Affordable Homeownership: Understanding Your Mobile Home and Land Mortgage Options

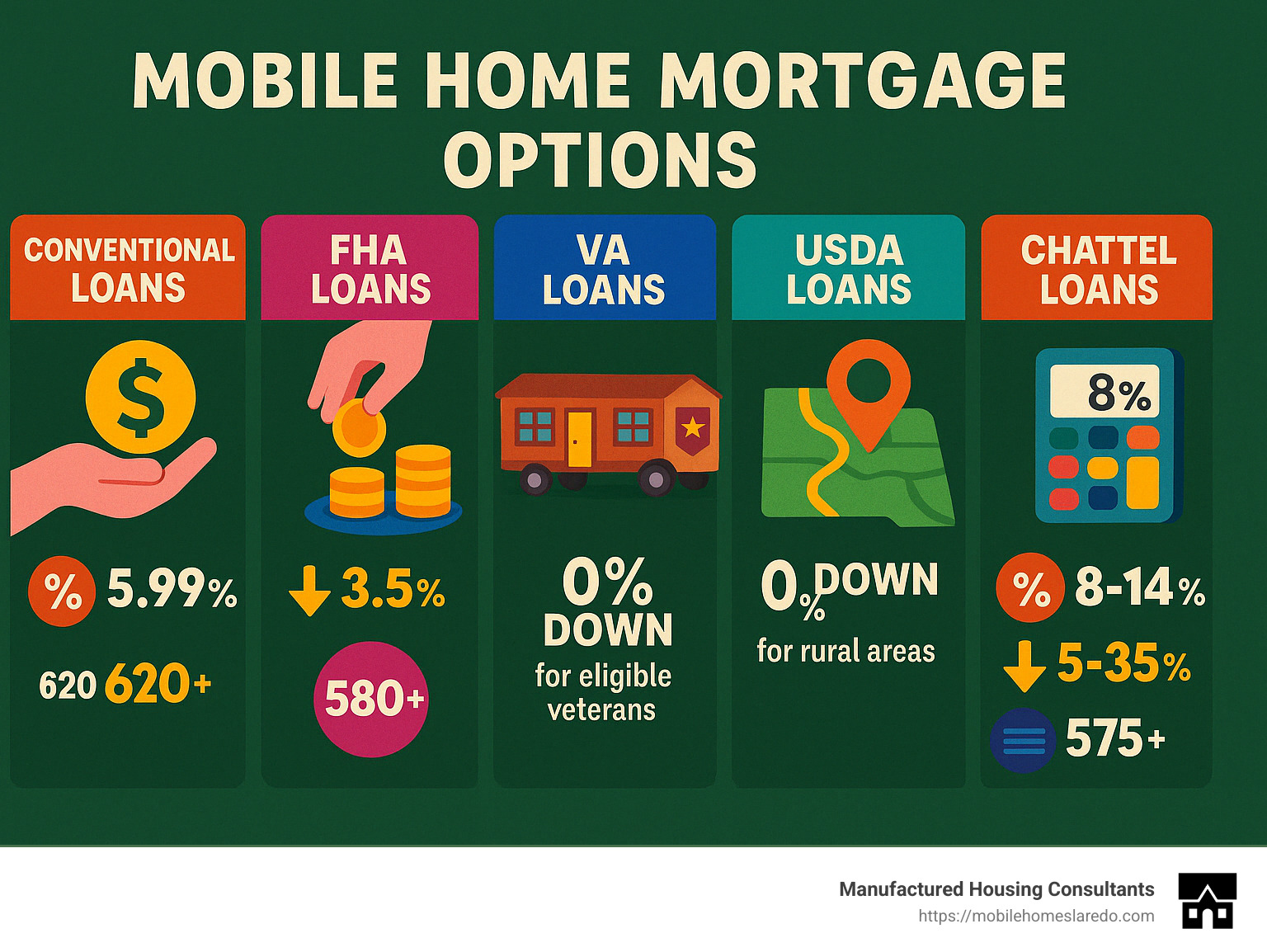

If you’re looking for a mortgage for mobile home and land, here are the key options available:

| Mortgage Type | Down Payment | Credit Score | Special Features |

|---|---|---|---|

| Conventional | 5-20% | 620+ | For permanently attached homes |

| FHA | 3.5-10% | 500-580+ | Requires foundation certification |

| VA | 0% | No minimum | For eligible veterans |

| USDA | 0% | 640+ | For rural properties |

| Chattel | 5-35% | 575-620+ | Higher rates (8-14%) for mobile-only |

Finding affordable housing can be challenging, especially when you’re working with budget constraints. Mortgage for mobile home and land options provide a pathway to homeownership that can be significantly more affordable than traditional site-built homes. With manufactured homes averaging around $125,700 compared to traditional homes at $417,700, this housing solution deserves serious consideration.

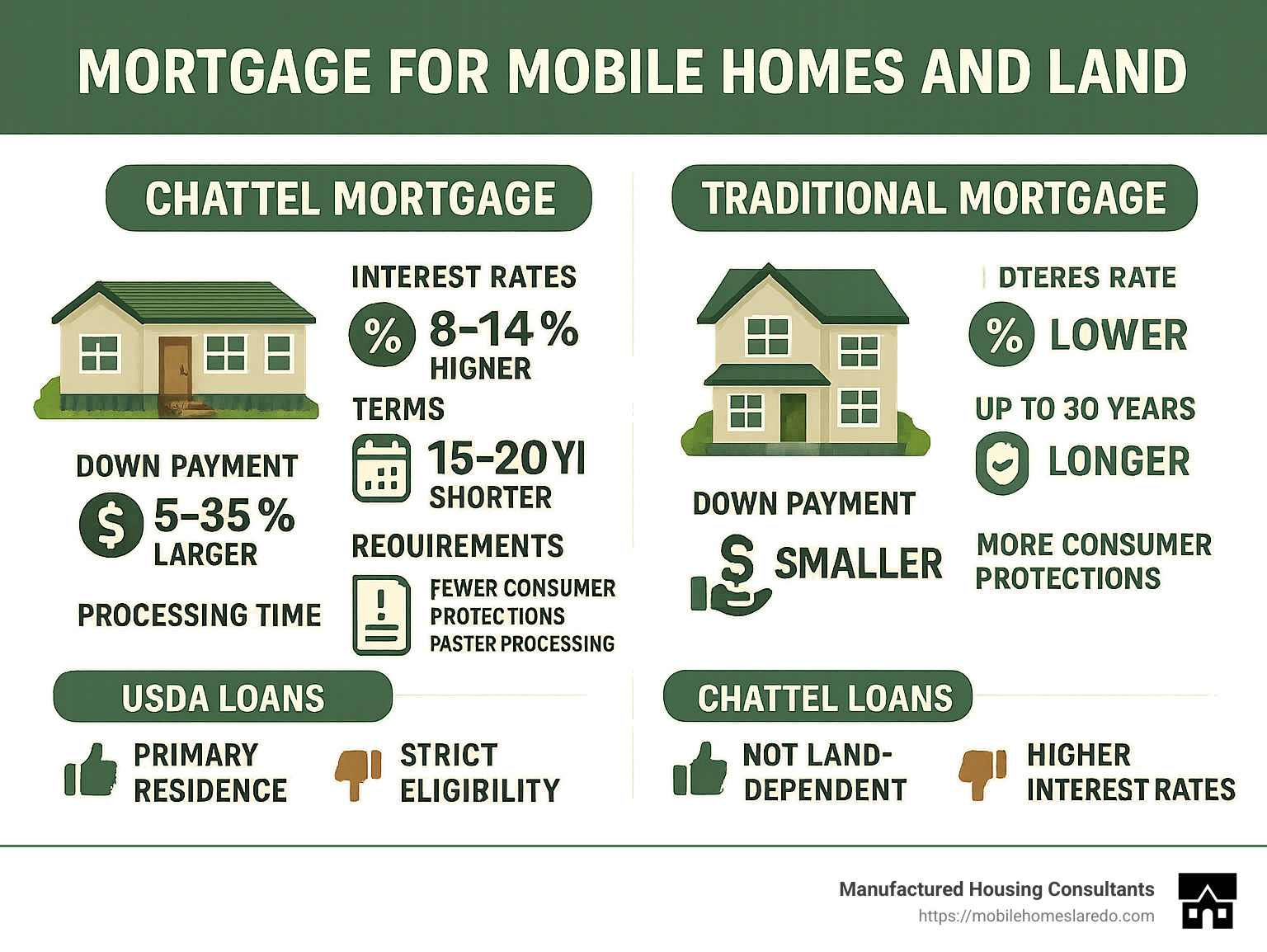

The key difference in financing mobile or manufactured homes compared to traditional homes lies in how they’re classified. When a manufactured home is permanently attached to land you own, you can access conventional mortgage options. Without permanent attachment or land ownership, you’ll need specialized financing like chattel loans.

Understanding these distinctions is crucial because they directly impact your interest rates, loan terms, and overall affordability. For example, conventional mortgages for permanently affixed manufactured homes might offer interest rates starting at 5.99%, while chattel loans typically range from 8% to 14%.

“Mobile home financing may seem intimidating, especially for first-time home buyers or those seeking to refinance,” but with the right guidance, navigating these options becomes manageable.

Whether you’re considering a single-wide, double-wide, or multi-section home, knowing your financing options is the first step toward affordable homeownership. The right mortgage solution depends on your specific situation, including your credit score, down payment availability, and whether you’re purchasing both the home and land together.

Essential mortgage for mobile home and land terms:

Mortgage Options for Mobile Home and Land

When you’re shopping for a new home, understanding your financing choices can feel overwhelming—especially if you’re looking at a mobile or manufactured home. But don’t worry! Knowing how your home will be classified can clear up much of the confusion, helping you pick the best mortgage for mobile home and land for your needs.

The way your home is classified—whether it’s mobile, manufactured, or modular—directly impacts your mortgage options, interest rates, and loan terms. Let’s break this down clearly to help you make an informed decision.

Understanding Mobile, Manufactured, and Modular Homes

First things first—let’s clear up the terminology:

Mobile Homes are factory-built houses constructed before June 15, 1976. Why is this date important? Because that’s when the HUD Code (federal safety and construction standards) became mandatory. Homes built before this date don’t meet current HUD standards, making them trickier—and typically pricier—to finance.

Manufactured Homes are similar but built after June 15, 1976. These homes follow the HUD Code and often come with financing options similar to traditional site-built homes—as long as they’re permanently attached to the land. In fact, as Amy Bailey Oehler explains, “It has to be a manufactured home classified as ‘real property’—meaning you have to buy both the home and the land it sits on.” Doing this expands your financing options significantly.

Modular Homes are factory-built too, but with a twist. They’re delivered in sections, then assembled on-site into a permanent structure. Modular homes must follow state and local building codes (just like site-built homes), making financing simpler and often more affordable.

Why does all this matter? Because the classification of your home affects how lenders see it:

- Manufactured homes permanently affixed to land can qualify for traditional mortgages, often at lower rates starting around 5.99%.

- Homes not permanently attached or without land ownership typically require chattel loans, which have higher interest rates (around 8-14%) and shorter terms (15-20 years).

Many homebuyers unknowingly apply with lenders who don’t specialize in manufactured homes, leading to unnecessary rejections. In fact, in 2019, only 27% of manufactured home mortgage applications got approved, according to the Consumer Financial Protection Bureau. The good news? Finding the right lender makes all the difference—and we’ll guide you through it.

Types of Mortgages for Mobile Home and Land

When you’re financing a manufactured home and land together, you’ve got several solid choices:

Conventional Loans are available for manufactured homes that meet certain criteria:

- Permanently attached to a HUD-approved foundation

- Classified as “real property”

- At least 12 feet wide with a minimum of 400-600 square feet

- Built after June 15, 1976, and HUD-compliant

Conventional loans can offer attractive interest rates and terms similar to traditional home mortgages.

FHA Loans are another fantastic option, especially for first-time buyers and those with lower credit scores:

- Title I loans cover homes that might not yet be on a permanent foundation.

- Title II loans apply to homes permanently affixed to land.

With FHA, you can buy with as little as 3.5% down with a credit score of 580+, or 10% down if your score is between 500-579. Learn more about FHA options here.

VA Loans give a well-deserved advantage to veterans, active-duty service members, and eligible surviving spouses:

- Zero down payment

- No private mortgage insurance required

- Often lower interest rates and flexible credit guidelines

USDA Loans help buyers looking in eligible rural or suburban areas:

- No down payment needed

- Lower mortgage insurance than FHA loans

- Competitive fixed rates and 30-year terms

(Just make sure your location and income qualify!)

Chattel Mortgages come into play if your home isn’t permanently affixed or if you’re placing it on leased land:

- Higher interest rates (typically 8-14%)

- Shorter terms (15-20 years)

- Considered personal property, not real estate

- Larger down payment (usually between 5-35%)

Historically, chattel loans were the go-to for manufactured homes, but that’s changing fast. Back in 2013, around 86% of buyers used chattel loans—but by 2021, that number dropped to 42%, as more folks finded better mortgage options.

Eligibility Requirements for Mortgages

Qualifying for a mortgage for mobile home and land depends on a few important factors. Here’s what lenders typically look at:

Credit Scores: Each mortgage type has its own guidelines. Conventional loans usually require a 620+ score. FHA loans accept lower scores (500-580+) with varying down payments. VA loans don’t set minimums officially, but lenders often prefer around 620+. USDA loans typically look for a 640+ score, while chattel loans usually start around 575-620+.

Down Payments: Conventional loans usually require 5-20% down. FHA loans can go as low as 3.5%, VA and USDA loans require zero down, and chattel loans range between 5-35%.

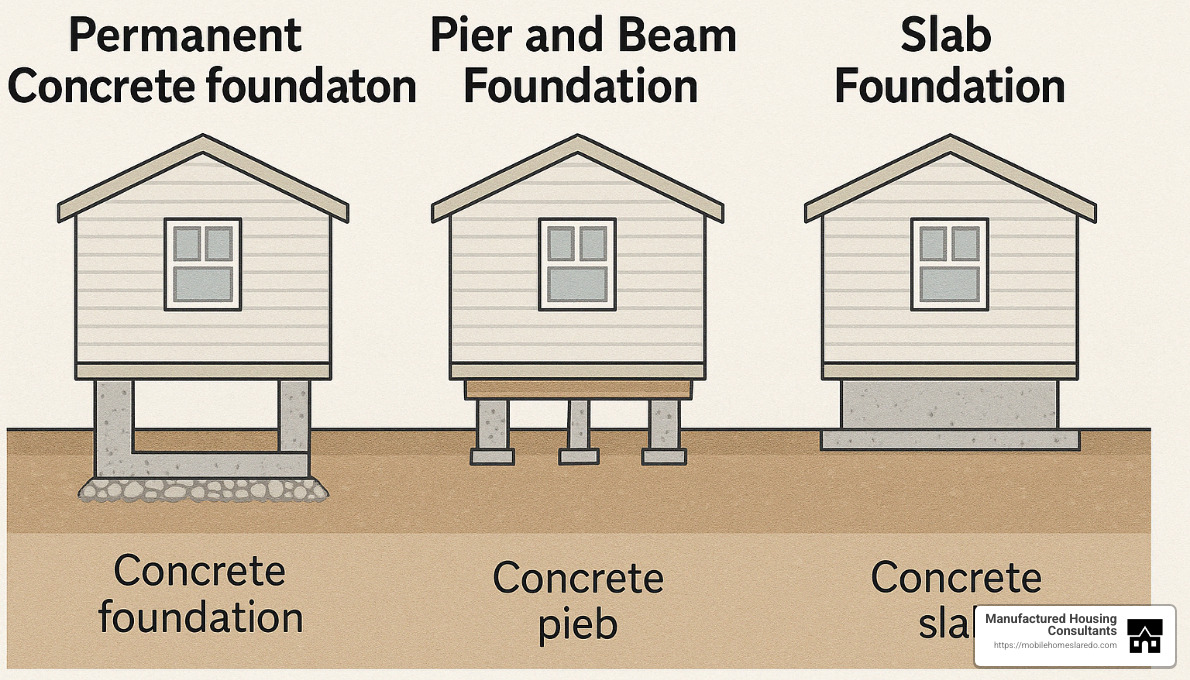

Foundation Types: Your home’s foundation dramatically affects your loan options. For conventional, FHA (Title II), VA, and USDA loans, your manufactured home usually must be:

- On a HUD-approved permanent foundation

- Wheels, axles, and towing equipment removed

- Properly connected to utilities

- Compliant with HUD installation standards

Land Ownership vs. Land Leasing: Owning both your home and land opens doors to better mortgage rates and terms. If your land is leased (think: mobile home parks or rented lots), you’ll likely need a chattel loan, which generally costs more in the long run.

“A manufactured home permanently affixed to land can open up more mortgage options.”

Bottom line? Take the time to explore and understand your mortgage choices. As one expert says, “Never accept a loan offer before researching your choices.” That bit of advice can save you thousands of dollars over the life of your loan—money better spent making your new place feel like home.

How to Secure a Mortgage for Mobile Home and Land

Getting a mortgage for mobile home and land might seem a bit intimidating, especially if it’s your first time buying or refinancing your home. But don’t worry—while the process is a little different from financing a traditional home, it’s completely manageable with the right guidance.

Let’s walk through each step together so you can feel confident and prepared along the way!

Steps to Getting a Mortgage for Mobile Home and Land

Step 1: Choose Your Lot Location

Before applying for financing, you need to decide exactly where your manufactured home will be placed. This step is crucial because it directly affects your mortgage options. Make sure you:

- Confirm zoning regulations in your chosen area allow manufactured homes.

- Check available utilities such as water, sewer, and electricity—these are essential and can affect your budget.

- Verify any community guidelines or homeowner association rules that could impact your plans.

- Look into accessibility and neighborhood amenities—schools, stores, healthcare, and more. Location makes a huge difference in your quality of life!

Step 2: Select Your Manufactured Home

Now comes the fun part—finding your dream home! When looking for your perfect manufactured home, consider:

- Whether you prefer a single-wide, double-wide, or multi-section home based on your family size and lifestyle.

- New or pre-owned options—both have advantages depending on your budget and preferences.

- Your home’s HUD certification (all homes built since June 15, 1976, have this certification and meet important safety standards).

- Energy-efficient features that can save you money long-term.

- Customizable layouts and designs that fit your family’s unique style and needs.

At Manufactured Housing Consultants, we’ve got you covered. With guaranteed lowest prices and a wide selection from 11 top manufacturers, we make finding your ideal home easy (and even fun!)

Step 3: Prepare the Land

Proper land prep is essential, especially if you want to qualify for traditional, lower-interest mortgage options. You’ll need to:

- Get all the necessary permits from local authorities.

- Arrange utility hookups, which typically range from $6,500 to $34,600 depending on your location and the type of connections needed.

- Install an approved foundation (like slab or pier-and-beam), which usually costs between $4,042 and $14,493.

- Make sure your home and foundation comply with local building codes and FHA guidelines.

- Create an access road or driveway if your land doesn’t already have one.

Getting this right sets your home up nicely, making financing easier and even boosting your home’s resale value down the line.

Step 4: Apply for Financing

Applying for a mortgage for mobile home and land might sound stressful, but knowing what to expect makes a huge difference. To make the process smoother:

- Check your credit reports ahead of time and clear up any mistakes.

- Gather financial documents, including income statements, tax returns, and bank statements.

- Shop around and compare lenders who specialize in mobile home financing.

- Consider getting pre-approved. It helps you understand your budget clearly and makes you look serious to sellers.

- Ensure your chosen home meets the requirements of your loan. For FHA loans, this includes an IBTS letter certifying your home meets HUD standards.

If you’re feeling overwhelmed, take a breath—we’re here to help at every step. Check out our detailed guide to make your Mobile Home Loan Application: Step-by-Step Guide a breeze.

Step 5: Close the Deal

You’re almost there! At closing, you’ll complete a few final steps to officially become a homeowner:

- A home inspection ensures your home is in great shape and meets lender requirements.

- An appraisal confirms your home’s value matches the loan amount.

- A title search confirms that there aren’t any hidden ownership issues or liens.

- You’ll secure appropriate homeowners insurance custom specifically for manufactured homes.

- Finally, you’ll sign all the paperwork and receive those exciting keys to your new home!

One customer recently shared their experience working with our team:

“I was extremely impressed with your customer service, attentiveness, and accuracy. It went so smoothly that I went ahead and refinanced two other homes! You made it easy and stress-free.”

Pros and Cons of Different Mortgage Options

When securing your mortgage for mobile home and land, understand the benefits and drawbacks of each loan type. Here’s a quick overview to help you decide:

Conventional Mortgages offer attractive low interest rates (starting around 5.99%) and longer terms (up to 30 years), but require a permanent foundation, higher credit scores (620+), and typically a bigger down payment (5-20%).

FHA Loans are fantastic if you have less-than-perfect credit (scores as low as 500). They offer low down payments (3.5% with a 580+ score), but you’ll pay mortgage insurance, and your foundation must meet FHA guidelines.

VA Loans let eligible veterans and service members buy with no down payment and no private mortgage insurance. They’re flexible in terms of credit, too, but your home must meet VA standards, and you’ll need to pay a funding fee unless exempt.

USDA Loans are perfect for rural areas, offering zero down payment and competitive rates. However, they’re limited by location and income requirements and have somewhat stricter credit guidelines (usually 640+).

Chattel Loans work when your home isn’t permanently attached or if you lease the land. Approval is quicker, but you’ll see higher interest rates (around 8-14%), shorter terms (about 15-20 years), and usually higher down payments.

Here’s a helpful visual to easily compare chattel vs. traditional mortgages:

As loan officer Richmond Chester wisely says, “Offering manufactured home lending lets lenders stand out in a competitive market. It’s personally rewarding helping families achieve affordable homeownership.”

You can learn more about today’s rates here: Mortgage Rates for Manufactured Homes.

Refinancing Your Mobile Home and Land Mortgage

Already own your home and wondering if refinancing is right for you? You’re not alone!

Refinancing your mortgage for mobile home and land can help you lower your monthly payments, reduce your interest rate, or switch from a chattel loan to a traditional mortgage. You might even use refinancing to take some cash out for home improvements or to consolidate debt.

When refinancing, you’ll typically need:

- At least 20% equity in your home

- A stable income and employment history

- An improved or stable credit score

- To ensure your home meets current appraisal and lending guidelines

Refinancing can be simpler than you think. One happy homeowner told us recently:

“Thanks so much! Refinancing felt easy with your guidance. Your expertise made reaching my financial goals completely stress-free.”

At Manufactured Housing Consultants, we even offer a special FICO Score Improvement Program to help you qualify for better refinance terms. For more details, see Financing Manufactured (Mobile) Homes (Title I).

With these clear steps and helpful tips, you’re ready to confidently secure the right mortgage or refinance option for your manufactured home and land. You’ve got this—and we’re always here to help!

Conclusion

Securing a mortgage for mobile home and land doesn’t have to be complicated. With the right information and assistance, you can steer the process successfully and achieve affordable homeownership.

Remember these key takeaways as you start on your manufactured home journey:

Classification matters in more ways than you might think. The distinction between mobile, manufactured, and modular homes isn’t just terminology—it fundamentally shapes your financing landscape. Homes built after June 15, 1976 that meet HUD standards open doors to better loan options that might otherwise remain closed.

Foundation is crucial to your financing success. I’ve seen many families surprised by how much a permanent foundation that meets HUD standards can transform their mortgage options. This single factor can be the difference between a higher-interest chattel loan and a conventional mortgage with more favorable terms spanning decades rather than years.

Land ownership expands options significantly. When you own both the home and the land beneath it, you’re not just purchasing property—you’re creating a pathway to conventional, FHA, VA, and USDA loans with terms that could save you thousands over the life of your loan compared to chattel financing.

Credit preparation helps secure better terms, even though manufactured home financing exists for almost every credit profile. Taking a few months to improve your score before applying can translate to lower interest rates and more favorable terms that benefit you for years to come.

Expert guidance is valuable in navigating the unique landscape of manufactured home financing. Working with specialists who understand this niche market often makes the critical difference between loan approval and denial.

At Manufactured Housing Consultants, we’ve helped hundreds of Texas families turn their manufactured home dreams into reality. Our team specializes in cutting through the confusion of manufactured home financing, offering personalized solutions for all credit types through our network of specialized lenders who understand the unique aspects of these homes.

“We know what goes into the loan process–there’s a lot of paperwork and a lot of time. That’s why having a trusted partner who is local, experienced, and accessible will provide the guidance and peace of mind you need.”

Whether you’re a first-time homebuyer looking to escape rising rents, hoping to upgrade from your current living situation, or interested in refinancing your existing manufactured home to better terms, we’re here to help you explore all available options. Our guaranteed lowest prices and specialized financing programs make the dream of affordable homeownership accessible to more Texas families every day.

The journey to manufactured home ownership may seem daunting at first, but with the right partner, it becomes an exciting path to affordable living. Take the first step toward achieving your homeownership goals today by contacting our team to discuss your mortgage for mobile home and land options. Your future home—and the financial freedom that comes with it—may be closer than you think.