Why FHA Loans Are Your Best Option for Bad Credit Homeownership

FHA loans for bad credit offer a clear path to homeownership, even if your credit score has seen better days. These government-backed mortgages are designed to help people with lower credit scores qualify for financing when conventional loans are not an option.

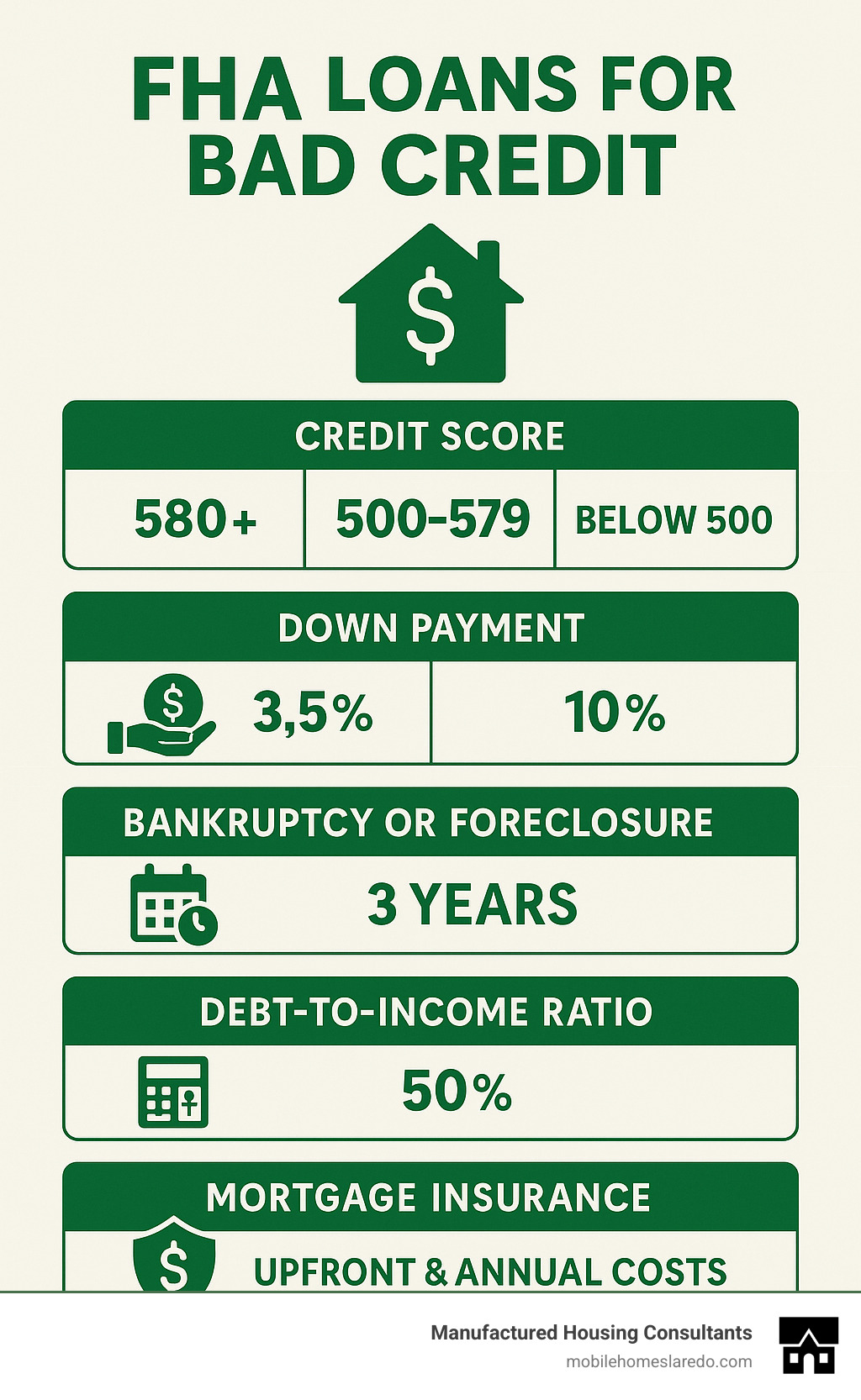

Quick Answer: FHA Loan Requirements for Bad Credit

- Credit Score 580+: 3.5% down payment required

- Credit Score 500-579: 10% down payment required

- Credit Score Below 500: Not eligible for FHA loans

- Maximum Financing: Up to 96.5% of home value

- Mortgage Insurance: Required (both upfront and annual premiums)

- Property Type: Must be your primary residence

The Federal Housing Administration (FHA) has helped Americans achieve homeownership since 1934. Unlike conventional loans that often require scores of 620 or higher, FHA loans accept scores as low as 500, although a larger down payment is needed.

The biggest advantage is that the FHA insures your loan, reducing the risk for lenders. This insurance allows them to offer better terms to borrowers with credit challenges, including lower down payments and more flexible qualifying requirements. The key difference is that FHA loans focus on your ability to make future payments, not just past credit mistakes.

Fha loans for bad credit terms made easy:

What is an FHA Loan and How Can It Help with Bad Credit?

An FHA loan isn’t a loan directly from the government. Instead, it’s a mortgage from a regular lender that is insured by the Federal Housing Administration (FHA). Think of the FHA as an insurance company for your lender.

This government-insured loan system is a game-changer for people with bad credit. Lenders are often hesitant to approve mortgages for borrowers with low credit scores. But when the FHA insures the loan, it reduces the lender’s risk, making them much more willing to work with you.

Since 1934, the FHA has helped Americans become homeowners, with a special focus on first-time homebuyers and those without perfect credit or large savings.

What makes FHA loans so powerful for bad credit situations?

- Lower Down Payment: While conventional loans often require 10-20% down, FHA loans can work with as little as 3.5% down if your credit score is 580 or higher.

- Easier Credit Qualifying: Where other loan programs might automatically reject a 580 credit score, the FHA’s flexible guidelines open doors that would otherwise be closed.

For families looking at manufactured homes in Texas, FHA loans are often the key to ownership. The FHA’s willingness to work with imperfect credit has made the dream of homeownership a reality for many of our clients. This is all possible because FHA insurance protects lenders if a borrower defaults, creating opportunities for those with some bumps on their credit report.

Key Requirements for FHA Loans for Bad Credit

While FHA loans are flexible, they have key requirements to ensure the loan is sustainable and the property is sound. Understanding these is your first step toward securing an FHA loan for bad credit.

One crucial aspect is the Mortgage Insurance Premium (MIP), which is mandatory for all FHA loans. It includes an Upfront MIP (UFMIP) of 1.75% of the loan amount (usually financed into the loan) and an Annual MIP paid monthly. This insurance protects the lender, allowing them to approve borrowers with lower credit scores.

FHA loans also have loan limits that vary by county, ensuring they serve low-to-moderate income borrowers. Finally, the property must meet FHA standards for safety and structural integrity. FHA loans are a fantastic option for manufactured homes, which have specific requirements. Learn more about an FHA Mortgage for Manufactured Home on our site.

Minimum Credit Score for FHA loans for bad credit

The FHA’s credit score requirements are significantly more forgiving than those for conventional loans.

- Credit Score 580 or higher: You can qualify for the lowest down payment of just 3.5% of the home’s purchase price.

- Credit Score between 500 and 579: You can still qualify, but you’ll need a larger down payment of at least 10%.

- Credit Score below 500: You are generally not eligible for an FHA mortgage.

While the FHA sets these minimums, individual lenders can have their own internal requirements, known as “lender overlays.” This is why it’s important to work with a lender who specializes in FHA loans. Lenders may also consider “compensating factors” like a larger down payment, low debt, or significant cash reserves to offset a lower credit score.

We can help you understand how to steer these requirements. You can find out how FHA loans can help you.

How a Low Score Affects Your Loan Terms and Costs

While an FHA loan makes homeownership possible with a lower credit score, your score does influence the loan’s terms and costs.

- Interest Rates: A lower credit score generally results in a slightly higher interest rate. While FHA rates are competitive, a 550 score will likely have a higher rate than a 700 score.

- Closing Costs: Your score doesn’t directly impact standard closing costs. However, with a higher interest rate, you might consider paying for “discount points” at closing to “buy down” the rate, which increases your upfront costs.

- Mortgage Insurance (MIP): FHA MIP rates are standard regardless of your credit score. The UFMIP is 1.75% of the loan amount, and the annual MIP is a percentage of the loan balance paid monthly.

- Loan-to-Value (LTV): If your score is between 500 and 579, you’ll need a 10% down payment, which means your LTV is limited to 90%. A higher down payment reduces the total interest paid over the life of the loan.

Even with slightly less favorable terms, FHA loans make homeownership attainable when other options are off the table.

Other Eligibility Factors: DTI, Income, and Property Standards

Beyond your credit score, lenders look at your overall financial health.

- Debt-to-Income Ratio (DTI): This compares your monthly debts to your gross monthly income. The FHA guideline is a housing ratio (front-end) of 31% and a total debt ratio (back-end) of 43%. Higher DTIs may be approved with strong compensating factors.

- Steady Employment and Sufficient Income: Lenders typically want to see a stable two-year work history and enough income to cover your mortgage and other debts.

- Primary Residence: The property must be the home you live in, not an investment property.

- Property Type: FHA loans can be used for single-family homes, 2-4 unit properties (if you occupy one), and manufactured homes.

- FHA Appraisal: The property must pass an FHA appraisal to ensure it meets minimum standards for safety, security, and soundness.

Understanding these factors helps you prepare for the application process. You can check local FHA loan limits here: Check FHA loan limits in your area.

Qualifying for an FHA Loan After Bankruptcy

A past bankruptcy doesn’t automatically disqualify you from getting an FHA loan.

- Chapter 7 Bankruptcy: The FHA generally requires a waiting period of two years from the discharge date. During this time, you must re-establish good credit by making all payments on time.

- Chapter 13 Bankruptcy: The waiting period is often shorter. You may be able to apply for an FHA loan after one year of making on-time payments in your repayment plan, but you will need permission from the bankruptcy court.

In both cases, the key is to show the lender that you have re-established financial stability. We can help guide you on what lenders will be looking for.

How to Prepare and Where to Find Help

Getting an FHA loan for bad credit is achievable with some thoughtful preparation. A little planning goes a long way toward success.

The first step is to get a clear picture of your finances. This means creating a budget and starting to save for your down payment and closing costs. Having these funds ready shows lenders you are a serious and committed borrower.

The application process begins with pre-approval. This isn’t a final loan guarantee, but it tells you how much house you can afford. For manufactured homes, this step is crucial because it lets you focus your search on homes that fit your budget.

We know navigating mortgages with credit challenges can feel overwhelming, and we’re here to help. From understanding your credit to finding the perfect manufactured home, we make the process smooth. You can find more info on how to buy a house with bad credit on our website.

Steps to Prepare for an FHA loan for bad credit

Preparing for an FHA loan for bad credit involves making small, consistent efforts to improve your financial profile.

- Pay bills on time. Payment history is the biggest factor in your credit score. Make all payments on or before the due date.

- Reduce credit card balances. High credit card debt hurts your score. Try to keep your balances below 30% of your available credit.

- Dispute credit report errors. Get free copies of your credit reports and check them for mistakes. Correcting errors can boost your score.

- Avoid new debt. Don’t open new credit cards or take on large loans in the months before you apply for a mortgage.

These steps show lenders you are committed to financial responsibility. We offer detailed guidance on credit repair for home loans to help our clients get ready.

Finding FHA-Approved Lenders and Housing Counselors

Finding the right team makes all the difference when seeking FHA loans for bad credit. Not all lenders specialize in helping people with lower credit scores or those interested in manufactured homes.

This is where Manufactured Housing Consultants excels. We are experts in providing affordable manufactured, modular, and tiny homes throughout Texas, and we understand how financing works for all credit types. Our specialized financing solutions and FICO Score Improvement Program help clients strengthen their credit to secure the best possible FHA loan terms.

We work directly with FHA-approved lenders who understand both diverse credit histories and the specific requirements for manufactured homes. This expertise can save you time and increase your chances of approval. Contact Manufactured Housing Consultants for FHA loan options.

For additional, impartial advice, you can also connect with a HUD-approved housing counselor. These professionals offer free or low-cost guidance on preparing for homeownership. You can talk to a HUD-approved housing counselor.

We also have comprehensive information on mobile home financing options on our website. With the right partners, securing an FHA loan for your manufactured home is within reach, even with bad credit.