Understanding Your Manufactured Home Trade-In Options

Trade in manufactured home programs allow you to use your existing home’s value toward the purchase of a new one, much like trading in a car. Here’s what you need to know:

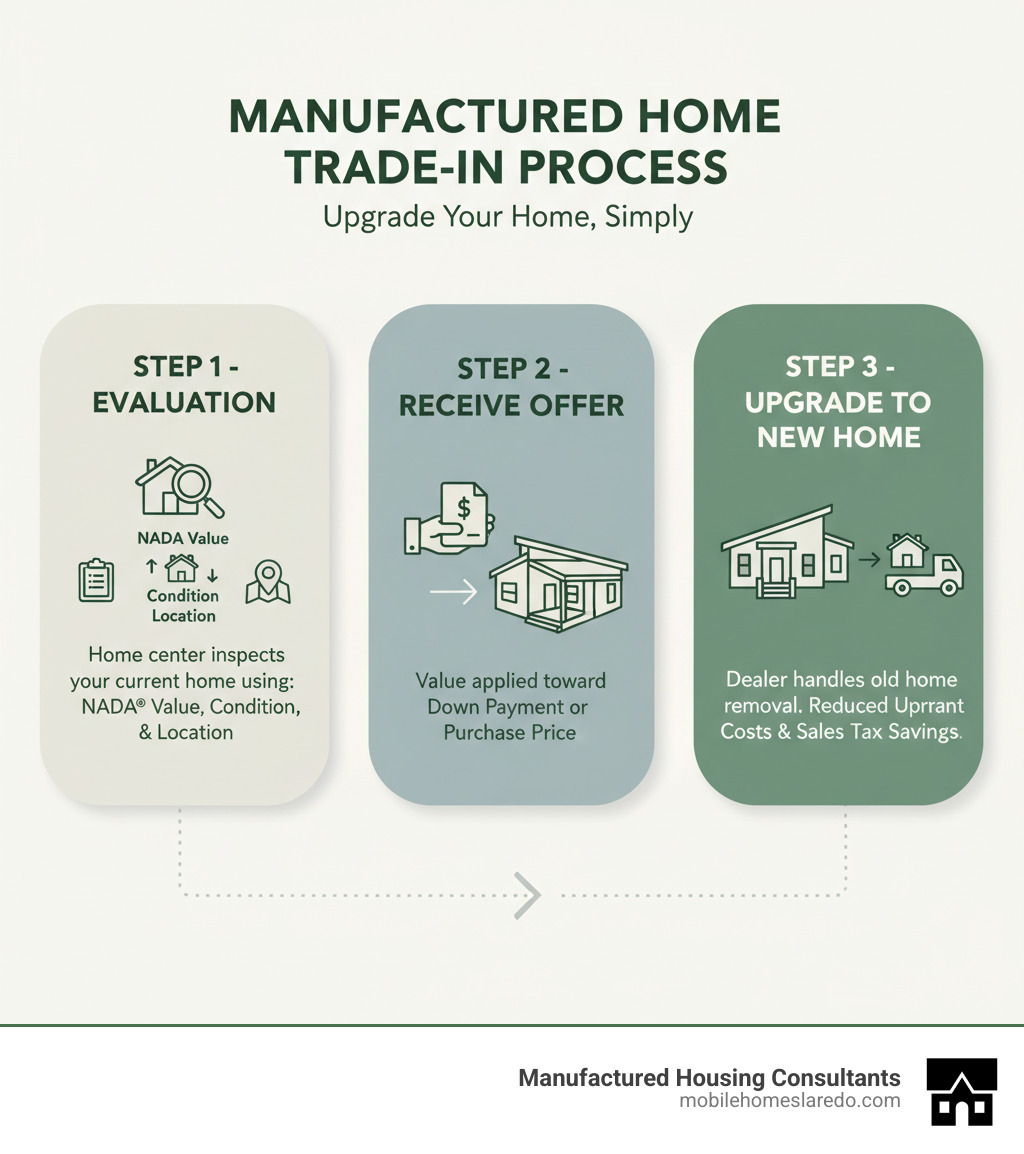

Quick Answer: How Trade-Ins Work

- Evaluation – A home center assesses your current home’s value based on NADA® guidelines, condition, and location.

- Offer – You receive a trade-in value that applies toward your down payment or purchase price.

- Upgrade – The dealer handles the removal of your old home while you move into your new one.

For many homeowners, upgrading to a newer manufactured home feels financially out of reach. The thought of selling an existing home, coordinating timing, and finding a down payment can be overwhelming. But there’s a simpler path forward.

Mobile home trade-in is an increasingly popular route for homeowners who wish to upgrade their living space without the complications of a separate sale. Instead of juggling listings and negotiations, you can work directly with a home center to apply your current home’s value toward a new purchase.

The trade-in process offers key advantages: you save on sales tax (paying only on the remaining balance), the home center handles the removal of your old home, and you can use the trade-in value to reduce or eliminate your down payment, making a modern home more attainable.

Whether you’re looking for more space, better energy efficiency, or a new location, understanding trade-ins puts you in control. Let’s walk through the process, what your home might be worth, and how to get started.

The Complete Guide to Your Manufactured Home Trade-In

You’ve decided to upgrade your manufactured home—congratulations! This guide covers everything you need to know about the trade in manufactured home process, from understanding your home’s worth to applying its value toward your dream home.

How is the Trade-In Value of a Manufactured Home Determined?

One of the first questions you’ll ask is: “What’s my home actually worth?” The answer depends on several factors that create a complete picture of your home’s value.

Understanding Valuation Methods

Manufactured homes have their own pricing guides. The most common starting point is the NADA® Book Value. Homes built in or after 1976 have a NADA® value, which provides a baseline estimate. You can find out your home’s potential NADA® value by purchasing a report online, but this is just an estimate.

A more accurate market-based appraisal looks at recent sales of similar homes in your area. This method captures current local demand and unique features that NADA® might miss.

What Makes Your Home More (or Less) Valuable?

Your home’s condition is the most important factor. We’ll look at everything from the roof and windows to plumbing, electrical, and interior finishes. A well-maintained home commands a higher value.

The age and size of your home also matter; a newer double-wide is typically worth more than an older single-wide. Your location plays a big role, too. Homes on privately owned land usually have higher values than those in leased communities.

Upgrades and improvements like a new roof, energy-efficient windows, or a modern kitchen can add real value to your trade-in.

There’s a difference between “in-place” and “pull-out” value. In-place value is what your home is worth in its current location and is generally higher. Pull-out value is the worth after it’s been removed, which is lower due to the costs of removal and transport.

Those transport costs are a real consideration, as moving a manufactured home requires specialized equipment and expertise, which factors into your final trade-in value.

For older homes, especially those built before 1976 (pre-HUD code), the trade-in value may be minimal. Sometimes removal costs outweigh their market worth. However, a trade-in can still be beneficial by removing the disposal burden from you.

For a deeper dive, see our guide on “Factors That Influence Mobile Home Values.”

The Step-by-Step Process

Ready to turn your current home into your down payment? Here’s how the process works.

What Can You Actually Trade In?

You can trade in more than just a manufactured home. We accept a variety of titled items, including boats, RVs, and vehicles. This flexibility allows you to leverage different assets to make your new home more affordable.

Getting Ready for Your Evaluation

To speed up the process, have these items ready: your title, the year, make, and model, and a payoff statement if you still have a loan. Tidying up and handling minor repairs before our visit also helps, as first impressions matter.

The Home Center Inspection

Our team conducts a thorough evaluation of your home’s structural integrity, interior condition, major systems (plumbing, electrical, HVAC), and general wear. This inspection, combined with market data and NADA® guidelines, helps us determine a fair trade-in value.

Receiving Your Offer

After the evaluation, we’ll present a trade-in offer. This value can directly reduce the down payment on your new home—sometimes covering it entirely—or be applied against the purchase price, lowering the amount you need to finance.

What If You Still Have a Loan?

A common question is whether a home must be paid off to be traded. The answer is no. We frequently work with homeowners who have outstanding loans.

You’ll get an exact payoff amount from your lender. We’ll compare your trade-in value to what you owe. If your home’s value is higher than your loan balance, that difference is equity you can apply to your new home. If you owe more than the trade-in value (being “upside down”), we may be able to roll the remaining balance into your new financing.

Our team can help coordinate with your lender to facilitate the payoff and title transfer. For more details, check out our “Mobile Home Loan Application Step by Step Guide.”

Financial Benefits of a Manufactured Home Trade-In

Let’s talk about how a trade in manufactured home can save you money and make your upgrade more manageable.

Skip the Hassle of Selling Separately

Selling a home on your own involves listings, showings, and negotiations. A trade-in eliminates this hassle. We handle the entire process, saving you time, money, and stress so you can focus on choosing your new home.

Turn Your Current Home Into Your Down Payment

A trade-in allows you to use your current home’s value to cover or reduce your down payment. This is a huge benefit for families who don’t have thousands in savings, making financing more accessible. It’s a key part of our guide, “How to Buy a Mobile Home with No Money Down.”

Save on Sales Tax

A surprising financial benefit is sales tax savings. You only pay sales tax on the remaining balance after the trade-in value is deducted. For example, on a $150,000 new home with a $30,000 trade-in, you’re only taxed on $120,000. This can save you hundreds or thousands of dollars.

We Handle the Heavy Lifting

Once we agree on your trade-in value, we typically handle removing your old home. You don’t need to coordinate transport or deal with site logistics. We take on that responsibility, making your transition seamless.

Making Your Dream Home Attainable

For many, upgrading to a newer, energy-efficient home seems impossible. A trade-in changes that. By leveraging the value of your current assets (home, RV, boat), you gain financial flexibility to make your dream home a reality sooner. We are motivated to make these deals work to help Texas families find the home they deserve.

Ready to Upgrade? Next Steps and Getting Started

You’ve learned how the trade in manufactured home process works and the financial benefits it offers. Now comes the exciting part—taking the first step toward your new home.

Trading in your current home simplifies the upgrade process, offering financial advantages like sales tax savings and down payment assistance. It also provides peace of mind, as professionals handle the heavy lifting.

What You Can Trade Toward Your New Home

You’re not limited to trading in just manufactured homes. We often accept other titled assets with verifiable value, like an RV, boat, car, or truck. This flexibility can help make your upgrade more affordable.

Finding the Right Partner for Your Trade-In

The success of your trade-in depends on working with a reputable dealer. Not all home centers offer comprehensive, transparent trade-in programs.

That’s where we come in. Here at Manufactured Housing Consultants, we’ve built our reputation on making homeownership accessible for families throughout Texas. Located in Laredo, we understand the local market.

What sets us apart? We offer a large selection from 11 top manufacturers, giving you real choices. Our pricing is straightforward—we guarantee the lowest prices. And our financing options work for all credit types, including our specialized FICO Score Improvement Program.

Your Path Forward Starts Here

Getting started is simple. Gather basic information about your trade-in (year, make, model) and request a loan payoff statement from your lender if applicable.

Then, reach out to our team. We’ll schedule a free, no-obligation evaluation of your trade-in. While we assess its value, you can explore our homes online and start dreaming about your upgrade. You might be surprised at what’s possible within your budget.

Our financing experts will discuss all available options, incorporating your trade-in value to create a package that works for you. You can explore your financing options for a new home on our website or discuss them with us in person.

Making Your Move

Upgrading your home shouldn’t be overwhelming. With the right partner, it’s an exciting journey. We handle the complexities—evaluations, paperwork, home removal, and lender coordination—so you can focus on choosing your perfect new home.

Your next chapter is waiting. Reach out to us, and let’s start the conversation. We’re ready when you are.