Why Rent-to-Own Mobile Homes Offer a Path to Homeownership Without Credit Barriers

Rent to own mobile homes no credit check programs provide an alternative path to homeownership for those facing traditional financing challenges. Here’s a quick overview:

Key Benefits:

- No initial credit check to get started

- Lock in your purchase price now, even if you buy later

- Build equity through rent credits

- Time to improve your credit score

- Try before you buy to ensure the home is a good fit

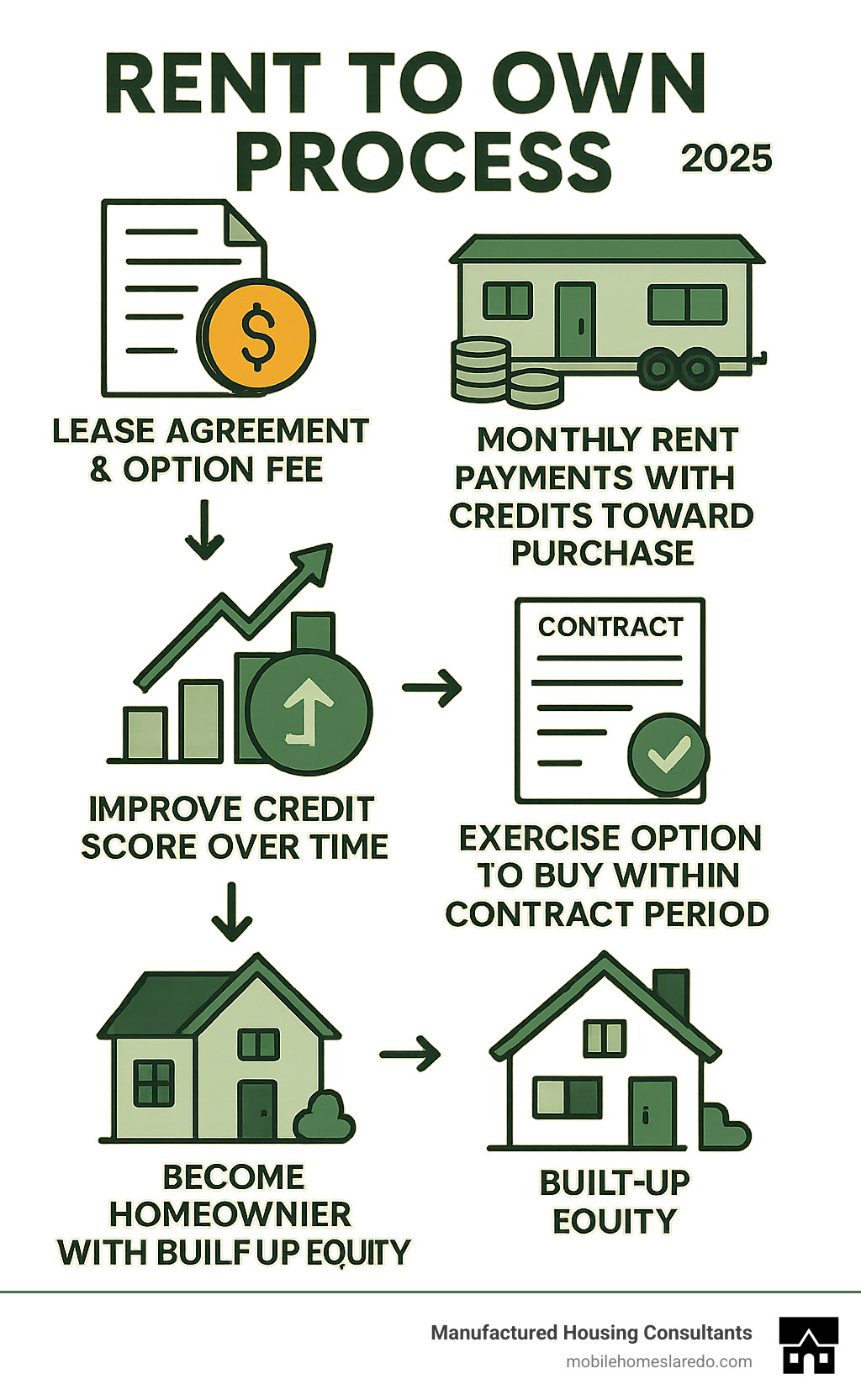

How It Works:

- Sign a lease-option agreement with the seller.

- Pay an option fee (typically $3,000-$6,000) for the right to buy.

- Make monthly rent payments, with a portion going toward the purchase.

- Exercise your option to buy within 1-5 years.

Many families struggle with homeownership due to strict credit requirements and large down payments. As one satisfied customer shared, “We bought a brand-new home, and it was the best decision we ever made” after using a rent-to-own program when conventional financing wasn’t an option.

While rent-to-own agreements may have slightly higher monthly payments, a portion builds toward your down payment. This structure gives you time to improve your finances while securing a home. The process is particularly effective for manufactured homes, as they can be difficult to finance through traditional lenders, making rent-to-own a great solution for both buyers and sellers.

The Ultimate Guide to Rent to Own Mobile Homes No Credit Check

How the Rent-to-Own Process Works

A rent-to-own mobile home agreement combines a standard rental lease with the future option to buy the property. It’s designed to give you time to save for a down payment or improve your credit score before committing to a purchase.

The process starts with a lease agreement that includes an “option to purchase” clause. This gives you the exclusive right to buy the mobile home at a pre-set price within a specific timeframe, usually one to five years. To secure this right, you pay an upfront, non-refundable “option fee,” typically ranging from $3,000 to $6,000, which is often applied to the purchase price if you buy.

A key feature is “rent credits.” Each month, a portion of your rent payment is set aside and credited toward your down payment. For example, if you pay an extra $200 per month, you’ll accumulate $2,400 in one year toward your home purchase. This allows you to build equity while you rent.

It’s important to distinguish between a “lease-option,” which gives you the right to buy, and a “lease-purchase,” which obligates you to buy. The lease-option is more flexible for those still building their financial standing. For mobile homes, “chattel loans,” which are secured by the home itself rather than land, are also a common financing tool.

Here’s a comparison of your options:

| Feature | Rent-to-Own (Lease-Option) | Traditional Mortgage | Standard Lease |

|---|---|---|---|

| Initial Credit Check | Often no or low requirement | High requirement (620+ FICO) | Often required, but flexible |

| Down Payment | Built over time via rent credits + option fee | Typically 3-20% upfront | N/A (security deposit only) |

| Monthly Payment | Rent + Rent Credit | Principal, Interest, Taxes, Insurance (PITI) | Rent only |

| Ownership | Option to buy in future | Immediate ownership | No ownership path |

| Flexibility | Can walk away (forfeit fees) | Long-term commitment | Month-to-month or fixed term |

| Maintenance | Often tenant’s responsibility (negotiable) | Homeowner’s responsibility | Landlord’s responsibility |

| Equity Building | Yes, via rent credits | Yes, over time | No |

We offer more info about our Rent to Own program to help you steer these options.

Weighing the Pros and Cons

A rent to own mobile homes no credit check agreement has both benefits and drawbacks.

Pros:

- No Immediate Credit Check: Many programs are designed for those with poor or limited credit, with some accepting scores as low as 500 or having no credit check at all.

- Try Before You Buy: Live in the home and community to ensure it’s the right fit before you commit to buying.

- Build Equity While You Rent: A portion of your rent helps you accumulate a down payment over time.

- Locked-in Purchase Price: The price is set at the start, protecting you from market inflation.

- Time to Improve Credit: The lease term gives you time to repair your credit score, making it easier to qualify for a mortgage later.

Cons:

- Higher Rent: Monthly payments are often higher than standard rent to account for the rent credits.

- Non-Refundable Fees: The upfront option fee is non-refundable if you decide not to buy.

- Risk of Losing Investment: You can forfeit your option fee and rent credits if you violate the lease or fail to purchase the home.

- Maintenance Costs: You may be responsible for repairs and upkeep, unlike in a standard rental.

- Complex Contracts: Agreements can be complex, so a thorough review is essential to avoid unfavorable terms.

- Market Value Drops: You are locked into the purchase price even if the home’s market value decreases.

Understanding Your Rent-to-Own Contract

The contract is a legally binding document, so it’s critical to understand every detail. We strongly recommend having a real estate attorney review the agreement before you sign. They can spot red flags and ensure your rights are protected.

Key terms to scrutinize:

- Purchase Price: The fixed price you’ll pay for the home.

- Option Fee Amount: The exact amount of the non-refundable fee and how it’s applied to the purchase.

- Rent Credit Details: The specific amount of your monthly rent that goes toward the purchase price.

- Lease Term Length: The duration of the rental period before you must decide to buy (typically 1-5 years).

- Maintenance Responsibilities: A clear definition of who pays for repairs—you or the seller. Proper anchoring is crucial for safety; you can read about mobile home tie-downs and safety to learn more.

- Default Clauses: The consequences of a missed payment or other lease violations.

- Early Payoff Options: Whether you can buy the home before the term ends and if there are any penalties.

Most terms are negotiable. Don’t hesitate to ask for changes to the price, rent credit, or maintenance duties. Always get a home inspection and appraisal before signing to confirm the property’s condition and value.

Navigating Your Path to Homeownership

How to Find Legitimate Rent to Own Mobile Homes with No Credit Check

Finding genuine rent to own mobile homes no credit check opportunities requires a smart search.

Start with online listing sites that specialize in rent-to-own or manufactured homes. Local real estate agents familiar with manufactured homes can also be a great resource. Don’t forget to connect with mobile home park managers, who often have inside knowledge of available properties. You might also find flexible terms from private sellers through local ads, but exercise extra caution.

Of course, working directly with us at Manufactured Housing Consultants provides access to our specialized knowledge and financing options.

To protect yourself from scams, always verify property ownership through public records and get a professional home inspection. Have a lawyer review the contract before signing, and be wary of deals that seem too good to be true.

For more guidance, check out our Tips for Buying Mobile Homes in Laredo to steer the local market.

What Happens if Your Plans Change?

Life is unpredictable, so it’s important to know the consequences if you can’t follow through with your rent-to-own agreement.

If you default on payments or other terms, you will forfeit your upfront option fee and all accumulated rent credits. The seller can also evict you and terminate your option to buy.

If you have a lease-option agreement and simply decide not to buy, you can walk away, but you will still lose your option fee and rent credits.

Communication with the seller is key. If you face challenges, contact them immediately. Some may be willing to negotiate new terms or an exit strategy. The legal consequences of walking away from a lease-option are usually limited to your financial investment, but a lease-purchase agreement is a binding contract to buy, which can have more serious legal ramifications.

Alternatives and Next Steps for Aspiring Homeowners

If a rent-to-own program isn’t the perfect fit, we offer other paths to homeownership.

Seller financing is a flexible option where the seller acts as the lender, creating payment terms that work for you. This is common with mobile homes and avoids traditional bank problems.

Our Bad Credit Mobile Home Loans Guaranteed Approval program is designed for those with credit challenges. We believe a low score shouldn’t be a permanent barrier to owning a home.

You can also take proactive steps to improve your credit with our Credit Repair for Home Loans services. Our FICO Score Improvement Program provides the time and support to build your credit, putting you in a stronger position for future financing.

At Manufactured Housing Consultants, we are committed to helping you achieve homeownership. With our guaranteed lowest prices, large selection, and specialized financing, we address the exact challenges that lead people to seek rent-to-own solutions.

Explore your mobile home financing options today and let our team make your experience easy and stress-free.