Why Used Mobile Home Loans Are Your Gateway to Affordable Homeownership

Used mobile home loans offer a path to homeownership that costs $200,000 to $300,000 less than traditional single-family homes. Here’s what you need to know:

Quick Answer: Used Mobile Home Loan Basics

- Loan Types: Chattel loans, FHA Title I, personal loans, traditional mortgages (with land)

- Credit Requirements: 580-620 minimum score for most programs

- Down Payment: 0-35% depending on loan type and location

- Interest Rates: 7-14% typically

- Age Limit: Maximum 20 years old for most lenders

- Terms: 5-30 years, with 25-year amortization cap

Getting a mortgage on a mobile home can be tricky. As one industry expert noted: “Many banks are hesitant to provide loans due to the fact that you could just drive it away.” But financing is definitely possible.

Used mobile homes in Canada range from $50,000 to $500,000, making them significantly more affordable than site-built homes. The key is understanding your options and requirements.

Three main factors affect your approval:

- Home certification – Must have valid CSA A-277, Z-240, or Silver Label

- Land ownership – Owned land gets better rates than park lots

- Credit profile – Scores below 575 may require 35% down

Whether you’re buying in a mobile home park or on private land, the financing works more like a car loan than a traditional mortgage. This means different rules, different lenders, and different strategies for success.

Used mobile home loans terms to learn:

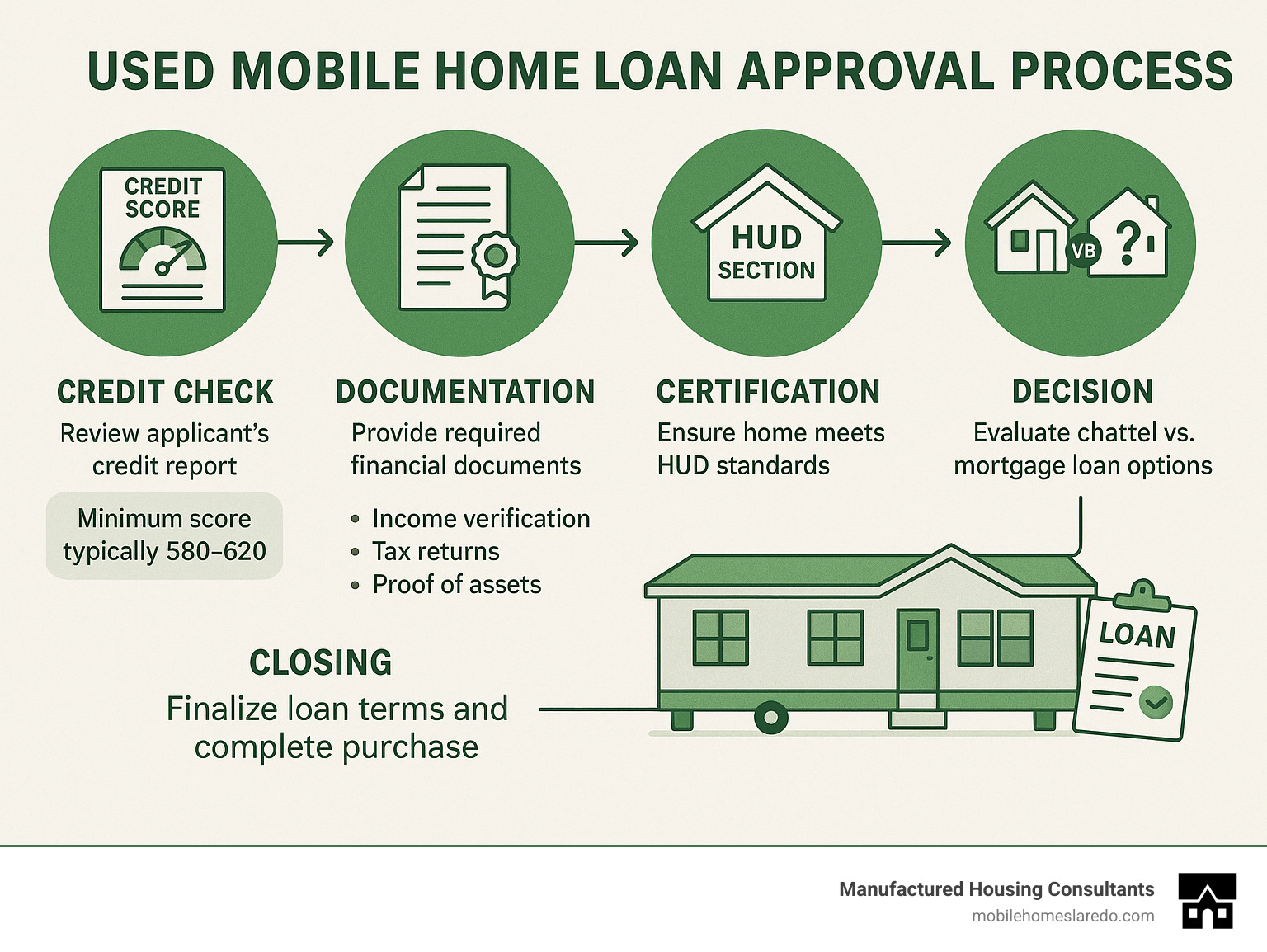

Used Mobile Home Loans: Eligibility, Rates & Process

Getting used mobile home loans feels different from buying a regular house. That’s because these loans work more similar to a car loan than a mortgage – your mobile home is considered personal property, not real estate.

Loan-to-value ratios typically range from 65% to 95% depending on placement. Park placement requires 35% down (65% LTV), while owned land allows 10-25% down (75% LTV).

Interest rates fall between 7% and 14% – higher than traditional mortgages but reasonable for personal property financing. Your credit score needs to be at least 580 with most lenders.

Your mobile home can’t be over 20 years old, and must have proper certification labels like CSA A-277, Z-240, or Silver Label. Amortization is capped at 25 years, creating higher monthly payments than 30-year traditional mortgages.

For a complete walkthrough, check out our Mobile Home Mortgage Financing guide.

What Are Used Mobile Home Loans & How They Differ From Traditional Mortgages

Used mobile home loans finance manufactured homes built on a steel chassis – and that steel frame makes all the difference in how lenders see your purchase.

With a traditional mortgage, your home is secured by real estate and recorded with a property deed. Your mobile home loan is secured by personal property and registered with a lien, just like a car title. This means higher interest rates (typically 7-14% vs 3-7% for traditional mortgages) and shorter terms.

Your used mobile home must meet federal HUD Code standards if built after 1976, requiring that HUD certification label. Even if your mobile home sits on a permanent foundation, it’s still considered personal property unless you go through a specific legal conversion process.

The asset mobility factor makes lenders nervous since you could theoretically drive away with their collateral. This perceived risk translates to stricter qualification requirements and lower loan-to-value ratios.

Loan Types: Chattel, Traditional Mortgage, Personal & More

Chattel loans are the workhorses of mobile home financing, especially for park placement. These treat your home as personal property, with interest rates between 8-14% and terms of 5-20 years. You’ll need 10-35% down, but don’t need to own land.

Traditional mortgages work when you own the land. These offer lower interest rates of 3-8% and terms up to 30 years, but may require permanent foundation placement.

FHA Title I loans are government-backed options for buyers with less-than-perfect credit. You can borrow up to $105,532 for single-section or $193,719 for multi-section homes. With 580+ credit score, you need just 3.5% down.

Personal loans work for smaller purchases with higher interest rates of 10-20% and shorter terms of 2-7 years, but offer faster approval without collateral requirements.

Land-home package loans combine both purchases into one loan with better rates than separate financing.

For more details, visit our Mobile Home Financing 2 guide.

Qualifying for Used Mobile Home Loans: Credit, Down Payment, Certification

Your credit score is the first hurdle. Most lenders want 580-620 minimum, though some work with 575+ for higher down payments. Below 575 typically requires 35% down. Need credit help? Our How to Buy a House with Bad Credit program includes FICO Score improvement assistance.

Down payment requirements vary by location: owned land typically requires 5-20% down, while leased land demands 35%.

Debt-to-income ratios are more flexible than traditional mortgages. Traditional banks cap at 40% DTI, while alternative lenders might accept 50%.

Certification requirements are crucial. You need CSA A-277 for modular homes, CSA Z-240 for mobile home construction standard, or Silver Label for used homes. US-built homes need HUD Labels if built after 1976.

Age matters – most lenders won’t finance homes over 20 years old. Income verification requires 2 years of work history for employees or 2 years of tax returns for self-employed buyers.

Rates, Terms & Costs: What to Expect

Interest rates vary by loan type: Chattel loans run 8-14%, traditional mortgages 3-8%, FHA loans 4-9%, and personal loans 10-20%. Credit unions often beat bank rates by 1-2%.

Loan terms are generally shorter than traditional mortgages. Maximum amortization is 25 years in Canada and 30 years in the US, with typical chattel loans running 10-20 years.

Loan-to-value ratios create clear financing tiers:

| Location Type | Maximum LTV | Typical Down Payment |

|---|---|---|

| Mobile Home Park | 65% | 35% |

| Owned Land | 75-90% | 10-25% |

| Land-Home Package | 90-95% | 5-10% |

Budget for additional costs: mortgage insurance for high-LTV loans, appraisal fees of $300-800, inspection costs of $200-500, and moving/setup costs of $3,000-8,000.

For current rates and statistics, the Manufacturing Housing Institute provides regular updates.

Owned Land vs Park Lots: Impact on Approval

Where you place your mobile home dramatically affects financing. Owned land offers LTV ratios up to 75% versus 65% in parks, meaning lower down payments and interest rates often 1-3% lower.

Owned land provides appreciation potential, no pad rent, and more privacy. Mobile home parks offer community amenities, shared utilities, and lower barrier to entry.

For park lots, you need valid lease agreement with 3+ years remaining and park owner cooperation. For owned land, you need clear title, proper zoning, utility access, and sometimes foundation requirements.

Before buying, verify local zoning allows mobile homes, check HOA restrictions, and understand setback requirements. Homes on owned land typically hold value better than park homes.

For comprehensive guidance, check our Buying Used Mobile Homes resource.

Financing Tips, Pitfalls to Avoid & Next Steps

Getting used mobile home loans doesn’t have to be stressful if you avoid common mistakes. After helping thousands of Texas families, we’ve seen the same problems repeatedly.

The biggest mistake? Falling in love with a home before checking certification labels. Without valid CSA A-277, Z-240, or Silver Label, most lenders won’t finance it. Always verify those tags first.

Money mistakes are expensive. Many buyers forget to include pad rent in monthly budget calculations. That $400-600 monthly lot fee affects your debt-to-income ratio. Same goes for mobile home insurance, which costs more than regular homeowner’s insurance.

Skipping professional inspection is like buying a car without looking under the hood. Yes, it costs $200-500 upfront, but can save thousands later by finding major electrical or plumbing issues.

Park lease terms can kill financing. If the lease has less than three years remaining, most lenders will decline. Check lease details early.

Bad credit doesn’t mean no credit. We work with alternative lenders specializing in credit challenges, with approval rates as high as 98% when you put more money down. Our FICO Score Improvement Program helps boost scores before applying.

Rate shopping is smart – multiple inquiries within 14-45 days count as one credit hit. Check credit unions first, as they often beat bank rates by 1-2%.

At Manufactured Housing Consultants, we’ve built our reputation making the impossible possible. Our guaranteed lowest prices and specialized financing programs work for all credit types.

Need guidance? Our Mobile Home Loan Application Step-by-Step Guide walks you through everything. For more options, check Mobile Home Financing 2.

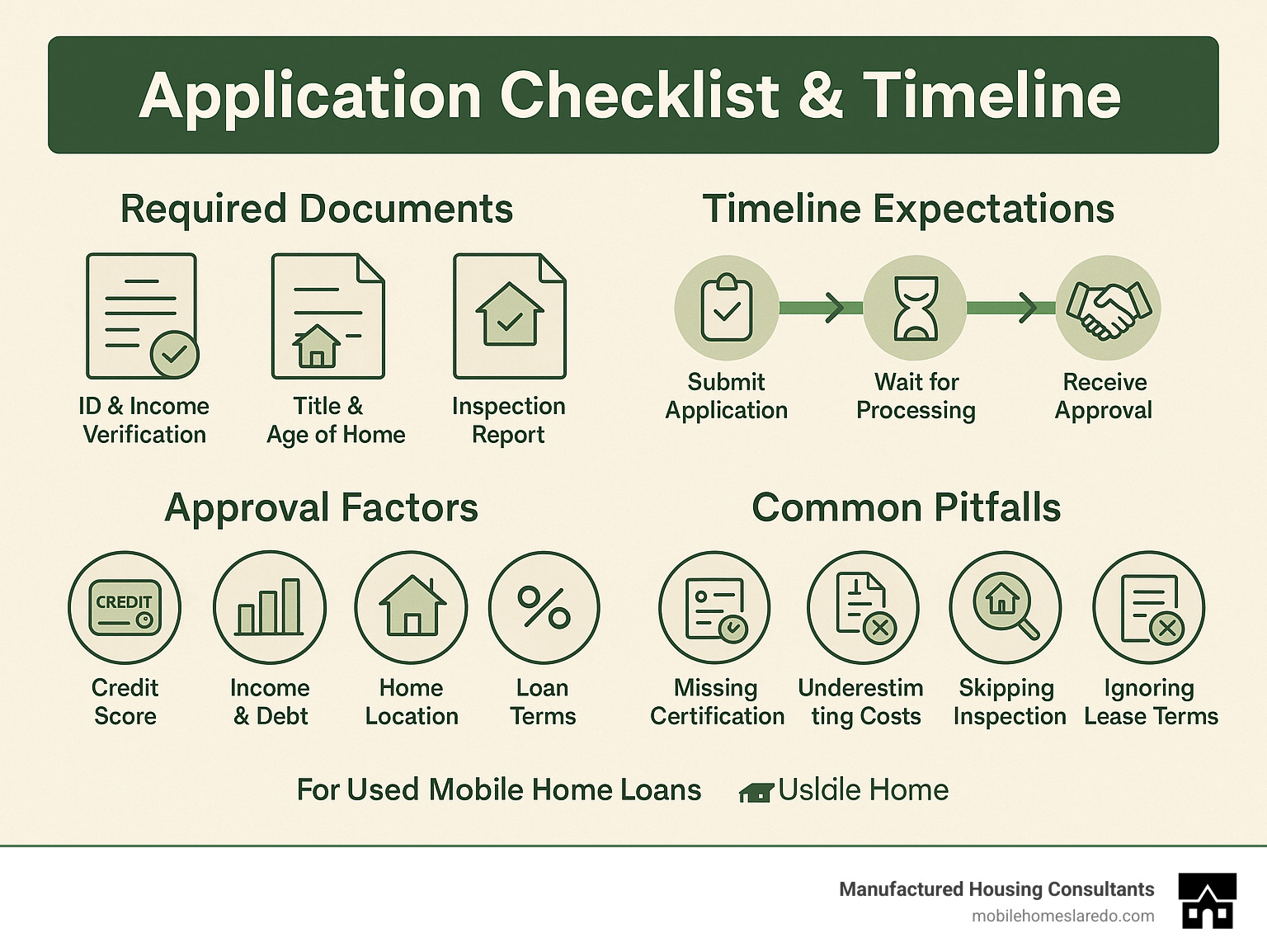

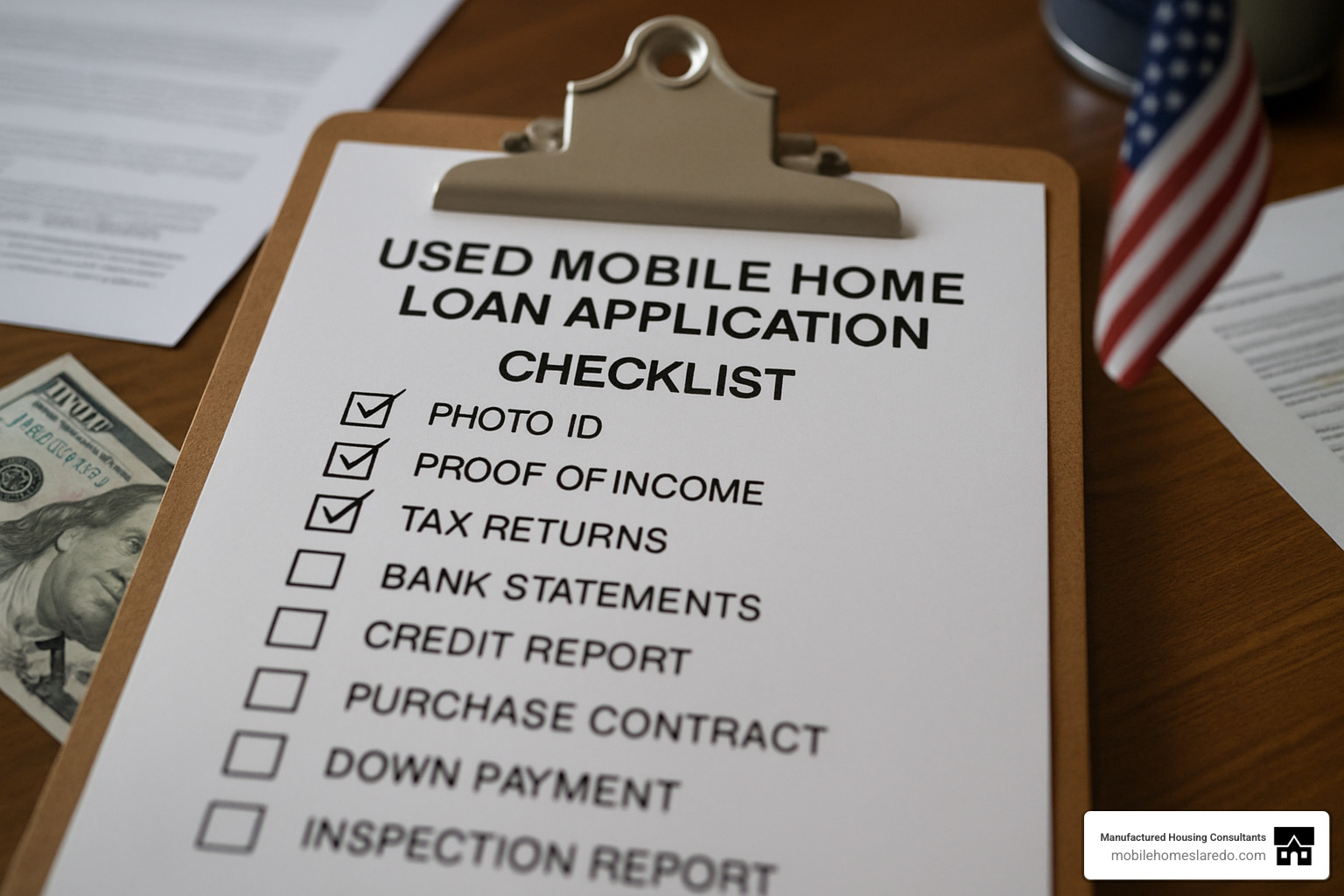

Application Checklist & Timeline

Getting your used mobile home loans application right the first time speeds up everything.

Start with basics: valid photo ID and recent pay stubs from 2-3 months. Self-employed buyers need two years of tax returns. Financial paperwork includes bank statements from 2-3 months showing spending habits and savings.

Your purchase contract should include all details about condition, appliances, and seller concessions. Park buyers need lease agreements with at least three years remaining.

Home-specific documents separate serious buyers from dreamers. Take clear photos of certification labels – CSA, HUD, or Silver Label tags prove safety standards. No tags usually means no loan.

Professional inspections and appraisals come next, taking time to schedule especially in rural areas. Insurance binders show you’re prepared – shop early as mobile home insurance differs from regular homeowner’s coverage.

Realistic timeline: Pre-approval takes 1-3 days with complete documents. Inspection needs 3-7 days to schedule. Appraisals require 5-10 days. Underwriting takes 7-14 days. Closing preparation needs 3-5 days.

Total time: 3-6 weeks from application to keys. Rural properties take longer.

Speed up approval by submitting everything at once. Answer lender requests same day – delays on your end become closing delays.

Deal-killers include: undisclosed debts, income mismatches, certification problems, or title issues.

Ready to start? Check your credit score, gather financial documents, decide between park living or owned land, get pre-approved, then shop for qualifying homes.

At Manufactured Housing Consultants, we make this easier with extensive selection from 11 top manufacturers and specialized financing programs. Our FICO Score Improvement Program helps if your credit needs work.

Used mobile home loans open doors to affordable homeownership that traditional housing can’t match. The key is preparation, patience, and working with people who understand this unique financing world.

For comprehensive guidance, visit our Financing Your Manufactured Home resource. Contact us today – we’re here to help you find your perfect home at guaranteed lowest prices.