The Great Depreciation Debate: Separating Fact from Fiction

Does a mobile home appreciate in value? This question has sparked countless debates, but the short answer might surprise you.

Quick Answer:

- Yes, mobile homes can appreciate in value – Recent FHFA data shows manufactured homes appreciated 211.8% between 2000-2024

- Appreciation rate: About 5% annually, nearly identical to site-built homes (212.6%)

- Key factor: Land ownership dramatically improves appreciation potential

- Reality check: Some homes appreciate, others depreciate – location and maintenance matter most

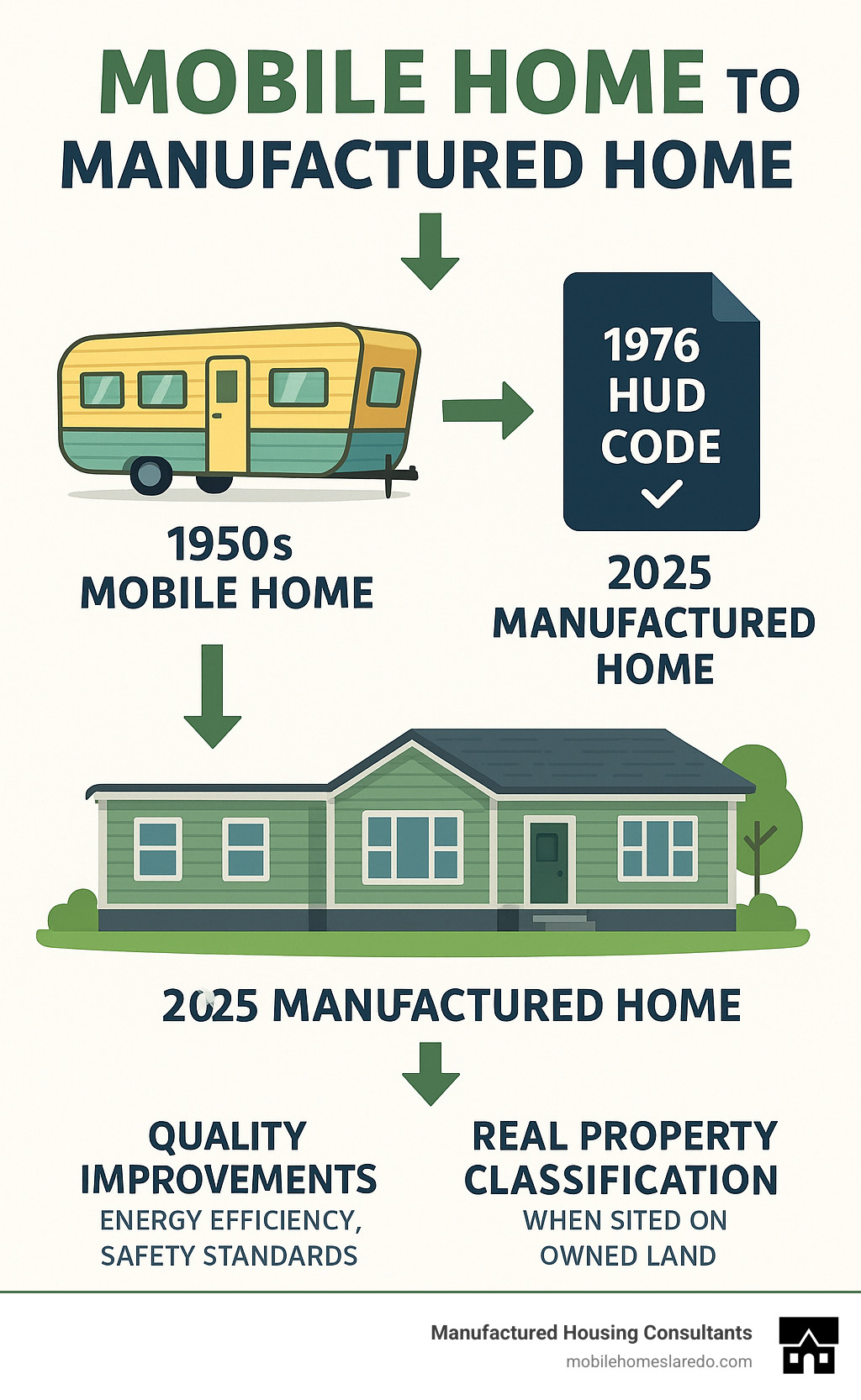

For decades, the common belief was that mobile homes automatically lose value like cars. This misconception stems from outdated perceptions and confusion about terminology.

The reality is more nuanced. Modern manufactured homes built after 1976 follow strict HUD safety and quality standards. They’re no longer the “trailers” of previous generations, yet many still cling to the car depreciation analogy.

As one industry expert put it: “It’s a common misconception that mobile homes immediately depreciate after the initial sale as cars do.”

The affordable housing crisis has brought manufactured homes back into focus. As traditional home prices soar, more Americans are finding they offer a path to homeownership without crushing debt.

What most people don’t know is that recent data shows manufactured homes can appreciate at rates similar to traditional site-built homes. The key is understanding what factors drive this appreciation.

Does a mobile home appreciate in value terms explained:

So, Does a Mobile Home Appreciate in Value? The Surprising Truth

If you’ve wondered “does a mobile home appreciate in value?”, you’re not alone. For decades, the common wisdom was no, but this is based on outdated myths that don’t match today’s reality. The truth is that modern manufactured homes are appreciating at impressive rates. Let’s explore the data.

The Data Doesn’t Lie: How does a mobile home appreciate in value compared to stick-built homes?

The old saying about manufactured homes losing value like cars is wrong. The numbers tell a different story. The Federal Housing Finance Agency (FHFA), which tracks home prices, has found that manufactured home values are appreciating significantly.

Between 2000 and 2024, manufactured homes appreciated by 211.8 percent. This is nearly identical to site-built homes, which saw 212.6 percent appreciation over the same period. That’s roughly 5% annual appreciation for both types of homes.

Since 2014, manufactured homes have often outpaced traditional homes, showing stronger year-over-year price increases in most quarters.

| Home Type | Appreciation (2000-2024) | Annual Appreciation Rate |

|---|---|---|

| Site-built Homes | 212.6% | ~5% |

| Manufactured Homes | 211.8% | ~5% |

The Urban Institute’s analysis confirms that manufactured homes appreciate and depreciate similarly to stick-built homes when properly maintained. A Datacomp study in Michigan found more manufactured homes increased in value than decreased, showing clear appreciation potential.

So when someone asks “does a mobile home appreciate in value?” you can confidently say yes—the data proves it. For more detailed analysis, you can explore scientific research on manufactured home price indexes or learn more about how values are determined.

The Deciding Factor: Why Land Ownership is Key to Value

While the appreciation data is encouraging, one factor is critical to your home’s value: whether you own the land underneath it. A traditional house includes the structure and land, but with manufactured homes, this isn’t always the case. This distinction is huge for your investment.

Real property versus personal property isn’t just legal jargon. It determines how your home is classified, financed, and taxed. A home on rented land is personal property (like an RV), but when permanently attached to land you own, it becomes real property.

Why does this matter? Land is the star of appreciation. Between 2012 and 2023, land prices jumped 261% while structure prices only rose 49%. Owning the land means you benefit directly from this growth. Renting a lot means you miss out.

Lot rent can also eat into your investment. While parks offer an affordable entry, lot rent can increase over time. You build equity in the home, but not the land, and you don’t control rent hikes. Financing also differs. Homes on rented land often use chattel loans with higher rates, while homes on owned land can qualify for traditional mortgages with better terms.

Datacomp’s research shows that location affects manufactured home values by more than 24%, with homes on owned property more likely to appreciate. For financing options, check out more info about mobile home financing. You can also explore scientific research on land price appreciation to understand these trends better.

Beyond Land: What other factors help a mobile home appreciate in value?

Land ownership is crucial, but other factors also determine if a mobile home will appreciate in value. Like traditional homes, several elements help build equity.

- Maintenance and Upkeep: A well-maintained home holds its value. Regular maintenance on the roof, siding, and HVAC system preserves your investment.

- Age and HUD Standards: Homes built after 1976 meet strict HUD Code standards for safety and quality, and generally appreciate better than older models.

- Community and Neighborhood: Clean, well-managed communities with good amenities are desirable and influence value.

- Local Housing Market: Strong job markets, population growth, and healthy local economies help all types of homes appreciate.

- Energy Efficiency: Modern features like better insulation, windows, and HVAC systems lower utility bills and attract buyers.

- Curb Appeal and Condition: A clean exterior, fresh landscaping, and inviting outdoor spaces make a home more attractive and impact its perceived value.

- Smart Upgrades: Updated kitchens, bathrooms, and flooring signal quality and can boost value.

The bottom line is that multiple factors influence appreciation, and the potential is there if you understand what drives value. For more detailed guidance, explore our resources about factors that influence mobile home values.

Making a Smart Investment in Your Future Home

We’ve debunked the myths and seen the data: a mobile home can appreciate in value. Now, let’s see what this means for your future. If you’re seeking an affordable path to homeownership without sacrificing quality or investment potential, you’ve found it.

Debunking the Myths and Embracing the Opportunity

Manufactured homes have had an image problem. Many still picture the flimsy trailers of the past, but that’s like judging modern smartphones by 1980s models. The reality is different. Since 1976, all manufactured homes must meet strict federal HUD Code standards for structural integrity, fire safety, and energy efficiency.

Your home is built in a controlled factory environment with consistent quality control, using the same materials found in site-built homes. Safety standards are often exceeded, as these homes must withstand transport and installation, making them incredibly sturdy.

The investment potential is real. The FHFA data shows a 211.8% appreciation rate over 24 years, nearly identical to site-built homes. This is a legitimate path to building wealth. As a primary residence, they offer stability without crushing debt, providing your own space with manageable monthly payments.

Changing demographics, like remote work and an aging population, are creating steady demand for manufactured homes, supporting their long-term value. For more insights, you can explore our detailed breakdown of ownership benefits.

Is a Manufactured Home a Good Investment for You?

Is this a good investment for you? The answer depends on your goals, but the potential is significant.

For a primary residence, manufactured homes solve the affordability challenge. You get more square footage for your dollar, meaning lower entry costs and manageable monthly payments. When you own the land, you build equity in both the structure and the land. As we’ve seen, land appreciation has been the real wealth builder in real estate, growing 261% between 2012 and 2023.

For investors, the lower purchase price can mean higher rental yields. A less expensive home can generate strong cash-on-cash returns, and demand for affordable rentals is high. Understanding your local market is key. In Texas, robust demand for affordable housing supports property values.

A manufactured home is a good investment if you commit to maintenance, plan to own the land, and understand that location and market conditions matter. When these factors align, appreciation potential is excellent. Building equity through homeownership is a reliable path to wealth, and manufactured homes make this path accessible to more people.

Want to understand more about making smart buying decisions? Check out our guide on buying used mobile homes for additional insights.

Your Next Steps to Affordable Homeownership

We’ve shown that the answer to “does a mobile home appreciate in value?” is yes, and we’ve explained how to make it work for you. The key takeaways are simple: Modern manufactured homes appreciate like traditional homes, especially on owned land. Land ownership, maintenance, and location are crucial for maximizing value. They offer an affordable path to homeownership without financial sacrifice.

Here in Texas, the opportunities are particularly strong. The state’s growth creates consistent housing demand, making manufactured homes a smart way to enter the market.

At Manufactured Housing Consultants, our mission is to help Texans achieve affordable homeownership. We work with 11 top manufacturers to provide the widest selection and guarantee the lowest prices.

Financing shouldn’t be a barrier. We offer specialized financing for all credit types, including a FICO Score Improvement Program to help you qualify for better rates. We’re committed to finding a solution that works for you.

The Texas housing market is competitive, but manufactured homes offer a way to get in now, build equity, and achieve long-term financial success.

Ready to explore your options? We’re here to help you find the perfect home and understand its value potential. Learn more about maximizing your mobile home’s resale value and find how the right manufactured home can be your smartest investment yet.

The future of affordable homeownership isn’t just bright—it’s appreciating. Let’s make it yours.