What You Need to Know About Buying Repo Mobile Homes

Repo mobile homes are manufactured homes repossessed by lenders from owners who defaulted on their loans. To recover losses quickly, lenders sell these homes at significant discounts, often making them an affordable path to homeownership.

Key Facts About Repo Mobile Homes:

- Savings Potential: Typically discounted 20% or more compared to market value

- Price Range: Many available for $10,000 to $50,000

- Condition: Sold “as-is” without warranties

- Where to Find Them: Bank websites, specialized dealers, and foreclosure auctions

- Financing: May not qualify for traditional mortgages; chattel loans are common

- Hidden Costs: Transport ($3,000-$10,000), installation ($7,000-$47,000), and utility connections ($1,000-$9,000)

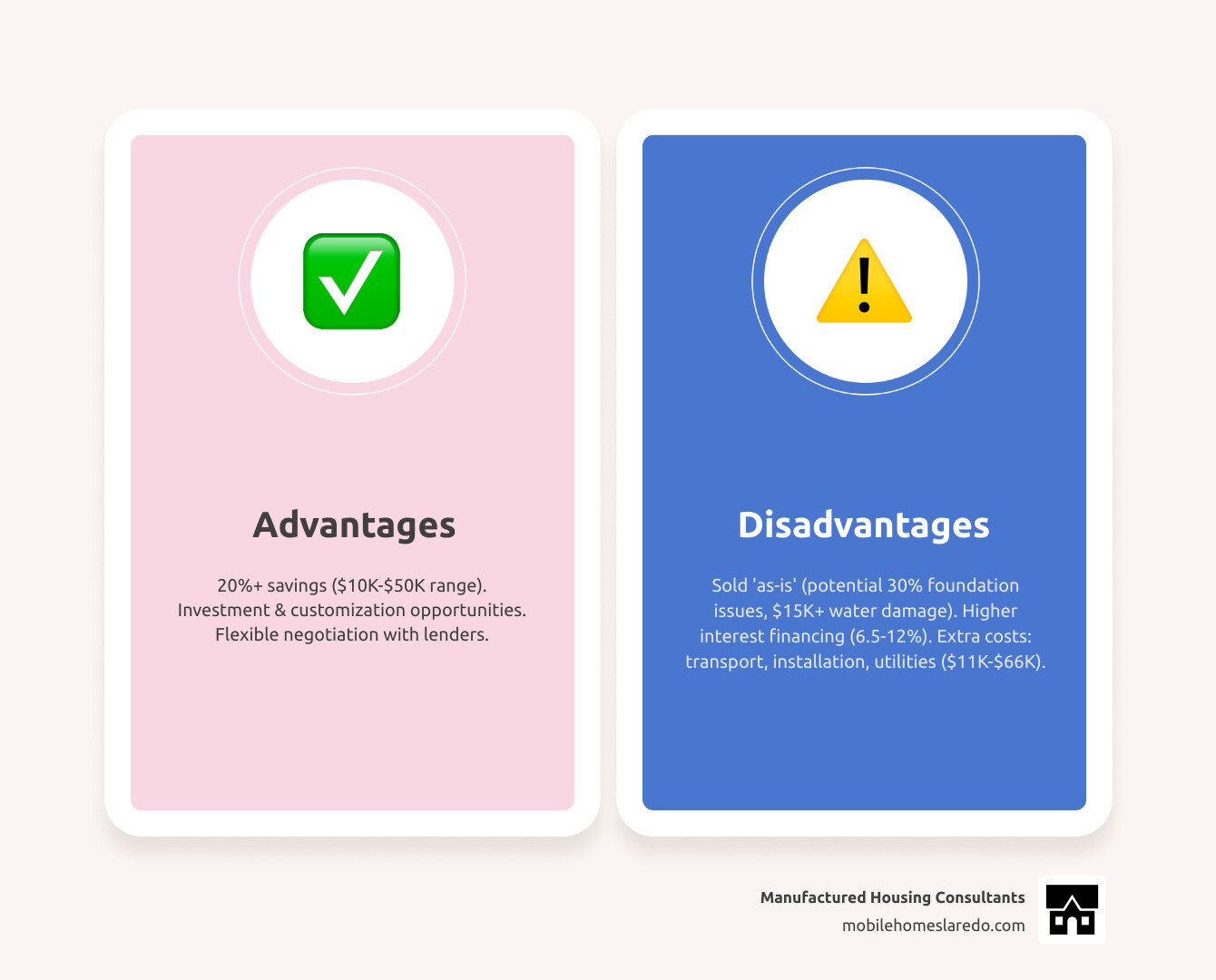

For many Texans, buying a repo mobile home offers a real path to homeownership when traditional housing is out of reach. While the upfront savings are substantial, these homes are sold in whatever condition the previous owner left them. Some are move-in ready, but others need serious work, like foundation repairs (an issue in ~30% of manufactured homes) or fixing water damage (which can exceed $15,000).

The good news? With a proper inspection and a realistic budget, a repo mobile home can be an excellent investment. This guide walks you through finding, inspecting, financing, and understanding the true costs beyond the sticker price.

The Ultimate Guide to Buying Repo Mobile Homes

Think of buying a repo mobile home as a treasure hunt for an affordable home. The main draw is saving 20% or more compared to market value, with many homes priced between $10,000 and $50,000. This makes homeownership accessible on a tight budget. For investors, it’s a chance to buy low, renovate, and profit. Lenders want these properties sold, which means they are often open to negotiating the price.

The catch is that these homes are sold “as-is,” meaning what you see is what you get, problems included. Unlike a traditional sale, a repo home may have deferred maintenance or hidden damage. This is why thorough due diligence is non-negotiable.

How to Find and Inspect Repo Mobile Homes for Sale

Finding repo mobile homes requires looking beyond mainstream real estate sites. Here’s where to start:

- Bank Websites: Lenders specializing in manufactured home loans often list repossessed inventory directly on their sites.

- Specialized Dealers: Companies like us, Manufactured Housing Consultants, have relationships with lenders, giving us access to a wide range of repossessed homes in Texas. We guide you through the entire process.

- Foreclosure Auctions: Local government agencies or auction houses offer deals, but this route is high-risk, with less time for inspection and competition from experienced investors.

- Online Listings: Sites like Craigslist may have listings, but proceed with caution and verify all information independently.

Once you find a home, the inspection is your most critical step. Always hire a professional inspector who specializes in manufactured homes. They can spot red flags you might miss.

Key areas to inspect include:

- Foundation: Look for uneven floors, wall cracks, or doors that don’t close properly. About 30% of manufactured homes develop foundation issues.

- Water Damage: Check for ceiling stains, musty smells, or soft spots in the floor. Repairs can exceed $15,000. Test all faucets and toilets.

- Electrical System: Faulty wiring causes 13% of house fires. Test all outlets, switches, and the breaker box.

- Plumbing: Check for leaks and the age of the water heater (lifespan is 10-15 years).

- HVAC System: Test both heating and cooling, as replacement is expensive.

- Roof: Look for leaks, damaged shingles, or signs of previous repairs.

- HUD Label and Data Plate: The red exterior HUD tag (for homes built after 1976) and the interior data plate are essential. Without them, financing and insuring the home can be nearly impossible.

- Pests: Look for signs of rodents, insects, or termites, which can cause severe structural damage.

Think of the upfront savings as your renovation budget. You get a blank canvas to create a home that fits your style. For more guidance on finding affordable options, check out our resources on Cheap Used Mobile Homes For Sale Near Me.

If you’re buying in Texas, familiarize yourself with state regulations from the Texas Department of Housing and Community Affairs (TDHCA), which oversees titles and installations: For our Texas customers, familiarize yourself with Texas-specific regulations.

Navigating Financing and Legal Problems

Financing a repo mobile home differs from a traditional home loan because many are considered personal property, not real estate.

- Chattel Loans: The most common option. They treat the home like a vehicle, with slightly higher interest rates (6.5%-12%) and shorter terms (15-20 years). A down payment of 5-20% is typical.

- Personal Loans: An option for lower-priced homes, but interest rates are higher (8%-15%) with shorter repayment periods.

- FHA Title I Loans: Government-backed loans that can be used for manufactured homes, offering flexible credit requirements. The home must meet FHA standards.

- Cash Purchase: The simplest route, eliminating interest and financing problems.

Specialized lenders are your best bet. At Manufactured Housing Consultants, we offer financing options for all credit types and have a FICO Score Improvement Program to help you qualify for better rates. For more details, explore our pages on Mobile Home Financing and Bad Credit Mobile Home Loans Guaranteed Approval.

The legal side is equally important. Ensure you have:

- A Clear Title: This proves the home is free of liens from previous owners. Without it, you could inherit someone else’s debt.

- Lien Releases: Official documents proving all previous debts on the home are paid.

- Bill of Sale: Your proof of ownership, detailing the price and the home’s VIN.

- Permits and Zoning Compliance: If moving the home, verify local zoning laws and secure all necessary permits for transport and installation.

Working with a professional who understands manufactured homes can prevent costly legal mistakes.

Understanding the True Costs and Risks of a Repo Mobile Home

The sticker price is just the start. Budget for these additional costs:

- Transport Fees: Moving the home can cost $3,000 to $10,000, depending on size and distance.

- Installation Costs: Setting the home on a foundation, leveling, and anchoring it costs between $7,000 and $47,000.

- Utility Connections: Hooking up water, sewer, and electricity typically runs $1,000 to $9,000.

- Renovation Budget: Since homes are “as-is,” set aside funds for repairs like foundation work, water damage, or cosmetic updates.

Hidden damages are the biggest risk, which is why a professional inspection is crucial. Also, consider that manufactured homes tend to depreciate over time, unlike site-built homes. The average lifespan is 30-55 years. You are buying affordability, not necessarily a high-growth investment. However, a repo home is the cheapest upfront option compared to a new or reconditioned used home, and the savings can be life-changing for those prepared for the work. For more insights, visit our page on Buying Used Mobile Homes.

Is a Repo Mobile Home Right for You?

So, is a repo mobile home the right choice for you?

This path is ideal if you prioritize affordability and are willing to put in some work. The 20%+ discount provides a budget for renovations, allowing you to customize your home without a massive mortgage. You’re not just buying a house; you’re creating a home custom to you.

However, this route isn’t for everyone. If you’re not prepared for potential surprises and repairs, a turnkey home may be a better fit. The “as-is” nature means you could face issues like foundation problems (affecting ~30% of manufactured homes) or water damage repairs (costing over $15,000).

Success with a repo mobile home hinges on two things:

- Professional Inspection: Hire an inspector who specializes in manufactured homes. It’s the best way to avoid catastrophic costs.

- Realistic Budgeting: Factor in the purchase price plus transport ($3,000-$10,000), installation ($7,000-$47,000), utilities ($1,000-$9,000), and renovations.

Navigating financing and legal requirements can be tricky. At Manufactured Housing Consultants, we simplify the process. We work with specialized lenders and offer financing for all credit types, helping families across Texas, including here in Laredo, achieve homeownership. We also ensure all legal details, like securing a clear title, are handled correctly.

In the long term, manufactured homes typically depreciate, with a lifespan of 30-55 years. But does that make it a bad investment? Not at all. You’re building equity in an asset you own instead of paying rent. Regular maintenance is key to preserving your home’s value and comfort for decades.

For many, a repo mobile home means freedom—from rent, from a large mortgage, and to create a space that is truly yours. It’s a practical stepping stone to financial stability.

The bottom line: A repo home is a great option for budget-conscious first-time buyers, investors, or anyone ready to do their homework in exchange for incredible savings.

If this sounds like you, we’re here to help. Our team at Manufactured Housing Consultants specializes in making the buying process easy. We believe everyone deserves a place to call home. Ready to learn more? Explore our comprehensive guide on Repossessed Mobile Homes and let’s start a conversation about your future home.