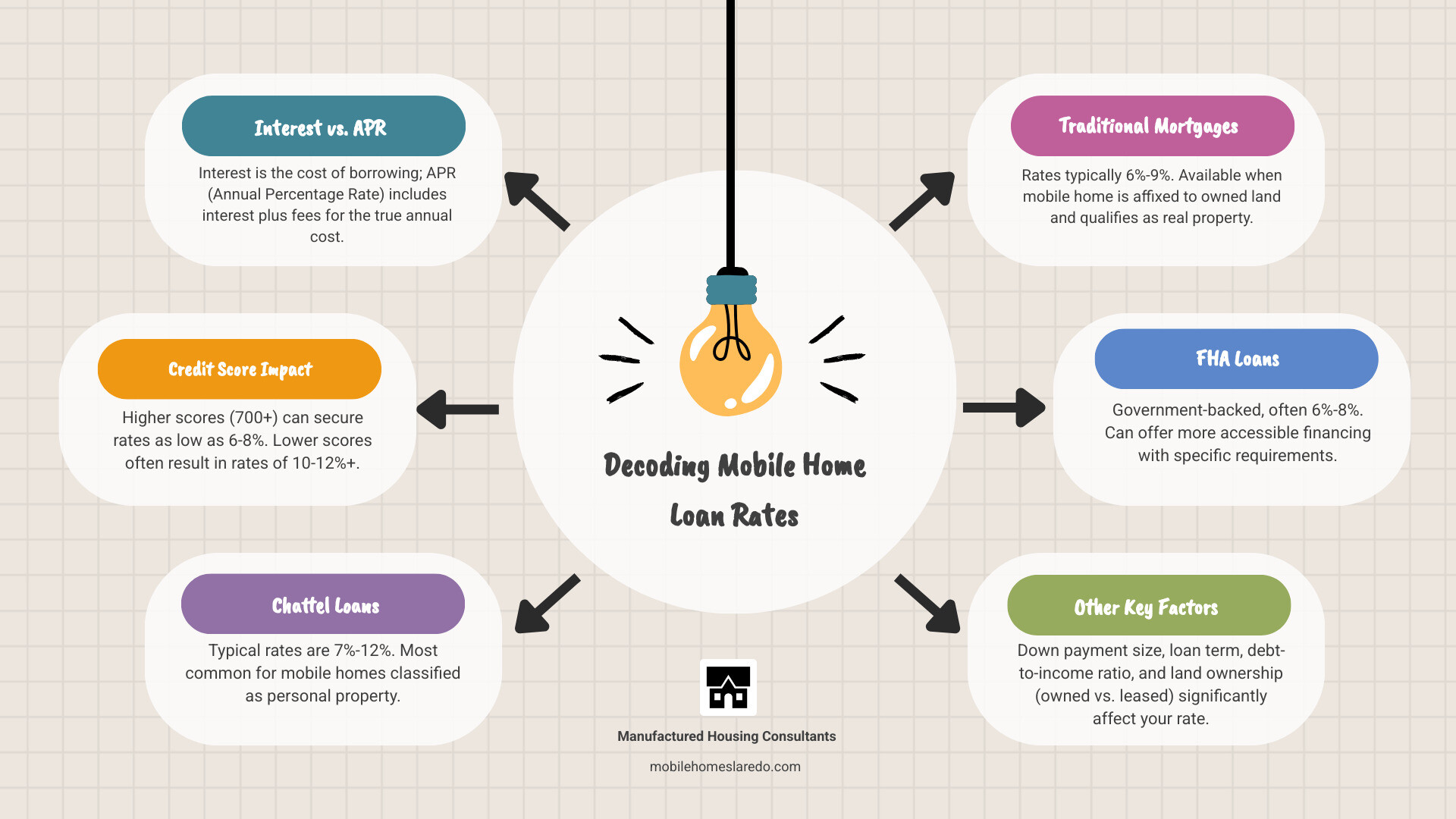

Quick Rate Comparison:

- Chattel loans: 7% – 12% (most common for mobile homes)

- Traditional mortgages: 6% – 9% (if home qualifies as real property)

- FHA loans: 6% – 8% (government-backed option)

- Personal loans: 8% – 15% (for smaller amounts)

When you’re looking at mobile home financing, the interest rate isn’t just a number – it’s the difference between affordable monthly payments and financial stress. Unlike traditional home mortgages, mobile home loans often come with higher rates because they’re typically classified as personal property rather than real estate.

The good news? You have more options than you might think. From chattel mortgages to government-backed loans, understanding your choices can save you thousands over the life of your loan.

Your credit score, down payment amount, and whether you own or lease the land all play huge roles in determining your rate. Even small improvements in these areas can lead to significant savings.

Relevant articles related to interest rates on new mobile homes:

Decoding Interest Rates on New Mobile Homes

Understanding interest rates on new mobile homes doesn’t have to be a puzzle. Let’s break down what you need to know to secure the best financing for your dream home.

What Are Typical Interest Rates on New Mobile Homes?

When shopping for financing, you’ll find that interest rates on new mobile homes work differently than traditional mortgages. While conventional home loans might range from 6-9%, manufactured home loans typically fall between 7-12%. This isn’t because lenders are trying to make your life difficult—it’s about how these homes are classified.

The big difference is real property versus personal property. If your new mobile home sits on land you own and is permanently attached to a foundation, it might qualify as real estate, opening the door to lower, traditional mortgage rates.

However, most mobile homes are financed through chattel loans, which treat your home more like a car or RV. Since these homes can be moved and may depreciate faster than site-built homes, lenders see them as slightly riskier. Don’t let this discourage you! Chattel loans are often easier to qualify for, process faster, and have more flexible requirements, making them perfect for homes in leased communities.

For detailed insights into current rates, check out our comprehensive guide on mobile home mortgage rates.

Key Factors That Determine Your Interest Rate

Your interest rate is based on several key factors. Understanding these gives you the power to improve your terms.

Your credit score is the most important factor. Scores above 670 typically open up the best rates. The good news? Even if your credit needs work, we have options and offer a FICO Score Improvement Program to help. It’s also wise to check your credit report for errors, which you can do for free at AnnualCreditReport.com.

Down payment amount makes a huge difference. The more you put down, the less risk the lender takes on, which often translates into lower interest rates on new mobile homes. Increasing your down payment from 5% to 10% can make a meaningful impact.

Your loan term creates a balancing act. Shorter terms usually mean lower rates but higher monthly payments. It’s about finding the sweet spot between a great rate and payments you can comfortably manage.

Debt-to-income ratio shows lenders your budget’s breathing room. Keeping your total monthly debt payments below 43% of your gross income makes you a more attractive borrower.

Land ownership dramatically affects your options. Owning the land can qualify you for traditional mortgage rates. Leasing in a community likely means chattel financing, which has higher rates but offers other benefits like community amenities.

New versus used homes also matter. New mobile homes generally qualify for better financing terms as they are seen as more reliable investments.

| Credit Score Range | Typical Interest Rate Impact (Chattel Loan) |

|---|---|

| 760-850 (Excellent) | Lowest available rates (7.0% – 8.5%) |

| 700-759 (Very Good) | Very competitive rates (8.0% – 9.5%) |

| 670-699 (Good) | Good rates (9.0% – 10.5%) |

| 580-669 (Fair) | Moderate rates (10.0% – 12.0%+) |

| Below 580 (Poor) | Higher rates, but options available (12.0%+) |

If you’re concerned about credit challenges, we specialize in helping people with all credit types. Learn more about bad credit mobile home loans.

How Loan Types Affect Your Financing

Not all mobile home loans are created equal. Each type comes with its own characteristics and interest rates on new mobile homes.

Chattel mortgages are the most common choice. These loans treat your home as personal property, meaning slightly higher rates (typically 7-12%) but easier qualification and faster processing. They’re perfect for homes in leased communities.

Traditional mortgages are available when your mobile home qualifies as real estate. These typically offer the lowest rates (6-9%) because the property gives lenders more security.

Government-backed options can be game-changers. FHA loans offer competitive rates with lower down payments and flexible credit guidelines. Our team can help you explore FHA mortgage options. VA loans provide incredible benefits for eligible veterans, including no down payment requirements and typically the lowest interest rates on new mobile homes available. Learn more about VA loan benefits.

Personal loans can work for smaller manufactured homes but typically come with higher rates (8-15%) and shorter terms.

Fixed vs. Variable Rates: Which Should You Choose?

Choosing between fixed and variable rates depends on your financial comfort level.

Fixed-rate loans lock in your interest rate for the entire loan term. Your monthly payment stays the same, making budgeting easy and predictable. The trade-off is that fixed rates typically start slightly higher than variable rates.

Variable-rate loans start with lower rates that can change over time with the market. This means lower initial payments, but your payments could increase if interest rates rise. Most people financing mobile homes choose fixed rates for peace of mind.

For a complete overview of all your financing possibilities, explore our detailed guide on financing your manufactured home.

How to Get the Lowest Possible Interest Rates on New Mobile Homes

You understand the factors, and you’re ready to take action. Here is your game plan for securing rock-bottom interest rates on new mobile homes.

-

Boost Your Credit Score: This is your secret weapon. Pay all bills on time, pay down existing debt, and keep credit card balances low (ideally below 30% of your limit). Our FICO Score Improvement Program is designed to walk you through this process and maximize your creditworthiness.

-

Save for a Bigger Down Payment: A larger down payment reduces the lender’s risk and can open up better rate tiers. It also lowers your total loan amount, saving you money over the life of the loan.

-

Shop Around for Lenders: This is crucial. Don’t accept the first loan offer you receive. Compare offers from banks, credit unions, and manufactured home specialists. At Manufactured Housing Consultants, we work with multiple lenders, which means we can help you compare offers to find the best deal without you having to do all the legwork.

-

Get Pre-Approved: Pre-approval shows sellers you’re a serious buyer and gives you a clear budget and a rate you qualify for. It also helps identify any potential financing issues early, giving you time to address them. Learn more about how pre-approval can streamline your journey in our guide on the pre-approval process.

-

Watch Out for Hidden Costs: A great rate can be offset by high fees. Always look at the Annual Percentage Rate (APR), which includes fees and gives a truer picture of the loan’s cost. Sometimes a slightly higher interest rate with lower fees saves you money in the long run.

-

Consider Government-Backed Loans: FHA and VA loans can be game-changers. FHA loans offer competitive rates with flexible credit and down payment options. For veterans, VA loans often provide the best interest rates on new mobile homes available, sometimes with zero down payment.

Securing great financing is about setting yourself up for long-term financial success. For a comprehensive look at all your possibilities, explore our guide on financing options.

Take the Next Step Towards Your New Home

Understanding interest rates on new mobile homes and financing options can be complex, but you don’t have to steer it alone. With the right knowledge and a trusted partner, homeownership becomes an exciting journey.

Partnering with an Expert for the Best Deal

Here in Laredo, Texas, we at Manufactured Housing Consultants believe everyone deserves the chance to own an affordable, quality home. We’re not just a dealership; we’re your partners in making that dream come true.

Our comprehensive approach means we’re with you every step of the way, especially when it comes to securing the most favorable interest rates on new mobile homes.

-

Expert Guidance: We speak plain English, not financial jargon, explaining every aspect of your loan options so you can make informed decisions.

-

Streamlined Applications: We know what lenders look for. We help you gather the right documents and present your financial picture in the best light to avoid pitfalls that can hurt your interest rate.

-

Finding the Best Terms: Our extensive lender network allows us to compare offers and ensure you get the most competitive rates available. Our guarantee of lowest prices extends to your financing.

-

FICO Score Improvement Program: We understand that your credit score today doesn’t define your future. This unique program helps boost your creditworthiness, potentially opening doors to even better interest rates.

With homes from 11 top manufacturers and financing solutions for all credit types, we can match you with the perfect home that fits your lifestyle and budget.

Don’t let the complexity of interest rates keep you from your dream home. We’re here to cut through the confusion and help you secure financing that makes sense.

Ready to turn your homeownership dreams into reality? Get started with your mobile home financing today. Your new home is waiting.