Affordable Double Wide Financing Made Simple

Financing a new double wide manufactured home provides a practical path to homeownership at roughly half the cost per square foot of traditional site-built homes. If you’re exploring your options, here’s what you need to know (and yes, these homes are built to the federally regulated HUD Code standards, giving buyers extra peace of mind):

Quick Answer: Double Wide Financing Options

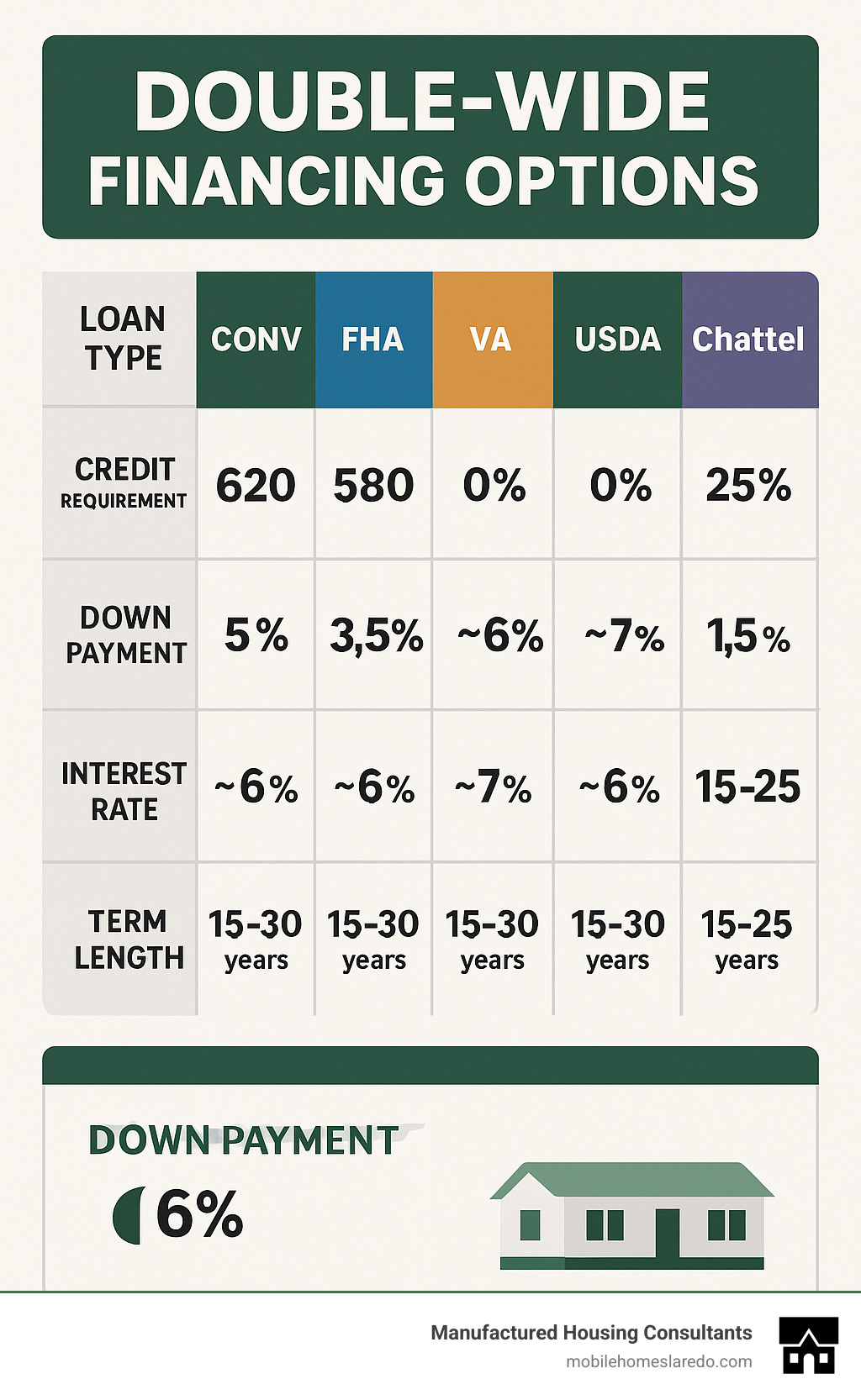

- Conventional loans: Require 620+ credit score, 5% down payment, permanent foundation

- FHA loans: Minimum 580 credit score for 3.5% down, 500-579 for 10% down

- VA loans: 0% down for eligible veterans, 620+ credit score recommended

- USDA loans: For rural areas, income restrictions apply

- Chattel loans: For home-only (575+ credit score), higher rates (8%+)

- Personal loans: No collateral required, higher rates (12%+), shorter terms

As of March 2024, the average cost of a new double-wide manufactured home in the U.S. is $144,800 dramatically less than the $361,250 average for a single-family site-built home. This price difference makes manufactured housing an increasingly popular option for budget-conscious buyers seeking quality housing.

With manufactured homes representing about 9% of new single-family residential buildings, they’ve become a mainstream housing solution. Modern double-wides offer 1,000-2,000+ square feet of living space with open floor plans, multiple bedrooms, and customizable features that rival site-built homes.

However, financing a new double wide comes with unique considerations. Only about 30% of manufactured home loan applications are approved, compared to more than 70% for site-built homes. This challenge stems from outdated perceptions about manufactured housing and special requirements like permanent foundations and real property titling.

The good news? Multiple financing paths exist, from traditional mortgages to specialized manufactured home loans. Your options will depend on:

- Your credit score and financial situation

- Whether you own or will lease the land

- If the home will be permanently installed

- The age and specifications of the home

Understanding these factors will help you steer the financing landscape and secure the most favorable terms for your new double-wide home.

Basic financing a new double wide vocab:

Why Double Wides Deserve a Closer Look

Double-wide manufactured homes have evolved dramatically since the “mobile homes” of yesteryear. Today’s models offer spacious, family-friendly layouts that accommodate growing households with ease. Most double-wides provide:

- 1,000-2,000+ square feet of living space

- 3-4 bedrooms and 2+ bathrooms

- Open-concept floor plans perfect for modern living

- Master suites with walk-in closets and en-suite bathrooms

- Full-sized kitchens with islands and dining areas

“The quality of today’s manufactured homes rivals site-built construction,” says Sam Landy, CEO of UMH Properties. “Factory-built homes are constructed in controlled environments with precision engineering and quality materials.”

Beyond space and quality, double-wides offer impressive build times. While a site-built home typically takes 7-9 months to complete, a double-wide can be built in the factory in 2-3 weeks and installed on your property within days of delivery.

Perhaps most compelling is their resale potential. Double-wides typically hold their value better than single-wides, with potential for appreciation when permanently installed on owned land with proper maintenance.

Double Wide Basics: Costs, Benefits & Drawbacks

Before diving into financing options, let’s examine what you’re actually buying when you purchase a double-wide manufactured home.

Double-wides are a perfect middle ground in the manufactured home world – spacious enough for families but still affordable. Built entirely in climate-controlled factories according to the HUD Code (established in 1976), these homes arrive in two sections that join together at your property, creating a comfortable space typically 20-32 feet wide by 40-60 feet long.

As of March 2024, you can expect to pay around $144,800 for a new double-wide. That breaks down to about $72.21 per square foot—a remarkable savings compared to site-built homes that average $143.83 per square foot. That’s nearly half the cost for the same amount of living space!

But the sticker price is just the beginning of your investment story. Think of buying a double-wide like an iceberg—the home price is what you see above water, but there’s more beneath the surface:

| Expense Category | Typical Cost Range | Notes |

|---|---|---|

| Double-Wide Home | $100,000-$200,000 | Varies by size, features, and region |

| Land (if purchasing) | $10,000-$100,000+ | Location-dependent |

| Site Preparation | $4,000-$10,000 | Includes clearing, grading, foundation |

| Delivery | $2,000-$5,000 | Distance-dependent |

| Installation | $5,000-$15,000 | Foundation type affects cost |

| Utility Connections | $3,000-$7,000 | Water, sewer, electric, gas |

| Skirting/Steps | $1,000-$5,000 | Material quality varies cost |

| Permits/Fees | $1,000-$5,000 | Locality-dependent |

When comparing double-wides to their single-wide cousins, the differences become clear. Single-wides might be easier on your wallet initially, but double-wides offer significantly more space and better resale potential:

| Feature | Single Wide | Double Wide |

|---|---|---|

| Size | 500-1,300 sq ft | 1,000-2,000+ sq ft |

| Average Price | $82,900 | $144,800 |

| Layout | Narrower, linear | Spacious, open concept |

| Bedrooms | 1-3 | 2-4+ |

| Bathrooms | 1-2 | 2-3+ |

| Resale Value | Lower | 20-50% higher than single-wide |

| Financing Options | More limited | More conventional options |

Up-Front & Hidden Costs to Budget For

When financing a new double wide, some expenses tend to sneak up on excited new homeowners. Let’s pull back the curtain on these “hidden” costs:

Those building permits? They’re non-negotiable and can run $1,000-$5,000 depending on your county. Your foundation choice matters too – not just for stability but for financing. Most traditional mortgage programs require a permanent foundation ($6,000-$15,000), with options ranging from concrete slabs to crawl spaces.

Don’t forget the finishing touches! Skirting (that material covering the space between your home and the ground) costs $1,000-$5,000 depending on whether you choose vinyl, metal, or brick. And your beautiful home needs to get to your property somehow—transport fees typically run $2,000-$5,000, with narrow roads or bridges potentially adding to that figure.

Tax considerations also differ from traditional homes. You’ll pay sales tax on your purchase in most states, plus annual property taxes that may be structured differently than for site-built homes. Insurance premiums also tend to run higher for manufactured homes, averaging $800-$1,200 annually.

“I see it all the time,” shares Nick Fanelli of Pleasant Valley Homes. “Excited buyers focus on the home price tag but forget that site preparation and utility connections often account for 30-40% of their total investment. Planning for these costs upfront prevents unpleasant surprises.”

Pros & Cons Every Buyer Should Weigh

Double-wides offer compelling advantages that make them increasingly popular. Affordability tops the list—at roughly half the cost per square foot of site-built homes, they make homeownership possible for many families. The efficient construction process means less waste, fewer weather delays, and dramatically shorter build times.

The customization options might surprise you. Today’s manufacturers offer numerous floor plans and finish options that let you personalize almost every aspect of your home. Modern double-wides also feature impressive energy efficiency, often meeting or exceeding the standards of comparable site-built homes.

Quality control is another significant benefit. Factory construction allows for consistent quality standards and multiple inspection points throughout the building process. And if you’re in a hurry, the speed from order to move-in (sometimes as little as 3-4 months) beats the typical 7-12 month timeline for traditional construction.

But let’s be realistic about potential challenges too. Financing a new double wide can be trickier than with site-built homes—fewer lenders offer manufactured home loans, and interest rates may be slightly higher. You’ll also need to either own or lease land, with leased land limiting some financing options.

Despite tremendous quality improvements, some communities and buyers still hold outdated perceptions about manufactured homes. You might also encounter zoning restrictions in certain areas. While not guaranteed, manufactured homes may face faster depreciation than site-built homes, especially on leased land. And while built to HUD standards, some models may have greater weather vulnerability than traditional construction.

“The depreciation concern is largely overblown,” explains Steve Sexton, financial expert. “When properly installed on a permanent foundation on owned land, manufactured homes can appreciate similarly to site-built homes in the same neighborhood. It’s all about location and maintenance—just like any home.”

Financing a New Double Wide: Loan Options, Eligibility & Rates

Finding the right financing for your dream double wide doesn’t have to feel like navigating a maze blindfolded. As someone who’s helped hundreds of families just like yours, I can tell you there’s a perfect financing solution waiting – we just need to find which path makes sense for your situation.

Financing a new double wide comes down to three main factors: your financial picture, the specifics of the home you’re eyeing, and whether you already own land or plan to lease. Let’s walk through your options together, just like I would if we were sitting at my desk in Laredo.

Traditional Mortgages for Financing a New Double Wide

If you’re looking for the most affordable long-term option (and who isn’t?), conventional mortgages typically offer the best rates and terms. Think of these as the “gold standard” for manufactured home financing.

To qualify, your double wide needs to check a few important boxes: built after June 1976 when the HUD Code went into effect, permanently installed on a proper foundation, all transportation equipment removed, and titled as real property (we’ll help with that paperwork!). The home also needs to be at least 400 square feet, which isn’t usually an issue with double wides.

The conventional mortgage landscape offers several excellent programs:

Fannie Mae Standard MH requires a 5% down payment, a credit score of at least 620, and your debt-to-income ratio shouldn’t exceed 43%. It’s straightforward and reliable.

Fannie Mae MH Advantage is my personal favorite for buyers who can swing it – with only 3% down required for homes that have site-built features like pitched roofs, drywall throughout, and energy-efficient appliances. You’ll still need that 620+ credit score.

Freddie Mac Home Possible works beautifully for families with modest incomes, requiring just 3% down but a slightly higher credit score of 680+.

The beauty of conventional mortgages is they offer terms up to 30 years (though cash-out refinancing is limited to 20 years), competitive interest rates typically 1-2% higher than traditional homes, and mortgage insurance that goes away once you reach 20% equity. Plus, you can finance both your home and land together – one payment, one loan, nice and simple.

As James from our Laredo office always tells clients, “Converting your manufactured home to real property is like finding money in your couch cushions – it’s a simple step that saves thousands over your loan’s lifetime.”

Government-backed loans provide even more options:

FHA Loans come in two flavors: Title I for the home only (up to $93,000 for a double-wide) or home and lot combined (up to $237,096); and Title II for home and land together with just 3.5% down if your credit score is 580+, or 10% down for scores between 500-579. The home must be your primary residence on a permanent foundation, though the mortgage insurance sticks around for the life of the loan.

VA Loans are a tremendous benefit for our veterans, active-duty service members, and surviving spouses. With 0% down payment options and competitive rates, they’ve helped countless military families achieve homeownership. Your double wide will need to be at least 700 square feet and permanently installed on land you own.

USDA Loans work wonderfully for properties in rural areas (which is more places than you might think!). If your household income is within 115% of your area’s median income, you might qualify for 0% down. Like VA loans, the home must be on a permanent foundation on owned land.

One thing to note: cash-out refinancing for manufactured homes is typically limited to 65% loan-to-value ratio, compared to 80-85% for site-built homes. It’s just one of those industry quirks we work with.

Chattel & Alt-Loans for Financing a New Double Wide

Sometimes life doesn’t fit neatly into the conventional mortgage box. Maybe you’re placing your double wide on family land or in a manufactured home community. This is where chattel loans and alternative financing shine.

Chattel loans finance just the home as personal property (similar to how car loans work). They’re particularly useful when:

- You’re placing your home on leased land

- You own land but prefer to keep it separate from your home financing

- You need to close faster than a traditional mortgage allows

Chattel loans typically require credit scores between 575-660+, down payments from 5-20%, and carry interest rates between 8-12% (sometimes higher). They offer shorter terms (usually 15-25 years) but approve much faster – often days instead of weeks – with less paperwork than traditional mortgages.

As Maria, our financing specialist, often says, “Chattel loans aren’t the villain some make them out to be. They’re simply a different tool in our toolbox that helps many families achieve homeownership when traditional routes aren’t available.”

FHA Title I Loans are government-backed chattel loans worth considering. They can finance just the home or both home and lot, with maximum loan amounts of $193,719 for your double-wide and lot. If you’re using leased land, you’ll need at least a 3-year lease. Down payments start around 5%, and terms extend up to 20 years.

For buyers with stellar credit or those needing smaller loan amounts, personal loans offer flexibility with no collateral requirements, no appraisal or foundation requirements, and quick approval. The trade-off? Higher interest rates (12-36% typically) and shorter terms (usually 5-7 years) with maximum loan amounts generally between $25,000-$100,000.

Can You Bundle Home & Land or Finance Home-Only?

When financing a new double wide, you have options for handling the home and land portion of your purchase:

Bundling home and land together through traditional mortgages (conventional, FHA, VA, USDA) typically offers the best overall value: lower interest rates, longer terms up to 30 years, potential tax benefits through mortgage interest deductions, better appreciation potential, and the simplicity of a single payment covering both assets.

Home-only financing makes sense in specific situations: when you already own your land free and clear, when you’re placing your home on leased land, or when you’re purchasing land separately through another arrangement.

Here’s a smart strategy many of our clients use: leveraging existing land equity. If you already own land, you may be able to use its value toward your down payment, potentially reducing or eliminating your out-of-pocket costs while improving your loan-to-value ratio for better terms.

For homes going on leased land, lenders typically require certain protections: a minimum 3-year initial lease, 180-day termination notice requirements, renewable lease terms, and clear rights to cure any lease defaults.

As we often tell our clients at Manufactured Housing Consultants, “The best financing solution isn’t always the most obvious one. By understanding all your options, we can find the path that saves you the most money while getting you into your dream home faster.”

According to the Manufactured Housing Institute, manufactured homes represent nearly 10% of new single-family home starts – a testament to their growing popularity as an affordable, quality housing solution. For more detailed statistics and industry insights, check out the Manufactured Housing Institute’s Quick Facts.

Ready to explore which financing option for your new double wide makes the most sense for your situation? Our team at Manufactured Housing Consultants is just a phone call away.

Application Checklist & Pre-Closing Steps

Ready to make your double wide dreams a reality? Financing a new double wide requires some paperwork prep, but don’t worry—we’ll walk you through everything you need.

Think of your loan application as telling your financial story. You’ll need to gather personal identification (your driver’s license and Social Security card), along with proof of income through W-2s, pay stubs, and tax returns from the past two years. Your lender will also want to see recent bank statements to verify you have funds for the down payment and closing costs.

“The biggest hurdle I see is when buyers aren’t prepared with their documentation,” says Maria Sanchez, loan specialist at Manufactured Housing Consultants. “Having everything organized from the start can cut weeks off your approval timeline.”

Beyond your personal finances, you’ll need paperwork related to your new home and where it will sit. This includes your purchase agreement, the home’s specifications, and a site plan showing exactly where your double wide will be placed. If you’re buying an existing home rather than ordering new, be sure to locate the HUD data plate and certification labels—these verify the home meets federal safety standards and are absolute must-haves for lenders.

The journey from application to moving day typically follows ten steps: pre-qualification, home selection, land acquisition, formal application, appraisal, underwriting, conditional approval, closing preparation, closing, and funding. Each step builds on the last, creating a clear path to homeownership.

Don’t be surprised if your lender requests additional information during underwriting—this is completely normal! They might ask for letters explaining credit issues or additional proof of income. Quick responses to these requests keep your loan moving forward smoothly.

Converting Your Double Wide to Real Property

Want to access the best interest rates? You’ll need to convert your double wide from personal property (like a vehicle) to real property (like a traditional home). This simple but crucial process can save you thousands in interest over your loan term.

Start by installing your home on a permanent foundation that meets FHA/HUD requirements—usually a concrete slab, pier and beam system, or crawl space. Once secured, you’ll need to remove all mobile elements including wheels, axles, and hitches. These parts aren’t just removed; they’re surrendered as part of the conversion process.

Next, connect your home to permanent utilities and file an affixation affidavit with your county recorder’s office. This legal document declares your intent to make the home a permanent structure. The final step involves surrendering any vehicle title to your state’s motor vehicle department and ensuring the county assessor records your home as real property for tax purposes.

“Converting to real property is like open uping a treasure chest of better loan options,” explains Thomas Rivera at Manufactured Housing Consultants. “The process might seem tedious, but the financial benefits make it well worth the effort.”

Credit Boost & Down Payment Hacks

With approval rates for manufactured home loans hovering around 30% (compared to 70% for traditional homes), giving yourself every advantage matters. Your credit score is the golden ticket to better rates and terms, so aim for at least 620 for conventional loans—though 680+ will open up the best offers.

Before applying, focus on paying down revolving debt below 30% of your available credit. This quick move can boost your score significantly in just a few billing cycles. Also, resist the temptation to open new credit cards or auto loans while your home loan is in process—even after approval but before closing. New inquiries can derail your loan at the last minute.

If your credit needs more than a quick fix, consider Manufactured Housing Consultants’ FICO Score Improvement Program. Their custom approach has helped countless buyers qualify for better rates, sometimes saving tens of thousands over the life of a loan.

For down payments, you have more options than you might think. Most people know about the standard requirements—3.5% down for FHA loans with good credit, 5% for conventional loans—but there are creative approaches too. Family members can often contribute gift funds toward your down payment. If you already own your land, its equity can count toward your requirement, potentially eliminating the need for cash down payment altogether.

Many states also offer down payment assistance specifically for manufactured housing buyers. These programs can provide grants or low-interest second mortgages to help cover your initial costs. Don’t overlook manufacturer incentives either—some offer closing cost credits or special financing terms that reduce your out-of-pocket expenses.

Site Prep Tips Lenders Love

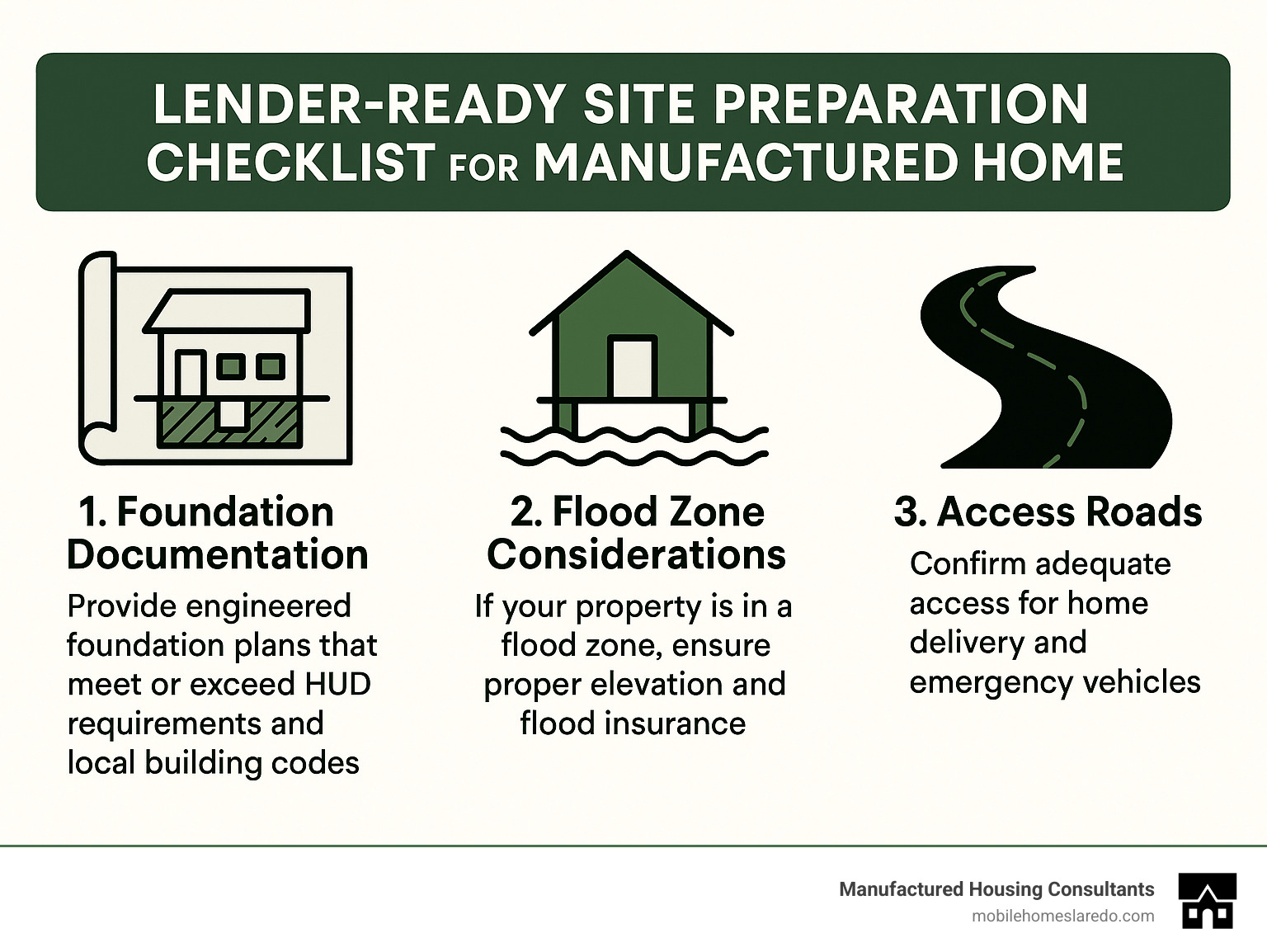

Your land preparation speaks volumes to lenders about how well you’ll maintain their investment. A properly prepared site not only ensures your home’s longevity but also smooths the path to financing a new double wide.

Start with professional foundation plans that meet or exceed HUD requirements. These engineered drawings show lenders you’re serious about a permanent installation. If your property sits in a flood zone, address elevation requirements early—waiting until after loan application can cause costly delays.

“I’ve seen loans fall apart at the last minute because the site wasn’t ready,” notes Carlos Mendez, site preparation specialist. “Lenders want confidence that your home will be safely and properly installed according to all local codes.”

Access roads matter more than you might think. Your delivery team needs to get a massive double wide to your property, and emergency vehicles must be able to reach your home after installation. Clear documentation of adequate access reassures lenders about both delivery and long-term safety.

Utility connections should be either in place or clearly planned before loan application. This includes water, sewer/septic, electric, and gas hookups. Having permits in hand for these connections signals to lenders that you’ve steerd local regulations successfully.

Proper drainage might seem like a minor detail, but it’s a major concern for lenders. Water pooling around your foundation can cause structural issues down the road. Simple grading that directs water away from your home site can prevent future problems and satisfy lender requirements.

With all site prep elements in place and well-documented, you’ll present yourself as a prepared, responsible borrower—exactly the kind lenders are eager to work with. For more detailed guidance, check out our Mobile Home Loan Application Step-by-Step Guide.

Conclusion & Next Steps

The journey to financing a new double wide home might seem complex at first glance, but it’s absolutely worth the effort. When you finally hold those keys in your hand (like the happy homeowners in the photo above!), you’ll join thousands of Texans who’ve finded the perfect balance of affordability, space, and quality.

Throughout this guide, we’ve walked through everything from loan options to site preparation, giving you the roadmap to steer what can sometimes feel like unfamiliar territory. The beauty of manufactured housing lies in its accessibility – offering a genuine path to homeownership when traditional housing markets might seem out of reach.

Permanent foundation we talked about? It’s truly the cornerstone of favorable financing. By properly installing your home and converting it to real property, you open up conventional mortgage options with their attractive rates and longer terms. Your credit score matters tremendously too – aim for that magic 620+ number to access the best rates and most flexible options.

Don’t rush your financing decision! We’ve seen too many families accept the first loan offered, only to find later they could have saved thousands with a different lender or loan type. Take your time to compare rates, terms, and requirements – a few extra days of research can lead to years of savings.

When budgeting for your new double wide, think beyond just the sticker price. Land costs, site preparation, delivery fees, utility connections – these expenses add up quickly but are essential parts of creating your perfect home. Planning for these from the beginning prevents unpleasant surprises down the road.

Here at Manufactured Housing Consultants, we’ve helped countless Texas families steer this process. Our team understands the unique challenges and opportunities in manufactured home financing because it’s what we do every day. We pride ourselves on offering the lowest guaranteed prices on double-wides from 11 top manufacturers, paired with specialized financing solutions custom to your specific situation.

Our FICO Score Improvement Program has been particularly helpful for families who need a little boost to qualify for better rates. We’ve seen clients improve their scores by 30+ points in just a few months, opening doors to financing options they didn’t think possible.

Ready to take that exciting next step? We’d love to show you our selection of beautiful, modern double-wides and help you secure financing that makes sense for your budget and dreams. Our Laredo office welcomes visitors who want to see floor plans and discuss options in person, or you can start the process online today.

Learn more about Mobile Home Financing and begin your journey to affordable homeownership with experts who truly understand manufactured housing.

Your double-wide dream home is closer than you think – let’s make it happen together!