Why Mobile Home Trade-Ins Are Growing in Popularity

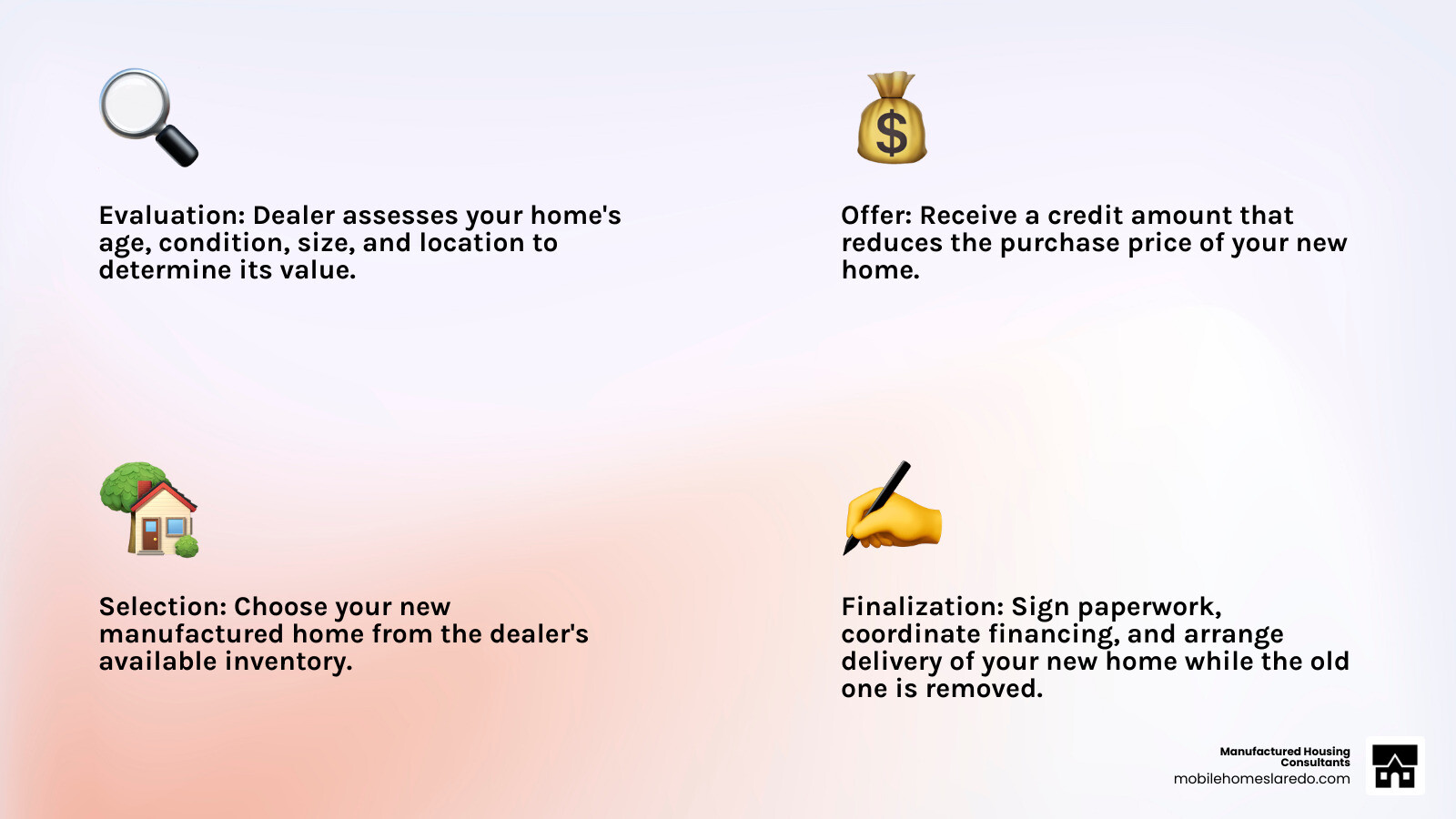

A mobile home trade in allows you to use the value of your current manufactured home as credit toward purchasing a new one—similar to trading in a car. Instead of selling your home separately, you work directly with a dealer who evaluates your current home, offers you credit for it, and applies that value to your new home purchase.

Quick Overview: What You Need to Know

- What it is: Exchange your current mobile home for credit toward a new manufactured home.

- Who handles it: Reputable dealers evaluate your home and manage the entire process.

- Value factors: Age, condition, size, location, and upgrades affect your trade-in amount.

- Financial benefits: Reduces your down payment and may offer sales tax savings (in Texas, you only pay tax on the difference).

- Loan requirements: You don’t need to pay off your current home first—dealers can coordinate with your lender.

- Types accepted: Most manufactured homes built after 1976, some pre-1976 homes, and occasionally other titled assets.

More Texas homeowners are finding that trading in their current home offers a practical path to upgrading their living situation. Instead of navigating the complexities of listing a property and waiting for buyers, a trade-in turns your existing home into instant buying power.

This approach is valuable if you’re working with limited financing options or are concerned about your credit history. The trade-in value works like a substantial down payment, which can make qualifying for a new home easier and reduce your monthly payments. You work with one dealer who handles everything—from evaluation to coordinating financing and delivery of your new manufactured home, eliminating the stress of juggling a sale and a purchase at the same time.

The Complete Guide to the Mobile Home Trade In Process

Trading in your mobile home is a straightforward way to upgrade your living situation. Instead of juggling two separate transactions—selling your old home while buying a new one—you work with one dealer who handles everything. Your current home becomes instant buying power, allowing you to skip the headaches of listing your property and waiting for buyers.

This approach leverages your existing equity, reducing what you need to finance and making your dream home more accessible. Understanding your Mobile Home Values is the first step, so let’s walk through how it works.

How Your Mobile Home’s Trade-In Value is Determined

Determining your home’s value involves a methodical assessment. For homes built after 1976, dealers often reference the NADA® value guide, the industry standard for manufactured housing. This is combined with a market-based appraisal, which considers what similar homes are selling for in your area.

Several key factors shape the final offer:

- Age: Homes built after the 1976 federal HUD Code was established hold their value better. Pre-1976 homes have minimal trade-in value, sometimes only for salvage.

- Condition: A well-maintained home with a solid roof, siding, and functional systems (plumbing, electrical, HVAC) will command a better price.

- Size: Larger homes, like double-wides, are typically worth more than single-wides.

- Location: A home on privately owned land is generally more valuable than one on a leased lot. However, homes in desirable communities can still command good prices.

- Upgrades: New appliances, updated flooring, renovated rooms, decks, or a permanent foundation all add value. For more details, see our guide on Factors That Influence Mobile Home Values.

‘In-Place’ vs. ‘Pull-Out’ Value: A Critical Distinction

Whether your home can stay where it is or must be moved significantly affects its value.

- In-place value is what your home is worth in its current location. This value is higher because it avoids relocation costs and includes existing utility connections and site improvements. We can potentially resell it on-site, which means a better offer for you.

- Pull-out value is the home’s worth after subtracting the substantial costs of moving it. Disconnecting utilities, transport, and permits can be expensive, which reduces the trade-in credit we can offer. For older homes, these costs can sometimes exceed the home’s value.

Understanding this difference helps set realistic expectations. Learn more about how location impacts worth in our article on Resale Value Mobile Home.

The Pros and Cons of a Mobile Home Trade In

Deciding whether to trade in or sell privately depends on your priorities. Here’s a quick comparison:

| Factor | Mobile Home Trade-In | Private Sale (Selling for Cash) |

|---|---|---|

| Speed | Faster, streamlined process. | Can be slow, involves finding buyers. |

| Convenience | High: Dealer handles everything. | Low: You manage the entire process. |

| Price | Often lower than private sale. | Potentially higher, but requires more effort. |

| Effort | Minimal for homeowner. | Significant for homeowner. |

| Tax Savings | Possible sales tax reduction. | No direct sales tax benefit. |

| Financing | Simplifies new home financing. | Separate transactions. |

The primary benefit of a trade-in is convenience. You avoid the stress of listing, showing, and negotiating. The main trade-off is a potentially lower value compared to a private sale, as dealers must account for refurbishment and resale costs. For most families, the time and hassle saved make trading in the smarter choice, especially when you factor in financial perks like tax savings and using your equity as an immediate down payment.

Navigating the Financials: Loans, Taxes, and Down Payments

Understanding the money side of a trade-in is simple. You can absolutely trade in a home even if you still have a loan on it.

We determine your loan payoff amount from your lender. If your trade-in value is more than you owe, the extra equity is applied to your new home purchase. If you owe more than the trade-in value (negative equity), the difference can often be rolled into your new loan. This allows you to move forward without paying out-of-pocket.

In Texas, you get a significant sales tax savings, as you only pay tax on the difference between the new home’s price and your trade-in credit. This can save you thousands.

Your trade-in also acts as a built-in down payment, reducing the amount you need to finance. This can lead to lower monthly payments and may help you qualify for better loan terms. Our team is experienced with Mobile Home Financing and can guide you through every step.

Final Steps: Preparing Your Home and Choosing a Partner

As you near the end of your mobile home trade in journey, two steps remain: preparing your current home and choosing the right dealer. A little preparation and a trustworthy partner will ensure you get the best possible outcome.

How to Prepare Your Home for a Top-Value Evaluation

A little effort can significantly increase your home’s valuation. We’re not looking for perfection, just a home presented at its best. Focus on these key areas:

- Clean and Declutter: A clean, organized space appears larger and better maintained. Tidy up inside and out, clearing countertops, scrubbing floors, and managing landscaping. First impressions count.

- Make Minor Repairs: Fix leaky faucets, tighten loose handles, patch small holes, and replace burnt-out bulbs. These small fixes show the home has been well cared for.

- Gather Your Documents: Have your home’s title, current loan information (including payoff amount), and original purchase documents ready. This streamlines the evaluation process.

- List All Upgrades: Create a list of improvements you’ve made, such as new appliances, updated flooring, renovated rooms, energy-efficient windows, a deck, or a permanent foundation. These add real value.

Presenting your home honestly and in its best light helps us see its full potential. You can also browse our Used Mobile Homes for Sale to see how similar homes are valued.

What to Look for in a Reputable Dealer for your mobile home trade in

Choosing the right partner is critical for a smooth experience. Not all dealers are the same, so look for these qualities:

- Transparency and Honesty: A good dealer explains their valuation process and all costs clearly, without pressure.

- Free, No-Obligation Evaluation: You should be able to get an assessment of your home’s value without any cost or commitment.

- A Wide Selection: A dealer with a diverse inventory gives you more choices. We work with 11 top manufacturers, offering a huge selection of New Mobile Homes.

- A Strong Reputation: Check online reviews and testimonials. A history of satisfied customers is a great sign.

- Clear Communication: Your partner should be responsive and explain things clearly, ensuring you feel comfortable and informed.

- Financing Expertise: Manufactured home financing is unique. Look for a dealer who understands the nuances and offers solutions for all credit situations, like our new mobile home financing options and FICO Score Improvement Program.

At Manufactured Housing Consultants in Laredo, Texas, we are qualified, licensed, and bonded professionals committed to making homeownership accessible. Our guaranteed lowest prices and dedication to a stress-free process are our promises to you. Ready to turn your current home into your new dream home? We’re here to help.