Finding Your Affordable Dream Home: The Repo Double Wide Advantage

When the dream of homeownership feels out of reach, repossessed double wide mobile homes can bridge the gap between wishful thinking and reality. These spacious manufactured homes offer a practical solution for families seeking comfort, space, and affordability all wrapped into one package. If youre completely new to factory-built housing, you can start with this concise overview of manufactured housing on Wikipedia.

What exactly are these homes? Simply put, they’re manufactured housing units that lenders have reclaimed after previous owners couldn’t keep up with their payments. The silver lining in this situation is that these homes typically hit the market at 20-40% below their actual value creating a golden opportunity for you to save thousands.

Most repossessed double wide mobile homes offer generous living spaces ranging from 1,300 to 2,300 square feet. With 3-4 bedrooms and multiple bathrooms, these homes provide ample room for growing families or those who simply appreciate having extra space. Modern amenities come standard in many models, giving you comfort without the premium price tag.

Here’s what the typical repo double wide looks like by the numbers:

| Feature | Details |

|---|---|

| Price Range | $39,900 to $129,342 (20-40% below market value) |

| Typical Size | 1,300 to 2,300 square feet |

| Financing Options | FHA (580+ credit score), Conventional (620+ credit score), Up to 100% LTV |

| Where to Find Them | Bank websites, REO listings, Mobile home dealers, Online directories |

| Buying Process | 4-6 weeks (home only), 6-8 weeks (with land) |

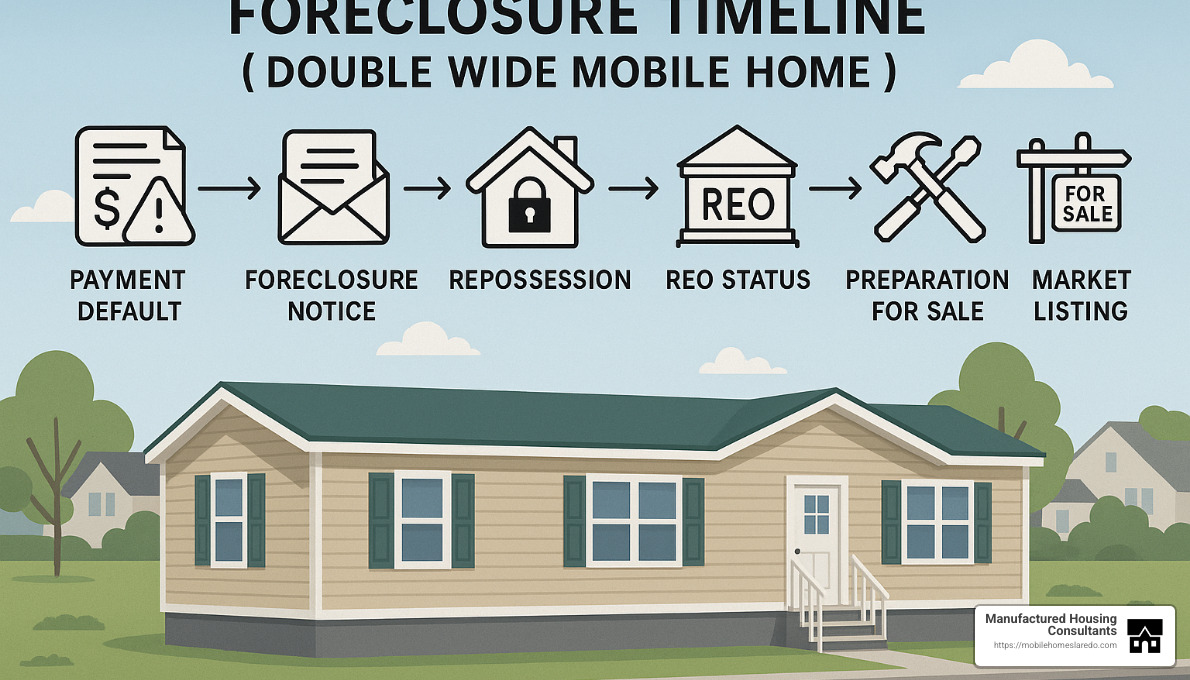

The journey of these homes to the market is straightforward. When payments stop, lenders step in and repossess the unit, classifying it as Real Estate Owned (REO) property. Banks aren’t in the housing business they want to recover their investment quickly, which creates an opportunity for you to secure substantial savings.

One advantage of buying a repo double wide is that the steepest depreciation has already occurred. Unlike new units that lose value the moment they leave the lot, these homes have weathered the initial depreciation storm. With proper maintenance and good location, they can actually build equity over time.

If you’re considering this path to homeownership, you’ll need to act decisively. The Texas market alone currently features over 160 repossessed mobile homes, with double wides making up a significant portion of this inventory. These homes rarely stay available for long the combination of space and savings makes them highly sought after.

Ready to explore foreclosure mobile homes for sale? The path to affordable homeownership might be closer than you think. With the right guidance and a bit of patience, your family could soon be enjoying the comfort and security of your own spacious home without the financial strain of traditional housing options.

Repossessed Double Wide Mobile Homes 101

Ever wondered what happens to mobile homes when payments stop? Repossessed double wide mobile homes are manufactured housing units that lenders have reclaimed after owners couldn’t keep up with their payments. Once the foreclosure process wraps up, these homes become what industry folks call “Real Estate Owned” or REO properties.

Double wides are pretty spacious homes, manufactured in two separate sections that get joined together at your chosen location. They typically offer between 1,300 to 2,300+ square feet of living space—plenty of room for families looking for affordable housing without feeling cramped.

The real magic of repo double wides lies in their price tag. These homes typically sell for 20-40% below current market value. Imagine finding a home that would cost $80,000 new, but you can snag it for somewhere between $48,000-$64,000 instead. That’s the kind of savings that can make homeownership possible when it seemed out of reach.

| Comparison | New Double Wide | Repossessed Double Wide |

|---|---|---|

| Average Price | $80,000-$150,000 | $39,900-$129,342 |

| Depreciation | Immediate 20-30% | Already experienced |

| Financing Rate | 5.2%-5.5% | 5.4%-5.5% |

| Down Payment | 5-20% | Often lower, sometimes 0% |

| Closing Timeline | 30-45 days | 4-8 weeks |

| Condition | New | Variable, “as-is” |

Here at Manufactured Housing Consultants, we’ve seen countless Texas families achieve their homeownership dreams through repossessed double wide mobile homes. These homes give you substantial living space at a fraction of what you’d pay for traditional housing.

How Do Repossessed Double Wide Mobile Homes Hit the Market?

The journey from someone’s home to a repo listing follows a pretty predictable path. When a homeowner misses several payments (usually 3-6 months’ worth), the lender starts the foreclosure process by sending formal notices. After completing the legal steps to reclaim the home, the lender takes ownership, and the property gets that “REO” designation.

At this point, the lender has one goal: recover as much of their money as possible. They might make minimal repairs or just sell it “as-is” to move it quickly. Then it’s listed through various channels—sometimes directly through the lender, at auctions, or through partnered dealers like us.

This whole process typically takes between 30-90 days, though Texas tends to move particularly quickly due to our high demand for affordable housing. We’ve seen homes go from foreclosure to listing in just a few weeks when lenders are motivated.

Many banks and financing companies (like 21st Mortgage) partner with local dealers like Manufactured Housing Consultants to handle the inspection, refurbishment, and sales process. This partnership is actually great for you as a buyer because it means someone has usually checked the home for major issues before it hits the market.

Advantages of Repossessed Double Wide Mobile Homes

The biggest draw of a repossessed double wide mobile home is obviously the price. When you’re saving 20-40% off market value, that’s serious money staying in your pocket. On a $100,000 home, we’re talking about $20,000-$40,000 in savings—enough to pay for setup, land improvements, and still have money left over.

You’ll also find you have more negotiating power with banks than with private sellers. As one of our customers recently told us with a laugh, “The bank didn’t want to be in the housing business—they just wanted their money back!” This motivation means you can often negotiate favorable terms beyond just the purchase price.

The closing process tends to move faster too. While a traditional home purchase might drag on, repo homes typically close in 4-6 weeks for home-only loans, or 6-8 weeks if you’re buying with land. Banks don’t like holding non-performing assets on their books.

For the investors among you, repo double wides can be gold mines. With some strategic renovations, these homes can be rented out for steady income or flipped for a tidy profit. One of our investor clients in Laredo has built a portfolio of five rental properties this way, all starting with repo purchases.

The variety of available models is impressive too. We’ve helped families find everything from basic 3-bedroom units to luxury models with stone fireplaces, garden tubs, and gourmet kitchens. And since these homes have already gone through their steepest depreciation period, you don’t have to worry about losing value the minute you sign the papers.

One of our favorite success stories is a family in Laredo who purchased a 2015 repossessed double wide for $54,900—a home that would have cost over $85,000 new. With their $30,100 in savings, they added a beautiful covered porch, upgraded all the appliances, and still came in under their original budget. Now that’s smart homebuying!

Risks & Hidden Costs of Buying Repossessed Units

While the savings are tempting, it’s important to go in with eyes wide open. Repossessed double wide mobile homes do come with some potential pitfalls you should know about.

Most repo homes sell in “as-is” condition, which means what you see is what you get—including any problems that might be lurking under the surface. This is why we always recommend setting aside about 10-15% of your purchase price as a repair budget. Common issues include roof leaks, plumbing problems, HVAC repairs, and cosmetic damage from the previous owner or the repossession process itself.

Transportation costs can sneak up on you if the home needs to be moved. Expect to pay $5-$10 per mile per section, which means a double wide moved 50 miles could cost $500-$1,000 just for transport. Then there’s setup costs—foundation work, utility connections, and joining the sections properly—which typically run another $5,000-$15,000.

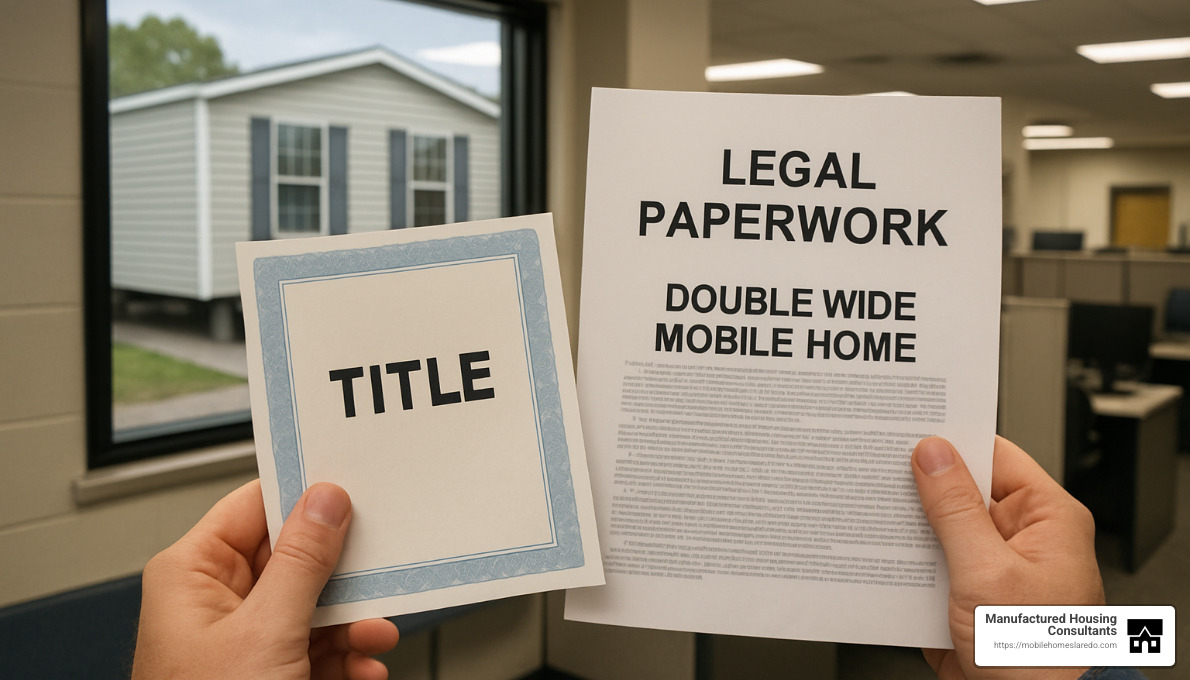

Title issues occasionally pop up with repo homes. Sometimes there are unresolved liens or paperwork problems that need cleaning up before you can take clear ownership. Always, always get a thorough title search before finalizing your purchase.

Older homes might need updates to meet current building codes, especially if you’re moving them to a new location. According to research from the Department of Housing and Urban Development, manufactured homes built after 1976 must comply with HUD Code standards, but local jurisdictions may have additional requirements. Insurance can be another challenge—some companies charge higher premiums for older manufactured homes or those with a repossession history.

Don’t forget about land considerations either. If you don’t already own property, you’ll need to factor in land purchase or lot rent. And establishing new utility connections can add another $1,000-$3,000 depending on your location’s infrastructure.

One of our Texas customers shared her experience: “I was initially drawn to the low price tag of $39,900 for my repo double wide, but quickly realized I needed another $8,000 for transportation, setup, and minor repairs. Even with these additional costs, I still saved about $25,000 compared to buying new.”

At Manufactured Housing Consultants, we believe in transparency about both the benefits and the challenges. We’ll help you understand the full picture so there are no unwelcome surprises after you’ve signed on the dotted line. With the right preparation and expectations, a repo double wide can be the affordable dream home you’ve been searching for.

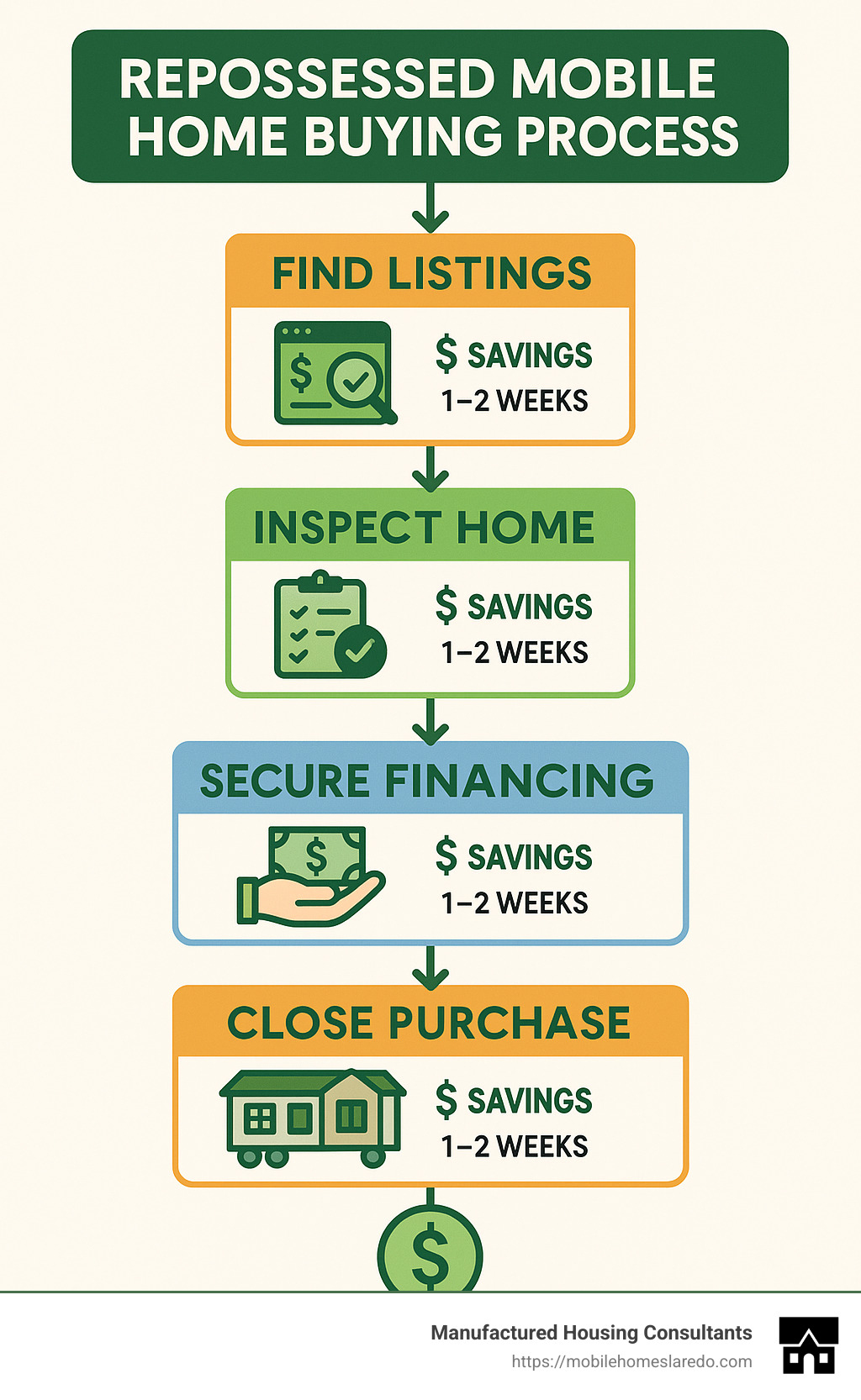

Step-by-Step Guide to Buying a Repo Double Wide

Finding your dream home doesn’t have to break the bank. Repossessed double wide mobile homes offer an affordable path to homeownership, but navigating the purchase process requires some know-how. Let me walk you through exactly how to find, evaluate, and purchase your perfect repo home.

When Sarah and Miguel came to us last month, they were frustrated after months of house hunting. “Everything in our price range needed major work,” Sarah told us. Then we showed them a beautiful repossessed double wide mobile home with three bedrooms, two baths, and a modern kitchen—all for $54,000. They couldn’t believe their luck!

The key to their success? Following a clear, strategic approach like this one:

First, establish a realistic budget that includes not just the purchase price, but potential repairs, transportation, and setup costs. Be honest with yourself about what you can truly afford.

Next, get pre-approved for financing before shopping. At Manufactured Housing Consultants, we help customers secure financing through our FICO Score Improvement Program, which opens doors even for those with less-than-perfect credit.

When you’re ready to start looking, cast a wide net. Search online directories, lender websites, and work with local dealers like us who often have access to homes that aren’t publicly listed. Create a shortlist based on your must-haves in size, location, and price range.

Never skip the inspection. I can’t stress this enough! A thorough, professional inspection can save you thousands in unexpected repairs. One client nearly purchased a repo home with hidden water damage that would have cost $8,000 to repair—money better kept in his pocket.

Before finalizing any purchase, verify there are no title issues or liens against the property. Make a competitive offer based on your research and the home’s condition, but be prepared to negotiate not just on price, but also on repair credits and closing costs.

Once your offer is accepted, finalize your financing, complete the closing paperwork, and arrange for transportation and setup if needed. Always conduct a final walkthrough before moving in to ensure everything is as expected.

Repossessed double wide mobile homes move quickly in today’s market. I’ve seen desirable units in Texas sell within 48 hours of listing. Being prepared to act swiftly can make all the difference between securing your dream home and watching someone else enjoy it.

Where to Find Listings & Evaluate Prices

Finding quality repossessed double wide mobile homes is like hunting for hidden treasure—you need to know where to look. The best sources include state inventory directories (Texas currently has over 160 repossessed mobile homes available), lender REO portals like 21st Mortgage, local dealers, online marketplaces, government agencies (HUD, VA, USDA), and occasionally auctions.

When James came to us looking for an affordable family home, he’d already spent weeks scrolling through general real estate sites with no luck. We showed him how to access specialized listings and within days, he’d found three potential homes that fit his needs perfectly.

Evaluating prices requires considering several factors. Age and condition significantly impact value—newer models (5-10 years old) in good condition typically cost more but offer better long-term value. Size and layout matter too; double wides range from 1,300 to over 2,300 square feet, with larger units offering more living space per dollar.

Don’t forget to consider the home’s current location, as this affects both price and potential moving costs. Research market comparisons by looking at similar models sold in your area. And pay attention to the manufacturer’s reputation—homes from respected builders like Clayton, Champion, or Fleetwood may command premium prices but often offer superior quality and durability.

At Manufactured Housing Consultants, we maintain relationships with multiple lenders and regularly update our inventory of available homes in Texas. This gives our customers access to units that aren’t widely advertised.

Just last month, we helped a young couple find a gorgeous 28×64 double wide (1,792 square feet) with 3 bedrooms and 2 baths for just $59,900—about 35% below its market value of $92,000. The home needed only minor cosmetic repairs and they moved in within three weeks of purchase.

For more detailed pricing information, check out our guide on Double Wide Manufactured Homes Prices.

Inspecting and Verifying Condition Before You Buy

The inspection might not be the most exciting part of buying a home, but it’s absolutely the most important—especially with repossessed double wide mobile homes that are typically sold “as-is.”

Maria learned this lesson the hard way when she almost purchased a repo home without a proper inspection. “It looked perfect during my quick walkthrough,” she told me. Thankfully, our professional inspector finded significant electrical issues that would have cost thousands to repair. Armed with this information, Maria negotiated a $5,000 price reduction and had the funds to make the repairs after closing.

A thorough inspection should always start with verifying the HUD data plate and certification labels are present and match the home’s documentation. These confirm the home was built to federal standards and are essential for financing and insurance.

Next, examine the structural integrity by checking the chassis, frame, and axles for rust or damage. Look for sagging in the roof or floors, and inspect the marriage line (where the two halves join) for proper alignment.

Pay special attention to the roof and ceiling, looking for water stains, sagging, or visible damage. Test all plumbing fixtures, checking for leaks and proper drainage. The electrical system deserves careful scrutiny—test all outlets and switches, check the panel for proper labeling, and look for any exposed wiring.

Don’t forget to test the HVAC system, verify all windows and doors operate properly, and check flooring for soft spots that might indicate subfloor damage. Inspect for signs of pests, mold, or wood rot, especially around bathrooms, kitchens, and windows.

While you can certainly perform a preliminary inspection yourself, I strongly recommend hiring a professional inspector who specializes in manufactured housing. These experts understand the unique construction methods used in mobile homes and can spot issues that might escape the untrained eye.

At Manufactured Housing Consultants, we offer free site inspections for our customers and can arrange professional inspections of any repossessed double wide mobile home you’re considering. This service has saved many clients from purchasing homes with hidden problems that would have turned their dream into a nightmare.

For more detailed guidance on the inspection process, visit our comprehensive guide on Buying Used Mobile Homes.

Financing Options for Repossessed Double Wide Mobile Homes

Finding the right financing for your repossessed double wide mobile home can feel overwhelming, but I promise there are great options available for almost every situation.

Take Carlos, for example. With a credit score of 605 and minimal savings for a down payment, he was worried he’d never qualify for a home loan. We connected him with an FHA lender who approved him for a Title I loan with just 3.5% down. Six weeks later, he moved his family into their beautiful repo double wide, with monthly payments $350 less than their previous rent.

FHA loans are fantastic options for many buyers, with credit score requirements as low as 580, down payments as low as 3.5%, terms up to 30 years, and current rates around 5.4%. These loans can finance both the home and land, making them versatile choices for different situations.

Conventional loans typically require slightly higher credit scores (usually 620+) and down payments between 5-20%. With terms up to 30 years and fixed rates around 5.5%, they’re good options for both land-home packages and home-only purchases.

If you’re a veteran, VA loans offer some of the best terms available, with credit score requirements around 640 and the possibility of financing up to 100% of the purchase price at competitive rates around 4.5%. The main requirement is that the home must be permanently affixed to a foundation.

For rural properties, USDA loans are worth exploring. With minimum credit scores around 640, the possibility of 100% financing, and impressively low rates around 2.8%, they’re excellent options if your property is in an eligible rural area.

Chattel loans (for home-only purchases) typically come with higher interest rates (7-12%) and shorter terms (15-20 years), but they offer a quicker closing process. These are commonly used when you don’t own the land or are placing the home in a community.

Some dealers, including Manufactured Housing Consultants, offer seller financing options that can be more flexible with credit requirements, though terms vary widely and may require larger down payments.

One of the most attractive aspects of financing repossessed double wide mobile homes is the potential for 100% loan-to-value ratios on primary residences. This means qualified buyers might finance the entire purchase without a down payment. Additionally, closing costs can often be rolled into the loan or covered by seller concessions.

At Manufactured Housing Consultants, we specialize in helping buyers with all credit types find financing solutions through our network of lenders and our FICO Score Improvement Program. We’ve helped customers with credit scores as low as 580 secure affordable financing for their dream homes.

For a step-by-step walkthrough of the application process, check out our Mobile Home Loan Application Step-by-Step Guide.

Navigating Legal & Title Issues

The legal aspects of purchasing a repossessed double wide mobile home might not be the most exciting part of your home-buying journey, but paying attention to these details can save you significant headaches down the road.

Just ask Roberto and Elena, who nearly lost their dream home due to an unfinded lien. Fortunately, our title search uncovered the issue before closing, and we worked with the lender to resolve it. “We would have been completely blindsided without your help,” Elena told us afterward. “Now we can enjoy our new home without worrying about someone showing up claiming ownership.”

Always start with a UCC (Uniform Commercial Code) search, as mobile homes are often titled as personal property rather than real estate. This search will reveal any liens or encumbrances against the home that might affect your ownership rights.

Verify that the lender has a clean title to transfer to you by requesting to see the original title or a title guarantee from the selling institution. If the home had previous liens, ensure that proper releases have been filed and recorded.

Many states require a habitability certificate for the resale of manufactured homes, which certifies that the home meets basic safety and living standards. Using an escrow service provides protection for both buyer and seller during the transaction process.

Research local requirements for recording the title transfer and, if applicable, converting the home to real property. Understanding the property tax implications of your purchase is also important, as these vary depending on whether the home is classified as personal property or real estate.

Before finalizing your purchase, verify that your intended location allows for manufactured housing and meets all local zoning requirements. Nothing is more heartbreaking than purchasing a home only to find you can’t place it where you planned.

A common issue with repossessed double wide mobile homes is missing documentation. If the HUD tags, data plate, or original title is missing, the process to replace these can be time-consuming and frustrating. Working with experienced professionals like our team at Manufactured Housing Consultants can help steer these challenges efficiently.

Recently, a client in Laredo faced a situation where their desired repo double wide had a missing title. Our team worked directly with the lender to obtain a duplicate title, saving the transaction and preventing potential legal complications down the road.

For more information about legal considerations when purchasing foreclosed homes, visit our comprehensive guide on Foreclosure Mobile Homes for Sale.

Negotiation and Closing Tips

Negotiating the purchase of a repossessed double wide mobile home is where you can really shine as a savvy buyer. With the right approach, you might save thousands beyond the already-discounted price.

Before making any offer, do your homework by researching comparable sales in the area. This knowledge gives you confidence in negotiating and helps establish what constitutes a fair price. When you spot needed repairs or improvements, don’t be shy about using these as negotiation points. Getting professional estimates for these repairs strengthens your position considerably.

Rather than asking the lender to make repairs (which they rarely will), negotiate for price reductions or credits at closing to cover these costs. Many lenders will also agree to pay certain closing costs as part of the deal, including title work, appraisal fees, or other expenses.

If you qualify, ask about 100% financing options that allow you to purchase with minimal out-of-pocket expenses. This approach helped the Garcia family purchase their repo double wide with just $1,200 in closing costs, preserving their savings for moving expenses and new furniture.

The market for quality repo homes moves quickly. Having your financing pre-approved and paperwork ready gives you a significant advantage over less-prepared buyers. When you find the right home, be prepared to act decisively.

While everyone loves a bargain, starting too low might result in losing the home to another buyer. Make your initial offer reasonable based on the home’s condition and market value. Always get everything in writing—ensure all agreements, including any repairs or credits, are documented in the purchase agreement.

Understand the typical closing timeline: 4-6 weeks for home-only purchases and 6-8 weeks for land-home packages. Plan accordingly, especially if you need to coordinate moving out of a rental property.

Before signing closing documents, review everything thoroughly and ask questions about any terms you don’t understand. This isn’t the time to be shy—you’re making a significant investment and deserve complete clarity.

At Manufactured Housing Consultants, we’ve helped hundreds of customers steer these negotiations successfully. One recent success story involved a family who purchased a 2011 28×48 Southern Energy double wide listed at $64,900. By identifying several needed repairs and leveraging our relationship with the lender, we helped them secure the home for $59,900 with $2,000 in seller concessions toward closing costs—a total savings of $7,000!

For more information about creative financing approaches, check out our guide on How to Buy a Mobile Home with No Money Down.

Conclusion & Your Next Move

Purchasing a repossessed double wide mobile home represents an outstanding opportunity to achieve affordable homeownership without sacrificing space or quality. These homes offer significant savings—typically 20-40% below market value—while providing the space and comfort families need.

To recap the key points from our guide:

-

Repossessed double wide mobile homes offer substantial savings compared to new units, with prices ranging from $39,900 to $129,342 depending on size, age, and condition.

-

The buying process involves several crucial steps: finding listings, inspecting the home thoroughly, securing appropriate financing, verifying legal and title status, and negotiating favorable terms.

-

While the potential savings are significant, buyers should be aware of the “as-is” nature of most repo homes and budget for potential repairs, transportation, and setup costs.

-

Financing options are plentiful, including FHA loans (minimum 580 credit score), conventional loans (minimum 620 credit score), and specialized manufactured home loans with up to 100% LTV for qualified buyers.

-

The market moves quickly, with desirable units often selling within days of listing. Being prepared to act swiftly can make the difference between securing a great deal and missing out.

At Manufactured Housing Consultants, we specialize in helping Texas families find and purchase quality repossessed double wide mobile homes. Our guaranteed lowest prices, specialized financing options, and FICO Score Improvement Program make us uniquely positioned to guide you through this process.

Whether you’re a first-time homebuyer, looking to downsize, or interested in an investment property, we invite you to explore the opportunities that repo double wides offer. Our team in Laredo is ready to help you find the perfect home to meet your needs and budget.

Ready to take the next step? Visit our dedicated page on bank repos or contact us today to begin your journey toward affordable homeownership through a repossessed double wide mobile home.

With proper research, careful inspection, and expert guidance, a repo double wide can be much more than just an affordable housing option—it can truly become your “Home Sweet Home.”