Your Path to Affordable Homeownership: VA Loans for Manufactured Homes

When the dream of homeownership seems out of reach, VA loans and manufactured homes can create a practical pathway for our veterans and service members. With traditional housing prices climbing faster than many can keep up with, manufactured homes offer a breath of fresh air – literally costing about half as much per square foot as their site-built counterparts.

Here in Texas, we’ve seen countless families like Maria’s find this affordable housing solution. The average manufactured home in 2022 came in around $125,200 – a welcome relief compared to conventional construction prices that continue to skyrocket while housing inventory remains frustratingly low.

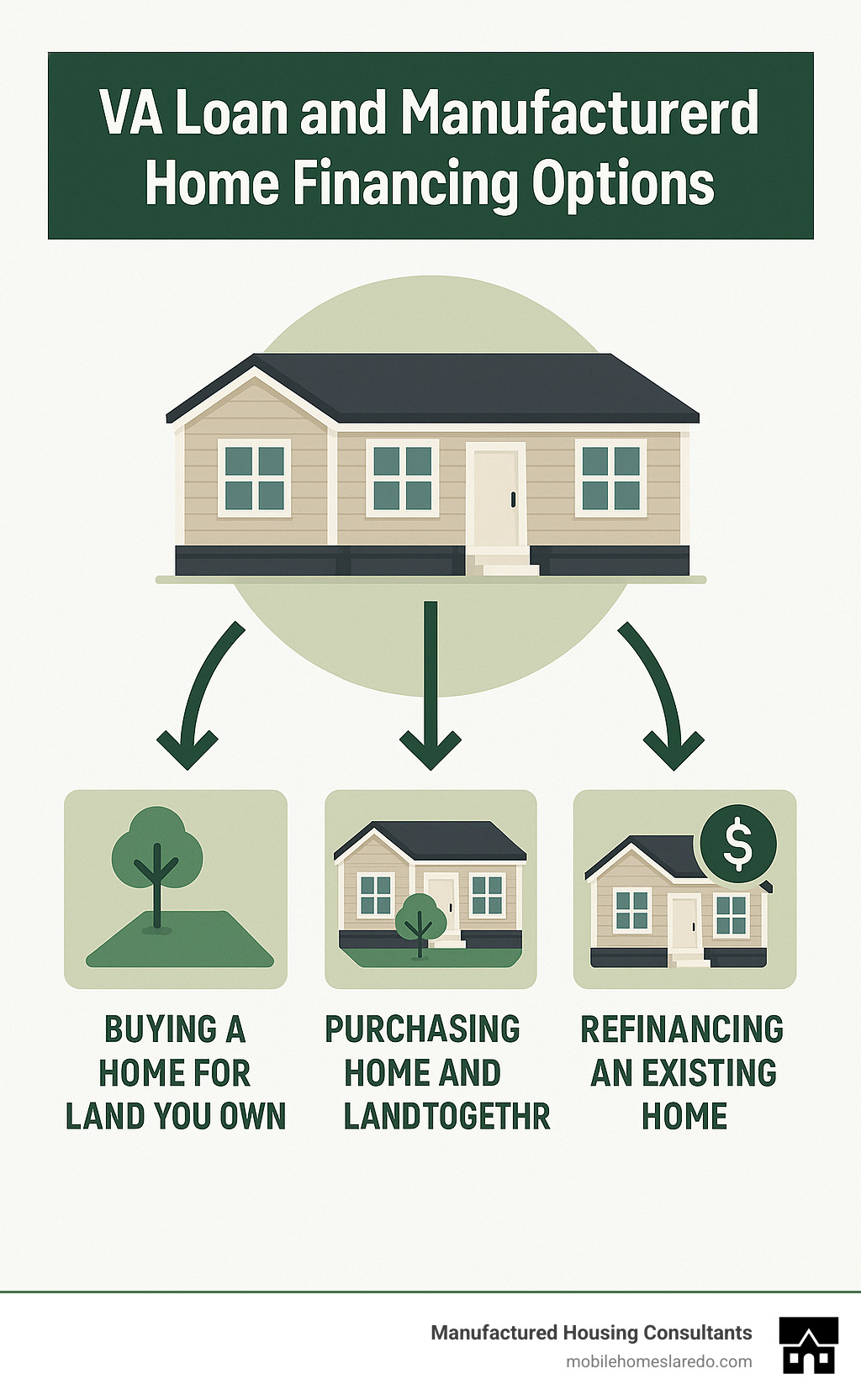

For those who’ve served our country, the VA loan program isn’t just another financing option – it’s a well-earned benefit that can truly change lives. These government-backed mortgages allow eligible veterans, active-duty service members, and surviving spouses to purchase qualifying manufactured homes with terms you simply won’t find with conventional financing.

| Quick Facts: VA Loans for Manufactured Homes | Details |

|---|---|

| Eligibility | Veterans, active-duty service members, and eligible surviving spouses |

| Down Payment | Often 0% (though some lenders require 5% for manufactured homes) |

| Property Requirements | Must be on permanent foundation, classified as real property, HUD-compliant |

| Minimum Size | Single-wide: 400 sq ft; Double-wide: 700 sq ft |

| Maximum Loan Terms | Single-wide: 20 years, 32 days; Double-wide: 23 years, 32 days; With land: 25 years, 32 days |

Why are more veterans considering this option? Today’s manufactured homes (built after June 15, 1976, when HUD standards went into effect) might surprise you. They offer modern designs, impressive energy efficiency, and customization options that rival traditional homes – all while being significantly more affordable.

Before you get too excited though, it’s important to understand that not all manufactured homes qualify for VA loans. Your home must be permanently affixed to a foundation, classified as real property (not personal property), and meet specific size requirements. Getting these details right from the start will save you headaches down the road.

Here at Manufactured Housing Consultants, we’ve helped countless Texas veterans steer this process. With our guaranteed lowest prices and selection from 11 top manufacturers, we’re proud to help those who’ve served our country find affordable, quality homes they can be proud of.

VA Loan and Manufactured Homes: Definitions, Property Criteria & Loan Terms

Before you start dreaming about your new home, let’s clear up what actually qualifies as a manufactured home under VA loan guidelines. Trust me – understanding these differences now will save you headaches later!

A manufactured home that’s eligible for VA loan financing must check several important boxes:

- Built after June 15, 1976, following HUD code standards

- Display a HUD tag (metal plate) on the exterior

- Include a data plate inside (usually tucked away in a kitchen cabinet, closet, or utility area)

- Be permanently attached to a foundation that meets both VA and local building codes

- Be legally classified as real property (not personal property)

- Meet minimum size requirements

- Have proper utilities and access

“The distinction between manufactured, mobile, and modular homes isn’t just semantics—it directly impacts your financing options,” explains Carlos Mendez, housing specialist at Manufactured Housing Consultants. “Veterans seeking VA loans need to understand these differences before shopping for a home.”

Property Checklist: VA loan and manufactured homes requirements

Let’s get specific about what the VA is looking for when you want to finance a manufactured home:

When it comes to size, the VA has minimum requirements to ensure comfortable living. Single-wide homes must have at least 400 square feet of living space, while double-wide homes need at least 700 square feet. This helps ensure you’re getting a home that meets basic living standards.

The foundation is perhaps the most critical element. Your manufactured home must sit on a permanent foundation that meets both VA standards and local building codes. This often requires an engineer’s certification. All transportation equipment – wheels, axles, and hitches – must be removed, and the foundation needs to be designed for your local weather conditions.

Your home also needs to be legally classified as real property (like traditional homes), not personal property (like vehicles). This involves proper title conversion and filing an affidavit of affixture with your county records office.

Age matters too! The home must be built after June 15, 1976, when HUD standards took effect. It needs to have the HUD certification label (tag) on the exterior and the data plate inside. The property also needs to meet all VA Minimum Property Requirements (MPRs) for safety and livability.

Regarding land, you must either own the land where the home sits or be purchasing it together with the home. Leased land situations rarely qualify unless the lease meets specific VA requirements. Finally, everything must comply with local zoning laws, with all proper permits in place.

According to the VA Home Loan Property Requirements, these standards ensure your new home will provide “safe, sanitary, and structurally sound living conditions” for years to come.

Dollars & Dates: Loan Amounts, Terms, Funding Fee

When it comes to financing terms, VA loans for manufactured homes work a bit differently than those for traditional homes:

The loan terms are generally shorter for manufactured homes, reflecting their typically faster depreciation rate. For a single-wide home, you’re looking at a maximum term of 20 years and 32 days. Double-wide homes can be financed for up to 23 years and 32 days, or 25 years and 32 days if you’re also purchasing the land. If you’re just buying a lot for a manufactured home you already own, the maximum term is 15 years and 32 days.

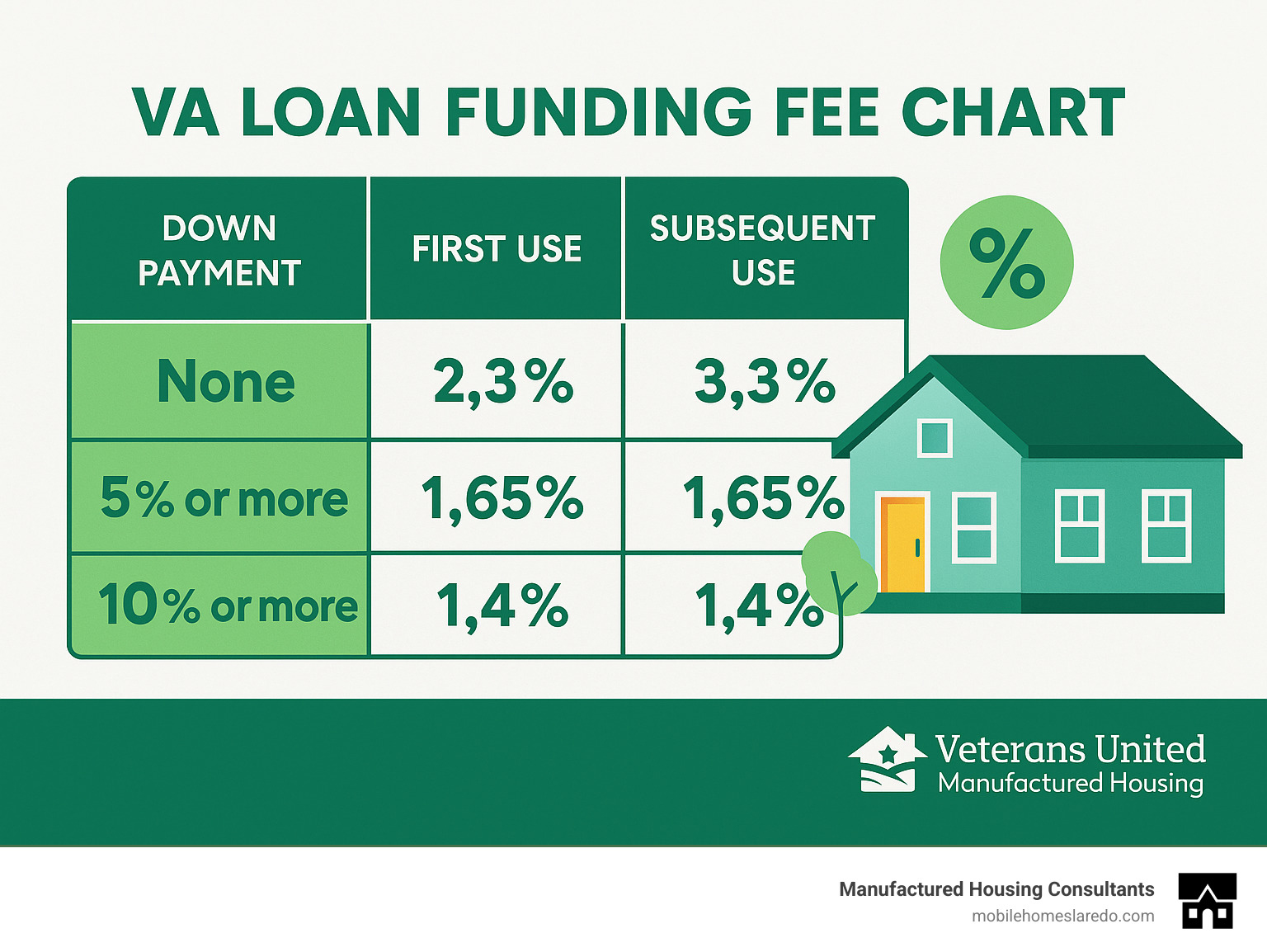

The VA funding fee is a one-time payment that helps keep the VA loan program running without taxpayer support. For manufactured homes, this fee typically ranges between 1.4% to 1.65% for first-time use, and can climb to 3.3% for subsequent uses. Good news for disabled veterans, though – if you have a service-connected disability, you might qualify for a complete funding fee exemption!

While traditional VA loans often require no down payment, some lenders are more cautious with manufactured homes and may ask for a 5% down payment. But don’t worry – at Manufactured Housing Consultants, we partner with lenders who offer true $0 down VA loans for qualifying manufactured homes.

For debt-to-income ratio, the VA typically recommends keeping your total monthly debt payments (including your new mortgage) below 41% of your gross monthly income. However, this can be flexible if you have other financial strengths.

The VA also looks at your “residual income” – what’s left in your pocket after paying major expenses each month. These requirements vary depending on your family size and where you live.

“What many veterans don’t realize is that VA loans for manufactured homes often have better interest rates than chattel loans or personal loans,” explains Juan Martinez of Manufactured Housing Consultants. “Even with the funding fee, the long-term savings can be substantial.”

For more detailed information about financing options, check out our guide on Mobile Home Mortgage Financing.

Step-by-Step Eligibility & Application Guide

The path to homeownership using a VA loan for a manufactured home might seem complicated, but I promise it’s manageable with the right guidance. Let’s walk through exactly how to turn your military service into the keys to an affordable manufactured home.

Borrower Roadmap: Securing VA loan and manufactured homes financing

Your journey begins with confirming you’re eligible for this valuable benefit. Start by obtaining your Certificate of Eligibility (COE) through the VA’s eBenefits portal. Don’t worry if technology isn’t your thing – your lender can help secure this document, or you can submit VA Form 26-1880 the old-fashioned way.

To qualify, you’ll need to have served 90 consecutive days during wartime, 181 days during peacetime, or completed 6 years in the National Guard or Reserves. Spouses of service members who died in the line of duty or from service-related disabilities may also be eligible – a small comfort during difficult times.

Your credit score matters too. Most lenders look for scores of at least 580-620 for manufactured home loans. If your score needs some TLC, don’t lose heart! At Manufactured Housing Consultants, our FICO Score Improvement Program has helped many veterans become mortgage-ready.

“I never thought I’d qualify with my credit history,” shares Army veteran Miguel Sanchez. “But after six months in the improvement program, my score jumped 85 points. Now my family has a beautiful double-wide on an acre outside San Antonio.”

Next, take a clear-eyed look at your finances. The VA prefers your debt-to-income ratio to stay at or below 41%, though exceptions exist. Remember to factor in all housing costs – not just the mortgage payment, but insurance, taxes, and utilities too.

Finding the right lender is crucial. Not all VA-approved lenders work with manufactured housing, and those that do may have different requirements. Shop around and ask specifically about their experience with VA loans and manufactured homes.

Once you’ve selected a lender, gather your paperwork: COE, income documentation (pay stubs, W-2s, tax returns), bank statements, photo ID, and DD-214 if applicable. With these in hand, you’ll secure pre-approval – your ticket to serious home shopping.

When selecting your manufactured home, verify it meets all VA and HUD requirements. Check for the proper square footage (at least 400 sq ft for single-wides and 700 sq ft for double-wides), HUD tags, and data plate. Working with specialists like our team at Manufactured Housing Consultants means you’ll only see homes that meet these standards, saving valuable time and preventing heartbreak.

The final stretch involves the VA appraisal, which confirms the home’s value and compliance with Minimum Property Requirements. Your lender will complete the underwriting process, and you’ll address any conditions they require. Then comes the exciting day when you review your closing disclosure, sign the loan documents, and receive the keys to your new home!

Conclusion & Next Steps

The journey to homeownership doesn’t have to be out of reach for veterans and active-duty service members. VA loans and manufactured homes create a powerful combination that can make your dream of affordable homeownership a reality, even in today’s challenging housing market.

Yes, the requirements are specific and the process has its complexities. But remember what makes this option so valuable: the potential for zero down payment, those competitive interest rates, and the absence of private mortgage insurance. For many veterans we’ve worked with, these benefits have made all the difference.

Here at Manufactured Housing Consultants, helping Texas veterans steer the manufactured home buying process isn’t just what we do—it’s our passion. Our team truly understands the unique requirements of VA loans for manufactured homes and we take pride in guiding you through every step of your journey.

“We’ve seen how these homes change lives,” says Juan Martinez. “Our mission at Manufactured Housing Consultants is simple: make affordable homeownership possible for veterans through quality manufactured homes and specialized financing options that work for real people.”

Ready to take the next step toward your new home? Here’s how to begin:

Start by checking your eligibility—you can obtain your Certificate of Eligibility through the VA’s eBenefits portal, or if that sounds daunting, let us help you with the paperwork. If your credit needs a boost, our FICO Score Improvement Program can help strengthen your loan approval chances.

When you’re ready to see what’s available, we offer an impressive selection of manufactured homes from 11 top manufacturers—all with our guaranteed lowest price in Texas. Our financing specialists can connect you with lenders who have specific experience with VA loans for manufactured homes and understand the unique needs of veteran borrowers.

We’d love to meet you in person at our Laredo location, where you can explore our selection and chat with our team about your specific needs, budget, and timeline. There’s nothing like walking through these homes to really envision your future in them.

With proper preparation and the right team behind you, your VA loan benefit can successfully open the door to a manufactured home that fits both your needs and your budget. The path to homeownership might have some twists and turns, but you don’t have to walk it alone.

We’ve helped countless veterans just like you understand the requirements, prepare properly, and finally receive the keys to their new home. We’d be honored to help you too.

VA loan and manufactured homes resources:

When you’re ready to begin your journey to homeownership, we’re just a phone call away.