Your Bridge to Homeownership Despite Credit Challenges

Rent to own mobile homes with land no credit check options provide a path to homeownership for families who can’t qualify for traditional mortgages. With many Americans having subprime credit scores, these programs focus on your income and down payment ability rather than your credit history.

Quick Answer: Key Features of No Credit Check Rent-to-Own

- No hard credit pull during application

- 10-35% down payment typically required

- Income verification instead of credit scores

- Same-day approval in many cases

- Higher interest rates (12-20%) than traditional loans

- Land included in the purchase agreement

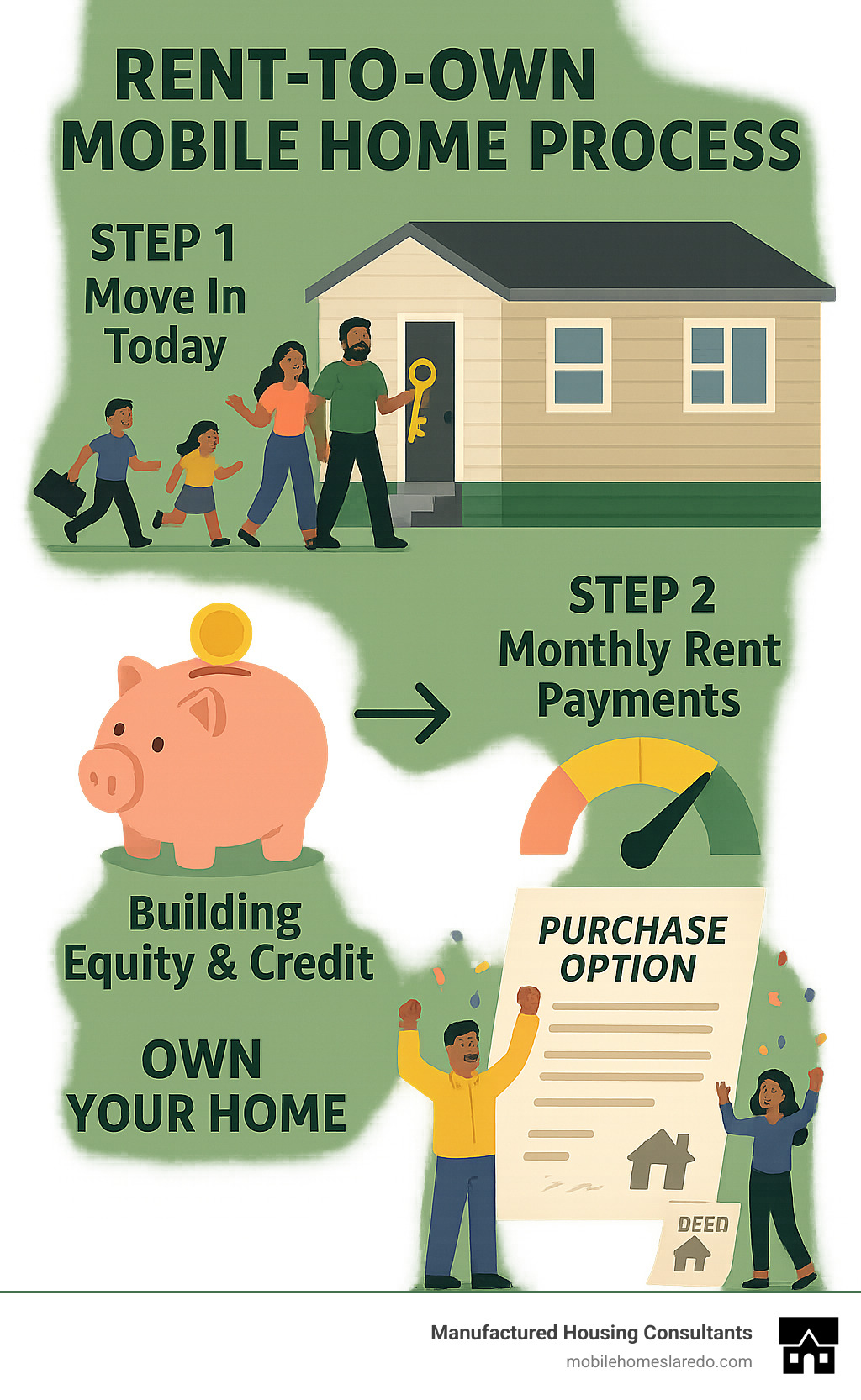

When credit challenges make traditional homeownership feel impossible, rent to own mobile homes with land no credit check agreements offer a different approach. They give you time to improve your credit while living in your future home. You lock in a purchase price today and build equity as a portion of your monthly rent goes toward your eventual down payment.

These programs are especially helpful for families in Texas, where affordable housing is limited. The approval process focuses on employment stability and your ability to make monthly payments, not past financial mistakes.

The Ultimate Guide to Rent to Own Mobile Homes with Land No Credit Check

When traditional banks slam the door because of your credit score, rent to own mobile homes with land no credit check programs open a window to homeownership. These agreements aren’t just about getting a roof over your head – they’re about building a future, one monthly payment at a time.

Think of it as a test drive for homeownership. You get to live in your potential future home while working toward actually owning it. No pressure from credit bureaus, no sleepless nights wondering if you’ll get approved. Just a straightforward path forward.

What is a Rent-to-Own (RTO) Agreement?

A rent-to-own (RTO) agreement is a contract that bridges the gap between renting and buying. You live in the home immediately while working toward ownership, making it ideal for those not yet ready for a traditional mortgage.

There are two main types:

- Lease-option: Gives you the choice to buy the home at the end of the lease. You can walk away if your plans change, though you’ll forfeit your initial fees.

- Lease-purchase: Obligates you to buy the home when the lease ends. This is a firm commitment but may come with better terms.

Key components of an RTO agreement include:

- Rent credits: A portion of your monthly rent is set aside to build up your future down payment.

- Option fee: An upfront, non-refundable fee that secures your right to buy the home.

- Locked-in purchase price: The sale price is fixed when you sign, protecting you from future market increases.

Owning the land is a crucial benefit. When the mobile home and land are sold together, it’s considered real property that can appreciate, unlike a home on a rented lot. These deals often use seller financing, which bypasses strict bank requirements. For more details on financing, see our guide on financing your manufactured home.

How the ‘No Credit Check’ Process Really Works

“No credit check” programs focus on your current financial stability, not past credit mistakes. Instead of a hard credit pull that can lower your score, sellers verify your ability to pay through other means.

Key factors include:

- Income Verification: Proof of steady income through recent pay stubs and bank statements is essential.

- Employment Stability: A consistent work history demonstrates reliability.

- Down Payment: A significant down payment (typically 10-35%) shows your commitment. New homes may require 20-35%, while used homes might need 10-25%.

This process is made possible by seller financing, where the seller or dealer acts as the lender. This allows for a more flexible, human-centered approval process, often resulting in same-day approval without the long waits associated with traditional mortgages.

Weighing the Pros and Cons

Understanding the benefits and drawbacks is key to making an informed decision.

| Pros | Cons |

|---|---|

| Build equity while renting | Higher overall costs (12-20% interest rates) |

| Try before you buy | Risk of losing deposits if you don’t purchase |

| Lock in purchase price | Maintenance responsibility falls on you |

| No immediate credit requirements | Potential for scams due to less regulation |

| Build credit over time | Limited home choices |

| Accessible homeownership path | Fewer consumer protections |

Two major risks are the forfeited option fee and repair costs. If you don’t complete the purchase, you lose your upfront fee and any rent credits. You are also typically responsible for all maintenance and repairs during the rental period.

It’s crucial to understand all terms. The Federal Trade Commission provides guidance on the risks associated with rent-to-own deals: The Federal Trade Commission (FTC) on RTO risks.

Typical Requirements and Costs for rent to own mobile homes with land no credit check

While requirements are simpler than for a traditional mortgage, you’ll still need to prepare.

Required Documentation:

- Government-issued photo ID

- Recent pay stubs (2-3 months)

- Proof of stable employment (at least 6 months)

- Recent bank statements

- Proof of address (e.g., utility bill)

- Personal references

Key Costs:

- Down Payment: The largest upfront cost, typically 10-35% of the purchase price.

- Interest Rates: Expect higher rates of 12-20% due to the seller’s increased risk. Many buyers refinance later once their credit improves.

- Additional Costs: Budget for property taxes, homeowners insurance, and potential closing costs.

- Loan Terms: Terms are often shorter (5-15 years), leading to faster ownership but higher monthly payments.

Finding Legitimate Sellers and Avoiding Scams

Navigating the RTO market requires caution. You can find opportunities through private sellers, specialized dealers, and online platforms.

How to Protect Yourself:

- Vet the Seller: Research their reputation, check reviews, and ask for references. Work with established dealers like Manufactured Housing Consultants for greater security.

- Verify Ownership: Confirm the seller legally owns both the home (check the VIN) and the land, and that there are no liens or unpaid taxes.

- Get It in Writing: Ensure every detail is in a legally binding contract. Verbal promises are not enforceable.

- Hire an Attorney: Have a real estate attorney review the contract before you sign. This is a crucial step to protect your investment.

Red Flags to Watch For:

- High-pressure sales tactics.

- Vague or hidden fees.

- Refusal to allow a professional inspection.

- Demands for payment in cash or via wire transfer.

If you suspect a scam, report it to your state’s consumer protection agency: Contact your state consumer protection agency if you suspect a scam.

Alternatives to rent to own mobile homes with land no credit check

If an RTO agreement isn’t the right fit, several other paths to homeownership exist, even with credit challenges.

- Flexible In-House Financing: Specialized dealers like us offer financing with more lenient requirements than banks. We focus on your income and ability to pay, and our FICO Score Improvement Program can help you qualify for better terms over time.

- Government-Backed Loans: FHA, VA, and USDA loans offer programs for manufactured homes with low down payments and flexible credit requirements. Check eligibility for these valuable options.

- Chattel Loans: Often available from credit unions, these loans finance the mobile home itself (not the land) and may have more flexible credit standards than traditional mortgages.

- Housing Assistance Programs: Non-profits and government agencies provide resources like down payment assistance and credit counseling. The U.S. Department of Housing and Urban Development is a great place to start.

- Used Mobile Home Financing: Buying a used home can significantly lower costs. We offer specialized Used Mobile Home Loans to make this path more accessible.

Our team at Manufactured Housing Consultants can help you explore every avenue to find the best solution for your family in Texas.

Taking the Next Step Towards Your Mobile Home

Your journey to homeownership doesn’t have to wait for perfect credit. With a rent-to-own agreement, your monthly payments build equity in your future home while you live in it, turning rent into an investment.

Owning both the mobile home and the land provides long-term stability and the opportunity to build real wealth as property values appreciate. Consistent, on-time payments can also help build your credit, opening up future refinancing options for a lower interest rate.

Success depends on due diligence. Carefully review your contract, verify the seller’s ownership, get everything in writing, and have a real estate attorney review the agreement. This upfront effort protects your investment.

At Manufactured Housing Consultants, we guide families through this process. Our specialized financing options work with all credit types, and our FICO Score Improvement Program helps you build toward traditional financing. We focus on your current income and commitment, not past credit issues.

Ready to stop renting and start building your own equity? Take control of your housing future today. Explore our mobile home financing options and find how a rent-to-own program can be your bridge to homeownership.