Finding Affordable Housing Without Credit Barriers

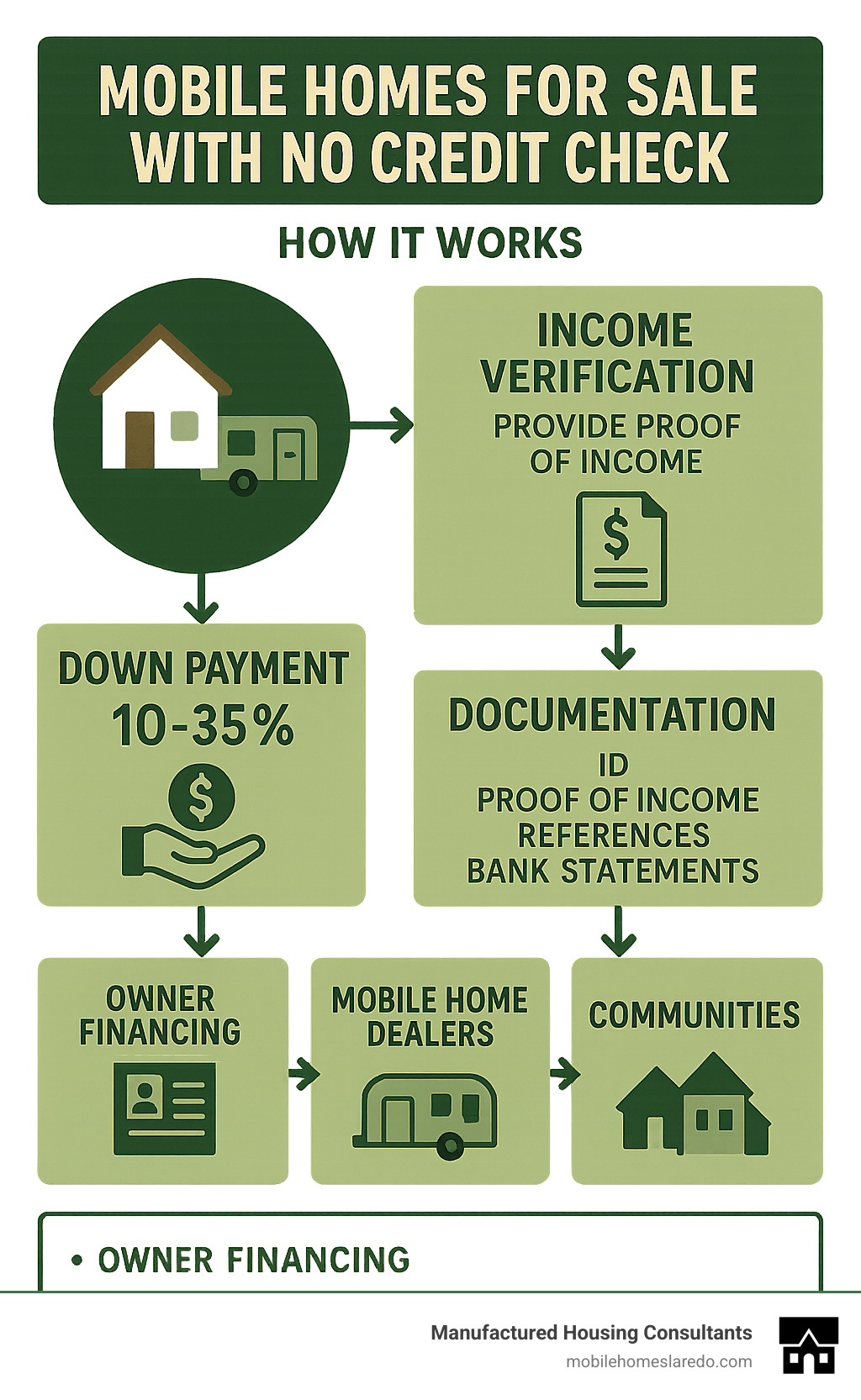

Mobile homes for sale no credit check options are available through several financing paths if you have limited or damaged credit. Here’s what you need to know:

- Owner financing: Many mobile home sellers offer in-house financing with no traditional credit check

- Income verification: Most no-credit-check deals require proof of income instead of credit scores

- Down payment: Expect to pay 10-35% down, depending on the seller

- Interest rates: Typically higher than traditional loans (12-20%)

- Documentation: You’ll need ID, proof of income, references, and bank statements

Over half of all Americans currently have subprime credit scores, making no-credit-check mobile home options increasingly relevant for families seeking affordable housing solutions.

If traditional financing has closed doors for you, don’t give up on homeownership. Mobile homes represent one of the most accessible paths to having a place of your own, with prices per square foot significantly lower than site-built homes.

“We’re not just selling homes, we’re building dreams,” as one dealer puts it – and that includes helping buyers with less-than-perfect credit.

When shopping for mobile homes with no credit check, you’ll typically encounter:

- Private sellers offering owner financing

- Mobile home dealers with in-house financing programs

- Mobile home communities with rent-to-own options

- Specialized lenders like 21st Mortgage or Cascade who focus on manufactured housing

While traditional financing focuses heavily on credit scores, no-credit-check options prioritize your income stability and down payment amount. This alternative path may come with higher costs but provides homeownership opportunities that might otherwise be inaccessible.

Mobile Homes for Sale with No Credit Check: How It Works

Looking for a path to homeownership when traditional banks say “no”? You’re not alone. The process of buying a mobile home with no credit check works quite differently than getting a mortgage, and that can be a good thing if your credit isn’t perfect.

Instead of obsessing over your credit score, sellers who offer mobile homes for sale no credit check look at what really matters: your current income, job stability, and ability to make a down payment. It’s a more human approach to financing.

Here’s what the journey typically looks like: You’ll find a mobile home you love through a dealer, private seller, or community that offers no-credit-check options. Rather than running your credit, they’ll verify your income and employment. You’ll negotiate a down payment (usually 10-35% of the purchase price), submit some basic paperwork, sign your financing agreement, and often move in much faster than with traditional financing.

Most of these deals are structured as chattel loans, meaning the mobile home itself serves as collateral, not land. This is different from traditional mortgages where both land and home secure the loan.

Here’s a straightforward comparison to help you understand what you’re getting into:

| Feature | No-Credit-Check Financing | Traditional Mobile Home Financing |

|---|---|---|

| Credit Requirements | None or minimal | Usually 580+ score minimum |

| Down Payment | 10-35% | 3.5-20% |

| Interest Rate | 12-20% | 5-12% |

| Loan Term | 5-15 years | 15-30 years |

| Approval Time | Often same-day | 2-4 weeks |

| Documentation | Income verification, ID, references | Full credit check, income, assets, debt ratio |

| Loan Type | Usually chattel (personal property) | Chattel or real property mortgage |

| Refinance Options | Limited | More available |

What Does “No Credit Check” Really Mean?

When you see mobile homes for sale no credit check, it doesn’t mean there’s no evaluation of your finances at all. Think of it as a different kind of assessment.

What it typically means is there’s no hard credit pull that might ding your credit score, no minimum credit score requirement, and decisions are based mainly on your current income and ability to make payments.

Some sellers might still do a “soft pull” of your credit (which doesn’t affect your score) just to get basic information. Others skip credit checks entirely, focusing solely on your income and references.

Private party sales—buying directly from a mobile home owner—often truly involve no credit check whatsoever. When dealing directly with an individual seller, they’re usually just concerned about whether you can make consistent payments, not what happened with your credit five years ago.

Typical Requirements & Paperwork

While mobile homes for sale no credit check options bypass traditional credit evaluations, you’ll still need to prove you can make payments. It’s reasonable when you think about it—they’re just looking for different evidence that you’re reliable.

You’ll typically need to provide a government-issued photo ID, recent pay stubs (usually from the last 2-3 months), verification of at least 6 months at your current job, recent bank statements, personal and professional references, proof of where you currently live, and of course, your down payment.

Some sellers might also ask for tax returns (especially if you’re self-employed), utility payment history, or rental payment history from your landlord. The exact requirements vary, but the focus is always on showing stable income and reliability.

At Manufactured Housing Consultants, we work with you to understand exactly what documentation will strengthen your application and increase your chances of approval. For a more detailed walkthrough of the application process, check out our Mobile Home Loan Application Step-by-Step Guide.

Types of Sellers Offering No Credit Check Deals

Not all no-credit-check sellers are created equal. Each type offers different advantages depending on your situation.

Individual private owners often offer the most flexible terms and may accept lower down payments. There’s usually room for negotiation, but be careful about potential title issues. Small-lot dealers specialize in owner financing with more inventory to choose from and sometimes include warranties, though interest rates are typically higher than banks.

Mobile home park communities combine home purchase with lot rental, sometimes offering rent-to-own programs and community amenities, but remember you’ll have ongoing lot rent on top of your home payments. Cash investors who flip mobile homes may offer creative financing for buyers with challenging financial histories, though prices are typically higher to cover their investment.

At Manufactured Housing Consultants, we connect you with various types of sellers throughout Texas, giving you more options regardless of your credit situation. We believe everyone deserves a path to homeownership.

Buying New vs Used Mobile Homes for Sale No Credit Check

Contrary to what many believe, both new and used homes can be available with no-credit-check financing. Your choice comes down to priorities and budget.

New mobile homes typically require a higher down payment (20-35%) for no-credit-check deals but come with warranties, modern features, better energy efficiency, and customization options. The purchase price is higher, and income requirements might be stricter.

Used mobile homes are more widely available with no-credit-check financing and often require lower down payments (10-25%), making homeownership more accessible. Despite common myths, there are no age restrictions for financing used mobile homes. While the initial cost is lower with potentially faster move-in, you should be prepared for possible repair needs.

When buying used, a thorough inspection becomes crucial. Check for water damage, examine the structural integrity, test all systems, inspect the exterior, and verify the VIN number and title status. If you’re planning to relocate a used home, remember to budget for transportation fees, setup costs, utility connections, and permits.

At Manufactured Housing Consultants, we offer both new and used mobile homes with flexible financing options for buyers of all credit types in the Laredo area.

Understanding Owner Financing for Mobile Homes for Sale No Credit Check

Owner financing is the backbone of most mobile homes for sale no credit check deals. This arrangement cuts out traditional lenders entirely—the seller becomes your bank. It’s a more personal way of doing business.

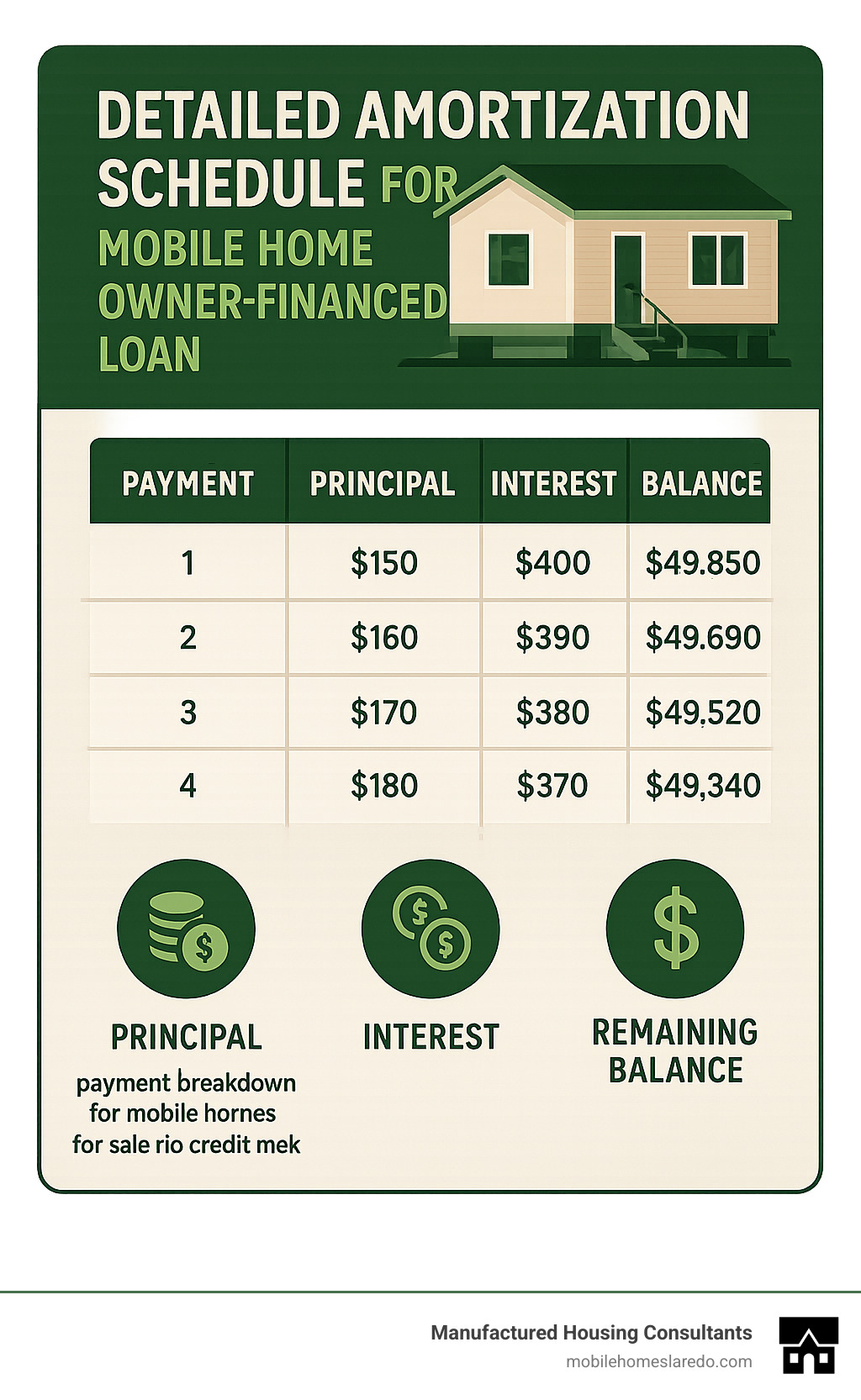

The legal foundation of owner financing is the promissory note, which details all your loan terms—purchase price, down payment, interest rate (typically 12-20%), payment amount and frequency, loan duration (usually 5-15 years), and what happens if you default.

Sellers often maintain legal ownership until the loan is paid off, either by withholding the title, using a land contract, or filing a security agreement. Many owner-financing deals include a balloon clause requiring smaller regular payments for 3-7 years followed by one large final payment. You’ll need to plan for refinancing or saving for this balloon payment.

Your amortization schedule will show how each payment divides between principal reduction (paying down your loan) and interest payments, plus your remaining balance after each payment. While interest rates are typically higher than traditional loans, owner financing offers flexibility to negotiate terms based on your specific situation.

For more details about manufactured home financing options, visit our page on Financing Your Manufactured Home.

Pros, Cons, and Smart Alternatives

When you’re looking at mobile homes for sale no credit check, it’s like finding a different path up the mountain of homeownership. This route comes with its own views, challenges, and rewards that are worth understanding before you take your first step.

The Benefits & Drawbacks of Mobile Homes for Sale No Credit Check

The beauty of no-credit-check options is that they open doors for folks who might otherwise be left out in the cold. If you’ve weathered some financial storms or are just starting to build your credit history, these opportunities can be life-changing.

The approval process is refreshingly quick—often same-day—because sellers are looking at your current income rather than your past credit mistakes. This means you could be moving into your own home within weeks instead of months. Plus, making consistent payments can actually help rebuild your credit over time, creating a positive spiral effect on your financial health.

These deals also tend to be more flexible and straightforward than traditional mortgage applications. There’s less paperwork, fewer strict requirements, and a more human approach to qualification. As one of our recent buyers put it, “I felt like they were actually listening to my situation, not just looking at a number on a screen.”

However, this accessibility comes with trade-offs. Interest rates typically run between 12-20%—significantly higher than traditional loans. You’ll also need to bring more money to the table upfront, with down payments usually ranging from 10-35% of the purchase price.

The loan terms are generally shorter too (5-15 years versus 15-30 years for conventional mortgages), which, combined with higher interest rates, means your monthly payments will be larger. This also affects how quickly you build equity in your home, as more of each payment goes toward interest rather than principal early on.

It’s also worth noting that these arrangements sometimes have fewer consumer protections than traditional mortgages, making it especially important to understand exactly what you’re signing.

Avoiding Scams & Predatory Deals

Unfortunately, where there are people in need, there are sometimes others looking to take advantage. Being aware of the warning signs can save you from a costly mistake.

Be wary of anyone who rushes you to sign paperwork or seems reluctant to put all terms in writing. Even in the no-credit-check world, extraordinarily high interest rates should raise red flags. Watch out for hidden fees that suddenly appear at closing or requests for payment through untraceable methods like wire transfers or gift cards.

To protect yourself, always verify the mobile home’s VIN number and title status. This confirms the seller actually owns what they’re selling. Consider using an escrow service to hold funds until all conditions of the sale are met—this provides a layer of security for both parties.

It’s also worth investing in professional help. A qualified mobile home inspector can spot potential issues, while a real estate attorney can review contracts before you sign. Even in no-credit-check deals, a licensed closing agent or title company can provide valuable oversight.

At Manufactured Housing Consultants, we believe in transparency at every step. We’ll show you all the paperwork, explain the terms in plain English, and give you time to make an informed decision. Your peace of mind matters to us as much as making the sale.

Improving Approval Odds with Bad or No Credit

Even when pursuing mobile homes for sale no credit check, strengthening your financial position can help you secure better terms. Think of it as bringing extra tools for your journey.

Saving for a larger down payment is perhaps the most powerful strategy. Aiming for 15-20% (or more) not only improves your chances of approval but often leads to better interest rates. It shows sellers you’re serious and financially responsible.

Demonstrating stable income is equally important. Lenders want to see that you’ve held your job for at least a year and that your monthly income comfortably covers the projected payment. Don’t forget to include all income sources—that side gig or part-time job counts too.

If your own financial profile needs backup, consider bringing in a co-buyer or co-signer with stronger credit or income. Just make sure everyone understands they’re equally responsible for the loan. We’ve seen many successful purchases where family members team up to make homeownership possible.

Even simple credit-building activities can make a difference. Secured credit cards, credit-builder loans, and services like Experian Boost (which reports rent and utility payments) can help establish positive history.

Don’t underestimate the power of good references. Current and previous landlords who can vouch for your on-time payments, employers who can confirm your reliability, and personal references who know your character can all strengthen your application.

Our FICO Score Improvement Program has helped countless buyers boost their credit profiles before purchasing. Even small improvements can lead to significantly better terms.

Alternative Financing Paths if No Credit Check Falls Through

If the no-credit-check route doesn’t work out, don’t lose hope—several other paths might still lead you home.

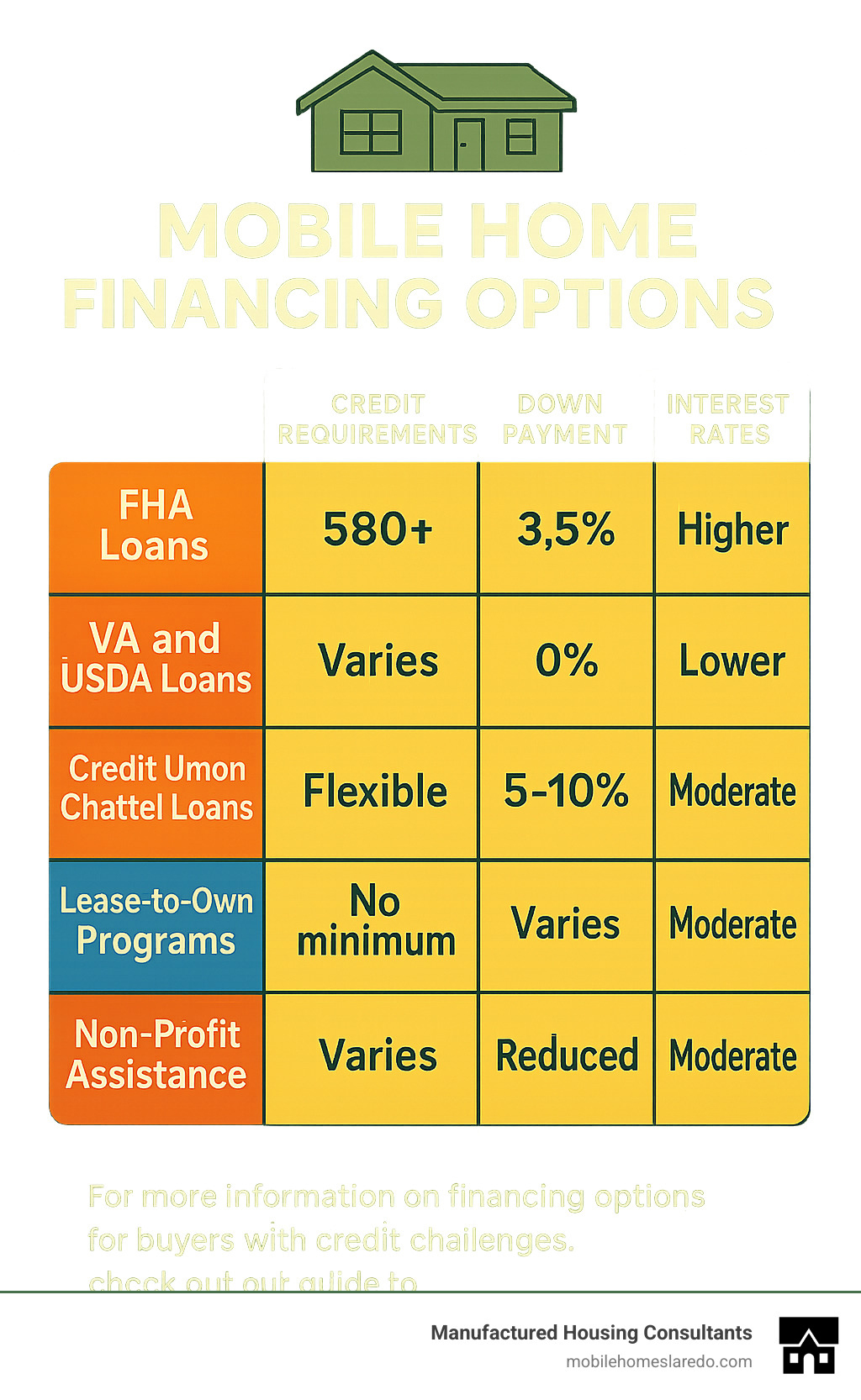

FHA Title I loans offer a government-backed option with more lenient credit requirements (typically 500+) and down payments as low as 5%. These loans can finance both the home and land with terms up to 20 years, making them worth exploring if you have some credit history.

For veterans, active military members, or rural homebuyers, VA and USDA loans can be excellent options. These programs often feature lower interest rates and reduced (or even zero) down payment requirements, though they do have specific property criteria that must be met.

Credit unions frequently offer more flexible chattel loans than traditional banks. They’re often willing to look beyond just credit scores and consider your overall financial picture. While membership is typically required, many credit unions are community-based and easy to join.

Lease-to-own or rent-to-own programs provide a gradual path to ownership. A portion of your monthly rent applies toward the eventual purchase, giving you time to build credit while already living in your future home. These arrangements typically include a pre-determined purchase price and require consistent payment history.

Various non-profit housing assistance programs specifically aim to help buyers with credit challenges. Organizations like Next Step connect buyers with affordable loans and offer credit counseling and homebuyer education. Some even provide down payment assistance to qualified applicants.

For more detailed information on financing options for buyers facing credit challenges, our guide to Bad Credit Mobile Home Loans Guaranteed Approval walks through various possibilities.

For scientific research on how sub-prime credit impacts housing opportunities, check out the Credit.com Free Credit Report Card which provides valuable insights into credit scoring factors.

At Manufactured Housing Consultants, we believe everyone deserves a chance at homeownership. We’ve helped buyers with all types of financial backgrounds find their path home, and we’re ready to help you too.

Conclusion

Finding mobile homes for sale no credit check options isn’t just possible—it’s a realistic path to homeownership for many Americans whose credit history has closed traditional doors. Yes, these financing arrangements typically come with higher interest rates and down payments, but they provide a valuable bridge to affordable housing that might otherwise remain just out of reach.

At Manufactured Housing Consultants, we’ve walked alongside countless buyers facing credit challenges. As a Texas-based leader in affordable manufactured housing, we’ve built our business around creating pathways to homeownership, regardless of what your credit report might say.

We believe everyone deserves a place to call home—a belief that shapes everything we do:

We guarantee the lowest pricing on manufactured homes in the Laredo area, because affordability matters. Our relationships with 11 top manufacturers give you plenty of choices without sacrificing quality. And our specialized financing programs are designed with real people in mind—not just perfect credit scores.

Many of our customers have found success through our FICO Score Improvement Program, which helps boost your credit before buying. This isn’t just about getting you into a home today; it’s about setting you up for financial success tomorrow.

Our experienced consultants understand what you’re going through. They’re real people who’ve helped families just like yours steer the sometimes confusing world of mobile home financing. Whether you’re dreaming of a cozy single-wide or need space for a growing family in a double-wide, we’re here to find solutions that work for your unique situation.

While no-credit-check financing opens immediate doors to homeownership, we also encourage thinking long-term. Simple strategies to improve your credit over time could potentially allow you to refinance later at better rates—potentially saving thousands over the life of your loan.

Ready to stop renting and start owning, regardless of your credit situation? Let’s talk. At Manufactured Housing Consultants, we see beyond credit scores to the family that deserves a place to call home.

For more information about our available homes and services, visit our mobile homes page.

Don’t let credit challenges keep you in the rental cycle. With the right guidance and approach, that mobile home you’ve been dreaming about could be more within reach than you ever thought possible.