Why Texas Mobile Home Loans Make Homeownership Possible

Texas mobile home loans offer an affordable path to homeownership. Because manufactured homes are typically less expensive than site-built homes, they are a popular choice for many Texans. With the right guidance, you can steer the financing process even with imperfect credit.

Quick Answer: Types of Texas Mobile Home Loans

- Chattel Loans – For homes not permanently attached to land (5-20% down, higher rates)

- Real Property Loans – For homes titled with land (3.5-20% down, better rates)

- FHA Loans – Government-backed, as low as 3.5% down (580+ credit score)

- VA Loans – For veterans, 0% down payment possible

- Conventional Loans – Traditional mortgages (5-20% down, 620+ credit score)

Interest rates: 7-12% | Loan terms: 15-30 years | Min credit score: 550-660+

The biggest challenge for buyers is understanding that where your home sits dramatically affects your loan options, interest rates, and down payment. Financing a home in a park is very different from financing one on land you own.

Texas residents have access to various financing sources, including banks, credit unions, and specialized lenders. To ensure quality, the Texas Department of Housing and Community Affairs (TDHCA) supervises manufacturers and installers. This guide will walk you through the steps of securing a loan for your Texas mobile home.

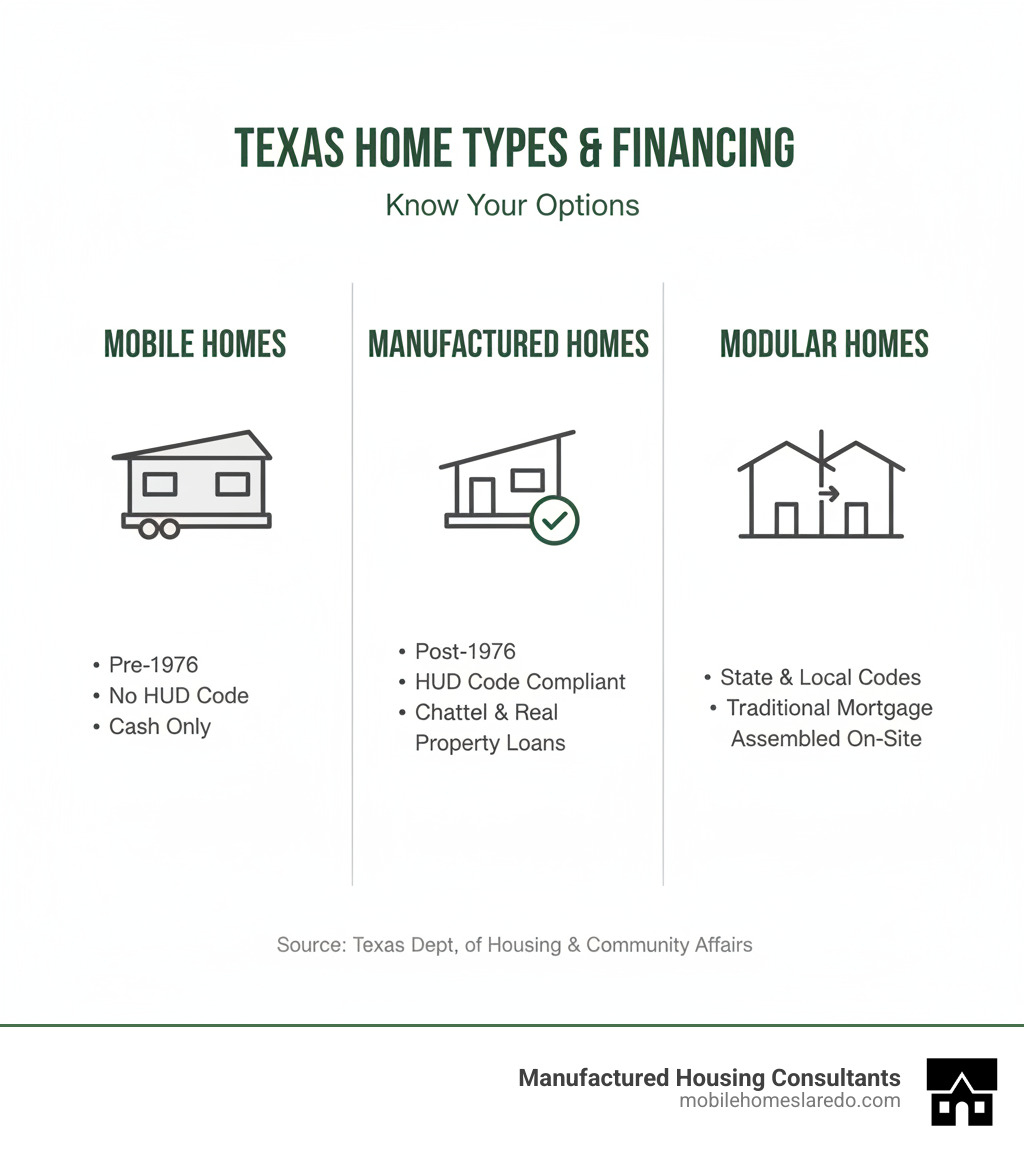

Understanding Texas Mobile Home Loans

Financing a manufactured home is different from a traditional house. The biggest factor is whether the home is considered personal property (like a car) or real estate (a house on a foundation). This distinction determines your financing options. While banks and credit unions offer some loans, specialized lenders understand the nuances of manufactured housing and offer more flexibility, especially for homes in parks or buyers with challenging credit.

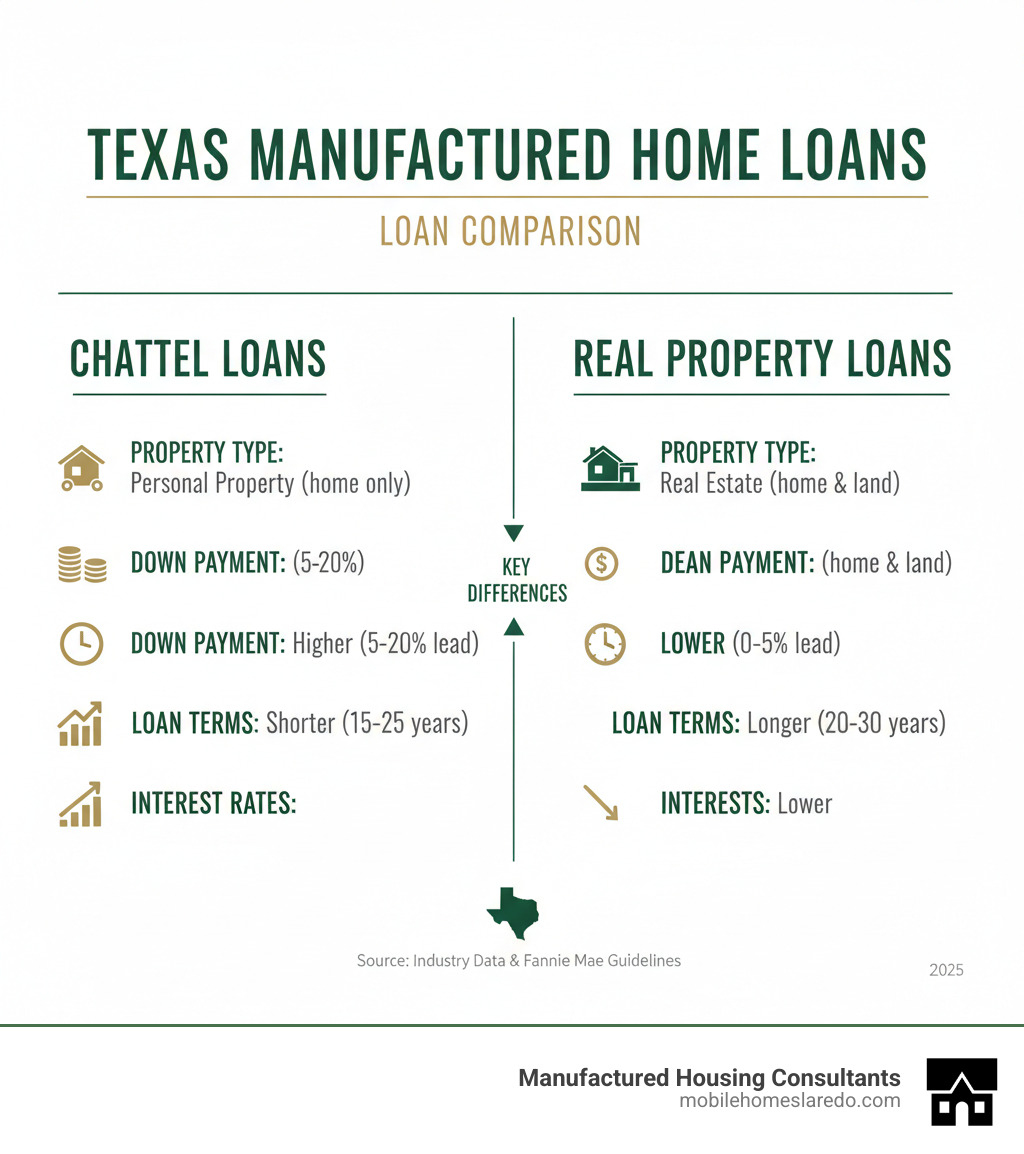

Key Loan Types: Chattel vs. Real Property

Understanding the two main types of Texas mobile home loans is crucial, as it affects your interest rate, down payment, and loan terms.

Chattel Loans (Personal Property)

A chattel loan finances the home itself, not the land. This is the loan type for homes in a mobile home park or on leased land.

- Down Payment: 5% to 20%

- Loan Term: 15 to 25 years

- Interest Rates: Typically higher than real property loans

These loans are common and sometimes preferred for their faster processing. For more details, you can learn about chattel mortgages.

Real Property Loans (Real Estate)

A real property loan is a traditional mortgage available when the manufactured home is permanently attached to land you own, and both are titled together as real estate.

- Down Payment: As low as 0% (VA), 3.5% (FHA), or 5%+ (Conventional)

- Loan Term: Up to 30 years

- Interest Rates: Generally lower, as the land provides extra security

These loans open the door to government-backed programs like FHA, VA, and USDA. Fannie Mae has specific guidelines on titling. For a broader look, see our guide on mobile home mortgage financing.

Eligibility and Home Requirements

To qualify for Texas mobile home loans, both you and the home must meet certain criteria.

Borrower Requirements:

- Credit Score: Most lenders look for a minimum score of 580-620. A score of 660+ will secure better rates, and 740+ is considered excellent. Options exist for those with lower scores, and you can explore FHA loans for bad credit.

- Down Payment: This varies by loan. Chattel loans require 5-20%, FHA loans need as little as 3.5%, and VA or USDA loans may require 0% down for eligible borrowers.

Home Requirements:

- Age: The home must be built after June 15, 1976, to meet HUD Code standards.

- Foundation: For real property loans, the home must be on a permanent foundation.

- Setup: The tow hitch, wheels, and axles must be removed, and the home must be permanently connected to utilities.

- Size & Condition: The home must be in good condition and meet minimum size requirements (often 400+ sq. ft.). Double-wides are more easily financed than single-wides.

Interest Rates, Terms, and Documentation

Here’s a quick look at the numbers and paperwork involved in Texas mobile home loans.

- Interest Rates: Typically range from 7.4% to 12%, depending on your credit score, loan type, down payment, and the home’s age and type.

- Loan Terms: Chattel loans usually have terms up to 25 years, while real property loans can extend to 30 years.

- Required Documents: Be prepared to provide proof of income (pay stubs, W-2s), asset verification (bank statements), a valid photo ID, and information about the home.

The loan process generally follows these steps: gather documents, get pre-approved, select your home, submit a formal application, complete the appraisal/inspection, and close the loan. The entire process in Texas can take just two to three weeks. For a detailed walkthrough, see our mobile home loan application step-by-step guide.

Special Programs and Scenarios

Beyond standard loans, several programs address specific needs.

- Homes in Parks or on Leased Land: These situations typically require a home-only chattel loan.

- Veterans Programs: The Texas Veterans Land Board (VLB) and VA loans offer excellent benefits, including 0% down payment options for eligible veterans. Learn more about VA loans and manufactured homes.

- First-Time Buyers & Credit Challenges: FHA mortgages for manufactured homes offer low down payments and flexible credit requirements. USDA loans provide 100% financing in eligible rural areas.

- Refinancing: If you already own a manufactured home, refinancing can lower your monthly payment, change your loan term, or allow you to take cash out of your home’s equity.

Finding the Right Lender and Getting Started

Choosing the right lender for your Texas mobile home loan is a critical step. Not all lenders are created equal, and your choice can mean the difference between a smooth process and a frustrating one.

Specialized Lenders vs. Traditional Banks

While your local bank may seem like the obvious choice, they often lack experience with manufactured home financing. Specialized lenders, on the other hand, live and breathe this industry.

Why Specialized Lenders Have the Edge:

- Niche Expertise: They understand HUD Code requirements and the difference between chattel and real property loans.

- Flexible Options: They have programs for homes in parks, older models, and buyers with less-than-perfect credit.

- Faster Processing: Their familiarity with the process leads to quicker closings, often weeks faster than a traditional bank.

Traditional banks often have stricter criteria and may decline manufactured home loans altogether. For a smoother experience, a specialized lender is typically the better partner to help you finance your mobile home.

Your Next Steps to Securing a Texas Mobile Home Loan

Now it’s time to turn knowledge into action. The path to homeownership is straightforward.

1. Get Pre-Approved: This is the most important first step. Pre-approval tells you what you can afford and shows sellers you are a serious buyer. The process is quick and gives you confidence in your home search.

2. Choose Your Home: With a pre-approval in hand, you can shop for a home that fits your budget and meets loan requirements. Many dealers offer a large selection from top manufacturers to ensure you find the perfect fit.

3. Finalize Your Loan: After selecting a home, you’ll complete a formal application, an appraisal will be conducted, and then you’ll move to closing. In Texas, this process can take as little as 2-3 weeks.

Finding a Good Partner

A good lending partner makes homeownership accessible by offering specialized financing for all credit types and programs like a FICO Score Improvement Program to help you qualify for better terms. Look for dealers who guarantee competitive prices on quality homes from top manufacturers and have a knowledgeable team to guide you. For more details, review a mobile home loan application step-by-step guide.

Ready to Begin?

The dream of homeownership is closer than you think. Don’t let financing concerns hold you back. Whether you’re looking for a new model or an affordable used home, help is available.