Understanding Brand New Manufactured Home Costs

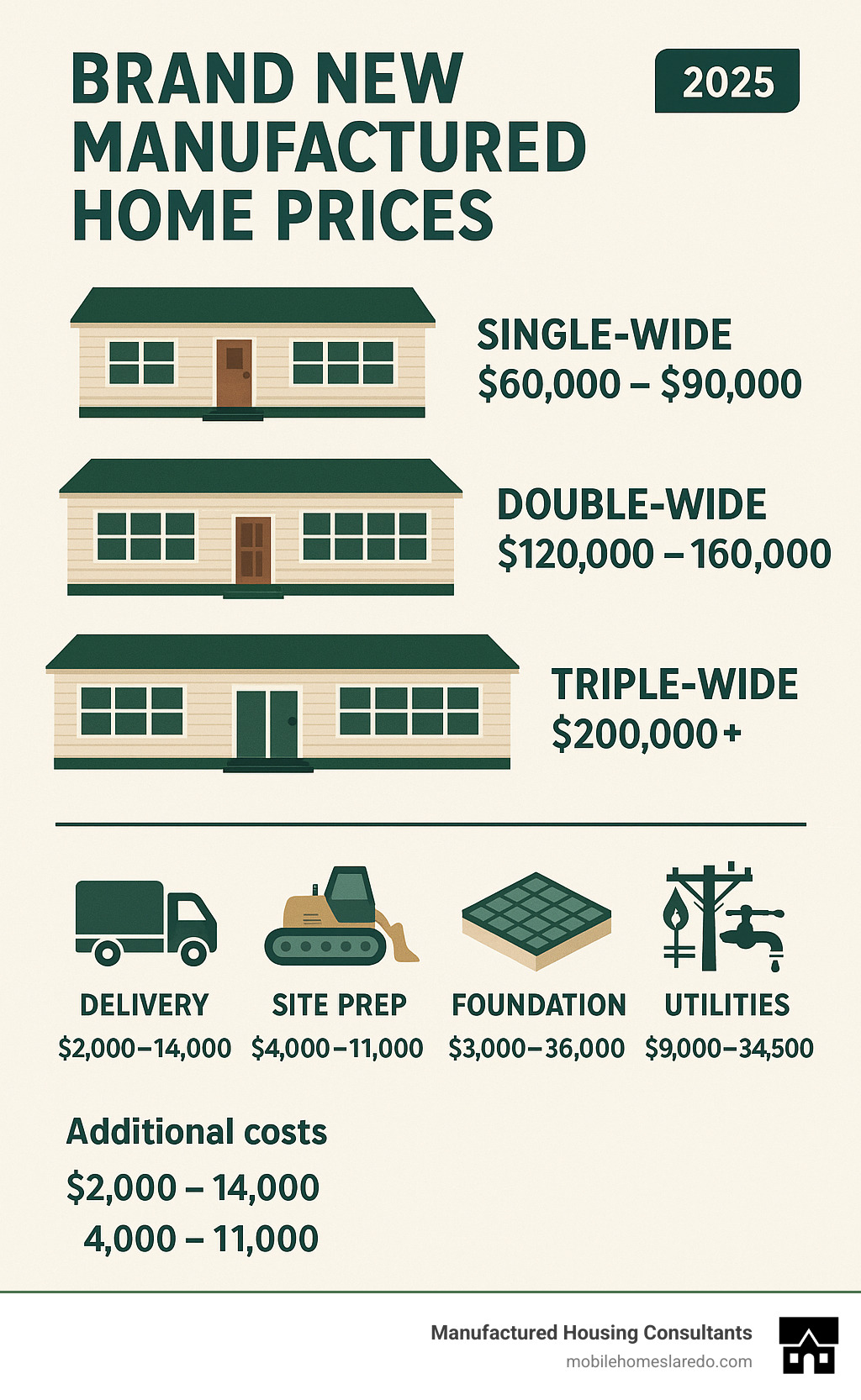

Brand new manufactured home prices typically range from $60,000 to $250,000+ depending on size and features. Here’s what you can expect to pay:

Single-Wide Homes: $60,000 – $90,000

Double-Wide Homes: $120,000 – $160,000

Triple-Wide Homes: $200,000 – $250,000+

Additional costs like delivery, setup, land, and permits can add $50,000-$100,000 to your total investment.

Manufactured homes offer an attractive path to homeownership, costing significantly less than traditional site-built homes. The average manufactured home sold for $120,000 in October 2023, compared to over $400,000 for a new site-built home.

Modern manufactured homes aren’t the “mobile homes” of decades past. Today’s factory-built homes meet strict HUD standards, offering quality construction in climate-controlled facilities. They’re built faster than traditional homes (2-4 months vs. 10-12 months), which helps keep costs down.

The appeal is getting more house for your money. A spacious double-wide with modern amenities can cost less than a down payment on a comparable site-built home. Plus, factory construction ensures consistent quality and fewer weather-related delays.

However, the sticker price is just the starting point. Delivery, setup, land costs, and site preparation can significantly impact your total investment.

Brand new manufactured home prices definitions:

Deconstructing Brand New Manufactured Home Prices

Understanding the full cost of a manufactured home is crucial. Brand new manufactured home prices aren’t just the sticker price; additional costs can make or break your budget. Let’s break down the base price and the additional expenses that can surprise first-time buyers.

Base Price Ranges by Home Size

The size of your manufactured home is the biggest factor in determining your starting price.

Single-wide homes are your most budget-friendly option, perfect for first-time buyers. These homes measure up to 18 feet wide and 90 feet long, offering 784 to 1,440 square feet of living space. You’re looking at brand new manufactured home prices between $60,000 and $90,000 for most single-wides, with some basic models starting as low as $50,000.

These homes are ideal for individuals, small families, or those who prefer cozy, efficient spaces. Modern designs make excellent use of every square foot.

Double-wide homes are great for growing families. Built in two sections that are joined on-site, these homes typically measure at least 20 feet wide and can offer over 2,200 square feet of comfortable living space. Expect to pay between $120,000 and $160,000 for a quality double-wide.

The extra space means more bedrooms, additional bathrooms, and room to spread out. They are the most popular choice for families wanting a “real house” feel without the traditional price tag.

Triple-wide homes are the luxury option. Made from three sections, these homes offer expansive floor plans that rival large site-built homes, perfect for those who want space to entertain. Brand new manufactured home prices for triple-wides start around $200,000 and can exceed $250,000.

Working with 11 top manufacturers means you’ll find options in every size category to match your space needs and budget.

Beyond the Sticker Price: Additional Costs to Budget For

The home price is just the beginning. You must also budget for land, foundations, and utility hookups.

Land costs are unavoidable unless you already own property. You can purchase land outright or rent a lot in a manufactured home community. Community lot rent typically runs $300 to $1,000 monthly. Buying land is a larger upfront investment but gives you complete control.

Site preparation gets your land ready for your new home. This process costs between $4,000 and $11,000 and includes surveying, clearing, excavation, and leveling. Placing a home on rural land needing extensive work, like a well or septic system, can add $58,000 or more.

Your home needs a solid foundation, and foundation costs vary. A basic surface mount foundation might cost around $3,000, while a frost-wall foundation starts around $20,000 to $25,000. A full basement can cost $35,000 to $45,000. Your foundation choice also affects financing and taxes.

Delivery and installation are critical steps that cost between $2,000 and $14,000. This covers transporting and joining the home sections on your foundation. Full-service delivery is recommended.

Utility connections bring your home to life. Connecting to existing utilities is cheaper, but bringing utilities to vacant land costs $9,000 to $34,500. This includes a well ($3,000-$15,000), septic systems ($3,500-$10,000+), electrical work ($2,000-$9,000), and HVAC installation ($5,000-$11,000).

Don’t forget permits and fees ($500 to $2,000), plus potential impact fees ($1,500 to $10,000) depending on your location.

Finally, finishing touches like skirting ($900-$3,000), decks, garages ($10,000-$50,000+), and landscaping ($3,200-$15,000+) complete your home. Property taxes and insurance add ongoing costs of roughly $5,500 to $16,500 annually.

Key Factors That Influence Final Brand New Manufactured Home Prices

Even within the same size category, brand new manufactured home prices can vary significantly based on your choices.

Home layout complexity affects pricing beyond square footage. More bedrooms and bathrooms cost more but add value and flexibility.

Customizations and upgrades make the home yours, but they can also increase costs quickly, typically adding $10 to $150 per square foot. Upgrades like granite countertops, premium floors, or a walk-in shower improve your daily living experience while increasing the price.

Energy-efficient features cost more upfront but save money long-term on utility bills. This includes improved insulation, energy-efficient windows, and high-performance HVAC systems.

Location matters for delivery costs and overall value. Remote locations increase transportation expenses, while desirable areas can improve your home’s long-term value.

Manufacturer reputation influences pricing. The 11 top manufacturers we work with offer different levels of quality and standard features. Higher-quality manufacturers might cost more initially but often provide better value.

Here’s how standard features compare to popular upgrades:

Kitchens typically come with laminate countertops and basic appliances but can be upgraded to quartz/granite counters and stainless steel appliances. Bathrooms standard with tub/shower combos can be improved with walk-in showers and dual vanities. Flooring upgrades from basic vinyl or carpet to hardwood or premium tile make a dramatic difference. Exterior options range from standard vinyl siding to stone accents, while interior finishes can include crown molding and built-in shelving.

Understanding these factors helps you invest your upgrade dollars wisely. Our team will guide you to get the home you want within your budget.

Making a Smart Investment: Value, Financing, and Your Next Steps

This section explores the long-term value and financing options, helping you decide if a new manufactured home is the right choice for your future.

Financing Your New Home and Finding Incentives

The biggest hurdle in homeownership is often financing. That’s why our business focuses on making financing accessible for everyone in Laredo, Texas. We believe everyone deserves a shot at owning their own home, regardless of credit history.

When financing brand new manufactured home prices, you have several solid options. Government-backed loans are a great starting point. FHA loans are fantastic for first-time buyers, requiring smaller down payments and being more forgiving with credit scores. For veterans or active military, VA loans are a game-changer, often offering zero down payment options. In eligible rural areas, USDA loans also offer zero-down financing for qualified buyers.

Conventional mortgages come into play when your manufactured home sits on a permanent foundation and you own the land. These work like traditional home loans, typically requiring around 20% down but often offering the lowest interest rates.

Chattel loans are specifically designed for manufactured homes, which are often considered personal property (especially on rented land). While interest rates might be slightly higher than traditional mortgages, they are accessible and practical for this situation.

Lenders typically require that your monthly housing costs not exceed 32% of your gross monthly income, and total debt payments not exceed 40%. We help you steer these guidelines to find financing that works for you.

Don’t forget about government incentives and programs. We also offer our FICO Score Improvement Program to help you secure the best possible terms. You can also Find your home’s NADA® value for reference on existing home values.

The Long-Term Value Proposition and Lifespan

Are manufactured homes a good investment? It’s a fair question, and the answer might surprise you.

Today’s manufactured homes are built to last. Every home built after June 1976 follows strict HUD Code standards for safety and quality. With proper maintenance, you can expect 30 to 55 years of solid living.

Regarding appreciation versus depreciation, a manufactured home on owned land with a permanent foundation is considered real estate and can appreciate like a traditional home. The land value, not just the structure, drives appreciation.

If your home is considered personal property (e.g., in a leased community), it might depreciate more like a car. However, you still get incredible cost-effectiveness, living in a quality home for a fraction of the cost of comparable site-built housing. Maintenance costs are also typically lower, and you can remodel and upgrade to maintain value.

Resale value depends heavily on your foundation type and land ownership. Homes on owned land with permanent foundations perform better in resale markets. For more details, you can Learn about permanent foundations from HUD.

The bottom line is you’re investing in affordable, quality housing that provides comfortable living for decades while potentially building equity.

Is a New Manufactured Home Right for You?

After reviewing the prices, costs, and financing, is a new manufactured home right for your family?

The affordability factor is hard to ignore. You get significantly more home for your money compared to traditional construction. The speed of construction is another huge win (2-4 months vs. over a year), with no weather delays.

Quality control in factory settings means consistent construction and multiple inspections. You also get impressive customization options, from floor plans to energy-efficient upgrades that save you money on utilities.

However, there are some considerations. Depreciation can happen if you don’t own the land or have a permanent foundation. Financing can be more complex, though we handle most of that for you. Additional site costs are real and need planning. Some outdated perceptions about manufactured homes still exist, but they’re rapidly changing.

When ready, use these negotiation strategies: Research manufacturers and market prices. Get a clear breakdown of all costs. Negotiate the total cash price, not just monthly payments. Ask for invoice costs to understand markups. And always compare financing options.

At Manufactured Housing Consultants, we’ve built our reputation on guaranteed lowest prices and a selection from 11 top manufacturers. Our specialized financing options work with all credit types, and our FICO Score Improvement Program helps you get the best terms.

We believe manufactured homes offer an excellent, affordable, high-quality solution for many families. If you’re ready to explore this homeownership opportunity, we’d love to help you Explore our available homes and find your perfect match.