Navigating new mobile home financing can feel overwhelming, but it’s a gateway to affordable housing in today’s market. Rising home prices have made traditional homeownership a challenge, especially for individuals like Maria in Texas, who search for budget-friendly yet stylish housing solutions. Manufactured homes present a compelling alternative, offering modern amenities without the hefty price tag. But how does one finance these gems effectively?

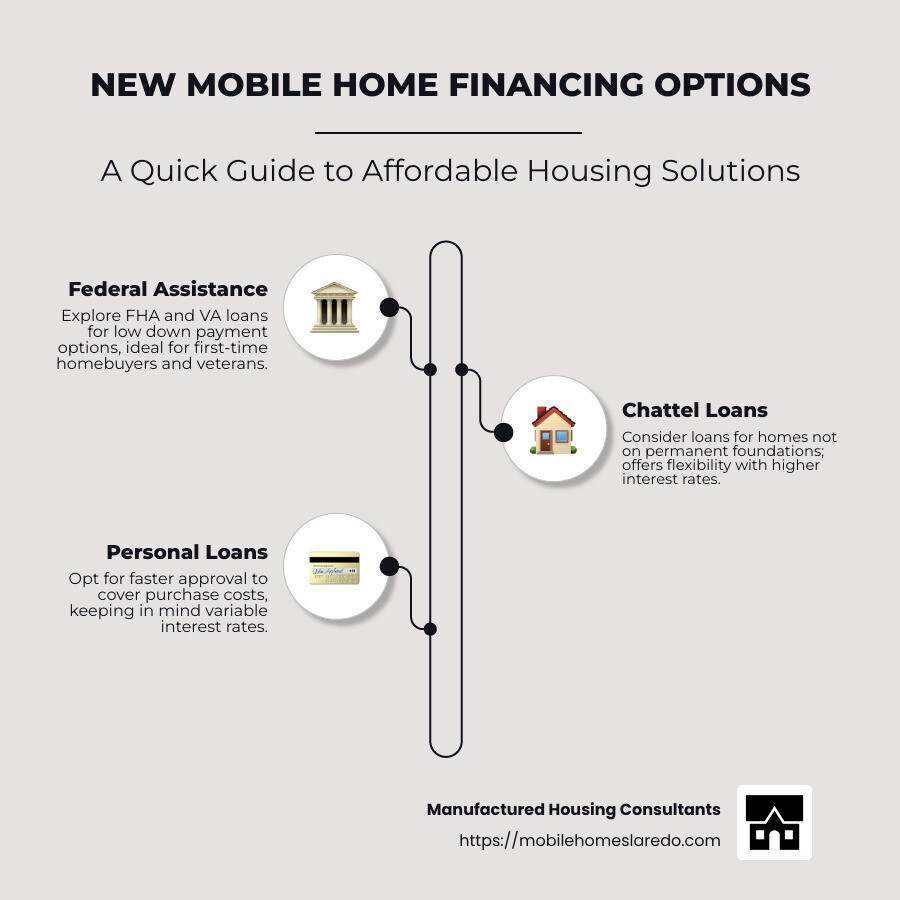

Here’s a quick guide to new mobile home financing:

- Federal Assistance: FHA and VA loans provide low down payment options, catering especially to first-time homebuyers and veterans.

- Chattel Loans: Designed for homes not affixed to permanent foundations, these offer flexibility, although often with higher interest rates.

- Personal Loans: A faster approval route, personal loans can cover purchase costs, albeit with variable interest rates.

With these financing options, entering the mobile home market is more within reach than many imagine. Let’s explore the path from dream to reality.

Understanding Mobile and Manufactured Homes

When exploring housing options, it’s important to understand the differences between mobile homes, manufactured homes, and modular homes. These types of homes offer unique benefits and challenges. Let’s break them down.

Mobile vs. Manufactured Homes

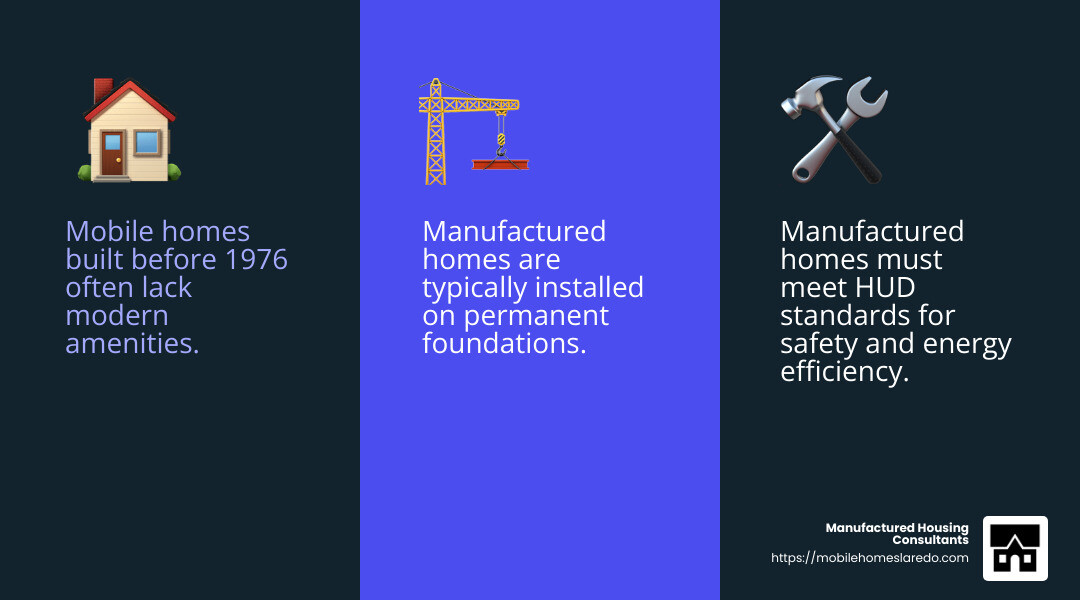

Mobile Homes were built before 1976. They were designed for mobility, with wheels and axles allowing them to be moved easily. However, these homes often lack modern amenities and safety features. As a result, they are less common today.

Manufactured Homes are the modern evolution of mobile homes. Built in factories and transported in sections, they must meet strict standards set by the Department of Housing and Urban Development (HUD). These standards ensure quality in areas like structural integrity, fire safety, and energy efficiency. Manufactured homes are usually installed on permanent foundations, offering a stable living environment.

HUD Standards

The HUD standards, established in 1976, revolutionized the way factory-built homes were constructed. These standards ensure that manufactured homes meet specific safety, durability, and efficiency criteria. This means they are often more reliable and long-lasting than their predecessors.

Modular Homes

Modular Homes are another type of factory-built housing. Unlike manufactured homes, modular homes are built in sections (or modules) and must comply with local building codes, just like traditional homes. Once assembled on-site, they look and function like typical stick-built houses. Modular homes offer more customization options, allowing buyers to tailor their homes to fit personal preferences and needs.

While modular homes are not designed for frequent relocation, they can be moved with careful planning and resources. This flexibility, combined with their adherence to local building codes, makes them an attractive option for many homebuyers.

Understanding the distinctions between these types of homes can help you make informed decisions when considering new mobile home financing options. Next, we will dig into the various financing avenues available, ensuring you find the right fit for your housing dream.

New Mobile Home Financing Options

When it comes to new mobile home financing, there are several options available. Each has its own set of benefits and requirements. Let’s explore some of the most popular choices.

FHA Loans

FHA loans are backed by the Federal Housing Administration. They are designed to help first-time homebuyers and those with lower credit scores. These loans offer competitive interest rates and require a lower down payment—sometimes as low as 3.5%.

FHA loans are available for manufactured homes, but the home must meet certain criteria. It should be installed on a permanent foundation and comply with HUD standards. These loans can be used for both the home and the land, or just the home if the land is leased.

VA Loans

For veterans and active-duty military members, VA loans are a great option. These loans often require no down payment and offer competitive interest rates. They are backed by the Department of Veterans Affairs and provide flexible terms.

VA loans can be used to purchase a manufactured home. However, the home must be the buyer’s primary residence, and it must meet specific safety and quality standards.

Chattel Loans

Chattel loans are specifically for purchasing mobile homes without land. These loans are secured by the home itself, not the land it sits on. This makes them a good choice if you plan to lease the land or already own it.

Chattel loans generally have higher interest rates and shorter terms compared to traditional mortgages. However, they offer greater flexibility and faster approval processes.

Personal Loans

Personal loans can also be an option for financing a mobile home. They provide quick access to funds and have fewer restrictions. However, they typically come with higher interest rates and shorter repayment terms.

Personal loans are unsecured, meaning they don’t require collateral. This can be useful if you don’t want to risk losing your home in case of default. But remember, the lack of collateral often results in higher interest rates.

Exploring these new mobile home financing options can help you find the best fit for your needs and budget. Next, we’ll walk you through the steps to secure financing, ensuring a smooth journey from dream to reality.

Steps to Secure New Mobile Home Financing

Securing new mobile home financing can feel overwhelming, but breaking it down into simple steps can make it manageable. Let’s explore the key steps: improving your credit score, saving for a down payment, and choosing the right lender.

Improve Your Credit Score

Your credit score plays a big role in the financing process. It affects the interest rates you’re offered and the types of loans you qualify for. To get the best rates, aim for a credit score of at least 700, though 750 or higher is ideal. Here’s how you can improve your score:

- Pay Bills on Time: Consistent, on-time payments boost your credit score.

- Reduce Debt: Lower your debt-to-income ratio by paying down existing debts.

- Check Your Credit Report: Look for errors and dispute them with the credit bureaus if necessary.

Save for a Down Payment

A larger down payment can lower your monthly payments and interest rates. Here’s what to keep in mind:

- FHA Loans: Require as low as 3.5% down if you have a credit score of 580 or higher.

- VA Loans: Often require no down payment for eligible veterans and active-duty military.

- Chattel Loans: Typically require a minimum down payment of 5% to 20%, depending on your credit score.

Saving for a down payment might take time, but it’s worth it for the long-term savings on your loan.

Choose the Right Lender

Selecting the right lender is crucial for securing favorable new mobile home financing. Here’s what to consider:

- Compare Offers: Request quotes from multiple lenders to find the best interest rates and terms.

- Consider Specialized Lenders: Some lenders specialize in mobile home financing and might offer better terms.

- Check Online Options: Online lenders may provide competitive rates and a convenient application process.

Take your time to research and compare lenders. This step can save you thousands over the life of your loan.

By following these steps, you’ll be well on your way to securing financing for your new mobile home. Next, we’ll discuss some common financing challenges and how to overcome them.

Financing Challenges and Solutions

Navigating new mobile home financing can be tricky. There are several challenges you might face, but don’t worry—there are solutions too! Let’s explore some common issues: loan-to-value ratios, depreciation, and lender requirements.

Loan-to-Value (LTV) Ratio

The loan-to-value ratio is a key factor in mobile home financing. It compares the loan amount to the appraised value of the home. Lenders use this ratio to assess risk. A lower LTV means less risk for the lender, which can result in better loan terms for you.

Solution: To improve your LTV ratio, consider making a larger down payment. This reduces the loan amount relative to the home’s value, making your application more attractive to lenders.

Depreciation

Unlike traditional homes, mobile homes can depreciate in value over time. This is a concern for lenders because it impacts the home’s resale value.

Solution: Choose a well-maintained home or consider investing in a new manufactured home. Newer homes tend to hold their value better. Additionally, placing your mobile home on owned land, rather than a rented lot, can help maintain its value.

Lender Requirements

Lenders often have specific requirements for mobile home loans. These can include higher interest rates, shorter loan terms, and larger down payments due to perceived risks.

Solution: Shop around to find lenders who specialize in mobile home financing. They may offer more favorable terms. Also, consider improving your credit score and saving for a larger down payment to meet lender requirements and secure better loan conditions.

By understanding these challenges and their solutions, you can steer the process with confidence. Up next, we’ll tackle some frequently asked questions about mobile home financing.

Frequently Asked Questions about New Mobile Home Financing

Is it harder to get a mortgage for a mobile home?

Yes, getting a mortgage for a mobile home can be more challenging than for a traditional house. Lenders often see mobile homes as riskier investments due to their potential for depreciation. This can lead to higher interest rates and stricter credit score requirements.

Credit Score: A higher credit score can make it easier to qualify for a loan with better terms. For instance, you might need a credit score of at least 620 for a conventional mortgage or chattel loan. FHA loans can be an option with scores as low as 500 if you can afford a 10% down payment.

Down Payment: Most mobile home loans require a down payment. Some programs, like VA loans, offer no down payment options, but they are limited to qualifying veterans and active-duty service members.

What are the financing options for mobile homes?

There are several financing options available for mobile homes, each with its own set of requirements:

-

FHA Title I and Title II Loans: These are government-backed loans. Title I is for purchasing just the home, while Title II covers both the home and land. They often require lower down payments and are available to borrowers with lower credit scores.

-

Freddie Mac and Fannie Mae: These institutions offer programs like CHOICEHome Mortgage and MH Advantage, which cater to mobile home buyers. They have specific requirements, such as the home needing a driveway or garage.

-

VA Loans: Available to veterans, these loans don’t require a down payment and don’t include mortgage insurance, provided the home meets certain standards.

-

Personal Loans: While these can be used for mobile homes, they often come with higher interest rates and shorter terms, making them less favorable.

Can I buy a mobile home with no money down?

Yes, it’s possible, but options are limited. VA loans are a primary choice for those eligible, as they require no down payment. Additionally, some states offer down payment assistance programs that can help cover the initial costs for mobile homes. It’s worth checking with local housing authorities to see what assistance might be available in your area.

By exploring these options and understanding the requirements, you can find the best path to financing your mobile home.

Conclusion

At Manufactured Housing Consultants, we understand that buying a home is a big step, and we are here to make the dream of homeownership a reality. With new mobile home financing options, we offer a path to affordable housing that fits your budget and lifestyle.

Financing Options: We provide a variety of financing solutions custom to your needs, whether you’re a first-time buyer or looking to upgrade. Our specialized financing programs accommodate all credit types, ensuring you have access to the best possible terms. We even offer a FICO Score Improvement Program to help you qualify for better rates.

Affordable Homes: Our selection includes a wide range of manufactured, modular, and tiny homes from 11 top manufacturers. We guarantee the lowest prices, making homeownership more accessible than ever. Whether you choose a brand-new model or a pre-owned home, you’ll find an option that suits your financial situation.

Choosing the right financing can be daunting, but our team is here to guide you every step of the way. From pre-approval to closing, we ensure a smooth process, so you can focus on what matters most—finding the perfect home for you and your family.

If you’re ready to explore your financing options and take the next step towards owning a mobile home, contact us today for expert guidance and support. Let’s turn your dream home into a reality!