Your Guide to Affordable Homeownership with Repo Mobile Homes

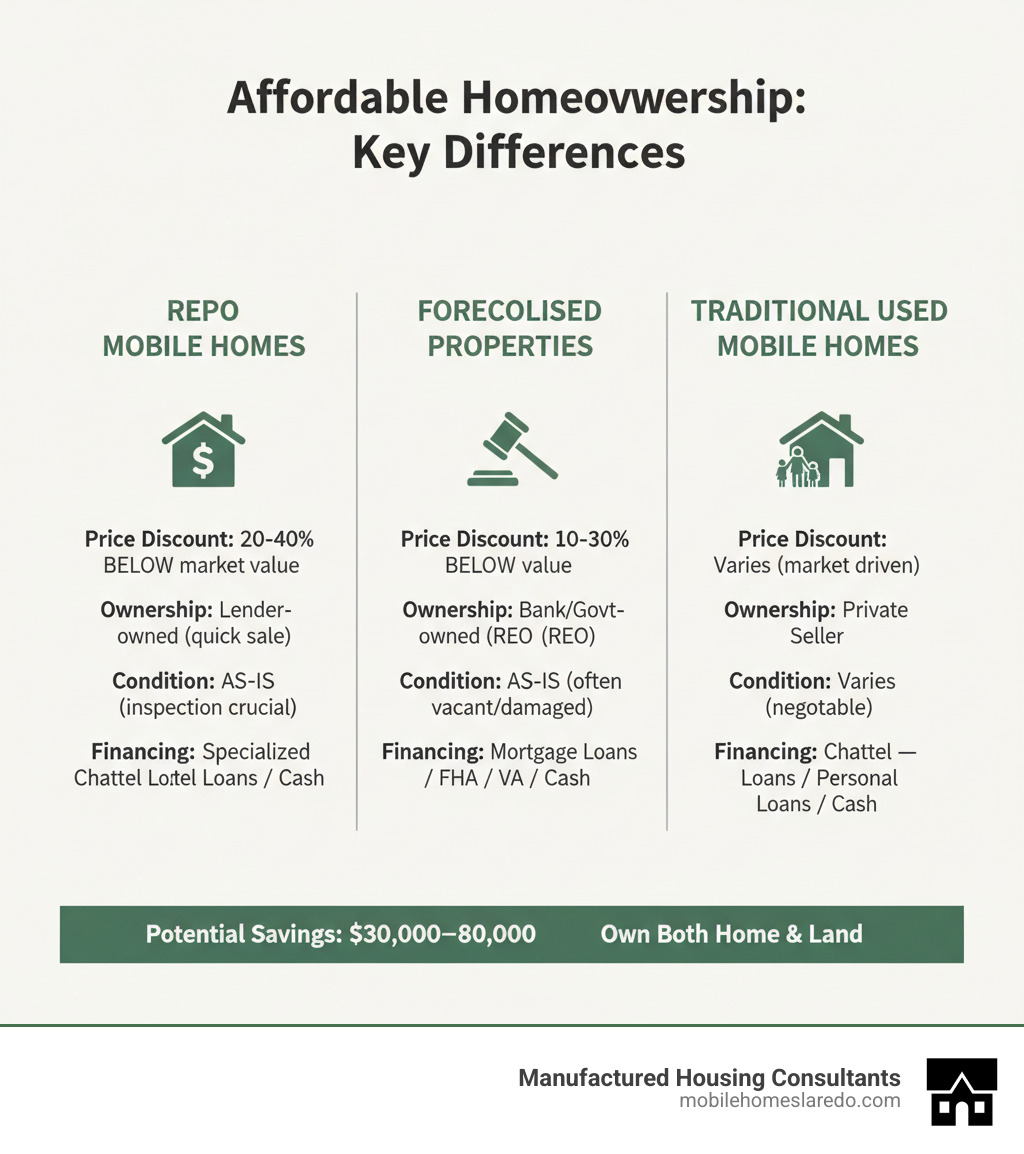

Repo mobile homes in my area offer a unique opportunity to achieve homeownership at prices significantly below market value. These repossessed manufactured homes typically sell for 20-40% less than comparable properties, providing immediate equity and a pathway to owning both a home and land.

Quick Answer: Where to Find Repo Mobile Homes Near You

- Contact Local Specialists – These companies maintain current repo inventories

- Check Bank REO Departments – Banks and lenders list repossessed properties on their websites

- Search Government Sites – HUD, VA, and Fannie Mae/Freddie Mac post foreclosure listings

- Visit County Courthouses – Public records reveal recent repossessions

- Use Specialized Marketplaces – Manufactured housing websites aggregate repo listings

Average Savings: $30,000-$80,000 compared to market-rate homes

When a buyer defaults on their loan, the lender repossesses the home. Motivated to sell quickly, they offer these properties at deeply discounted prices.

Owning both the home and land is particularly valuable. You avoid monthly lot rent and benefit from land appreciation. In fact, research shows manufactured homes on owned land can appreciate similarly to site-built homes.

But repo purchases require careful navigation. These homes sell “as-is,” meaning you need to understand potential risks, secure specialized financing, and budget for inspections and possible repairs. The good news? With proper guidance and due diligence, the rewards far outweigh the challenges.

How to Find, Finance, and Purchase Repo Mobile Homes in My Area

Finding repo mobile homes in my area might seem daunting, but think of it as an adventure with a fantastic reward. We’re here to guide you through every step, from understanding these homes to celebrating at the closing table.

What Are Repo Mobile Homes and What Are the Benefits?

A ‘repo’ mobile home is one that a lender has repossessed after the owner defaulted on their loan. Unlike traditional sellers, these lenders are highly motivated to sell quickly to recover their investment. This urgency is why you can find significant savings.

The primary benefit is saving 20-40% below market value, giving you instant equity. When you also own the land, you eliminate monthly lot rent (often $300-$800) and build wealth as the land appreciates. Research from the Federal Housing Finance Agency confirms that manufactured homes on owned land can appreciate just like site-built homes, creating a powerful investment.

Beyond finances, true ownership means freedom. You can plant a garden, add a workshop, or customize your home without needing a landlord’s approval.

If you’re considering this as an investment property, the numbers get even more interesting. With lower purchase prices, you can achieve faster returns, potentially seeing 8-12% annual returns from rental income. For more insights into this opportunity, you can explore online guides on repossessed mobile homes.

The Potential Risks and How to Mitigate Them

Repo homes are sold “as-is,” which carries risks. However, with the right approach, every risk can be managed.

The biggest risk is hidden damage like structural, electrical, or plumbing issues. A professional inspection is essential, not optional. For $300-$500, a certified inspector specializing in manufactured homes will check everything from the foundation to the HVAC system. Skipping this step could lead to thousands in unexpected repairs.

Title issues like liens or unpaid taxes can be a major problem. Protect yourself with a comprehensive title search and title insurance for both the home and land (typically $500-$1,500). This shields you from costly legal claims. Online guides for foreclosed mobile homes offer more detail on these legal steps.

Foundation problems deserve special attention because a manufactured home’s stability depends entirely on proper installation. Your inspector should scrutinize the foundation to ensure it meets local codes. Poor installation can lead to structural issues that cascade through the entire home.

Zoning restrictions can limit property use. Before making an offer, contact your local planning department to verify what’s allowed on the property to avoid disappointment.

Rural properties may have utility challenges like wells and septic systems, which should be inspected. Also, verify legal, year-round road access, as some rural roads aren’t maintained in winter.

Financing can be trickier than traditional homes, especially for older manufactured homes or those needing repairs. This is where working with specialists makes all the difference. They have built relationships with lenders who understand these unique properties and know how to make deals work.

Insurance for manufactured homes operates differently than for site-built houses. Shop around with multiple providers and be clear about your home’s age, type, and location. Expect to pay $600-$1,200 annually, which is actually quite reasonable for full coverage.

How to Find Repo Mobile Homes with Land for Sale in My Specific Area

Now comes the treasure hunt! Finding repo mobile homes in my area requires casting a wide net, and we’ll show you exactly where to look.

Start with local manufactured housing specialists. They often maintain current inventories of affordable manufactured, modular, and tiny homes, including bank repos. Their teams often know about opportunities before they hit public listings. Many are committed to offering competitive prices with selections from top manufacturers.

Building relationships with local manufactured housing specialists pays off tremendously. These professionals have their ears to the ground and often hear about repossessions before the general public. They understand the local market and can guide you toward the best opportunities.

Online resources open up a world of possibilities. Check the REO (Real Estate Owned) or foreclosure sections on major bank websites—lenders list their repossessed properties there. Government agencies like HUD, the VA, and Fannie Mae/Freddie Mac all maintain searchable databases of foreclosed properties. Specialized manufactured housing marketplaces aggregate listings from multiple sources, making your search more efficient. You can explore resources for manufactured homes to find additional helpful tools. Guides on bank repo manufactured homes can provide more specific search strategies.

Don’t overlook offline methods. County courthouse records are public and reveal recent repossessions and upcoming auctions. This requires some legwork, but you might find opportunities before they’re widely advertised. Sometimes the simplest approach works best—drive through areas with manufactured homes or rural properties and watch for “For Sale” signs on repos that haven’t hit the broader market yet.

Networking opens doors too. Talk with local real estate investors, property managers, and mobile home park owners. They often know about properties or sellers looking to move quickly. In many areas, opportunities range from affordable starter homes to larger properties with significant acreage, often with flexible financing options.

Financing Your Repo Mobile Home Purchase

Financing a repo mobile home can seem complex, as traditional lenders may hesitate. However, specialized financing options are readily available and often more flexible than you’d expect.

FHA Title I loans are government-backed and designed specifically for manufactured homes. They can cover both the home and land with competitive interest rates and down payments as low as 3.5%. The catch? Your home needs to meet FHA standards, but most repos in decent condition qualify.

Chattel loans finance the manufactured home itself, treating it similarly to a vehicle loan with the home as collateral. These typically carry higher interest rates and shorter terms (15-20 years) than traditional mortgages, but they’re accessible and commonly used for manufactured homes.

When you’re buying a manufactured home with land, land-home combo loans often provide the best terms. These combine financing for both property and structure into a single mortgage, offering lower interest rates than chattel loans and terms extending up to 30 years. Your monthly payments become much more manageable.

For eligible buyers, VA loans (for veterans) and USDA Rural Development loans (for designated rural areas) offer remarkable benefits, including up to 100% financing with no down payment required. A specialist can help clients determine their eligibility for these powerful programs.

Sometimes the lender selling the repo property offers direct financing, creating a flexible option especially for buyers who might not qualify for traditional loans. Terms are negotiated directly, which can work beautifully for both parties.

Here’s something exciting: financing for repo mobile homes with land can include up to 100% LTV (Loan-to-Value) financing on primary residences for qualified buyers. This means potentially financing the entire purchase price and keeping your cash for repairs or improvements.

Many manufactured housing specialists offer financing options for various credit types. They understand that credit scores fluctuate. Some may even offer programs to help you improve your score to secure the best possible terms. It’s worth inquiring about these services when you contact them.

The Purchase Process: From Inspection to Closing

Buying repo mobile homes in my area follows a slightly different path than traditional home purchases, but a good specialist will walk beside you through every step. Expect the closing timeline to take 6-8 weeks for properties with land—a bit longer than home-only deals because of the additional complexities with land titles and surveys, but absolutely worth the wait.

Start by getting pre-approved for financing before you seriously shop. This tells you exactly what you can afford and makes your offer much more attractive to sellers. When you find the perfect property, it’s time to make an offer. Lenders are motivated sellers, so there’s often room for negotiation on price.

Always include contingencies in your offer for inspection, appraisal, and financing. These protect you—if any condition isn’t met, you can walk away without losing your earnest money. Think of contingencies as your safety net.

The specialized inspection is your most important protection. Hire a professional who knows manufactured homes inside and out. This $300-$500 investment examines the home’s structure, systems, foundation, and potential problems. Never, ever skip this step.

Your lender requires an appraisal to determine the property’s fair market value. For manufactured homes with land, this needs an appraiser experienced with these unique properties. Not all appraisers understand how to properly value manufactured housing.

Title work verifies both the home’s title and the land’s title. A title company searches for liens, encumbrances, or ownership disputes. This is where title insurance proves invaluable. You’ll also confirm zoning compliance, utility access, and other relevant property details during this phase.

Before closing, conduct a final walk-through. Verify the property matches the agreed-upon condition and no new damage has occurred. This is your last chance to catch any issues before ownership transfers.

Finally comes closing, where all documents are signed, funds transfer, and ownership officially becomes yours. For properties with land, this typically happens with a title company or attorney. The extra paperwork and time for a repo with land delivers long-term benefits that make the process worthwhile. For more details about what to expect, you can find guides online about purchasing bank repo manufactured homes.

Budgeting for Your Purchase: Costs Beyond the Price Tag

The low purchase price of repo mobile homes in my area is undeniably attractive, but smart budgeting means looking at the complete financial picture. Planning for all associated costs prevents surprises and keeps your path to homeownership smooth.

Closing costs are the fees for finalizing your loan and property transfer, typically running 3-6% of the loan amount. This includes loan origination fees, appraisal fees, title search fees, attorney fees, and recording fees. Sometimes sellers offer concessions covering part or all of these costs, so it never hurts to ask.

Your specialized manufactured home inspection runs around $300-$500, and as we’ve emphasized, this money is incredibly well spent. If you’re buying land, lenders often require a survey to verify property lines and identify encroachments. Surveys cost $400-$1,000 depending on property size and complexity.

Title insurance protecting your ownership against future claims typically costs $500-$1,500 for both home and land titles. Your lender requires full coverage homeowner’s insurance with them listed as loss payee, which runs $600-$1,200 annually for manufactured properties. Budget for the first year’s premium upfront.

Since repo homes sell “as-is,” set aside funds for immediate repairs or desired improvements. Based on industry experience, initial repairs for repo mobile homes with land typically range from 5-15% of the purchase price. Your inspection report guides this budgeting, showing you exactly what needs attention.

Don’t forget annual property taxes for both home and land—these vary significantly by location. Utility hook-ups or deposits might be needed if services need connecting or transferring to your name. If the home requires moving to your land, factor in transportation and setup costs.

By accounting for these elements upfront, you’ll have a realistic budget and be fully prepared for your repo mobile home purchase. Local buying guides can offer additional insights into smart budgeting for manufactured homes.

Take the Next Step Towards Your Dream Home

You’ve reached the end of our guide, showing your commitment to homeownership. Searching for repo mobile homes in my area is about more than a bargain—it’s about building a foundation for your future, creating wealth, and owning a place that’s truly yours.

To recap: this opportunity offers savings of 20-40% below market value for immediate equity. By owning your land, you eliminate monthly lot rent and invest in an appreciating asset, building real wealth for your family.

Yes, the process requires due diligence. Inspections, title searches, and specialized financing are your safety net, turning a potential gamble into a smart investment. You don’t have to do it alone.

Manufactured housing specialists help families like yours achieve homeownership. Their teams understand repo mobile homes, often offering a large selection from top manufacturers at competitive prices. Many have financing solutions for various credit types and may offer programs to help you qualify for the best terms.

Local specialists can guide you through every step, from inspection to getting your keys. They have often helped countless families achieve affordable homeownership.

The path to owning your home is clearer than you might think. It starts with taking that first step and reaching out to a specialist to see what’s possible. Your dream home might be waiting in an inventory right now.

Ready to find your affordable dream home? Reach out to a local manufactured housing expert to explore their inventory of repossessed mobile homes and let them guide you through the process.