Buying used mobile homes can be a savvy way to secure affordable housing without sacrificing style or comfort. For those, like Maria, seeking budget-friendly options, used mobile homes offer a unique blend of value and livability in today’s high-priced market.

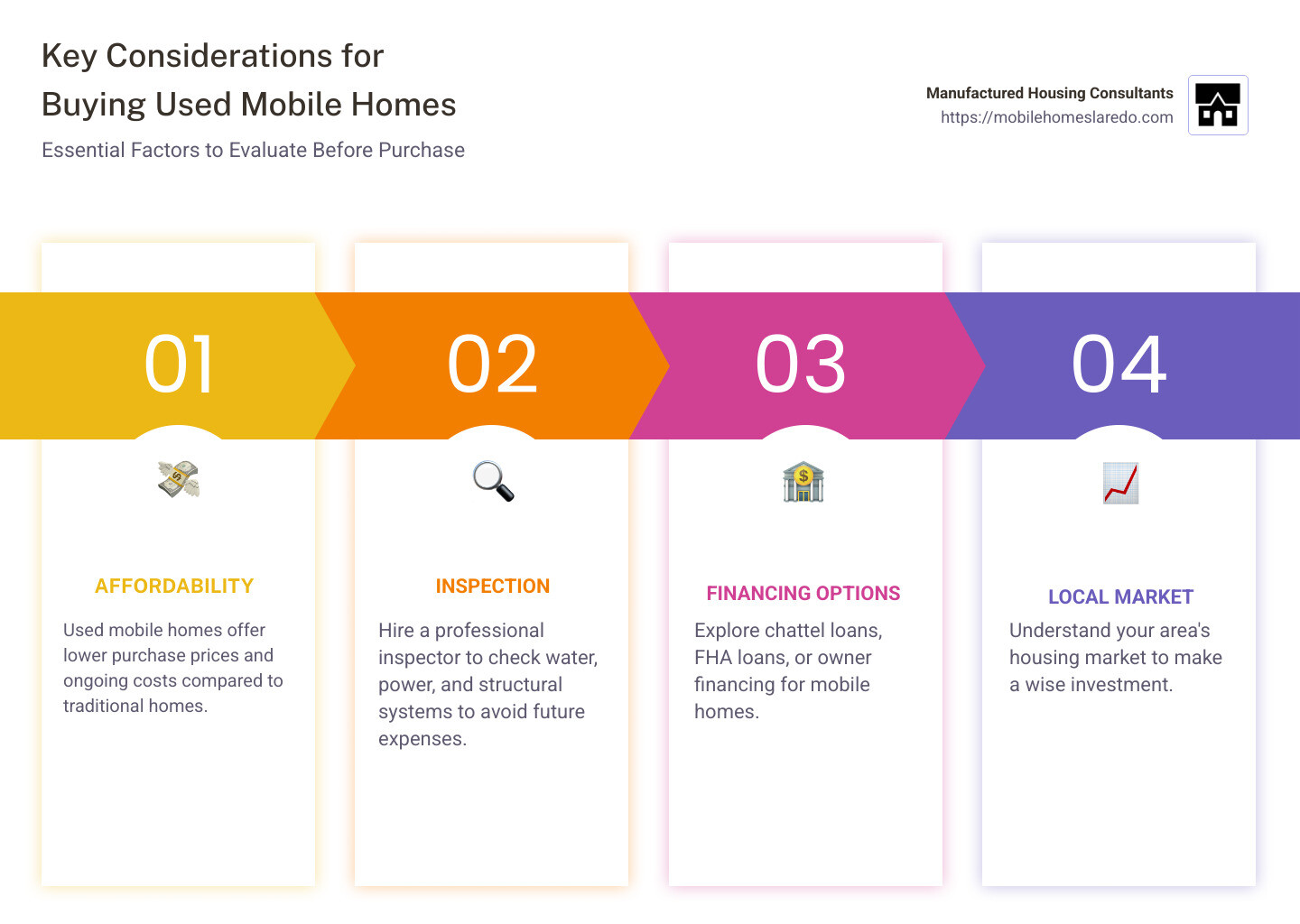

Key Considerations:

- Affordability: Used mobile homes often have lower purchase prices and ongoing costs compared to traditional homes.

- Inspection: Hiring a professional to check the home’s water, power, and structural systems is crucial. This ensures you avoid future expenses.

- Financing: Explore diverse financing options custom for mobile homes, like chattel loans or FHA loans, to find what fits your situation.

- Local Market: Understand your area’s housing market to ensure you’re making a wise investment.

Used mobile homes, with their improved space and appealing price points, have garnered attention from those wanting modern homes without breaking the bank. Before sealing the deal, it’s essential to consider the roof’s condition, the sturdiness of walls, and the home’s compliance with construction standards. In particular, watch for any signs of water damage or electrical issues that might turn a good buy into a costly endeavor.

Used mobile homes also benefit from their placement in established communities, providing a sense of stability and often access to necessary amenities.

For those new to the market, the process can seem daunting, but armed with the right knowledge and a clear understanding of your needs, buying used mobile homes can be a rewarding and smart investment.

Understanding Used Mobile Homes

When considering buying used mobile homes, understand the unique aspects that differentiate them from new homes. This includes factors like depreciation, resale concerns, and investment risks.

Depreciation

Used mobile homes typically depreciate more quickly than traditional homes. This is because they are considered personal property rather than real estate. According to a report by the Federal Housing Finance Agency, many still assume mobile homes depreciate like cars. However, it’s important to note that proper maintenance can help retain value over time.

Resale Concerns

Reselling a used mobile home can be challenging. The market for these homes is more limited, and potential buyers may be wary of older models due to concerns about condition and compliance with modern standards. Homes built before 1976, for example, may not meet the HUD Code, making them less appealing to buyers. Additionally, the societal stigma surrounding mobile homes can impact resale potential.

Investment Risk

While used mobile homes offer affordability, they come with certain investment risks. The potential for depreciation and difficulty in resale means you might not recoup your initial investment. Moreover, if the home was not properly maintained or if it has structural issues, the cost of repairs can quickly add up. Therefore, it’s crucial to conduct thorough inspections and research before purchasing.

Conclusion

Understanding these factors is vital for anyone considering entering the used mobile home market. While they offer a cost-effective housing solution, being aware of the potential pitfalls can help you make an informed decision. By doing so, you can enjoy the benefits of affordable living while minimizing financial risks.

Benefits of Buying Used Mobile Homes

When it comes to buying used mobile homes, there are several compelling benefits that make them an attractive option for many buyers. Let’s explore these advantages:

Lower Cost

One of the biggest perks of purchasing a used mobile home is the lower cost. Compared to new homes, used ones are generally much less expensive. This affordability opens doors for individuals who might otherwise be priced out of homeownership. In fact, a used manufactured home often comes with a smaller down payment and lower mortgage rates, making it a feasible choice for budget-conscious buyers.

Less Hassle

Buying a used mobile home can also mean less hassle. Unlike new homes that require you to make numerous decisions about layouts, materials, and finishes, a used home is ready to move into. This means you can skip the lengthy design and construction process. Additionally, used homes often come with established utilities and landscaping, saving you time and effort.

Established Neighborhood

Another advantage of buying used mobile homes is they are often located in established neighborhoods. This means you’ll be moving into a community that already has amenities like grocery stores, schools, and parks in place. In areas like Laredo, TX, these communities can offer easy access to city amenities, enhancing your lifestyle with convenience and social opportunities.

By choosing a used mobile home, you can enjoy the benefits of a well-settled area without the wait and uncertainty of new developments.

These benefits highlight why many people choose used mobile homes as a practical and affordable housing option. Next, we’ll dig into key considerations when purchasing a used mobile home to ensure you make a wise investment.

Key Considerations When Buying Used Mobile Homes

When it comes to buying used mobile homes, being informed is your best friend. Let’s break down the key factors you should consider:

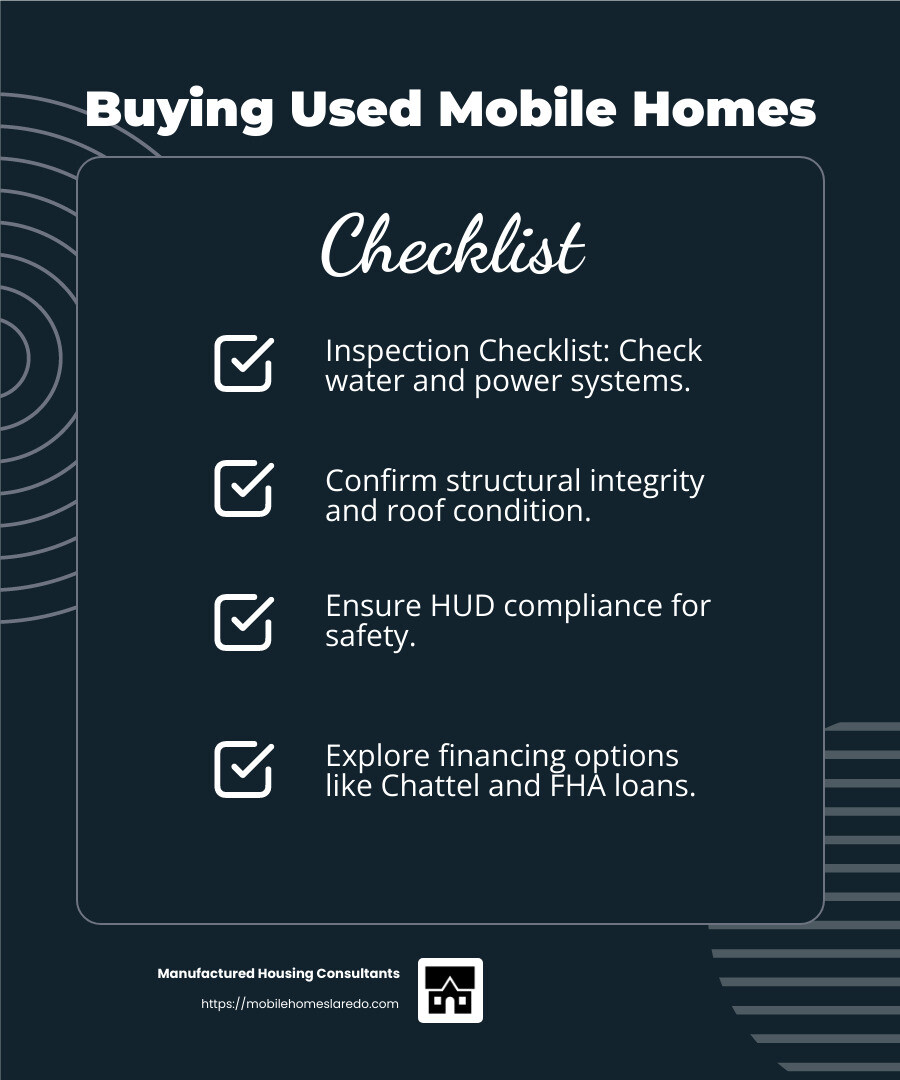

Inspection Checklist

Before making a purchase, it’s crucial to conduct a thorough inspection. Here’s a simple checklist to guide you:

- Water System: Check for leaks around faucets and under sinks. Water damage can lead to costly repairs.

- Power System: Ensure all electrical circuits are functional. Look for any signs of wear or damage.

- Roof Condition: Prefer shingled roofs over metal ones for better water drainage. Inspect for any missing or damaged shingles.

- Walls and Floors: Look for cracks or signs of mold. Make sure the floors are level.

- Structural Integrity: Confirm the home is level and not sinking.

Hiring a professional inspector can save you from unexpected surprises. They can spot issues that might not be visible to the untrained eye.

HUD Compliance

Understanding the HUD Code is essential. The passage of this code in 1976 improved the quality and safety of mobile homes.

- Check for HUD Compliance: Look for a HUD plate to ensure the home meets the standards. Homes built after 1976 are generally safer and more reliable.

- Park Regulations: Some mobile home parks have age restrictions on the homes they accept. Make sure the home you’re interested in is allowed in your chosen community.

Financing Options

Financing a used mobile home can be different from traditional homes. Here are some options to consider:

- Chattel Loans: These are designed for mobile homes and treat the home as personal property. They might have higher interest rates.

- FHA Loans: Federal Housing Administration loans can be an option if the home meets specific criteria.

- Owner Financing: This can be a flexible option if you can’t secure a traditional loan. However, be aware of potentially higher interest rates and the need for seller approval.

Being aware of these considerations can help you make a smart choice when navigating the used mobile home market. Up next, we’ll explore the various financing options available to help you purchase your ideal home.

Financing Options for Used Mobile Homes

When buying used mobile homes, understanding your financing options is key. Let’s explore the main types:

Chattel Loans

Chattel loans are a popular choice for mobile homes, especially when the home isn’t tied to land. Here’s what you need to know:

- Personal Property: Chattel loans treat your mobile home as personal property, not real estate. This means they focus only on the home itself.

- Interest Rates: They often come with higher interest rates than traditional mortgages. Rates can range from 8% to 14% depending on your credit score.

- Approval Process: The approval process can be quicker than other loans, but terms are usually shorter, often up to 23 years.

This type of loan is ideal if you already own land or are leasing a lot.

FHA Loans

The Federal Housing Administration (FHA) offers loans for mobile homes, but there are some conditions:

- HUD Compliance: The home must be HUD-compliant and meet certain safety standards. Check for a HUD plate to confirm compliance.

- Real Estate Status: FHA loans require the home to be classified as real estate, meaning it must be permanently affixed to the land.

- Lower Down Payment: One of the benefits is the lower down payment, which can make it easier for first-time buyers to secure a loan.

These loans are a great option if you’re looking for lower interest rates and longer terms.

Owner Financing

Owner financing can be a flexible alternative if traditional financing isn’t an option:

- Direct Agreement: You make payments directly to the seller instead of a bank. This can be beneficial if you have a low credit score.

- Flexible Terms: Terms can be negotiated between you and the seller, but be cautious of potentially higher interest rates.

- Deed and Taxes: Often, the owner holds the deed until full payment is made. You will be responsible for property taxes and insurance.

This option can be a lifesaver if you can’t qualify for a conventional loan, but always consult with a real estate attorney to protect your interests.

Each financing option has its pros and cons. Consider your financial situation, credit score, and long-term plans before deciding. Next, we’ll tackle some frequently asked questions about buying used mobile homes to further guide your decision.

Frequently Asked Questions about Buying Used Mobile Homes

Is it wise to buy a used mobile home?

Buying a used mobile home can be a smart choice, especially if you’re looking for a more affordable housing option. One of the main advantages is lower cost. Used mobile homes often sell for much less than new ones, sometimes as low as $20,000 for a single-wide unit, compared to $50,000 for a new one.

However, it’s important to consider depreciation. Mobile homes can depreciate in value over time, much like cars. This means they might not be the best investment if you’re looking to build equity. On the flip side, if the home is in a desirable area or part of an established neighborhood, it could hold its value better.

Be aware of the investment risk. If you’re buying in a mobile home park, you don’t own the land, which can affect resale value. Always weigh the pros and cons based on your financial goals and housing needs.

What is the average useful life of a mobile home?

The average useful life of a mobile home can vary widely. With proper maintenance, many mobile homes can last 30 to 55 years or more. Key factors that affect longevity include how well the home is maintained, the quality of materials used, and if it complies with HUD standards.

HUD compliance is crucial. Homes built after 1976 must meet HUD’s Manufactured Home Construction and Safety Standards, which ensure better durability and safety. Look for a HUD plate to verify compliance.

Regular upkeep, such as checking for water damage, maintaining the roof, and servicing heating and cooling systems, will extend the life of your mobile home. A well-maintained mobile home can offer a comfortable living environment for decades.

How to inspect a used mobile home?

Inspecting a used mobile home is a critical step in the buying process. Here’s a quick inspection checklist to guide you:

- Foundation: Check for signs of sinking or tilting. This can be a major issue if not addressed.

- Roof and Ceilings: Look for leaks or water damage. These are common in older units.

- Walls and Windows: Check for cracks, gaps, or moisture build-up. These can indicate structural problems or poor insulation.

- Flooring: Test for strength and look for warping or soft spots.

- Plumbing and Electrical: Ensure faucets, toilets, and outlets are functioning properly.

- Exterior: Inspect siding and skirting for damage or rot.

Hiring a professional inspector is highly recommended. They have the expertise to spot issues that might not be obvious to the untrained eye. An inspector can provide a detailed report, helping you make an informed decision and potentially save you from costly repairs down the line.

By understanding these aspects, you’ll be better equipped to steer the used mobile home market. Next, we’ll wrap up with some concluding thoughts on making your decision.

Conclusion

Navigating buying used mobile homes can seem daunting, but with the right knowledge and resources, it becomes much simpler. At Manufactured Housing Consultants, we pride ourselves on offering a wide selection of affordable mobile, manufactured, and modular homes. Our commitment is to help you find the perfect fit for your needs, while providing specialized financing options for all credit types.

Decision Factors

When considering a used mobile home, weigh several factors. Cost is often a primary consideration, as used mobile homes can be significantly cheaper than new ones. However, always factor in potential maintenance and repair costs. Ensure the home complies with HUD standards post-1976, which ensures better safety and durability.

Location is another crucial factor. A mobile home in a desirable or established neighborhood can retain its value better, despite the general depreciation trend. Also, consider the park’s rules and land ownership, as these can affect your long-term investment.

Final Thoughts

Buying a used mobile home can be a wise choice for those seeking affordability and flexibility. By understanding the key considerations and planning carefully, you can make a decision that suits your lifestyle and financial goals. A thorough inspection and professional guidance are invaluable in this process.

At Manufactured Housing Consultants, we are here to assist you every step of the way. Our team is ready to help you explore options and make an informed decision. Visit our mobile home delivery and set-up costs page to learn more about our services and how we can make your mobile home buying experience seamless and stress-free.