Why Rent-to-Own Mobile Homes Are Gaining Popularity

Cheap mobile homes rent to own offer a path to homeownership for those who may not qualify for a traditional mortgage. If you have credit challenges or need time to save for a down payment, this option can provide a bridge to owning your home.

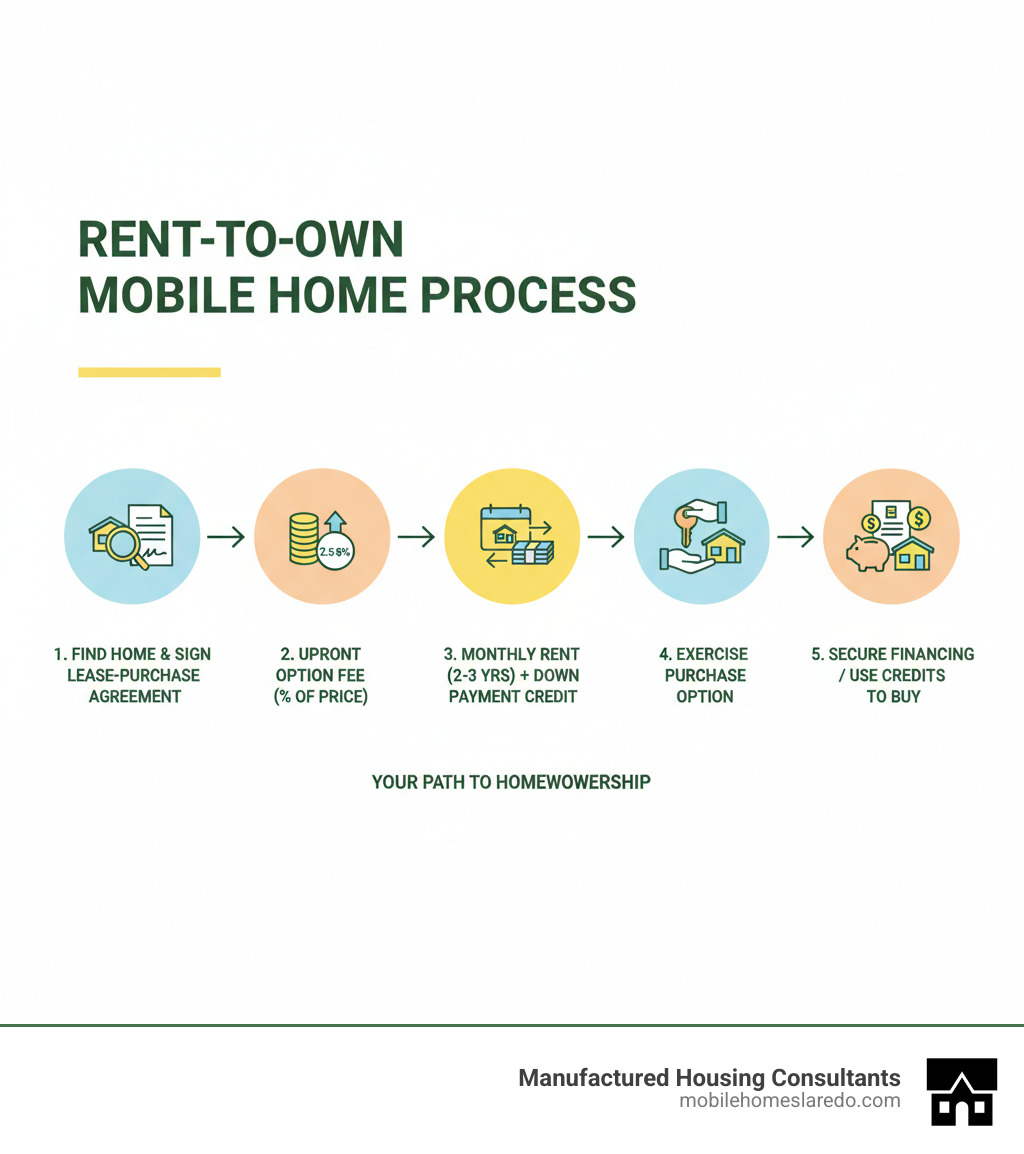

Quick Answer: How Rent-to-Own Works

- Sign a lease agreement with an option or obligation to buy (typically 2-3 years).

- Pay an upfront option fee (usually 2.5%-8% of the purchase price).

- Pay monthly rent, with a portion often going toward your down payment.

- Purchase the home at the end of the lease at a pre-agreed price.

However, these deals carry risks. The Federal Trade Commission cautions against them due to potential scams and the risk of losing money if you can’t complete the purchase. Contracts vary widely and have no standard template, making it essential to have an attorney review any agreement before you sign.

This guide will walk you through finding and securing a rent-to-own mobile home, helping you spot good deals, avoid pitfalls, and decide if this path is right for you.

Understanding Cheap Mobile Homes Rent to Own

Navigating the path to homeownership can be overwhelming, but cheap mobile homes rent to own offer a viable route. Here’s a breakdown of the process, benefits, risks, and costs to help you make an informed decision.

The Process Explained: From Lease Agreement to Purchase

A rent-to-own agreement is a contract to rent a home for a set period (typically 2-3 years) with the future ability to buy it. It’s a bridge to homeownership, allowing you to live in your future home while preparing financially.

It’s crucial to understand the two main types:

- Lease-Option: This gives you the option to buy. It’s flexible, but if you don’t buy, you’ll likely forfeit your upfront fees and rent credits.

- Lease-Purchase: This obligates you to buy. It’s more binding, and failing to purchase can lead to legal consequences and the loss of your investment.

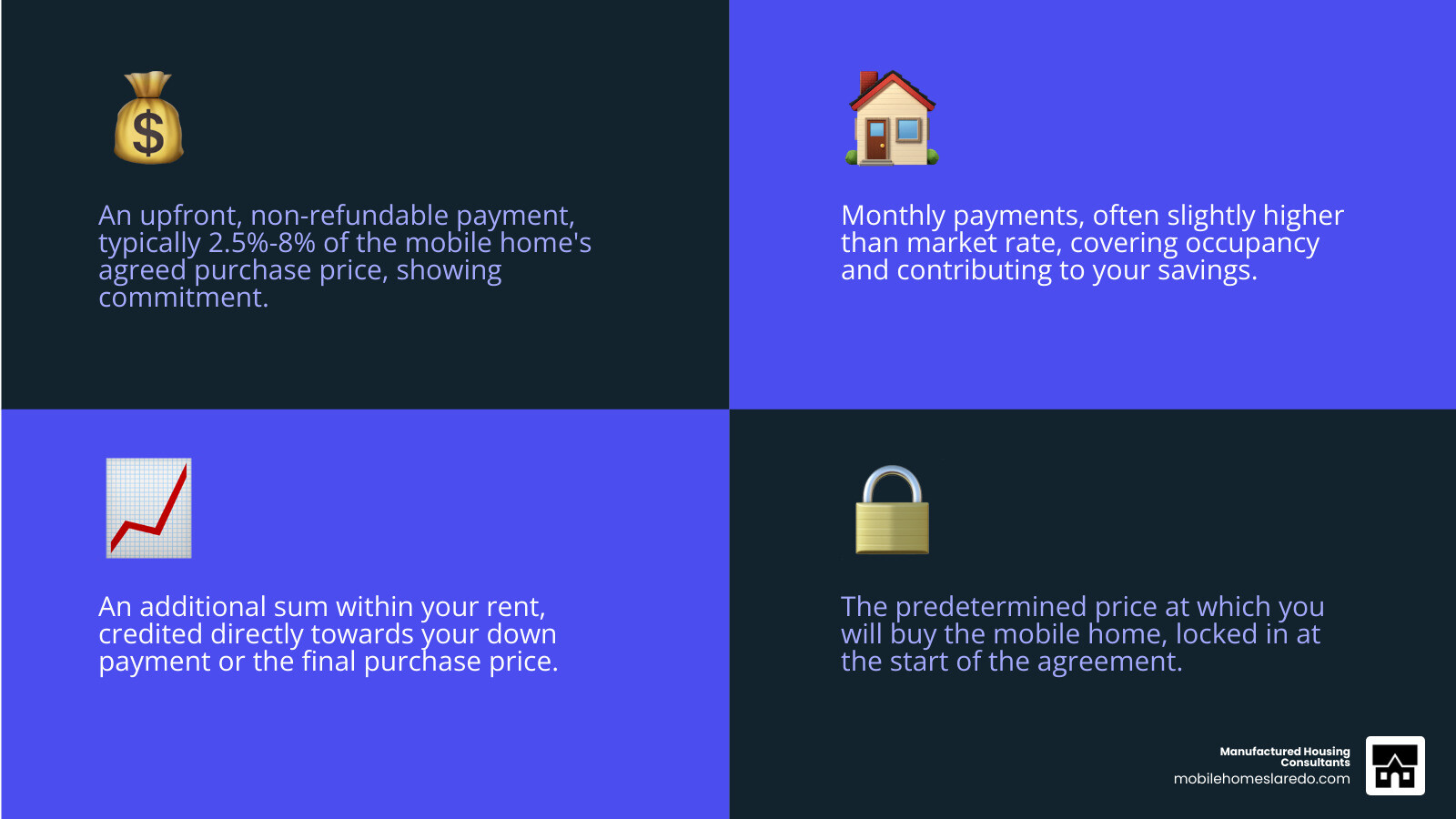

Key financial components include a non-refundable option fee (2.5%-8% of the purchase price), a rent credit (an extra amount paid monthly that builds toward your down payment), and a locked-in purchase price set at the start.

Since there is no standard contract, it is vital to have an attorney review any agreement before you sign. For more details, the Federal Trade Commission offers guidance on rent-to-own deals. If credit is a concern, explore our Rent to Own Mobile Home No Credit Guide.

Weighing the Pros and Cons of a Rent-to-Own Path

It’s important to weigh the benefits against the risks before committing.

| Advantages of Rent-to-Own Mobile Homes | Disadvantages of Rent-to-Own Mobile Homes |

|---|---|

| Locked-in Purchase Price: Protects you from rising market values. | Higher Monthly Payments: Rent is often above market rate due to the rent premium. |

| Time to Save & Build Credit: Allows you to improve your financial standing. | Risk of Losing Money: Option fee and rent credits are often non-refundable if you don’t buy. |

| “Test Drive” the Home & Community: Live in it before fully committing. | Maintenance & Repairs: You might be responsible for costs during the lease. |

| Path to Ownership: Makes homeownership accessible without immediate full financing. | Limited Inventory: Fewer rent-to-own homes are available compared to traditional sales. |

| Builds Equity: A portion of your rent contributes to your down payment. | Potential for Scams: Requires vigilance to avoid fraudulent deals. |

The biggest benefits are having time to improve your credit and save for a down payment. A locked-in purchase price protects you if home values rise, and you get to “test drive” the community.

The primary risk is losing your non-refundable option fee and rent credits if you can’t complete the purchase. Monthly payments are typically higher than standard rent, and you may be responsible for maintenance and repairs.

Understanding the Costs and Financials

For example, on a $100,000 home with a 5% option fee ($5,000) and a $200 monthly rent credit, you would accumulate $7,200 in credits over three years. In total, you’d have $12,200 ($5,000 + $7,200) toward the purchase, leaving a balance of $87,800 to finance.

While rent-to-own is often more lenient than traditional financing, you’ll still need a stable income. The goal is to use the lease period to improve your financial standing and qualify for a mortgage. At Manufactured Housing Consultants, we specialize in financing for all credit types and offer a FICO Score Improvement Program to help. If you’re worried about your credit, our guide on Bad Credit Mobile Home Loans Guaranteed Approval can provide more information.

How to Find and Secure Cheap Mobile Homes Rent to Own

Finding listings requires diligence. Here’s where to look and how to protect yourself.

Where to Find Listings:

- Online Resources: Use filters on mobile home-specific websites.

- Mobile Home Communities: Contact community managers directly.

- Real Estate Agents: Work with agents who specialize in manufactured homes.

- Local Search: Look for “For Rent-to-Own” signs in desired neighborhoods.

Our team at Manufactured Housing Consultants can also connect you with opportunities across Texas.

How to Avoid Scams:

The FTC warns of fraud in rent-to-own deals. Protect yourself with these steps:

- Verify Ownership: Confirm the seller legally owns the property before paying.

- Check for Liens: Ensure the property is free of liens or unpaid taxes.

- Get Everything in Writing: The contract must detail all terms.

- Consult an Attorney: A real estate attorney can identify red flags before you sign.

If you suspect a scam, contact your state consumer protection agency. For local listings, check our Rent to Own Mobile Homes Near Me page.

Your Next Steps to Homeownership

You’ve learned the ins and outs of rent-to-own mobile homes. Now it’s time to take action. This section provides the key steps to prepare for an agreement and find the right home for your future.

Key Steps to Prepare for Your Agreement

Preparation is key to a successful rent-to-own experience. Taking these essential steps can mean the difference between homeownership and a costly mistake.

- Get Legal Advice. Before signing, have a real estate attorney review the contract. Since there’s no standard agreement, an attorney can spot unfair clauses and protect your interests. This is a non-negotiable step.

- Get a Professional Inspection. Hire a home inspector to check for issues with the foundation, plumbing, roof, and electrical systems. This gives you leverage to negotiate repairs or price adjustments before you commit.

- Research Property Value. Ensure the locked-in purchase price is fair by researching the sale prices of comparable homes in the area. This prevents you from overpaying.

- Clarify Maintenance Duties. The contract must clearly state who is responsible for repairs and maintenance. Understand these potential costs and budget for them.

- Plan for Financing. Use the lease period to prepare for a mortgage. Improve your credit score, save for a larger down payment, and research loan options. Our resources on credit repair for home loans can help. You can also find local home buying assistance programs through HUD for expert guidance.

Ready to Find Your Home? Start Here

The journey to homeownership is achievable with the right support. At Manufactured Housing Consultants, we make it our mission to help families throughout Texas find their way home, regardless of credit history.

We specialize in affordable, modern manufactured homes from top builders, offering a vast selection. What sets us apart is our commitment to finding a financial solution for everyone. We offer financing for all credit types and a unique FICO Score Improvement Program to help you prepare for long-term success.

Our promise is simple: guaranteed lowest prices on quality homes. We believe everyone deserves the chance to own a home.

Don’t let financial barriers hold you back. If you’re ready to take the next step, our team is here to guide you. Explore available mobile homes today and let’s start your journey to homeownership together.