The Real Cost of Financing Your Manufactured Home

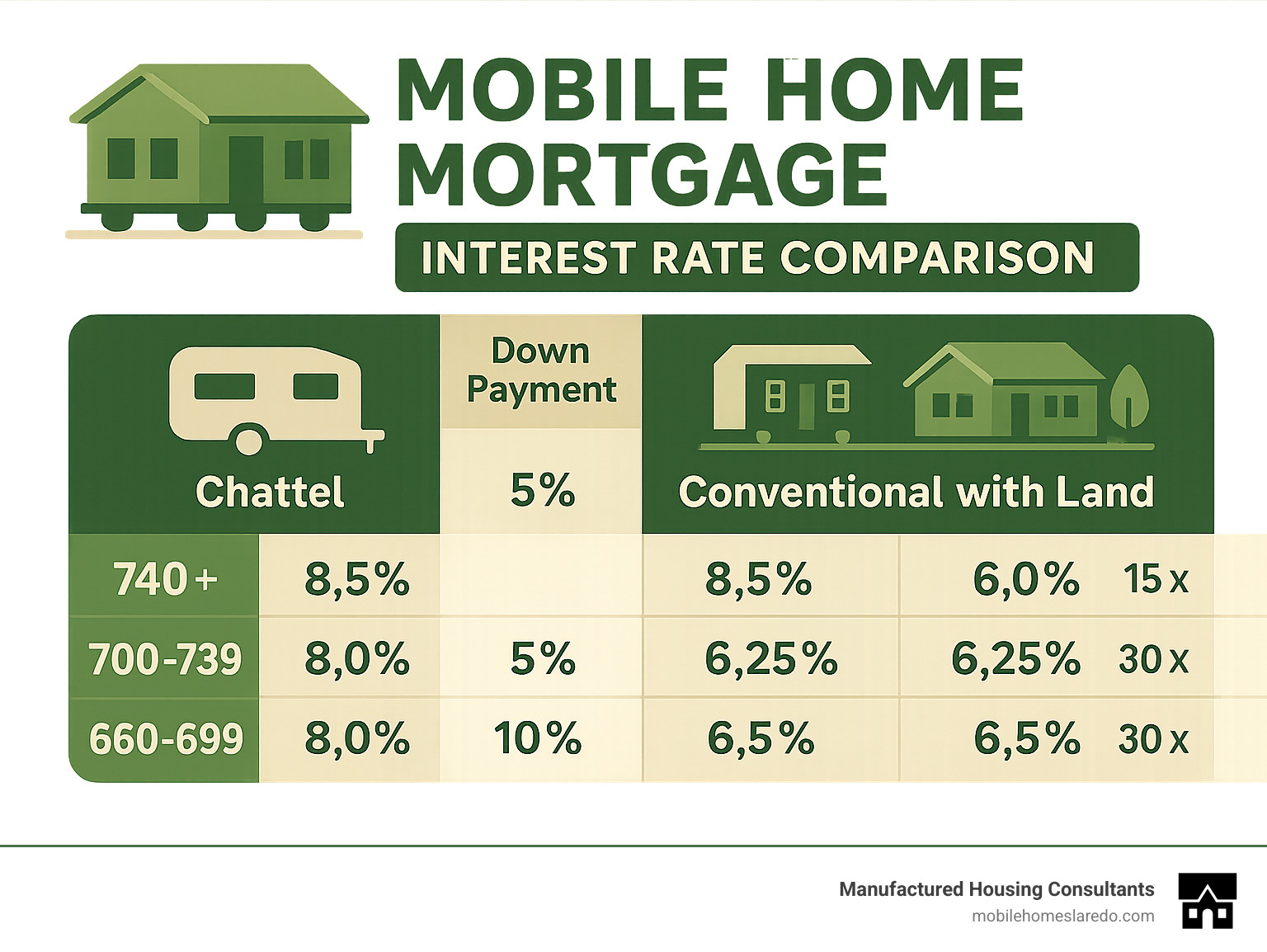

Mobile home mortgage interest rates typically range from 6% to 14% in 2024, with significant variations based on loan type and borrower qualifications:

| Loan Type | Current Rate Range | Typical Terms | Min. Credit Score |

|---|---|---|---|

| Chattel Loans | 8-14% | 15-20 years | 575+ |

| Conventional with Land | 6.5-7.5% | Up to 30 years | 620+ |

| FHA with Land | 6-7% | Up to 30 years | 580+ |

| VA with Land | 6-7% | Up to 30 years | No min |

| USDA with Land | 6-7% | Up to 30 years | 640+ |

When Maria first called our office in Laredo, she was shocked to find the 10% interest rate quote she’d received on her mobile home loan wasn’t unusual. “I thought I was being taken advantage of,” she told us. “I had no idea manufactured homes had such different financing than regular houses.”

Maria’s experience is common. The path to affordable manufactured housing is filled with financial surprises for first-time buyers.

The truth is that mobile home mortgage interest rates are substantially higher than those for traditional site-built homes. This isn’t because lenders want to penalize manufactured homeowners – it’s due to fundamental differences in how these properties are classified, financed, and how they hold value over time.

For many Texans facing a challenging housing market, manufactured homes offer an affordable path to homeownership. But understanding the financing landscape is crucial to making a smart investment.

The biggest factor affecting your rate? Whether you own the land underneath your home. Mobile homes on leased land typically require chattel loans with rates 2-5 percentage points higher than conventional mortgages for homes on owned land.

Your credit score, down payment, and the age of the manufactured home also significantly impact your interest rate. Buyers with scores above 740 and down payments of 20% or more can secure rates closest to traditional mortgages.

Mobile home mortgage interest rates further reading:

Understanding Mobile Home Mortgage Interest Rates

When you’re shopping for a manufactured home, the interest rate on your loan can feel like a mysterious number that someone just made up. But there’s real science behind these rates, and understanding the basics can save you thousands over the life of your loan.

Interest rates are simply the cost of borrowing money, shown as a percentage of your loan amount. Think of it as the “rent” you pay to use the lender’s money.

“Most folks who walk through our Laredo office door have the same first question,” says our senior loan specialist. “They want to know why the rate for their dream manufactured home is higher than what their cousin got on their brick-and-mortar house last year.”

Let’s break down the two main types of rates you’ll encounter:

Fixed-rate mortgages keep the same interest rate from your first payment to your last. Your monthly payment stays predictable – a real comfort when you’re budgeting for the long haul.

Adjustable-rate mortgages (ARMs) typically start with a lower fixed rate for 3, 5, or 7 years, then adjust periodically based on market conditions. These can save money initially but carry more uncertainty down the road.

When comparing loans, look beyond the basic interest rate to the Annual Percentage Rate (APR). This more comprehensive number includes both the interest rate and other loan costs, giving you a clearer picture of what you’ll actually pay.

One crucial detail: All manufactured homes built after June 15, 1976, must comply with the HUD code standards. This date matters tremendously for financing – homes built before this date are considered “mobile homes” rather than manufactured homes and often face higher rates or financing challenges.

2024 Snapshot: Current mobile home mortgage interest rates

As of spring 2024, here’s what the mobile home mortgage interest rates landscape looks like:

Chattel loans (when you’re just financing the home itself) typically range from 8% to 14%, with current averages around 10.24% for 30-year terms and 9.93% for 15-year terms.

If you’re buying both the land and the home, you’ll see much better rates – conventional loans are averaging around 6.94% for a 30-year fixed rate, while government-backed loans (FHA, VA, USDA) run about 6% to 7%.

Here in Laredo, our rates generally match the Texas state averages, though we’ve noticed clients in very rural areas sometimes face slightly higher rates due to perceived market risk.

Looking ahead, most financial analysts expect rates to remain relatively stable through 2024, with possible modest decreases if inflation continues to cool. But as we always tell our clients – trying to perfectly time the market is like trying to catch rain in a bucket during a thunderstorm. Sometimes it’s better to focus on what you can control.

Comparing Rates: Mobile vs Site-Built Mortgages

“I don’t understand why I’m paying so much more interest than my brother who bought a regular house!” This frustration comes up almost daily in our conversations with Laredo homebuyers.

The reality is that lenders view manufactured housing as carrying more risk. Historically, these homes depreciated faster than site-built homes (though modern manufactured homes hold value much better than their predecessors). Plus, when a home isn’t permanently attached to land, it’s considered personal property rather than real estate – another risk factor in lenders’ eyes.

The difference? Typically 1 to 3 percentage points higher for manufactured homes, with the gap widening significantly for chattel loans.

Let’s see what this means in real dollars for a $150,000 loan:

| Home Type | Interest Rate | Monthly Payment (30yr) | Total Interest Paid |

|---|---|---|---|

| Site-Built | 6.5% | $948 | $191,280 |

| Manufactured with Land | 7.5% | $1,048 | $227,280 |

| Manufactured without Land (Chattel) | 10.5% | $1,356 | $338,160 |

That difference in total interest between a site-built home and a chattel-financed manufactured home exceeds $146,000 – nearly the entire original loan amount!

But here’s the silver lining many buyers miss: the upfront savings on manufactured housing (often 20-50% less than comparable site-built homes) can offset these higher interest costs, especially if you plan to refinance when conditions improve.

Key Factors That Move Rates

Your mobile home mortgage interest rates aren’t set in stone. Several factors can push them higher or lower:

Credit score is perhaps the most powerful lever. Scores above 740 typically secure the best rates, while scores below 620 face significantly higher rates or limited options. “We’ve seen clients improve their rate by more than 2 percentage points just by working on their credit score,” notes our financing specialist. “That’s why our FICO Score Improvement Program has been such a game-changer for many Texas families.”

Down payment size matters too. Putting down 20% or more reduces the lender’s risk and typically results in lower interest rates. Some loans for well-qualified buyers allow down payments as low as 3% (conventional) or even 0% (VA, USDA).

Home age and condition affect rates because newer homes (less than 15 years old) generally qualify for better financing. Homes built after 1976 (HUD-code compliant) are essential for most traditional financing options.

Loan term influences rates as well – shorter terms (15 years vs. 30 years) typically offer lower interest rates but higher monthly payments.

Land ownership might be the biggest factor of all. Owning the land beneath your manufactured home allows access to traditional mortgages with substantially lower rates compared to chattel loans.

Debt-to-income ratio calculations matter to lenders. They prefer DTI ratios below 43%, with the best rates often going to borrowers below 36%.

Market indices beyond your control, including Federal Reserve policy, inflation rates, and bond markets, influence the baseline for all mortgage rates.

Chattel Loans vs Traditional Mortgages

When financing a manufactured home, the path you take makes an enormous difference in what you’ll pay:

Chattel Loans finance just the home itself, treating it as personal property (similar to a vehicle). They typically carry interest rates between 8% and 14% and have shorter terms, usually maxing out at 15-20 years. The upside? They process faster with fewer closing costs and may have less stringent credit requirements. The downside? Higher rates and limited refinancing options down the road.

Traditional Mortgages finance both the home and land together, treating the property as real estate. They offer interest rates much closer to site-built homes (6-7.5%) and allow longer terms (up to 30 years). They do involve more extensive underwriting and closing costs, and they require the home to be on a permanent foundation, but they provide much more refinancing flexibility.

Carlos, who recently visited our Laredo office, shares his experience: “I almost went with a chattel loan because the process seemed simpler. But when I ran the numbers, I realized that buying a small plot of land and using a conventional mortgage saved me over $300 monthly for the same manufactured home.”

The difference can be dramatic. For a $100,000 loan:

- 15-year chattel loan at 10.5%: $1,097 monthly payment

- 30-year traditional mortgage at 7%: $665 monthly payment

That $432 monthly savings can make homeownership significantly more affordable for many Texas families, even accounting for the longer payment period.

Land Ownership: Own vs Lease Impact on Rates

Whether you own the land underneath your manufactured home has perhaps the most significant impact on your mobile home mortgage interest rates and financing options.

When you own the land, you open up a world of financial advantages. You can qualify for traditional mortgage financing (conventional, FHA, VA, USDA) with interest rates typically 2-5 percentage points lower than chattel loans. The home must be on a permanent foundation, and you’ll need to “eliminate” or “cancel” the title to convert the home to real property. Both the land and home can appreciate in value over time, you’re protected from lot rent increases, and you have more control over your property.

When you lease the land in a manufactured home community, your options narrow considerably. You’ll likely need a chattel loan with substantially higher interest rates (8-14%) and shorter loan terms (15-20 years maximum). You remain vulnerable to lot rent increases, the home alone typically depreciates over time, and you have less control over community rules and changes.

“The financial difference is striking,” explains our housing consultant. “A client purchasing a $75,000 manufactured home on leased land might pay $900 monthly on the loan plus $500 in lot rent. That same client buying the home with land might pay $800 total with a conventional mortgage, build equity in both assets, and avoid future lot rent increases.”

For more information on how land ownership affects your options, visit our guide on Mortgage Rates for Manufactured Homes.

How to Secure the Best Mobile Home Mortgage Interest Rates

Securing the most favorable mobile home mortgage interest rates requires strategy and preparation. Here’s how to approach the process:

-

Shop Multiple Lenders: Rates can vary by 0.5% or more between lenders for the same loan type. Gather at least 3-5 quotes.

-

Time Your Rate Lock: Once you find a favorable rate, consider locking it. Rate locks typically last 30-60 days, though some lenders offer 120-day locks for manufactured homes.

-

Consider Float-Down Options: Some lenders offer “float-down” provisions that allow you to secure a lower rate if market rates drop during your lock period.

-

Improve Your Financial Profile: Even small improvements to your credit score, debt-to-income ratio, or down payment amount can yield significant rate reductions.

-

Consider Buying Points: Paying discount points (1% of loan amount per point) upfront can lower your interest rate, which may be worthwhile if you plan to keep the loan long-term.

The Consumer Financial Protection Bureau’s report on manufactured housing finance confirms that manufactured home loan applicants often receive fewer quotes and higher rates than site-built home buyers. Being proactive and well-informed can help overcome this disparity.

Loan Types & Terms at a Glance

Various loan programs are available for manufactured homes, each with different terms and requirements:

FHA Title I Loans:

- For manufactured homes only (no land required)

- Maximum loan amount: $69,678 for single-wide, $133,324 for double-wide

- Terms up to 20 years

- Minimum 3.5% down payment with 580+ credit score

- Requires mortgage insurance premium

FHA Title II Loans:

- For manufactured homes with land

- Higher loan limits based on county

- Terms up to 30 years

- Minimum 3.5% down payment with 580+ credit score

- Requires both upfront and annual mortgage insurance

VA Loans:

- For eligible veterans, service members, and surviving spouses

- Can finance manufactured homes with or without land

- Terms up to 25 years (with land)

- No down payment required

- No minimum credit score (though lenders typically want 620+)

- Funding fee required (unless exempt)

USDA Loans:

- For manufactured homes in eligible rural areas

- Must include land and be on permanent foundation

- Terms up to 30 years

- No down payment required

- Minimum 640 credit score typically required

- Guarantee fee and annual fee apply

Conventional Loans:

- Standard: For manufactured homes on permanent foundations

- MH Advantage (Fannie Mae): For homes with specific features resembling site-built homes

- CHOICEHome (Freddie Mac): Similar to MH Advantage

- Terms up to 30 years

- Down payments as low as 3% for qualified buyers

- Minimum 620 credit score (better rates at 740+)

Personal Loans:

- Unsecured loans based on creditworthiness

- Significantly higher interest rates (often 10-36%)

- Shorter terms (typically 7 years maximum)

- Faster approval process

- No home-specific requirements

“In Texas, particularly around Laredo, we’ve seen USDA loans become increasingly popular for manufactured homes due to the rural designation of many areas and the no-down-payment benefit,” notes our financing specialist.

Credit Score & Down Payment Sweet Spots

Your credit score and down payment amount create a powerful combination that significantly impacts your mobile home mortgage interest rates. Here are the key thresholds to aim for:

Credit Score Tiers:

- 740+: Best rates across all loan types

- 700-739: Good rates with minimal rate adjustments

- 660-699: Moderate rate increases

- 620-659: Higher rates, but still eligible for most conventional loans

- 580-619: Limited to FHA and some specialized programs

- Below 580: Limited options, significantly higher rates

Down Payment Impact:

- 20%+: Best rates, avoids mortgage insurance on conventional loans

- 10-19%: Good rates, but requires mortgage insurance on conventional loans

- 5-9%: Moderate rate increase, higher mortgage insurance

- 3-4%: Available for some conventional and FHA loans, higher rates

- 0%: Available for VA and USDA loans for qualified borrowers

At Manufactured Housing Consultants, our FICO Score Improvement Program has helped many Texas families achieve significant rate reductions. For instance, Maria from Laredo improved her score from 615 to 680 over six months, qualifying for a rate 1.75% lower than her initial quote—saving over $30,000 in interest on her manufactured home loan.

For buyers with limited credit history or scores below 575, we often recommend our equity programs that allow higher down payments (typically 35%) to secure financing.

Government-Backed Programs & Special Lenders

Several government-backed programs and specialized lenders offer competitive mobile home mortgage interest rates:

FHA Loans remain one of the most accessible options for manufactured home buyers with moderate credit. With down payments as low as 3.5% for credit scores of 580+, these loans are particularly valuable for first-time homebuyers in Texas.

VA Loans offer perhaps the best terms for eligible veterans and service members, with no down payment requirement and competitive interest rates. These loans can be used for manufactured homes on owned land with a permanent foundation.

USDA Rural Development Loans provide 100% financing for manufactured homes in qualifying rural areas, which includes many regions around Laredo and throughout Texas. Income limits apply, but they’re often generous enough to accommodate middle-income families.

Some state housing finance agencies also offer specialized programs. While Texas doesn’t have a dedicated manufactured housing program like New York’s SONYMA (which offers 30-year fixed rates, 3% down payments, and 120-day rate locks), the Texas Department of Housing and Community Affairs does offer some assistance programs that can be used with manufactured housing.

Credit unions often provide more favorable terms for manufactured housing than traditional banks. Their member-focused approach sometimes translates to more flexible underwriting and lower rates, particularly for members with established relationships.

“We’ve helped many clients in Laredo connect with credit unions offering rates 0.5-0.75% lower than national lenders for the same manufactured home loan,” shares our housing consultant.

Negotiating the Lowest mobile home mortgage interest rates

Contrary to what many buyers believe, mobile home mortgage interest rates are often negotiable. Here’s how to strengthen your position:

-

Shop Within a 14-Day Window: Multiple credit inquiries for mortgage loans within a 14-day period count as a single inquiry on your credit report, allowing you to compare offers without penalty.

-

Compare APR, Not Just Interest Rate: The Annual Percentage Rate includes fees and gives a more accurate picture of your total cost.

-

Use Competing Offers as Leverage: Lenders may match or beat competitors’ rates to win your business.

-

Consider Discount Points: Paying points upfront (1% of loan amount per point) can lower your rate, which may be worthwhile if you’ll keep the loan long-term.

-

Ask About No-Refi Rate Drops: Some lenders offer programs that allow you to reduce your rate if market rates fall, without going through a full refinance.

-

Timing Matters: Rates can fluctuate daily. If possible, time your application when rates are trending downward.

A client in Laredo recently saved 0.625% on their manufactured home loan simply by presenting a competing offer to their preferred lender, who then matched the rate to keep their business. This small negotiation saved them over $15,000 over the life of their loan.

Working with a broker versus a direct lender has pros and cons. Brokers can shop multiple lenders simultaneously but may add fees. Direct lenders might offer streamlined processing but limited options. At Manufactured Housing Consultants, we help clients evaluate both paths to find the most cost-effective solution.

Hidden Costs, Lot Rent & Total Monthly Budget

When calculating the true cost of your manufactured home financing, mobile home mortgage interest rates are just one component. Several other expenses impact your total monthly budget:

For Homes in Communities (Leased Land):

- Lot Rent: Typically $350-$600 monthly in Texas, with annual increases of 3-5%

- Utilities: Often higher per square foot than site-built homes due to construction differences

- Insurance: Specialized manufactured home insurance, typically $500-$1,000 annually

- Property Taxes: On the home only (personal property tax)

- HOA or Community Fees: Some communities charge additional fees for amenities

For Homes on Owned Land:

- Property Taxes: On both land and home (real property tax)

- Insurance: Coverage for both structure and land

- Utilities: Same considerations as above, plus well/septic maintenance if applicable

- Maintenance: Land upkeep, foundation inspection

One Laredo family we worked with was initially attracted to a manufactured home with a $900 monthly loan payment, only to find that lot rent ($500), utilities ($150), insurance ($75), and taxes ($75) brought their actual monthly housing cost to $1,700—nearly double the loan payment alone.

Most lenders require escrow accounts for taxes and insurance, meaning these costs are divided into monthly increments and added to your loan payment. This helps avoid surprise annual bills but increases your monthly payment.

For accurate budgeting, we recommend calculating your total housing cost as:

- Loan payment (principal and interest)

- Property taxes

- Insurance

- Lot rent (if applicable)

- Utilities (estimated)

- Maintenance reserve (typically 1% of home value annually)

Depreciation, Equity & Resale Considerations

Understanding how manufactured homes hold value is crucial when evaluating mobile home mortgage interest rates and loan options:

Depreciation Factors:

- Manufactured homes without land typically depreciate 3-3.5% annually

- Homes on owned land often maintain value better, sometimes appreciating with the land

- Newer, higher-quality homes with features like pitched roofs, drywall interiors, and energy efficiency depreciate more slowly

- Location significantly impacts value retention

“We always advise our Laredo clients that the land is often the appreciating asset,” explains our housing consultant. “A manufactured home on owned land gives you both a depreciating asset (the structure) and an appreciating asset (the land), creating a more balanced investment.”

Equity Building Strategies:

- Purchase land with your home when possible

- Choose a home with site-built features (MH Advantage or CHOICEHome eligible)

- Make improvements that add value (permanent foundation, attached garage, landscaping)

- Maintain the home carefully

- Pay extra toward principal when possible

Resale Considerations:

- Homes in well-maintained communities with amenities retain value better

- Homes with land transfer more easily and appeal to a broader market

- Financing availability for the next buyer impacts your resale options

- Longer-term loans may leave you underwater (owing more than the home’s value) in early years

A client in Texas recently sold their 10-year-old manufactured home on owned land for 92% of their purchase price—a remarkably strong value retention attributed to land appreciation offsetting home depreciation. Meanwhile, another client selling a similar-aged home in a leased-land community received only 60% of their original purchase price.

Reading the Fine Print: Fees, Penalties, Escrow

Beyond mobile home mortgage interest rates, loan agreements contain numerous terms that impact your total cost and flexibility:

Origination Fees:

- Range from 0% to 5% of loan amount

- Chattel loans typically have higher origination fees (2-5%)

- Can sometimes be negotiated or rolled into the loan

Prepayment Penalties:

- More common with chattel loans than traditional mortgages

- May apply for 2-5 years after origination

- Can significantly increase the cost of refinancing or selling

Loan Level Price Adjustments (LLPAs):

- Risk-based fees that increase rates based on credit score, down payment, and property type

- Manufactured homes typically face higher LLPAs than site-built homes

- Can add 0.5-2% to your interest rate

Servicing Transfer Terms:

- Your loan may be sold to another servicer after closing

- Important to understand how this might affect payment methods and customer service

Flex-Rate Caps:

- For adjustable-rate loans, caps limit how much rates can increase

- Typically capped at 2% per adjustment and 5-6% over the life of the loan

Bi-Weekly Payment Requirements:

- Some fixed-rate manufactured home loans require automatic bi-weekly payments

- Can help build equity faster but requires consistent account balance

One Laredo family we worked with almost signed a loan with a 5% prepayment penalty without realizing it—which would have cost them $7,500 to refinance just two years later when rates dropped. Our review of their loan documents caught this clause before closing.

For a comprehensive understanding of the application process, visit our Mobile Home Loan Application Step-by-Step Guide.

Conclusion: Your Roadmap to Smart Manufactured Home Financing

When I sit down with families here in Laredo, I often see the same look of relief wash over their faces when they finally understand the path forward. Navigating mobile home mortgage interest rates doesn’t have to be overwhelming – it just requires knowing where the pitfalls and opportunities lie.

At Manufactured Housing Consultants, we’ve walked alongside hundreds of Texas families on their journey to affordable homeownership. We’ve celebrated with them when they got the keys, and we’ve seen how the right financing decisions transform lives.

If there’s one thing I’ve learned from helping so many families, it’s that land ownership changes everything. Whenever possible, purchase the land with your home. This single decision can drop your interest rate by 2-5 percentage points by allowing you to access traditional mortgage products instead of higher-rate chattel loans.

Your credit score and down payment are powerful tools in your arsenal. Even a 40-point improvement in your score might save you thousands over the life of your loan. I remember working with the Rodriguez family – they spent six months improving their credit from 610 to 660 and saved over $100 per month on their payment as a result.

Looking beyond the interest rate is crucial too. A 30-year loan at 7% might have a lower monthly payment than a 20-year loan at 6.5%, but you’ll pay significantly more interest over time. Factor in your total monthly costs, including lot rent if applicable, and consider how the loan builds (or diminishes) your equity long-term.

Government-backed programs like FHA, VA, and USDA loans are often your best friends in this process. They offer competitive terms and more flexible qualification requirements. For veterans especially, VA loans can be a game-changer with their no-down-payment option and competitive rates.

Don’t be shy about shopping around and negotiating. I’ve seen rates vary by more than 1.5% between lenders for the exact same borrower and property. That difference could mean tens of thousands of dollars over your loan term.

Before you start your application, get prepared with our pre-approval checklist:

- Check and improve your credit score (aim for at least 620)

- Save for a meaningful down payment (10%+ will open more doors)

- Gather your income documentation (2 years of tax returns and recent pay stubs)

- Research which loan programs match your situation

- Explore land purchase options in your target area

- Calculate your complete monthly housing budget, not just the loan payment

Our FICO Score Improvement Program has helped many Texas families qualify for better rates when they initially thought homeownership was out of reach. Combined with our guaranteed lowest prices on homes from 11 top manufacturers, we help you maximize value while keeping financing costs manageable.

The right financing strategy isn’t just about getting approved – it’s about creating a sustainable path to building equity and financial security. The time you invest in understanding mobile home mortgage interest rates and financing options will likely be some of the most valuable financial research you’ll ever do.

For more detailed information about your options, visit our comprehensive guide on mobile home financing or stop by our Laredo office. We’re real people who understand the local market and genuinely care about helping you find the right path home.