Affordable Homeownership Within Reach

Single wide financing refers to loans and mortgage options specifically designed for purchasing single-section manufactured homes. Here’s what you need to know:

| Financing Type | Down Payment | Credit Score | Interest Rates | Max Loan Term |

|---|---|---|---|---|

| FHA Title I | 3.5-10% | 500-580+ | ~6.45% | 20 years |

| Chattel Loans | 5-35% | 575-660+ | 7-14% | 15-25 years |

| Conventional | 3-5% | 620+ | 7-14% | 30 years |

| VA Loans | 0% | No minimum | Varies | 30 years |

With site-built homes exceeding $412,000, manufactured housing offers an affordable alternative at just $127,250 on average, making single wide homes attractive for budget-conscious buyers.

“Manufactured housing provides opportunities to buy when you’re ready instead of putting that dream on hold,” notes one industry expert.

Single wide manufactured homes are built in a factory according to the HUD code established in 1976, then transported to your property on a permanent chassis. They typically range from 400 to 1,100 square feet.

Explore more about single wide financing:

Single Wide Financing 101: Loan Types, Requirements & Terms

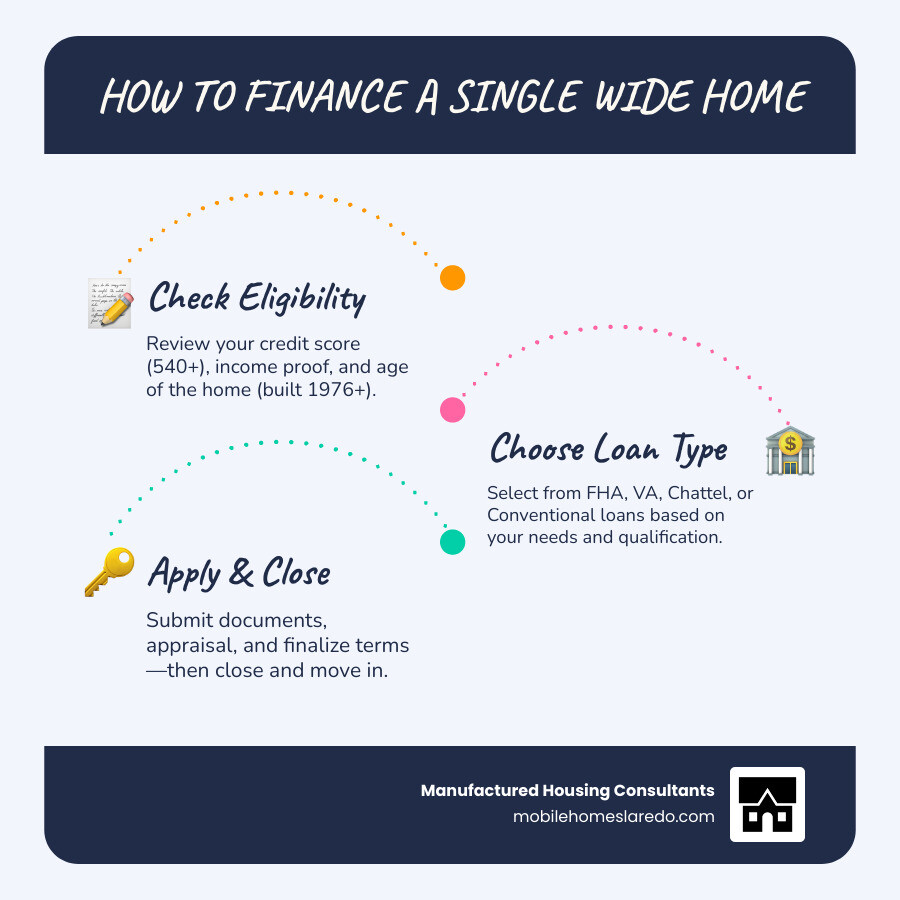

Navigating single wide financing can feel challenging at first, but we’ll break it down into easy-to-understand pieces.

Single wide manufactured homes can be financed in two main ways:

- As personal property (chattel loans) – similar to financing a car

- As real estate (mortgage loans) – similar to traditional home financing

Your path depends on whether you own the land, if your home will be permanently attached to a foundation, and if the title will be converted to real property.

Here’s a breakdown of your main financing options:

| Loan Type | Property Classification | Min. Credit Score | Down Payment | Interest Rate | Term Length |

|---|---|---|---|---|---|

| Chattel | Personal Property | 575-660 | 5-35% | 7-14% | 15-25 years |

| FHA Title I | Either | 500+ | 3.5-10% | ~6.45% | Up to 20 years |

| FHA Title II | Real Estate | 500+ | 3.5% | ~6.45% | Up to 30 years |

| VA | Real Estate | No minimum | 0% | Varies | Up to 30 years |

For your home to qualify for single wide financing, it generally needs to meet these requirements:

- Built after June 15, 1976 (when the HUD code went into effect)

- At least 400 square feet

- Permanently attached to a foundation (for mortgage loans)

- Titled as real property (for mortgage loans)

Single Wide Financing Loan Options Explained

Chattel Loans

Chattel loans treat your home like personal property. While they have higher interest rates (7-14%) and shorter terms (15-25 years) than traditional mortgages, they offer:

- Simpler qualification process

- Speedier closings

- Flexible placement options

- No land ownership required

Conventional Loans

Conventional loans through Fannie Mae’s MH Advantage or Freddie Mac’s CHOICEHome programs offer:

- 30-year terms

- Lower down payments (3-5%)

- Competitive interest rates

- Cancellable mortgage insurance

Your single wide needs to be permanently attached to a foundation, titled as real property, and meet specific standards.

Government-Backed Loans

FHA Title I Loans finance just the home with down payments as low as 3.5% (with a 580+ credit score) and loan terms up to 20 years.

FHA Title II Loans finance both home and land with similar down payment requirements but extend to 30 years.

VA Loans offer eligible veterans 0% down, competitive rates, and no minimum credit score (though lenders typically want 620+).

More info about Mobile Home Financing: What You Need to Know

Qualifying for Single Wide Financing

Your credit score is crucial for single wide financing. Here’s what lenders typically look for:

- FHA loans: 500-579 (with 10% down) or 580+ (with 3.5% down)

- Conventional loans: 620 or higher

- VA loans: No official minimum, but lenders usually want 620+

- Chattel loans: 575-660+, depending on the lender

Lenders will also look at:

- Debt-to-Income Ratio (DTI) – Most prefer monthly debt payments don’t exceed 43% of monthly income

- Income Verification – Typically 2+ year employment history

- Down Payment – Ranges from 0% to 35% depending on loan type and credit

More info about Single Wide Manufactured Home Prices

Securing the Best Deal & Avoiding Pitfalls

When shopping for single wide financing, compare rates from at least 3-5 different lenders. Credit inquiries for the same loan type within 14-45 days count as just one inquiry on your credit report.

Look beyond the interest rate to the APR (Annual Percentage Rate), which includes fees. Sometimes a loan with a slightly higher interest rate but lower fees can save you money long-term.

“Lock your rate once you find a good one,” advises our financing specialist. “Market rates can change daily.”

Watch for fees: Origination fees typically range from 1-5% of your loan amount, while third-party fees like appraisals ($300-$500), title searches, and recording fees add up quickly.

Avoid prepayment penalties if possible, and understand PMI requirements. With conventional loans, you’ll pay Private Mortgage Insurance with less than 20% down, adding approximately 0.5-1% annually until you reach 20% equity.

If placing your home in a manufactured home community, ensure your lease runs at least 3 years and provides protection against significant rent increases.

To preserve value in your manufactured home, choose a quality manufacturer, maintain your home properly, and place it on a permanent foundation.

How to Compare Lenders & Choose the Right Partner

Specialized manufactured home lenders understand the unique aspects of single wide homes and often offer chattel loans alongside other products. Local banks and credit unions provide more personalized service and may have special programs for local residents.

When comparing lenders, examine their loan products, terms, interest rates, fees, down payment requirements, and credit requirements. Customer service quality can make or break your experience.

Watch for red flags like pressure tactics, vague information, unwillingness to provide clear rate quotes, changing terms during the process, or hidden fees.

More info about Bad Credit Mobile Home Loans Guaranteed Approval

Common Challenges and Solutions

Higher interest rates on single wide loans can be offset by improving your credit score, making a larger down payment, or having a co-signer with excellent credit.

Land issues impact financing options. Ensure leased land meets lender requirements (typically a minimum 3-year term), and always check zoning laws before purchasing.

Title conversion from personal property to real property can be confusing. Work with a title company experienced in manufactured housing, ensure your home sits on a permanent foundation, and budget for associated fees.

Insurance for single wide homes tends to be more expensive. Shop multiple providers that specialize in manufactured housing, consider bundling with auto insurance, and ask about discounts for safety features.

More info about How to Buy a Mobile Home with No Money Down

Ready to Start Your Journey?

At Manufactured Housing Consultants, we’ve helped countless Texas families find affordable homeownership. We offer the lowest-price guarantee with transparent costs and no hidden fees.

Our selection includes single wide models from 11 top manufacturers, with options for every budget. Our specialized financing programs leverage relationships with multiple lenders who understand manufactured housing, with options for all credit types and down payments as low as 0% for qualified buyers.

If your credit needs improvement, our FICO Score Improvement Program offers free credit analysis and a personalized plan. Many clients see significant improvements in just a few months.

Ready to explore? Browse our selection online, check your credit reports, then contact our financing specialists for pre-qualification. Visit our Laredo location to tour available models and experience the quality firsthand.