Manufactured housing loans can be your key to homeownership, especially in today’s tight housing market. With housing shortages across the nation, many are turning to manufactured homes as a smart, affordable solution. Whether you’re buying a new place to call home or refinancing, there are several financing options available to suit varying needs.

Here’s a quick dive into what you need to know:

-

Understanding Manufactured Housing Loans

- Manufactured homes offer a cost-effective path to owning a home.

- Loans can be classified into various types like real property, personal property, and chattel mortgage.

-

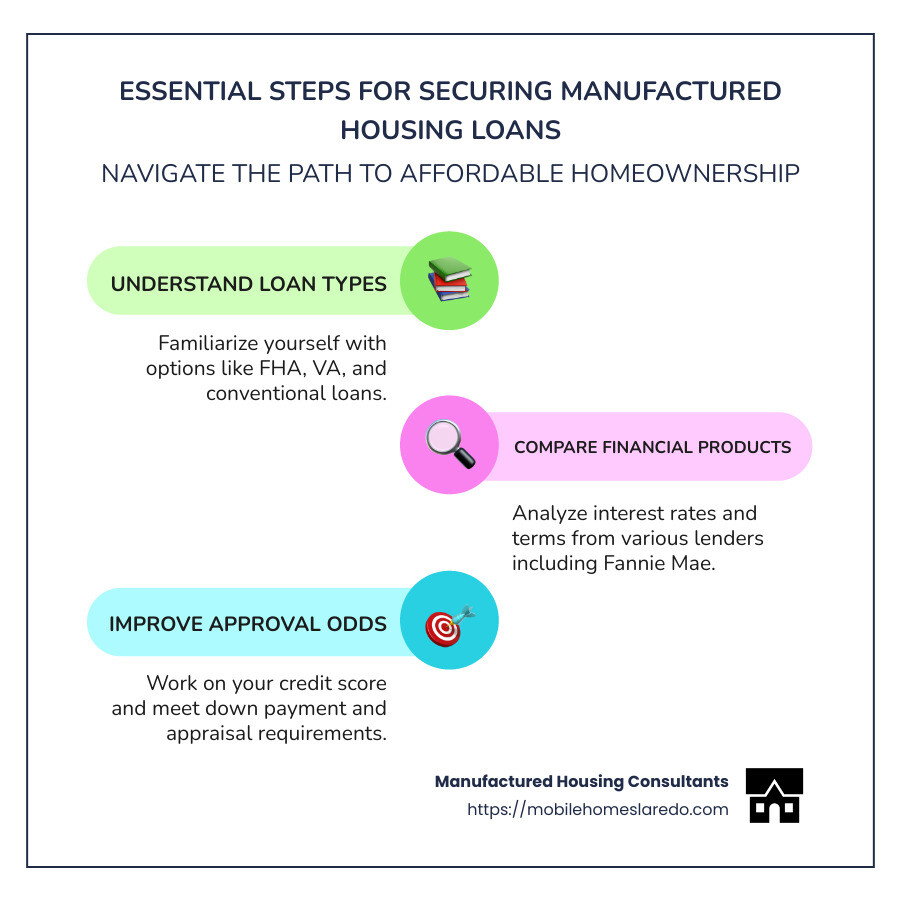

Key Loan Products

- FHA Loans: These loans often require lower down payments.

- VA Loans: Available to qualifying veterans with no down payment.

- Conventional Loans: May have stricter credit requirements but are available.

-

Financing Challenges

- Approval can be tough, especially with less-than-perfect credit.

- Approximately 54% of manufactured home financing applications get denied, according to research.

-

Finding the Right Loan

- Compare interest rates and terms from various lenders.

- Consider options like Fannie Mae and USDA loans for better terms.

Many Texans, like Maria, are seeking expert guidance to steer these options and find a home that fits their lifestyle and budget. With the right approach, manufactured housing might just be the affordable, attractive solution you’ve been searching for.

Understanding Manufactured Housing Loans

When it comes to manufactured housing loans, understanding the different types and terms is crucial. Let’s break it down.

Loan Types and Terms

Real Property vs. Personal Property

Manufactured homes can be classified as either real property or personal property. If the home is permanently affixed to land you own, it can be considered real property. This typically allows you to qualify for more traditional mortgage options. On the other hand, if your manufactured home is on rented land or is movable, it is considered personal property.

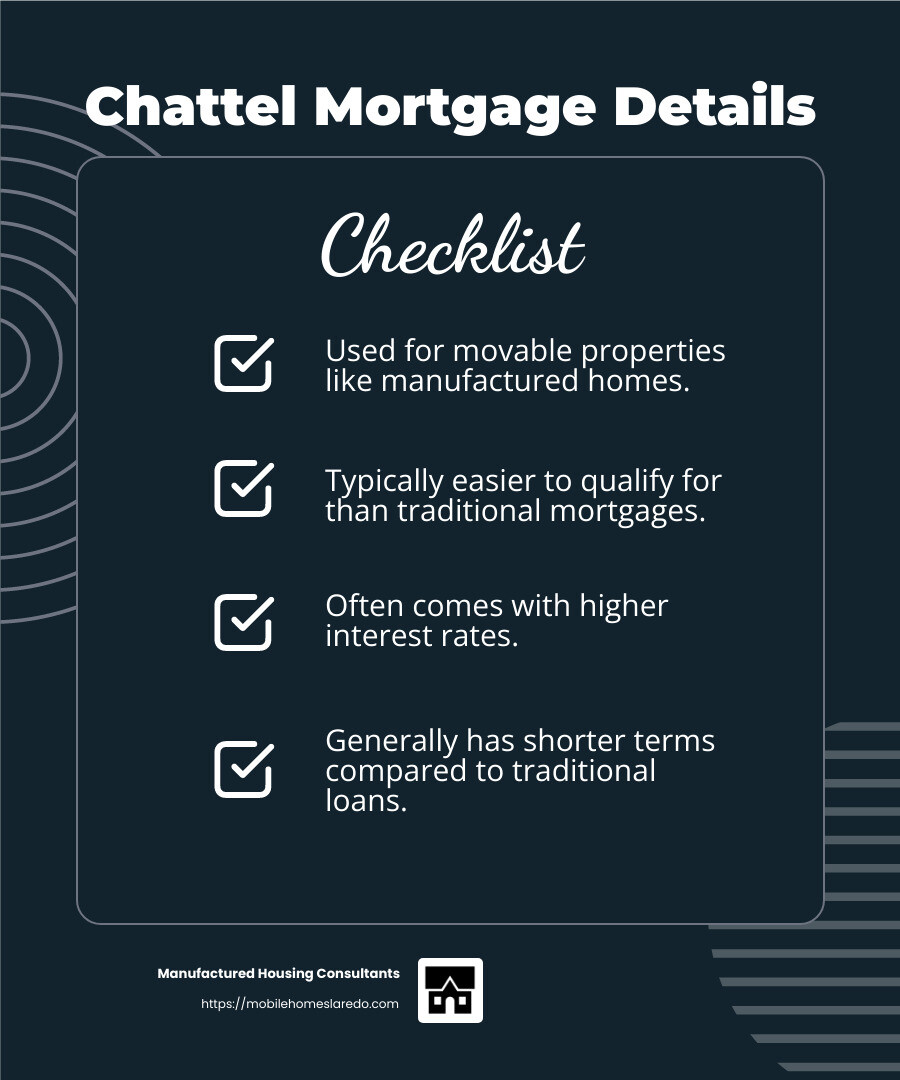

Chattel Mortgage

For homes classified as personal property, a chattel mortgage might be your go-to option. These loans are specifically for movable properties like manufactured homes. While they can be easier to qualify for, they often come with higher interest rates and shorter terms compared to traditional mortgages.

FHA Loans

The Federal Housing Administration (FHA) offers loans that are popular among manufactured home buyers. With lower down payment requirements and flexible terms, they’re an attractive option. The FHA Title I program specifically caters to those buying just the manufactured home without the land.

VA Loans

For veterans, VA loans are a fantastic option. They often come with no down payment and competitive interest rates, making them accessible and affordable.

USDA Loans

If you’re purchasing in a rural area, USDA loans might be available. They offer favorable terms similar to FHA loans, with the added benefit of targeting rural development.

Conventional Loans

These loans are available for manufactured homes but tend to have stricter credit score requirements. If you have excellent credit, this could be a viable choice.

Financing Options for Manufactured Homes

FHA Title I

This program is custom for those buying a manufactured home without the land. It’s a great option if you’re placing your home on a leased lot.

Fannie Mae

Fannie Mae offers specialized financing for manufactured homes, including options like MH Advantage, which provides terms similar to site-built homes. This can be a great path if you’re looking for more traditional financing structures.

Loan-to-Value Ratio

The loan-to-value (LTV) ratio is a key factor in financing. It compares the loan amount to the appraised value of the home. A lower LTV means less risk for the lender, potentially resulting in better terms for you.

Cash-Out Refinancing

If you already own a manufactured home, cash-out refinancing allows you to convert home equity into cash. It’s a useful option if you need funds for renovations or other expenses.

Navigating manufactured housing loans can be complex, but with the right information, you can find the best option to suit your needs. Next, we’ll explore how to steer the loan process effectively.

Navigating the Loan Process

Getting a manufactured housing loan can be a smooth journey if you know what to expect. Let’s explore some common challenges and tips to help you secure your loan.

Overcoming Common Challenges

Eligibility Criteria

Lenders look at several factors before approving a loan. Your credit score, income, and job stability are key. A solid credit score (usually 620 or higher) can open up better loan terms. But even with a lower score, having a stable job can tip the scales in your favor.

Down Payment

Most loans require a down payment. For FHA loans, you might need as little as 3.5%. If you can afford it, a larger down payment can lower your monthly payments and interest rate.

Appraisal Requirements

An appraisal determines your home’s value. It’s crucial for the lender to ensure the loan amount is appropriate. Be prepared for this step, especially if your home is older or has been moved before.

Land Ownership

Owning the land where your home sits can simplify financing. It allows your home to be classified as real property, opening doors to better loan options. If you’re leasing, make sure the lease is long-term to satisfy lender requirements.

Depreciation

Manufactured homes can depreciate like vehicles. This affects the loan-to-value ratio, which compares the loan amount to the home’s value. A low LTV is favorable for lenders, so maintaining or improving your home’s condition is important.

Lender Security

Lenders need assurance that they’ll recover their investment. This is why homes on rented land might face stricter terms. Demonstrating stability, like a long-term lease, can ease lender concerns.

Leased Lots

If you’re placing your home on a leased lot, ensure the lease is secure and long enough (typically at least three years). This protects you and satisfies lender requirements.

Tips for Securing a Loan

Credit Improvement

Boosting your credit score can lead to better loan offers. Pay bills on time, reduce debt, and regularly check your credit report for errors. Small improvements can make a big difference.

Homeownership Education

Some loans, especially those with high LTVs, require homeownership education. Programs like Fannie Mae’s HomeView® can guide you through the process and help you qualify for better terms.

Temporary Interest Rate Buydowns

Consider temporary interest rate buydowns to lower initial payments. This can make the loan more affordable in the early years and is available for many loan types, including FHA and Fannie Mae.

Navigating the loan process for manufactured homes doesn’t have to be daunting. With the right preparation and understanding, you can overcome challenges and secure a loan that fits your needs. Next, we’ll explore some final thoughts and how Manufactured Housing Consultants can assist you in achieving affordable homeownership.

Conclusion

At Manufactured Housing Consultants, we understand that navigating manufactured housing loans can be challenging. That’s why we’re committed to making the process as smooth and accessible as possible for everyone. Our goal is to help you achieve affordable homeownership with specialized financing options custom to your needs.

Affordable Homeownership

Manufactured homes offer a viable path to homeownership, especially in today’s market where traditional homes can be out of reach for many. With the average price of a manufactured home significantly lower than that of site-built homes, you can find a home that fits your budget and lifestyle. Our team is here to guide you through each step, ensuring you have access to the best options available.

Specialized Financing

We offer a range of financing solutions to accommodate all credit types. Whether you’re looking for FHA, VA, or conventional loans, our partnerships with lenders who specialize in manufactured housing loans mean we can help you find the right fit. Our expertise allows us to steer the complexities of these loans, ensuring you benefit from competitive terms and rates.

FICO Score Improvement Program

Credit score concerns? We’ve got you covered with our FICO Score Improvement Program. This initiative is designed to boost your credit score, making it easier for you to qualify for better loan terms. Through personalized plans and expert guidance, we work with you to improve your credit profile, leading to lower down payments and interest rates.

At Manufactured Housing Consultants, we’re more than just a dealership; we’re your partners in the journey to affordable homeownership. Whether you’re a first-time buyer or looking to upgrade, we’re here to support you with the lowest prices and a wide selection of homes. Ready to take the next step? Explore our financing options and let us help you find your dream home today.